- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Euro Under Pressure Despite Greek Deal

Market Brief

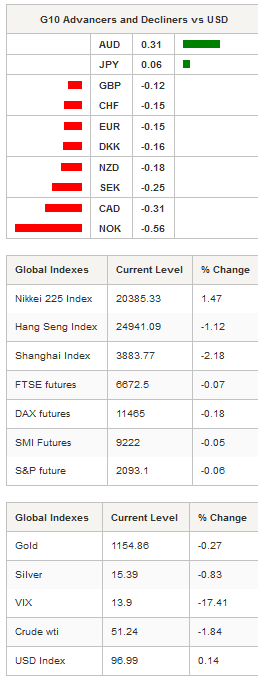

After a choppy Monday in the FX market, most currency pairs consolidated in the Asian session. A conditional deal has been reached between Greece and its creditors, allowing the cash-strapped nation to access €86bn of fresh bailout fund. However, there was no elation in both the stock and the FX markets as the level of uncertainty remains elevated. Alexis Tsipras, Greece’s Prime Minister, is expected to face tough political opposition as he will have to pass a new batch of economic reform, which are considered by many Greek parties as humiliating for the country. This morning, EUR/USD is edging slightly below the 1.10 threshold after having reached 1.12 the previous day as markets seem to believe that the concession Greece has to make are not sustainable over the long-term.

In Asia, regional equity returns are mixed this morning with Japan’s Nikkei 225 gaining 1.47%, helped by a weaker yen. USD/JPY is testing the 123.50/124 resistance area. On the downside, closest support can be found at 120.46 (low from July 8), then 118.89 (low from May 14). In China, the Shanghai Composite is down -2.18% as roughly 250 Chinese companies resumed trading on Tuesday. However, about 25% of listed companies are still suspended. The tech-heavy SZSE Composite is up 1.19%, after having lost more than 30% since the beginning of the month.

In Australia, the equity market finds support from a strong business confidence report as the NAB rose to a 1-year high at 10 in June compared with a reading of 8 in May. TheS&P/ASX 200 is up 1.90% while the Aussie rose 0.31% against the greenback. AUD/USD is finding strong support around 0.74 area and needs fresh boost to break that level to the downside. Encouraging US data may provide that little help and allow the Aussie to depreciate further against the US dollar. The closest support can be found around 0.7270 while on the upside the 0.76-0.78 resistance area will likely hold for an extended period of time.

In UK, the Office for National Statistics will release the June consumer price index this afternoon. Inflation is anticipated to have remained subdued in June with headline figure expected flat versus 0.1%y/y a month ago or 0.1%m/m versus 0.2% in May. Core CPI is expected to remain stable with median forecast at 0.9%y/y. GBP/USD is currently testing the 1.5461 resistance level (Fib 61.8% on June rally).

Crude oil prices are falling this morning as Iran and a major powers have reached a deal. WTI is down -1.84% while its counterpart from the North Sea is down -1.74% as Iranian crude oil is expected to flood the market soon.

Today traders will be watching CPI and PPI from Switzerland; CPI, RPI and PPI from UK; Industrial production from Eurozone and ZEW from Germany; Retail sales from Brazil; retail sales and import price from the US.

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.0997

S 1: 1.0916

S 2: 1.0819

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5467

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 125.86

R 1: 124.45

CURRENT: 123.50

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 0.9719

R 1: 0.9543

CURRENT: 0.9488

S 1: 0.9151

S 2: 0.9072

Related Articles

Economic resilience has held up, but emerging signs of weakness suggest investors should stay vigilant. Market volatility is creeping higher, hinting at a potential shift from...

Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. Over the previous week, the market fell sharply...

This week we got the second look at Q4 GDP, which showed the economy grew at a 2.3% annualized pace. Which was the same as the 1st estimate, but below the historical average of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.