Extraordinary European Expectations:

With Draghi and the ECB in play tomorrow night, attention stays on the euro during today’s trading session amidst mixed expectations.

While expected to provide yet more stimulus for the economy, it isn’t clear what avenues the ECB will take to achieve their goal. Mario Draghi knows all about under delivering on promises and we’ve called Draghi ‘the boy who cried wolf' on this blog before. I just feel the market is nervous about what could come and the price action leading into the decision reflects this view.

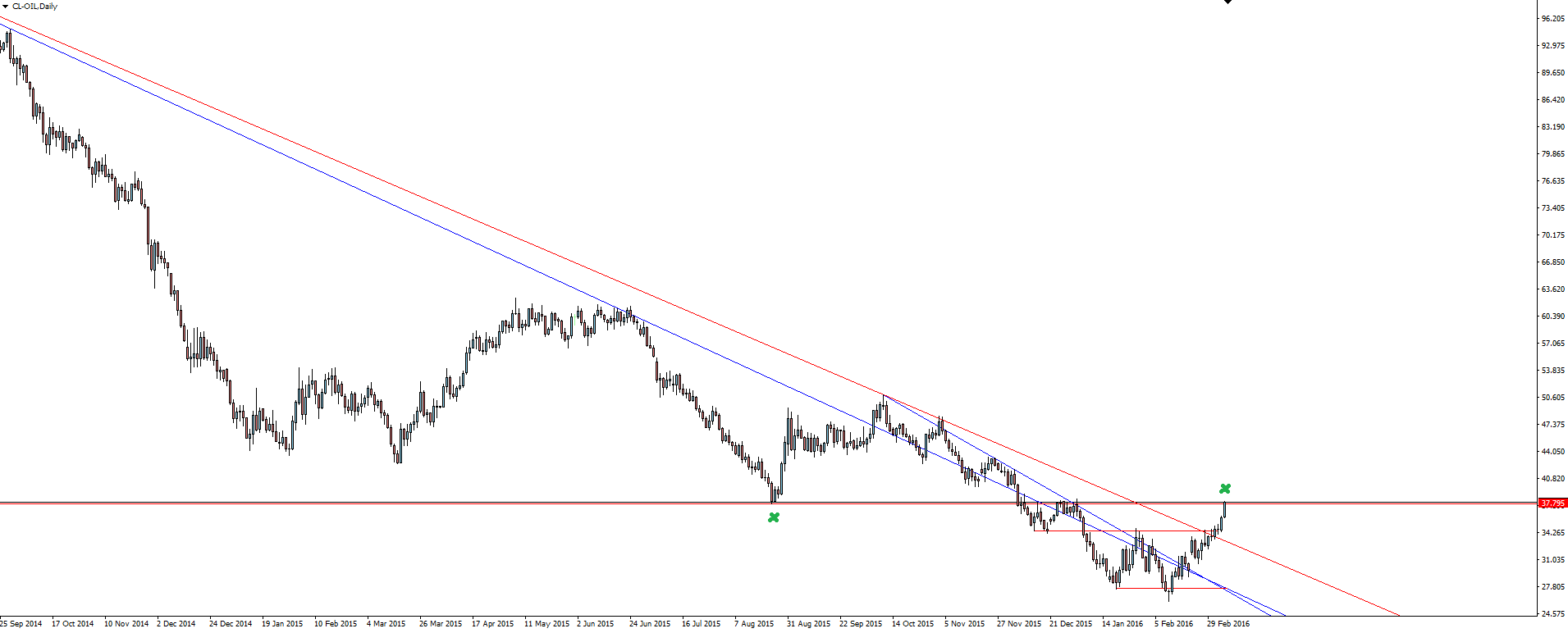

EUR/GBP Daily:

The fact that for the last month, the euro hasn’t really moved across all pairs reflects some of the distrust that markets have for Draghi surrounding the ECB’s recent monetary policy direction.

