Oil: First Steps Taken Toward a Coordinated Supply Effort

With futures markets now completely pricing out any chance of a rate hike from the Fed for the entirety of 2016, tomorrow’s FOMC minutes are expected to sound dovish in the wake of continued equity weakness.

As traders, we always have to think about market expectations and where the greatest risk comes from if expectations aren’t quite met. This would obviously be any rhetoric stating that the Fed plan to go full steam ahead with further rate increases. This just isn’t going to happen, but the risk is skewed to anything interpreted as hawkish. ANYTHING else is going to see the USD sell off and that’s what I’d be more inclined to position for.

Fed headlines did however take a back seat last night to OPEC’s decision to freeze oil production. Oil producing nations have quite frankly had enough of lower prices and are FINALLY starting to coordinate to cement the $25.00 level as a longer term low. This coordinated move, while still not including Iran, is highly significant because it is a step away from the internal bickering that has seen nobody want to make the first move in cutting supply. Saudi Arabia has said many times that while they want to cut supply, by doing so they would only be reducing their own market share while no material impact would be felt to price.

While markets haven’t reacted as positively as one may expect, the fact that a coordinated process has begun is hugely significant to the future direction of oil and something well worth taking note of.

Oil Technicals:

But while it may be a positive step toward a bottom, the charts aren’t quite there yet.

“Oil is in a bear market until it’s not.“

Remember when two bullish daily candles meant that oil was going to bounce?

Remember the week before when the one bullish daily candle meant the oil bottom was in?

Remember… I’ll stop there, as I’m sure you get the point I’m trying to make. We should still be trading what’s in front of us, and quite frankly that’s one big bear market.

