Some nice moves in the global markets last week and it looks like more of the same going into this week, albeit a bit more tepid I’m sure. We don’t have a strong number of major news events an the markets will be closed on Friday, so I’d expect the trends to continue but with much less momentum than we saw this week. Also, I’d expect some more profit taking in other markets which I will highlight below.

Be very careful with these recent markets. We are in very strong market correlations and most all markets are moving in the same direction. This means diversification is nearly impossible so I’m keeping my number of open positions limited.

1. Direxion Daily Brazil Bull 3X Shares (NYSE:BRZU) – Bullish

Last week I was calling for a continued bullish move, but only after a pullback. We saw the pullback, but it was massive. A 25% drop in one day! I personally didn’t trade BRZU as a result because that much volatility is just too rich for my tastes. Right now I’m watching to see if volatility picks up, but I’m still bullish on BRZU.

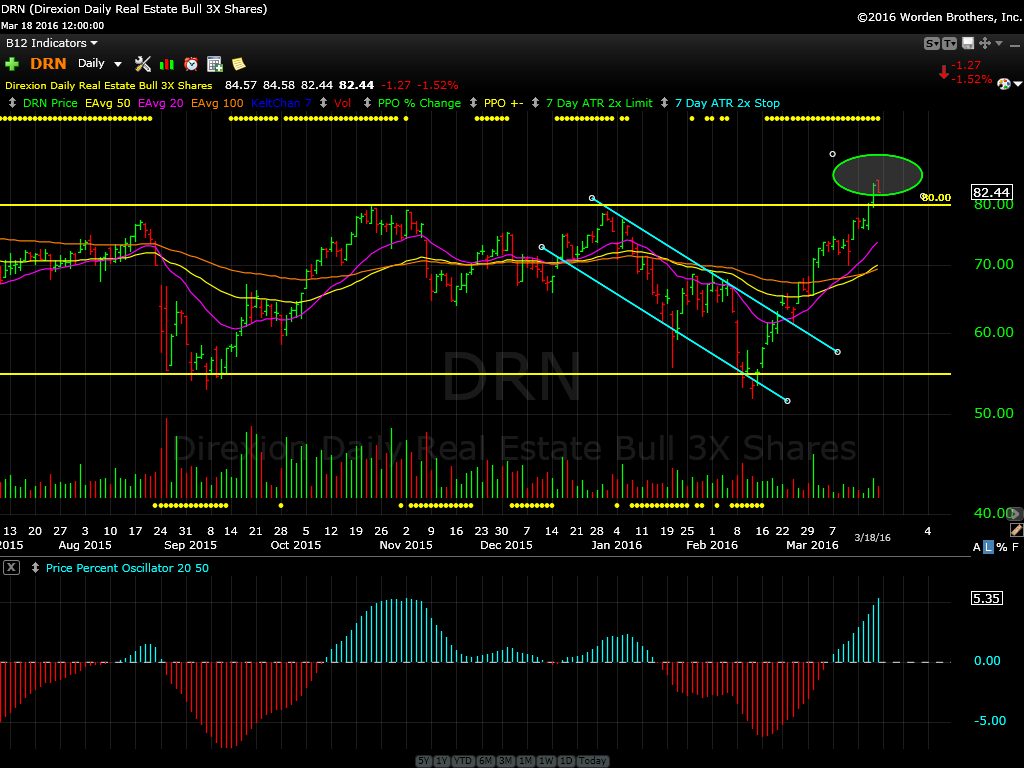

2. Direxion Daily Real Estate Bull 3X Shares (NYSE:DRN) – Bullish

Real Estate has finally pushed above its $80.00 resistance level. I’m bullish as long as it holds above this level. Price is on a clear trend upward, but the length of this move was in question. Now that it’s above $80.00 it could move much higher with a fall below $80.00 negating the move. My one concern is it’s an almost straight up move. We may see an exhaustion gap to close and reverse this quickly, so I’m drawing a line in the sand at $80.00.

