There has not only been a lot of money wasted short-selling the S&P over the last 3 years but there has also been a lot of wasted brainpower that went along with it. One of the things I have learned about the current rally is not to mess with it. In other words, nothing about the current selloff looks any different than the others. I just go with the flow.

Lessons Learned

All traders interpret the markets differently. One of the things about the New World Trading Order is that nothing stays the same for long. Whether it’s MrTopStep pointing out the return of Mutual Fund Monday or the late Friday Rip or a hot indicator, by the time Joe Public gets on it the trade is already used up.

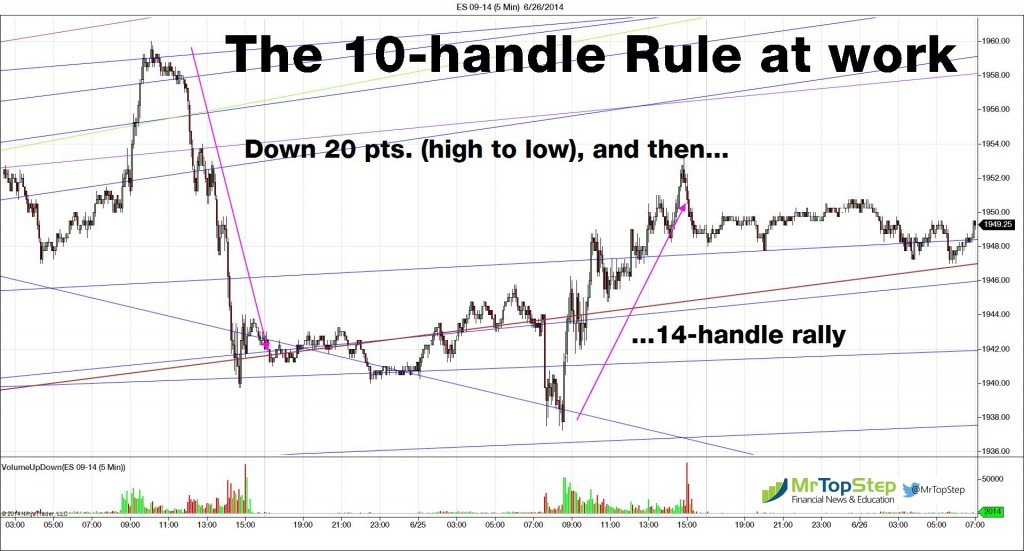

The largest pattern and one that has remained dominant is the overall direction of the S&P. In the MrTopStep trading room yesterday I pointed out several reasons why I did not think the S&P was going down. My first reason, one I didn’t mention, was simply because most people thought the S&P was going lower. The S&P has a long history of breaking hearts.

Below are some of the excerpts from the room after the ESU14 rallied early and started selling off again and was trading at the 1942.50-43.00 level.

09:17:03 TRADINGDATA2: (driley) I know that “everyone” is bearish and that they expect the ES to sell off, I dont think that way

09:19:20 TRADINGDATA2: (driley) First; we just had two down days in a row, we don’t get one down day very often and two is a rarity

09:20:52 TRADINGDATA2: (driley) Expect two way flow with a buy side bias going into the end of the 2Q

09:26:29 TRADINGDATA2: (driley) Do not forget “thin to win” next week is a short week; early Thursday close and close on Friday for the 4th of July

09:34:42 TRADINGDATA2: (driley) Chance_Stroot (09:30:00):ES has not been down 3 days in a row since late Jan

03:00:40 TRADINGDATA2: (driley) they just PUNISH the shorts…

03:02:51 TRADINGDATA2: (driley) I called it all the way up Bull

03:03:09 TRADINGDATA2: (driley) I said stops 49 to 53

03:03:14 PITBULL: YUP GOOD JOB

I know that it’s sometimes its hard to separate the bushes from the woods. I don’t pretend to have all the answers but every time I see the S&P sell off and the bears jump back in I know that it’s just a matter of time until the S&P levels off, back-and-fills and starts going back up.

I’m not your chart guy; I’m your feel guy. While I may not have gotten the traders in the room to go long, maybe, just maybe, I kept them from shorting at a critical level, the lows of the day. Compare the above with the time and sales data to see for yourself what we were saying in the Trading Room. Remember it’s US Central Time.

Asian markets closed higher across the board and Europe is trading modestly lower. Today’s economic schedule starts with the jobless claims number, personal income and outlays, Richmond Fed President Jeffrey Lacker speech on investing in people, in Lynchburg, Va., EIA natural gas report, Kansas City Fed Manufacturing Index, 7-year note auction, St. Louis Fed President James Bullard speech on monetary policy and income inequality in New York, Fed balance sheet, money supply and earnings from Nike (NYSE:NKE), Lennar Corp. (NYSE:LEN), ConAgra Foods (NYSE:CAG), McCormick & Co. (NYSE:MKC).

Vacation Time

Our view: The E-mini S&P (CME:ESU14) opened lower, rallied and then sold off a couple points and then chopped between 1945 and 1947 for a good share of the mid-morning trade. To me that means “back and fill” and that means the market is going back up.

I am not 100% sure how the end of the quarter will go; I still believe there is an upward bias, but if it happens to sell off again ( I highly doubt it) then the ESU will go back up next week.

After the June Quadruple Witching and the the Q2 rebalance it’s going to be vacation time. Obviously, we have already seen part of that as the colleges and schools let out for the summer, but it’s going to be much more prevalent next week when the CME closes early on Thursday and is closed on Friday for the 4th of July.

CME GROUP CHICAGO TRADING FLOOR HOLIDAY SCHEDULE FOR 2014*

Thursday, July 3, 2014

Foreign Exchange, Interest Rates, Commodities, GSCI, Weather & Real Estate close at 12:00 CT (CME commodity options close at 12:02 CT, CBOT Mini Grains close at 12:30 CT) Equities close at 12:15 CT

Closed Friday, July 4, 2014

As always, please make sure to use protective stops when trading futures…

- In Asia, 10 of 11 markets closed higher: Shanghai Comp. +0.65%, Hang Seng +1.45%, Nikkei +0.27%.

- In Europe, 7 of 12 markets are trading lower: DAX +0.04%, FTSE +0.01%

- Morning headline: “Global Markets Firm Up Ahead of US Open”

- Fair value: S&P-7.82 , NASDAQ -8.72 , Dow Jones -83.80

- Total volume: 1.53mil ESU and 5.6k SPU traded

- Economic calendar: Jobless claims, personal income and outlays, Richmond Fed President Jeffrey Lacker speech on investing in people, in Lynchburg, Va., EIA natural gas report, Kansas City Fed Manufacturing Index, 7-year note auction, St. Louis Fed President James Bullard speech on monetary policy and income inequality in New York, Fed balance sheet, money supply and earnings from Nike, Lennar Corp., ConAgra Foods, McCormick & Co.

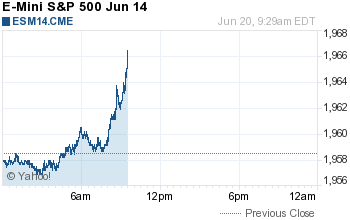

- E-mini S&P 500 1968.00+9.50 - +0.49%

- Crude Oil 102.15+0.02 - +0.02%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23215.381+17.551 - +0.08%

- Nikkei 225 15084.14-224.351 - -1.47%

- DAX 9804.90-62.85 - -0.64%

- FTSE 100 6735.12+1.50 - +0.02%

- Euro 1.3625