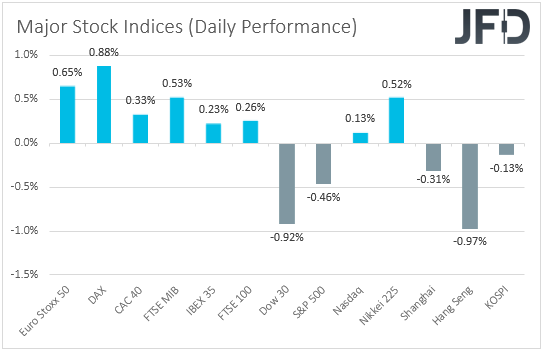

European shares rose yesterday, driven by technology stocks. However, sentiment softened during the US session, perhaps due to hawkish remarks by Fed’s Vice Chair Clarida, who said that the conditions for raising interest rates could be met by the end of 2022.

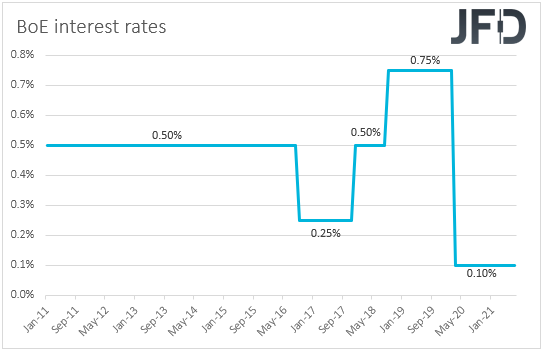

As for today, the main event on the agenda may be the BoE monetary policy decision. since the prior gathering, a couple of officials expressed the view that tapering should start sooner and thus, it would be interesting to see whether we will have, and if so, how many, votes in favor of tapering.

Dow Jones And S&P 500 Slide On Clarida's Policy Remarks

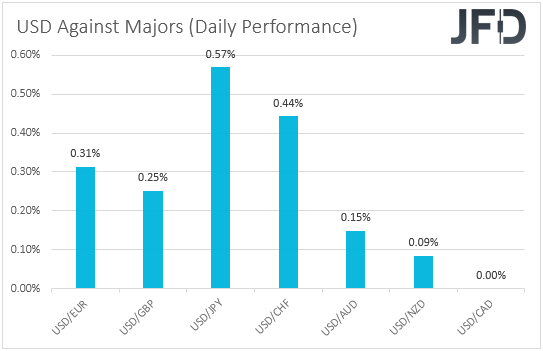

The US dollar traded higher against all but one of the other major currencies on Wednesday and during the Asian session Thursday. It gained the most versus JPY and CHF, while eked out the least gains versus AUD and NZD. The greenback was found virtually unchanged against CAD.

Although the strengthening of the US dollar points to risk-aversion, the weakening of the yen and franc, combined with the relative strength of the risk-linked aussie, kiwi and loonie, suggests that investors may have traded otherwise. So, to clear things up, we prefer to turn our gaze to the equity world. There, major European ones recorded gains, but investor morale deteriorated during the US session and rolled over soft into the Asian session today.

European shares hit fresh highs yesterday, with optimism over Q2 earnings adding fuel to the latest rally. However, looking at the details, we see that the main driver yesterday was technology stocks, which hit a 20-year peak. History has shown that technology is fairly resilient to any economic disruptions caused by the pandemic, and thus, being the best performer in the midst of rising cases of the Delta variant suggests that virus-related concerns have not vanished yet.

In the US, both the Dow and the S&P finished in the red, with only the tech-heavy NASDAQ 100 rising somewhat. Market chatter suggests that this may have been the result of the ADP report revealing that the private sector has gained less than projected jobs. Actually, it added less than half of what analysts have forecasted.

In any case, we don’t believe that this could have been the reason for the slide in Wall Street. After all, weaker jobs growth could mean a later tapering by the Fed, as well as later rate increases. As we noted several times in the recent past, low borrowing costs for longer is something good for equities.

In our view, the driver was hawkish remarks by Fed Vice Chair Richard Clarida, who said that the conditions for raising interest rates could be met by the end of 2022. Dallas Fed President Robert Kaplan and St. Louis Fed President James Bullard also sounded relatively hawkish, advocating for reducing the monthly asset purchases soon.