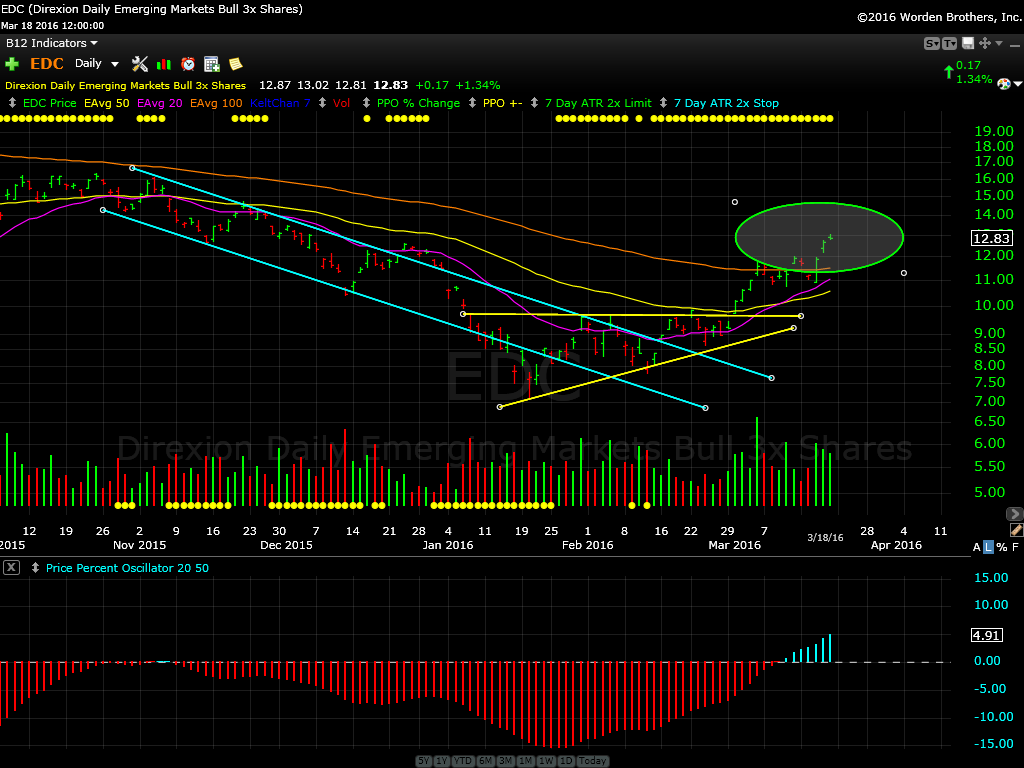

3. Direxion Daily Emerging Markets Bull 3X Shares (NYSE:EDC) – Bullish

This is a clear triangle breakout. Price has broken out of its triangle and now above all the major moving averages. I am looking more long term bullish on EDC with a support level of around $11.00.

