Why the U.S. dollar still reigns supreme

Rotation is a concept in finance on many levels. There is the business cycle, the economic cycle and seasonality. There is also rotation within the stock market. Often times it is related to the business or economic cycle. Investors will take about a rotation out of energy stocks and into technology stocks for example. And many investors trade the market this way.

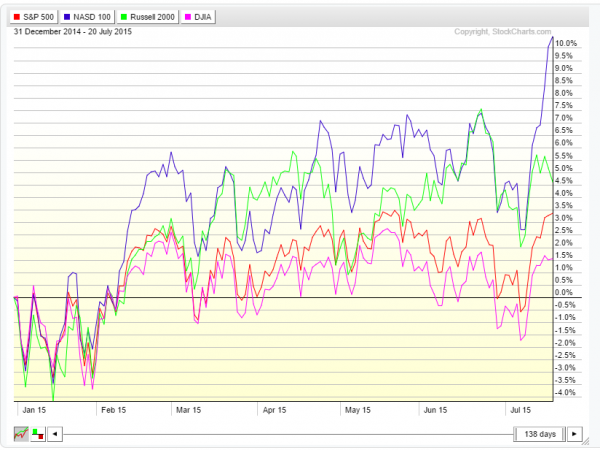

But with the different characteristics of the major market indexes it is also possible to see rotation between them. The chart below shows the performance of the Dow Jones Industrial Average, S&P 500, Russell 2000 and Nasdaq 100 since the beginning of the year. In a market that has been flat or range bound it is not a surprise to see the lines all going mainly sideways until recently, or at least in a tight range.

Looking a bit more closely though there is some interesting information to take away. First, the two large cap indexes, the Dow and the S&P have been very tightly correlated. tossing those two indexes aside gives the revised chart below.

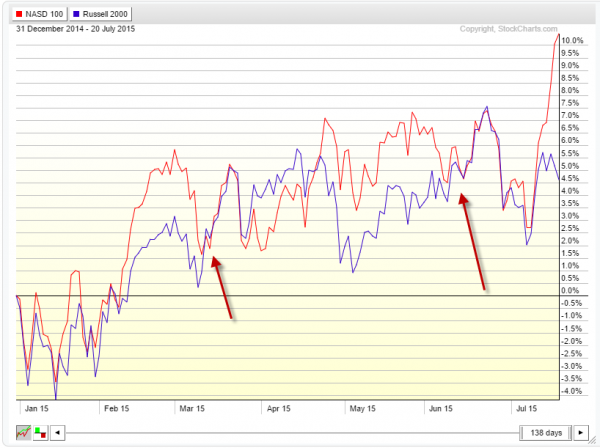

This chart now shows the Russell 2000 and Nasdaq 100 performance for this year. These two were also very tightly correlated. But there are also some big gaps that opened up and then were closed. To start February the the Nasdaq pushed higher. The Russell also moved but mot as much and not as fast. But by mid March, at the first arrow, the two came back together and stayed tightly correlated until late April.

At that point the Nasdaq advanced and the performance outpaced the Russell until the Russell rose to meet it in mid June at the second arrow. From that point they moved in tandem again. But then last week the Nasdaq exploded higher again. Will it result in a third incidence of the Russell playing catch up, by either rocketing higher, or a pullback in the Nasdaq? Nobody knows for sure, but there does seem to be a pairs trade there.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.