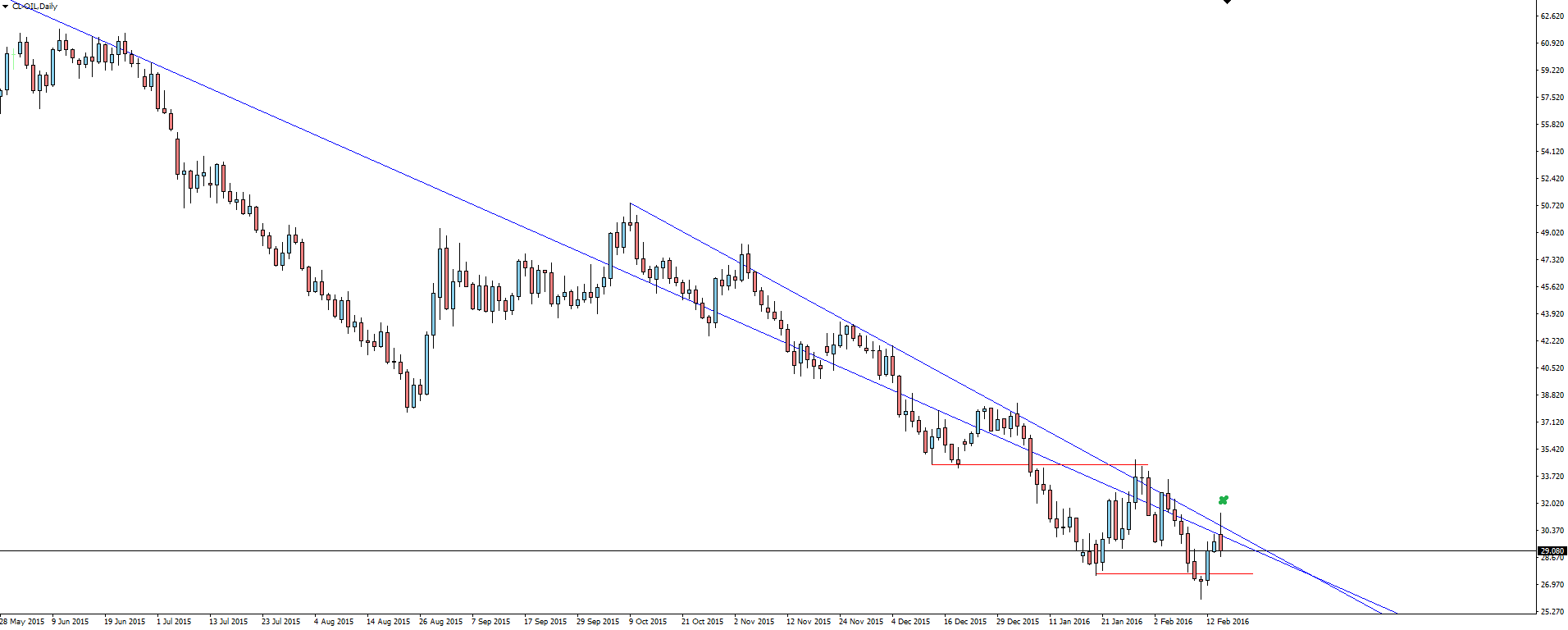

The daily chart shows that oil is still capped by long term trend line resistance. There also hasn’t been a higher high or higher low since October 2015. Bearish.

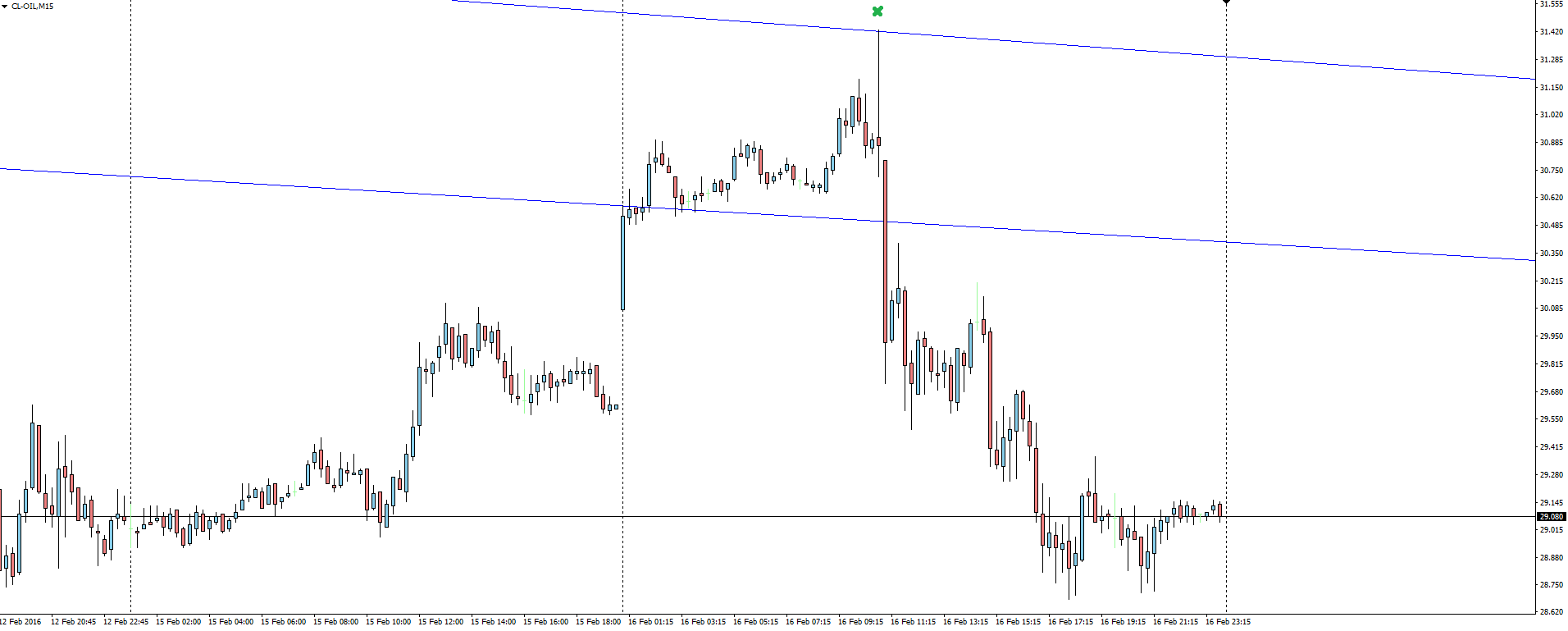

The 15 minute chart shows the headline reaction off trend line resistance when the news was first reported. As it’s a weekly trend line being shown on a 15 minute chart, it’s not going to line up perfectly but I still love including these charts when price, even combined with news, respects a level almost perfectly!

