Market Brief

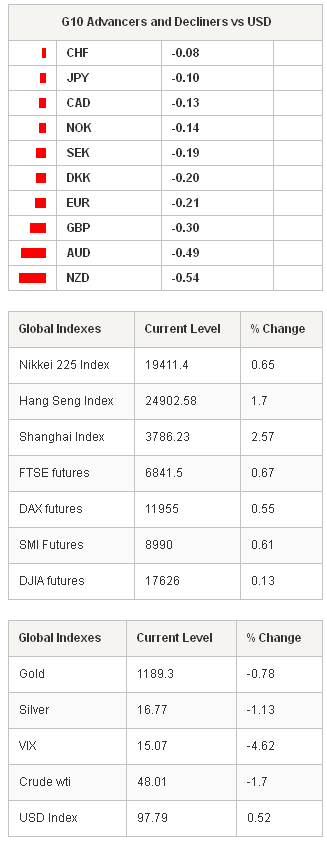

The FX markets started the week in a subdued fashion with the USD slightly stronger verse G10 and EM currencies. In Asian equity markets, Chinese stocks were the big gainers with the Shanghai Composite up 2.47% aided by PBoC governor pro-growth comments. The Hang Seng and Nikkei 225 rose 1.73% and 0.65% respectively. S&P 500 futures are pointing to a stronger open. Commodity currencies (AUD, NZD, NOK and CAD) were under pressure following falls in Crude Oil . extended loses as fear of supply disruption from military operations in Yemen were exaggerated (but situation remains fluid). Lingering worries over the lack of a tangible bailout solution for Greece will renew USD buying. In Japan, industrial production collapsed -3.4% m/m verse -1.9% expected. The decline was broad-based but critically focused in key export industries. The sharp decline may have been caused by slower demand from China during the New Year. USD/JPY remains contained in at 118.95 to 119.50 trading range.

USD/CNY fell on the open to 6.21 and the fix was only slighter higher. PBoC governor Zhou Xiaochuan provided markets with reassurance that managing a soft-landing would be the highest priority. China's central banks chief suggested that the countries growth rate had fallen too much and that policy makers had plenty of tools to respond. Governor Zhou mentioned using both interest rates and quantitative measures. He also highlighted declining inflation stating “we need to be vigilant to see if the disinflation trend will continue.” A pro-stimulus comment if there every was one. In regards to foreign exchange which policy makers have become extremely involved with recently (see Weekly Report), Zhou said China will change regulations radically this year. We remains constructive on the CNY based on China massive firepower still unused. China will continue to move in a proactive manner which will revive growth by Q3 2015.

In the European, session the focus will be on developments around the Greek reform proposal to the Eurogroup. With Greece running out of money negotiations are key for Greece to avoid an liquidity event (next Monday a €450m loan payment is due to IMF). Officials on both side stated that weekend talks were positive yet slow. Creditors have demanded that Greece must implement reforms before any of the €7.0bn from the bailout fund is disbursed. The most recent reform proposal looks to put property tax concession at the middle of the new agreement (estimated to raise €2.5bn of €3.0bn needed). However, Greece’s new reform has failed to include changes to labor laws and pension systems which are essential according to creditors to the final bailout program. We remain bearish on the EUR. Rejection at 1.1098 resistance areas suggests a test of 1.0570. Spanish HICP inflation provided a slight turn around at -0.7 from prior read at -1.2%y/y. Swiss KoF surprisingly increased to 90.8 verse 89.1 expected (prior revised to 90.3) decline.

In the US session personal spending & income, PCE deflator and pending home sales will hold traders attention.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| JN Feb P Industrial Production MoM | -1.90% | 3.70% | JPY / 23:50 |

| JN Feb P Industrial Production YoY | -0.60% | -2.80% | JPY / 23:50 |

| SZ Mar KOF Leading Indicator | 89.1 | 90.1 | CHF / 07:00 |

| UK Feb Net Consumer Credit | 0.9B | 0.8B | GBP / 08:30 |

| UK Feb Net Lending Sec. on Dwellings | 1.6B | 1.6B | GBP / 08:30 |

| UK Feb Mortgage Approvals | 61.5K | 60.8K | GBP / 08:30 |

| UK Feb Money Supply M4 MoM | - | -0.80% | GBP / 08:30 |

| UK Feb M4 Money Supply YoY | - | -2.20% | GBP / 08:30 |

| UK Feb M4 Ex IOFCs 3M Annualised | 5.20% | 5.50% | GBP / 08:30 |

| EC Mar Business Climate Indicator | 0.18 | 0.07 | EUR / 09:00 |

| EC Mar Industrial Confidence | -4 | -4.7 | EUR / 09:00 |

| EC Mar F Consumer Confidence | -3.7 | -3.7 | EUR / 09:00 |

| EC Mar Economic Confidence | 103 | 102.1 | EUR / 09:00 |

| EC Mar Services Confidence | 5.2 | 4.5 | EUR / 09:00 |

| SW Finance Minister Andersson Presents OECD Economic Survey | - | - | SEK / 11:30 |

| US Feb Personal Income | 0.30% | 0.30% | USD / 12:30 |

| CA Feb Industrial Product Price MoM | 0.90% | -0.40% | CAD / 12:30 |

| US Feb Personal Spending | 0.20% | -0.20% | USD / 12:30 |

| CA Feb Raw Materials Price Index MoM | 4.50% | -7.70% | CAD / 12:30 |

| US Feb Inflation Adjusted Personal Spending | 0.10% | 0.30% | USD / 12:30 |

| US Feb PCE Deflator MoM | 0.20% | -0.50% | USD / 12:30 |

| US Feb PCE Deflator YoY | 0.30% | 0.20% | USD / 12:30 |

| US Feb PCE Core MoM | 0.10% | 0.10% | USD / 12:30 |

| US Feb PCE Core YoY | 1.30% | 1.30% | USD / 12:30 |

| CA 27.mars Bloomberg Nanos Confidence | - | 55 | CAD / 14:00 |

| US Feb Pending Home Sales MoM | 0.40% | 1.70% | USD / 14:00 |

| US Feb Pending Home Sales NSA YoY | 8.70% | 6.50% | USD / 14:00 |

| US Mar Dallas Fed Manf. Activity | -9 | -11.2 | USD / 14:30 |

| NZ Feb Building Permits MoM | - | -3.80% | NZD / 21:45 |

Currency Tech

EUR/USD

R 2: 1.1280

R 1: 1.1043

CURRENT: 1.0812

S 1: 1.0768

S 2: 1.0613

GBP/USD

R 2: 1.5166

R 1: 1.4994

CURRENT: 1.4812

S 1: 1.4635

S 2: 1.4547

USD/JPY

R 2: 122.03

R 1: 120.50

CURRENT: 119.41

S 1: 118.33

S 2: 117.93

USD/CHF

R 2: 0.9984

R 1: 0.9812

CURRENT: 0.9685

S 1: 0.9491

S 2: 0.9450