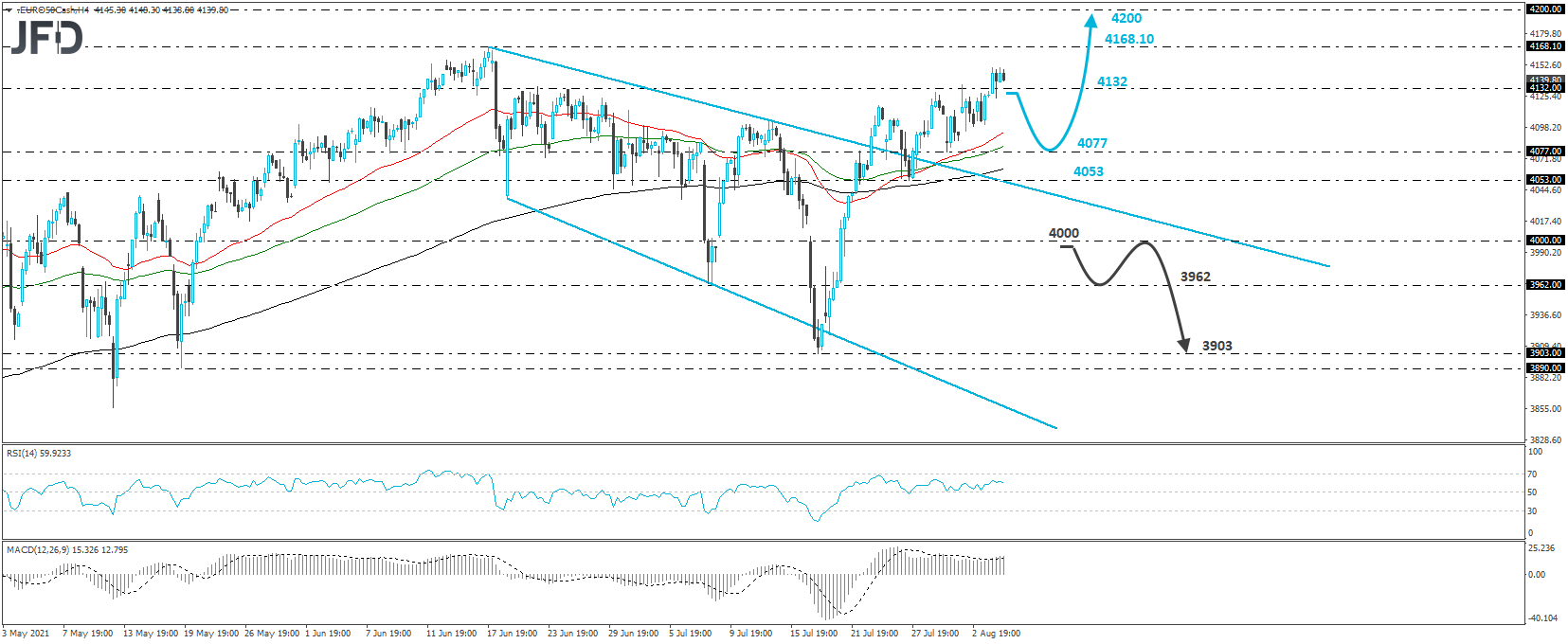

EuroStoxx 50 - Technical Outlook

The Euro Stoxx 50 cash index traded higher yesterday, breaking above the key resistance zone of 4132, which stopped investors from climbing higher between June 22 and 25. Overall, the index remains above the prior downside resistance line taken from the high of June 17 and thus, we would consider the short-term outlook to be positive.

Even if we see a correction lower, we would expect the bulls to jump back into the action from above the low of July 30, at 4077 and perhaps push the action up again, towards the record high of 4168.10, hit on June 17. If they are not willing to stop there, then they will enter the uncharted territory, and with no prior highs or inside swing lows to mark the next resistance, we would consider as a potential target the 4200 area.

On the downside, we would like to see a dip below the psychological round number of 4000, before we start examining the bearish case, at least in the short term. This may confirm the return below the downside line taken from the high of June 17, and may pave the way towards the 3962 barrier, marked by the low of July 8. Another break, below 3962, could trigger extensions towards the 3903 zone, defined as a support by the low of July 19.

Will The BoE Sound More Optimistic Than Previously?

Today, the main event on the agenda may be the BoE monetary policy decision. This is a “Super Thursday,” where apart from the decision, the meeting statement, and the minutes, we also get updated economic projections and a press conference by Governor Andrew Bailey.

Last time, this Bank decided to keep its policy settings unchanged, with only one member voting in favor of QE tapering. That member was Chief Economist Andy Haldane, for whom that was the last meeting. The Bank repeated that the surge in inflation is expected to be transitory, and added that they do not want to undermine the recovery by premature tightening, disappointing those expecting signals that something like that could be announced soon.

However, since then, a couple of officials expressed the view that tapering should start sooner than previously thought. Thus, it would be interesting to see whether we will have, and if so, how many, votes in favor of tapering. We will also dig into the statement and the minutes for clues as to whether, even those voting against QE tapering, are planning to support such an action at the upcoming gatherings.

With regards to the economic projections, officials could raise their inflation forecasts but still hold the view that the surge is likely to prove to be transitory. That said, due to concerns over the Delta variant of the coronavirus, the growth outlook remains uncertain. In any case, a more hawkish vibe than previously could support the British pound.