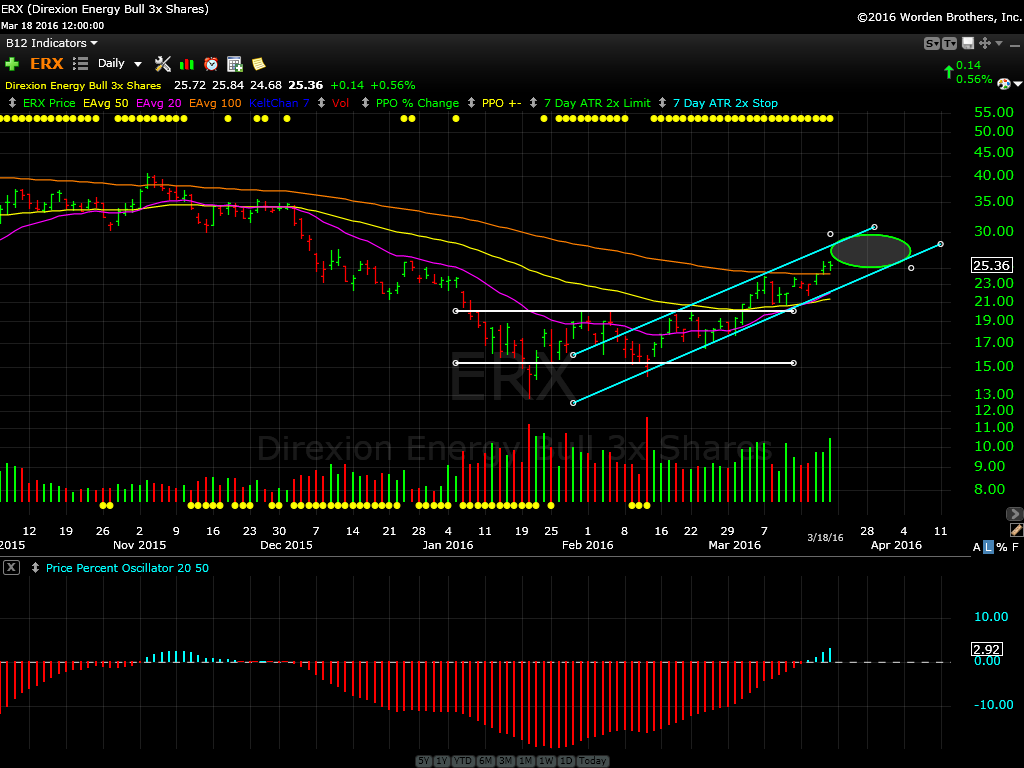

4. Direxion Daily Energy Bull 3X Shares (NYSE:ERX) – Bullish

I was bullish on ERX last week due to its breaking out of its sideways consolidation. We’re getting continued validation of the move now that price has moved above the 100-day EMA in Orange.

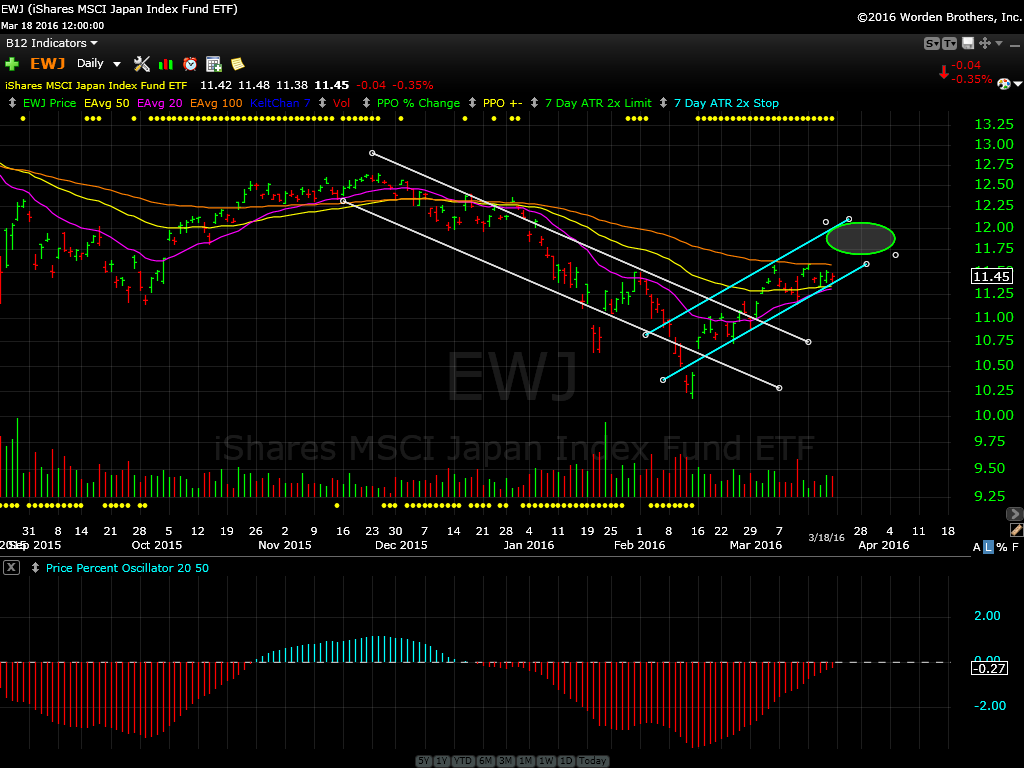

5. iShares MSCI Japan (NYSE:EWJ) – Short Term Consolidation

I was bullish on Japan last week, expecting it to move higher, but the move is fizzling. I’m not waiting for it to cross the 100-day EMA in Orange to prove this bullish move can continue. The longer it pauses, the more potential it has at resuming its previous existing longer term downtrend.