Chart of the Day:

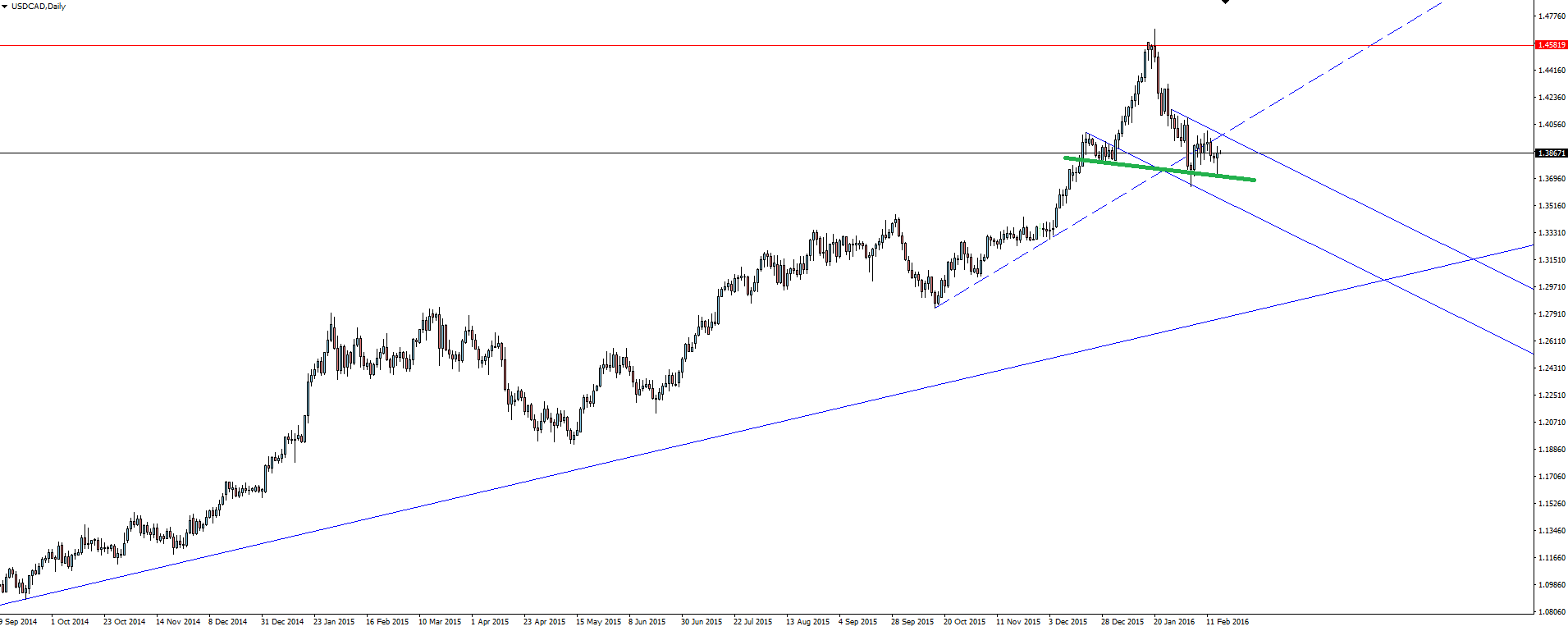

When we look at oil, it’s always wise to look at the loonie.

USD/CAD Daily:

Click on chart to see a larger view.

I’ll let you zoom into the lower time frame levels yourself depending on what you want to take notice of but I wanted to highlight some key zones where I will be looking for price to react.

Price has broken the most recent bullish trend line and has started to form a short term bearish channel. I’m not a fan of head and shoulders patterns and the subjectivity does my head in, but that one is pretty hard to miss even if you are using other levels to enter your trades around.

On the calendar Wednesday:

USD FOMC Member Rosengren Speaks

GBP Average Earnings Index 3m/y

GBP Claimant Count Change

GBP Unemployment Rate

USD Building Permits

USD PPI m/m

USD FOMC Meeting Minutes

Disclosure: In addition to the website disclaimer below, the material on this page prepared by Safe Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.