Market Brief

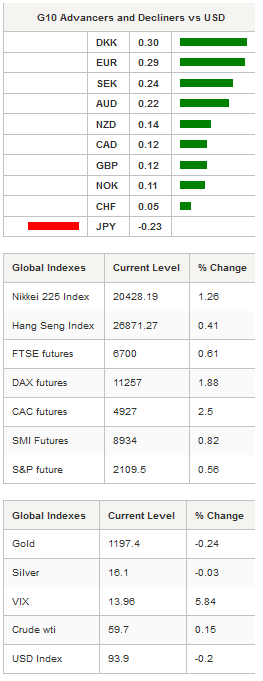

European political jitters and mounting uncertainties about Greece’s future will attract again all market’s attention this week as the “IMF deadline” is fast approaching. However, markets do not seem to consider a Greek default as bad news for the Eurozone anymore. The high level of uncertainty stemming from the Greek situation is weighing on investors’ mood and markets are now bored of this never ending back and forth negotiation process. EUR/USD is even on the rise again since Friday and European equity futures opened in green this morning while no agreement has been reached between Greece and its creditors. Euro Stoxx 50 is up 2.29%, the DAX is up 1.88% while the CAC 40 is up 2.50%. EUR/USD is testing the strong resistance at 1.14 as traders await the unwinding of “last chance” proposal by Greek government to EU officials.

On Friday, Brazil’s mid-month inflation report surprised markets to the upside with a read at 8.80%y/y versus 8.64% expected or 0.99% versus 0.85% consensus on a month-over-month basis. The BRL reacted negatively to the headline, USD/BRL gained momentum and erased losses of the previous day to return to 3.0980. The BCB’s quarterly inflation report due next Wednesday will shed some light on inflation forecast and therefore the development of Brazil’s monetary policy.

In Asia, Chinese markets are close today due to Dragon Boat Festival Public holiday. In Japan, the Nikkei 225 is up 1.26% to 20,428 while South Korea’s KOSPI is up 0.40%. In Hong Kong, the Hang Seng is up 0.41%. USD/JPY will need fresh boost to break the strong support standing at 122.50. Japan’s May Nationwide CPI figures and June first inflation estimates are due on Friday. The BoJ minutes of its May 21-22 meeting will also be released on Wednesday.

After a relative quiet week on the data front in the US, the upcoming week is going to be a busy one. We start today with May existing home sales growth expected at 4.8%m/m, up to 5.28m. On Tuesday, we continue with May durable goods orders, new home sales and June Markit Manufacturing preliminary PMI. Q1 GDP final figures are due Wednesday while personal income and spending, Markit Composite and Service preliminary PMI are due Thursday. Finally, the week will end with June’s final read of Michigan Sentiment index on Friday.

In Canada, May CPI were due last Friday and surprised markets to the upside with a read at 0.9%y/y versus 0.8% expected while Core CPI printed at 2.2%y/y versus 2.1% consensus. On the other side, April retail sales came in below expectations at -0.1%m/m versus 0.7% expected after vehicle sales preventing a lower read. Retail sales ex Auto came in at -0.6%m/m versus 0.3% consensus. USD/CAD moved slightly lower since then and sits currently on the 1.2242 support implied by the 50% Fibonacci level (on May-June rally). On the downside, a support lies at 1.2166 (Fibo 61.8%) while a resistance can be found around 1.2360 (previous high).

Today traders will be watching May Chicago Fed Nat Activity index and existing home sales from the US; May current account balance, foreign direct investment, tax collections and weekly trade balance from Brazil; June flash consumer confidence from the Eurozone

Today's CalendarEstimatesPreviousCountry / GMT JN May Convenience Store Sales YoY - 4.00% JPY / 07:00 TU Jun Consumer Confidence Index - 64.3 TRY / 07:00 SZ SNB Sight Deposits - - CHF / 07:00 DE Jun Consumer Confidence Indicator 11.3 13 DKK / 07:00 DE May Retail Sales MoM 0.20% -0.20% DKK / 07:00 DE May Retail Sales YoY - 0.50% DKK / 07:00 EC Former ECB President Jean-Claude Trichet Speaks in Vienna - - EUR / 09:00 BZ Central Bank Weekly Economists Survey - - BRL / 11:25 US May Chicago Fed Nat Activity Index 0.16 -0.15 USD / 12:30 BZ May Current Account Balance -$4600M -$6901M BRL / 13:30 BZ May Foreign Direct Investment $4200M $5777M BRL / 13:30 EC ECB Announces Weekly QE Details - - EUR / 13:45 CA Jun 19 Bloomberg Nanos Confidence - 56.7 CAD / 14:00 EC Jun A Consumer Confidence -5.8 -5.5 EUR / 14:00 US May Existing Home Sales 5.28M 5.04M USD / 14:00 US May Existing Home Sales MoM 4.80% -3.30% USD / 14:00 BZ Jun 21 Trade Balance Weekly - $678M BRL / 18:00 BZ May Tax Collections 94000M 109241M BRL / 22:00

Currency Tech

EURUSD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1379

S 1: 1.0882

S 2: 1.0521

GBPUSD

R 2: 1.6189

R 1: 1.5879

CURRENT: 1.5894

S 1: 1.5191

S 2: 1.5090

USDJPY

R 2: 135.15

R 1: 125.64

CURRENT: 123.01

S 1: 122.03

S 2: 118.18

USDCHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9173

S 1: 0.9072

S 2: 0.8986