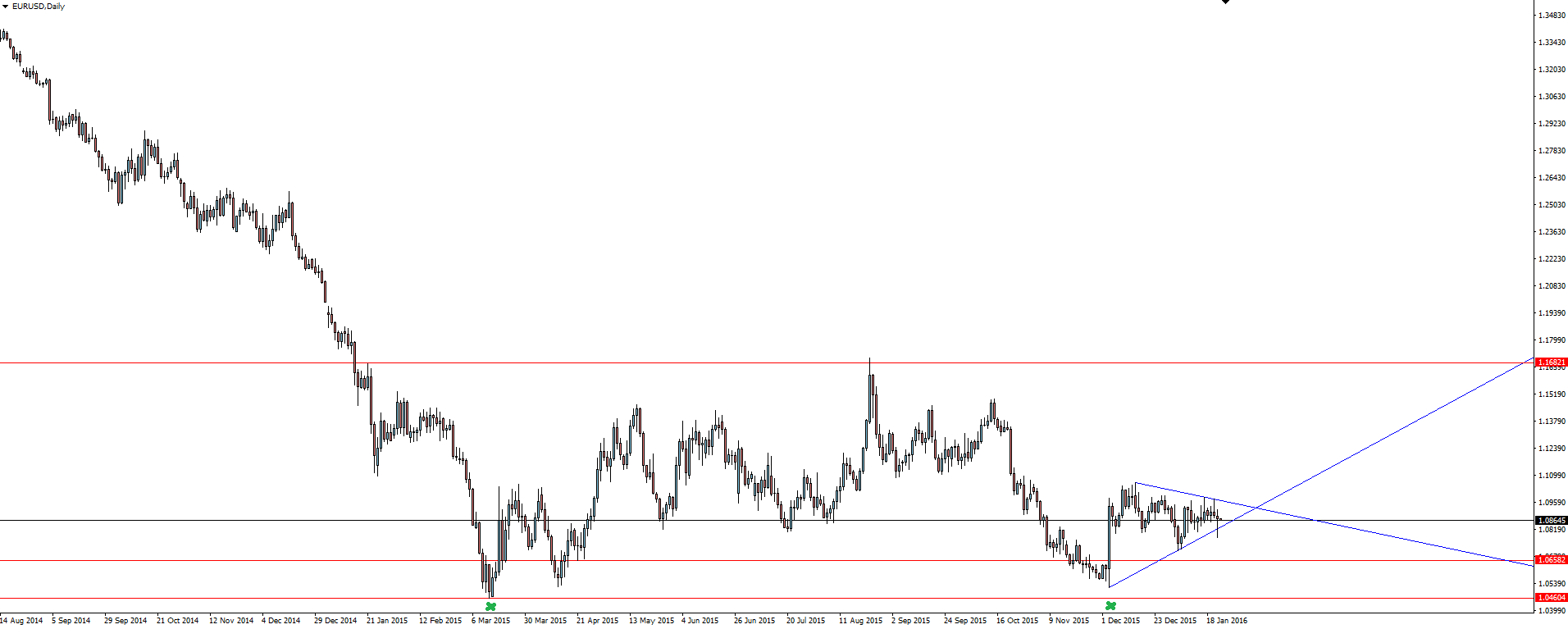

Mario Draghi: The Boy who Cried Wolf:

What did you learn from the stories that you were told as a child? Do you trust people that say one thing and then do another?

If you’re interested in human behaviour, and you should be if you are a trader, then the polarising interpretations of Mario Draghi’s comments overnight between the economist notes and traders via EUR/USD price action is fascinating!

Following Draghi’s monthly speech in Frankfurt overnight, we heard once again that the ECB was ‘ready to take action’ in March (their next decision, with no February meeting) as global risks escalate and inflation goals slip further away.

“There are no limits in policy action to achieve inflation goals.”

“The ECB has the power, determination, and willingness to act.”

“Will reconsider policy stance in March.”