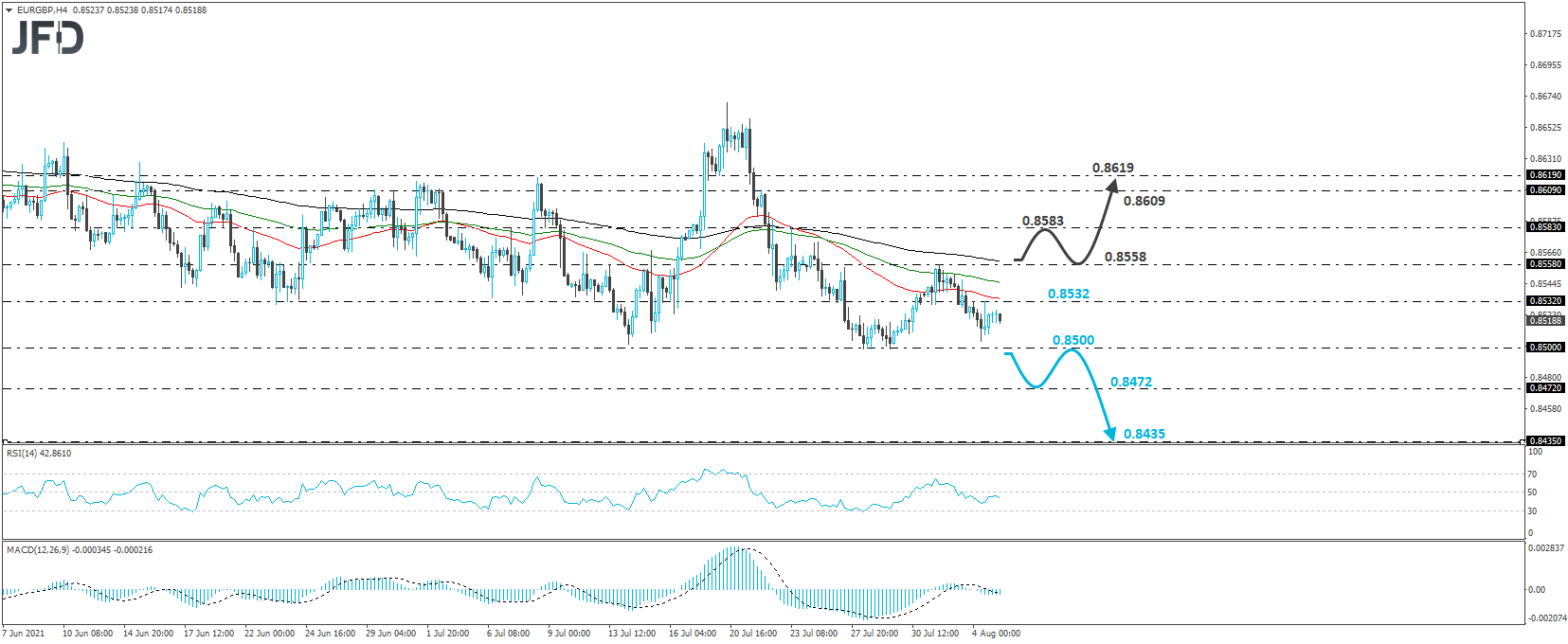

EUR/GBP – Technical Outlook

EUR/GBP traded in a consolidative manner on Wednesday, staying between the 0.8500 key support zone, and the resistance of 0.8532. Overall, the price structure has been lower highs since July 20, but recently, the bears found it difficult to push below 0.8500. Thus, in order to get confident on more declines, we would like to see a strong break below that barrier.

If indeed, the rate falls below that key hurdle, this will confirm a forthcoming lower low and may pave the way towards the 0.8472 level, marked by the low of Apr. 5. Another break, below 0.8472, could see scope for more declines, perhaps towards the 0.8435 area, near the low of Feb. 27, 2020.

On the upside, a rebound above 8558 would confirm a forthcoming higher high on the 4-hour chart and may be the signal that the bulls have gained full control, at least for a while. We could then see advances towards the 0.8583 barrier, marked by the high of July 23, the break of which could carry extensions towards the 0.8609 level, marked by the high of the day before.

As For The Rest Of Today's Events

Besides the BoE decision, today’s agenda also includes the US initial jobless claims for last week, which are expected to have declined to 384k from 400k, as well as Canada’s trade balance for June, with the nation’s deficit expected to have narrowed by nearly 0.6bn loonies.

As for the speakers, we will get to hear from Fed Board Governor Christopher Waller. However, we don’t expect him to say something we don’t already know. He spoke a couple of days ago and said that he and his colleagues should “go early and go fast” on QE tapering.