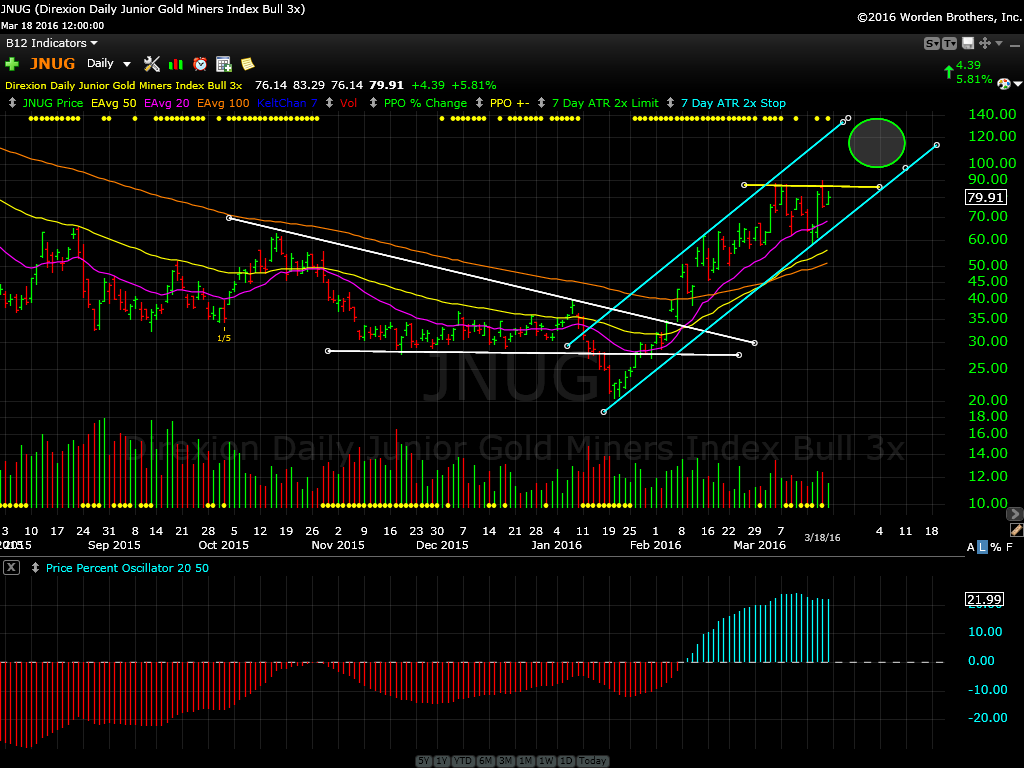

6. Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG) – Bullish

Still bullish on JNUG, but I’m also seeing a resistance level around $81.00. It looks like a potential triangle consolidation is forming, so we may see smaller moves coming up this week before another break out. The move needs to be above $81.00 to continue this bullish sentiment though.