There is plenty of room for surprise in both the extent of QE as well as in price from a technical point of view and I’m staying very cautious in euro positions and sizing heading into the decision.

Moving onto stock indices and the huge rally we’ve seen in the US market over the last few weeks is still moving full steam ahead.

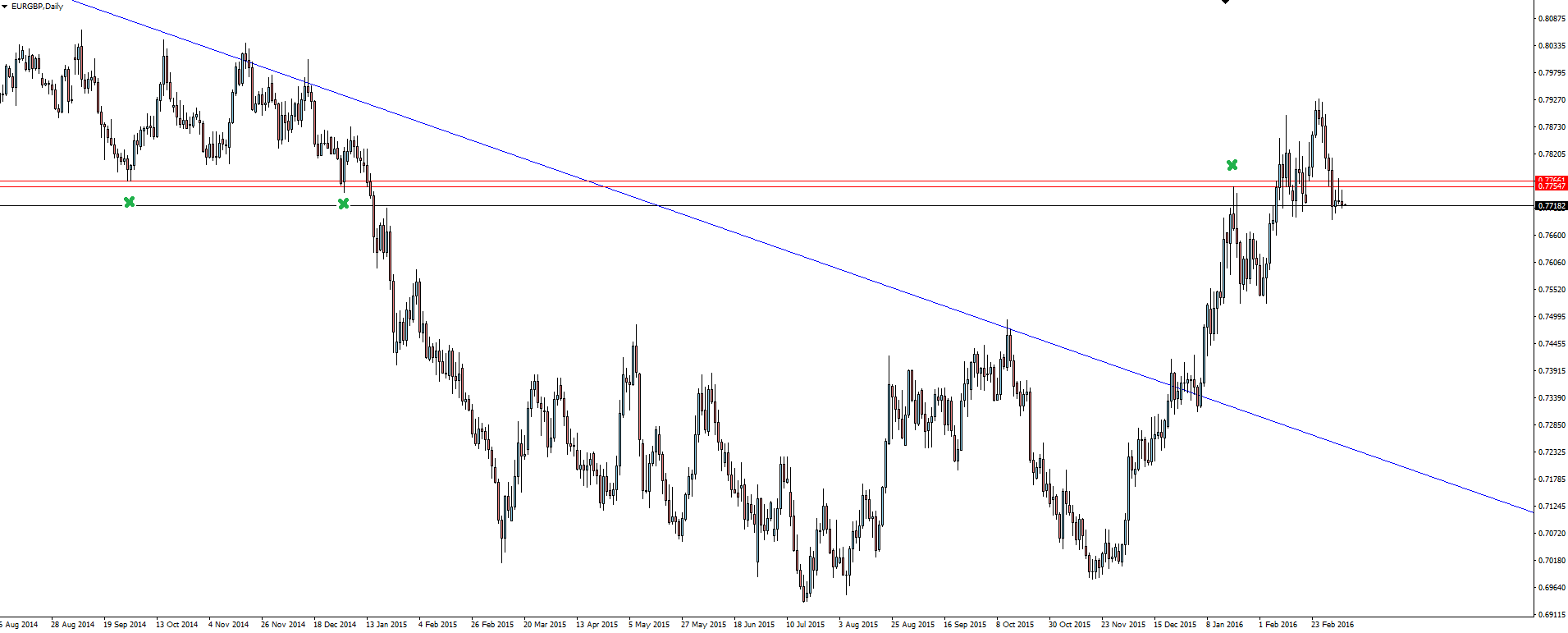

Stock/Oil Correlations:

The S&P 500 closed just above the hugely significant 2000.00 psychological level which as you can see from the chart below, has caused a reaction on either side of the market whether acting as support or resistance.