But aren’t these all just comments we’ve heard Draghi deliver before? Click that link and have a look at the comments after the October 22 ECB meeting when the euro was obliterated by talk of the ECB ‘actively exploring’ ways to expand their asset purchasing program.

With the stream of headlines and economist notes screaming dovish, it would seem that traders don’t share the same trust in Mr Draghi’s rhetoric.

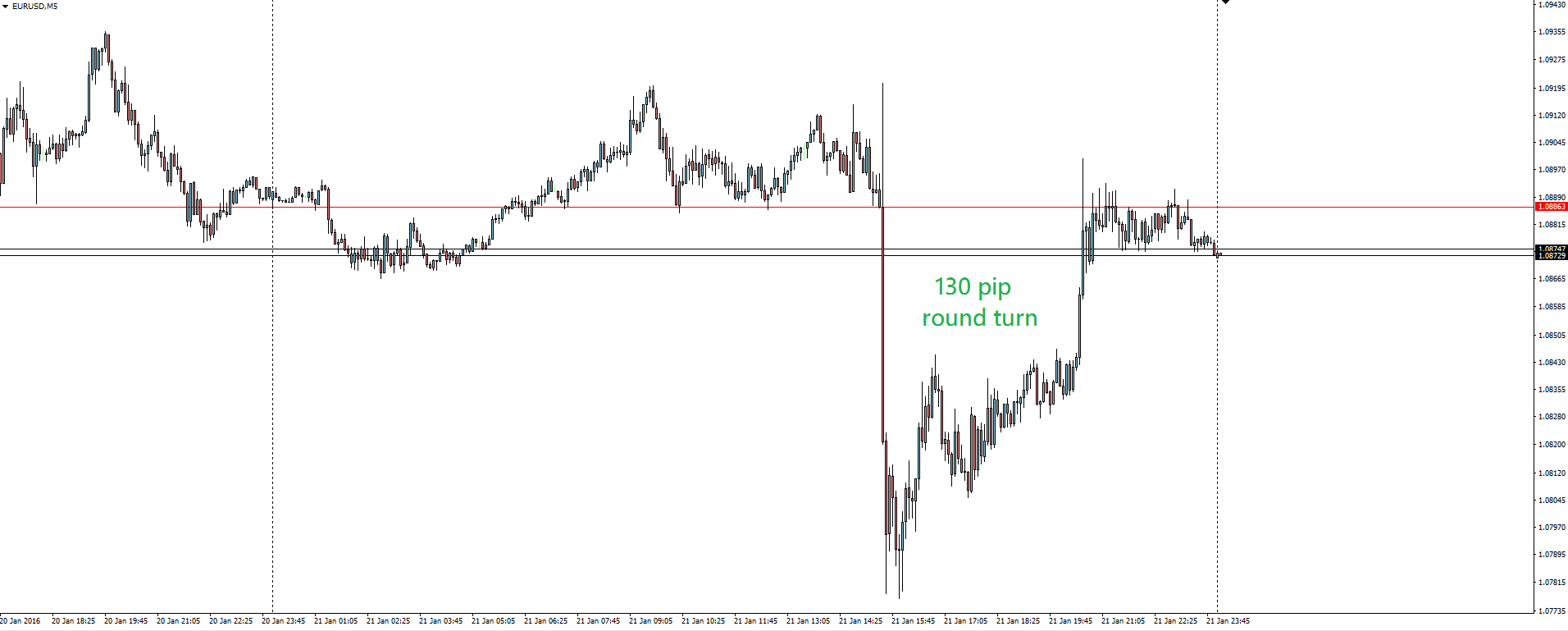

EUR/USD 5 Minute:

With the ECB being largely all talk up until now and riding on the coattails of a strengthening USD, buyers soon stepped into EUR/USD and the pair saw a 130 pip round turn!

Whether Draghi was admitting the ECB’s failure to act sooner or not, it doesn’t matter because the market isn’t convinced.