S&P 500 Daily:

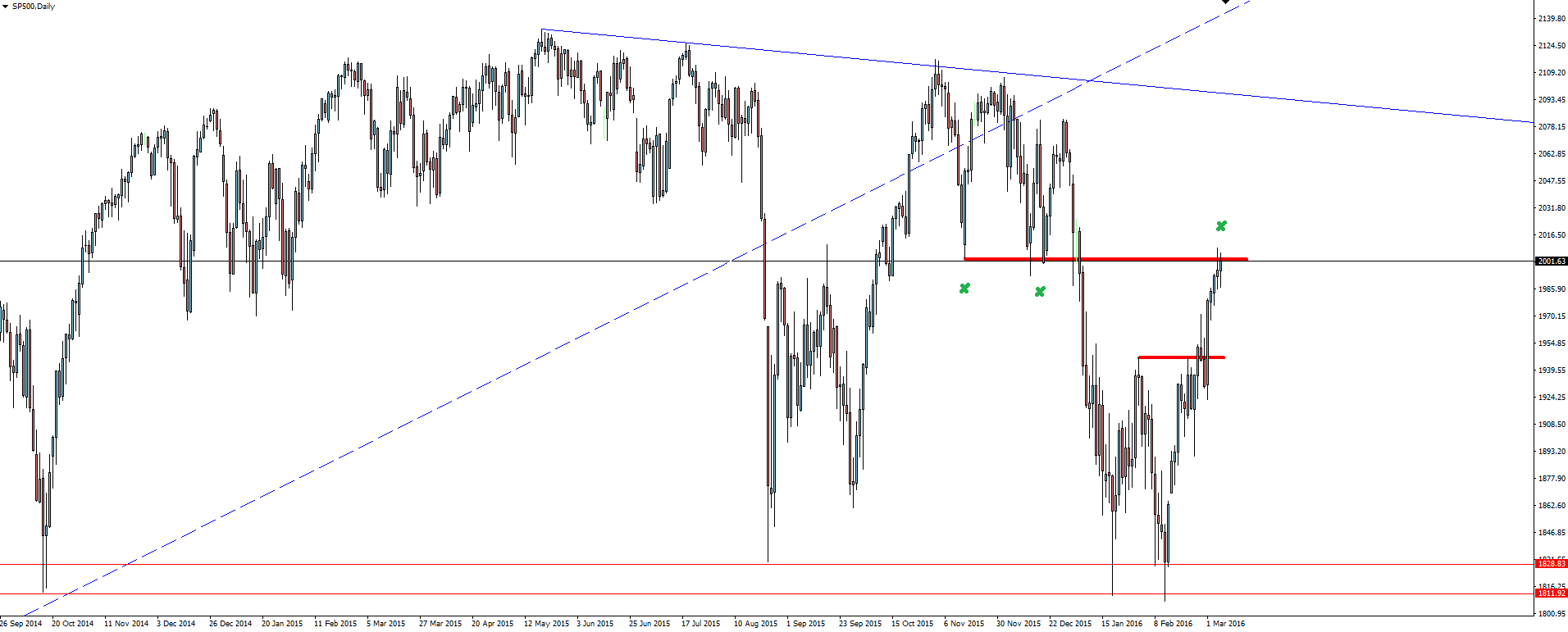

The slightly unconventional ‘stocks / oil correlation’ is also still in full swing. Look at the way that stocks here have closed the day at a hugely significant resistance level that has caused price to react in the past. Now move down to our oil chart of the day

Oil has also rallied overnight, breaking through the $40 level for the first time in 2016. And what’s this? Finally some technical damage being inflicted to the upside on oil? Has the world gone crazy?!

I’ve spent a bit of time having a laugh at months of what were totally unwarranted oil headlines on this blog and now that I feel they’re justified, I find it hilarious that I can’t find any!

Oh finance journalism, you’re so zany.

On the Calendar Tuesday:

AUD RBA Deputy Gov Lowe Speaks

JPY Current Account

JPY Final GDP q/q

CNY Trade Balance

GBP BOE Gov Carney Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices, give Forex signals or solicitation to trade Forex. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.