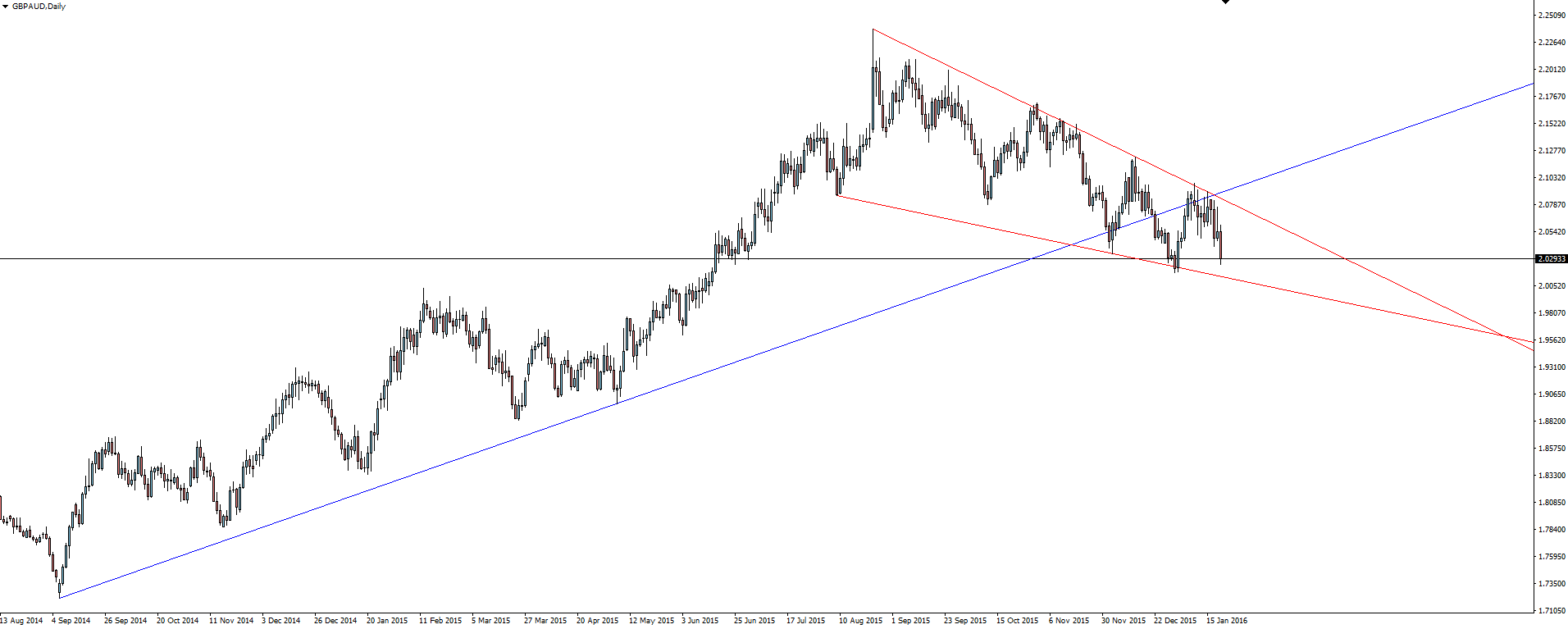

Chart of the Day:

We’ve been watching GBP drop, drop and then drop further… With some temporary relief in cable that we’re all obviously watching, we today turn our attention to GBP/AUD.

GBP/AUD Daily:

After breaking through trend line support, price has reached previous horizontal support at a swing low.

Do you see any merit in buying the dip at this point of confluence?

On the Calendar Friday:

Today’s Forex economic calendar is littered with 2nd tier PMI data from countries across the Eurozone. While the market should pay the most attention to the tier 1 releases listed here, it’s worth keeping an eye on the full calendar just in case.

EUR ECB President Draghi Speaks

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

GBP Retail Sales m/m

CAD Core CPI m/m

CAD Core Retail Sales m/m

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.