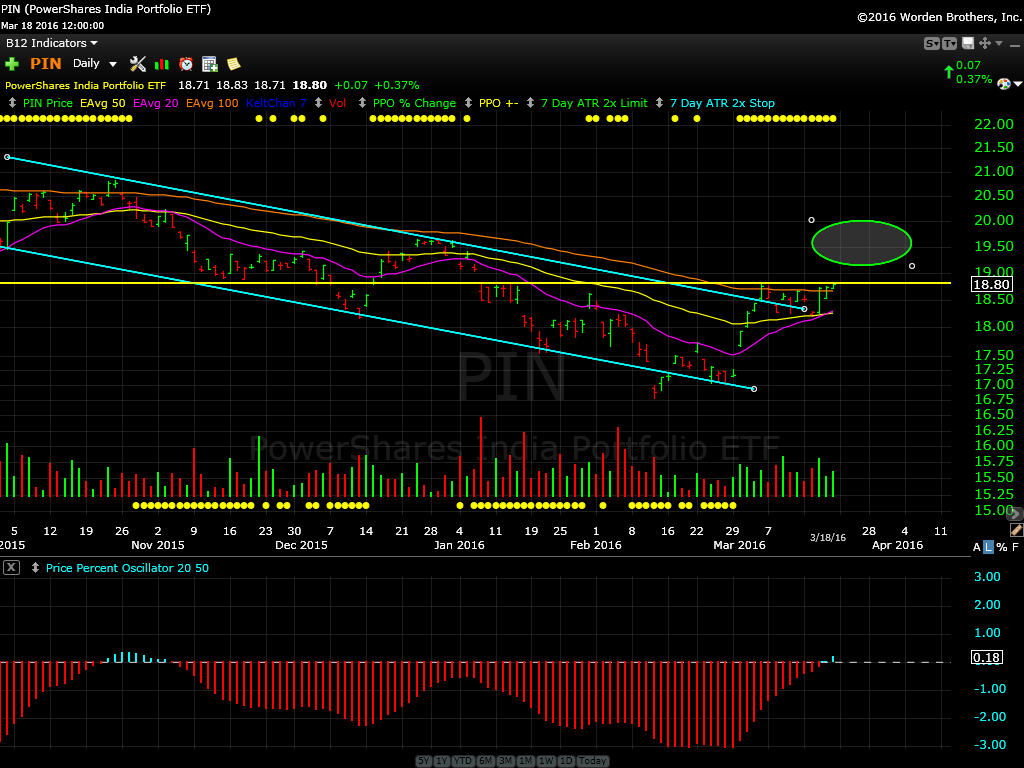

7. PowerShares India Portfolio (NYSE:PIN) – Consolidation (Bearish bias forming)

I’m not seeing much direction yet in India. Price is still bumping up against resistance of $19.00 and has yet to break out. I’ll be bullish when it’s above $19.00. With all the markets in such perfect correlation, it’s a warning sign that PIN may not be able to rise higher on its own. If the other major global markets begin turning back now, I’d suspect PIN will lead the charge lower as it hasn’t been able to take advantage of the strong global momentum higher.

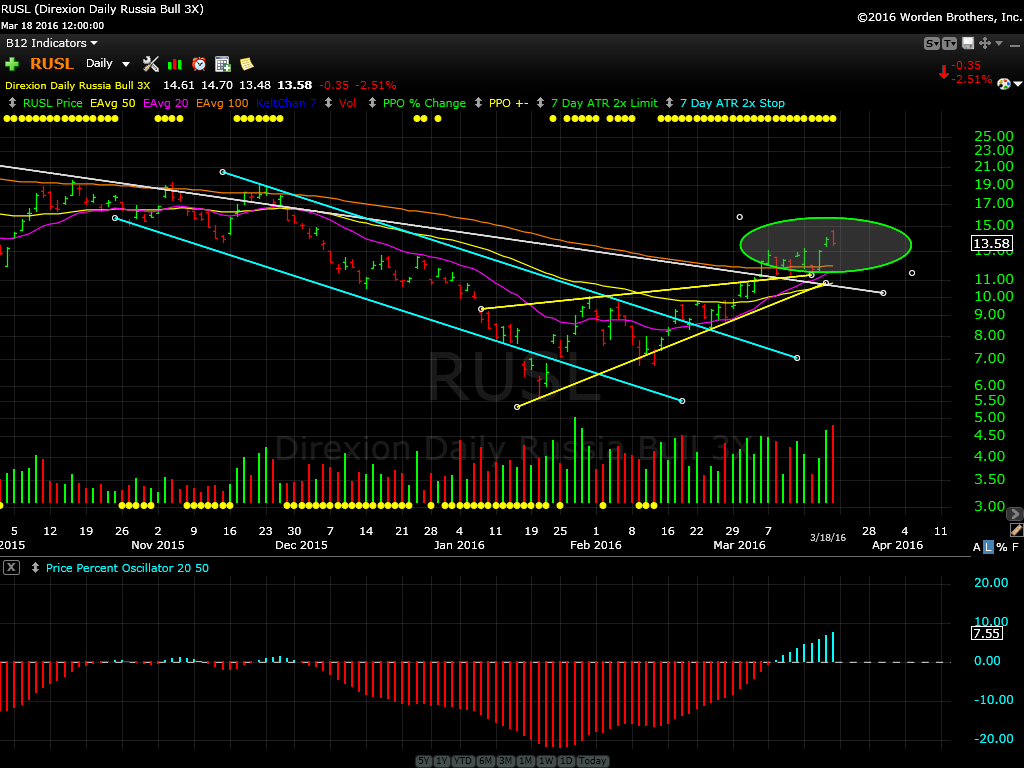

8. Direxion Daily Russia Bull 3X Shares (NYSE:RUSL) – Bullish

RUSL is tied at the hip with crude oil prices. Crude’s momentum is stalling somewhat, but we haven’t seen a reversal of forecast from looking at the technicals. In taking a position in RUSL I’d be asking for discounts instead of jumping in now because as you will see in my review of UWTI (Crude Oil, #14, below), UWTI is losing some of its kick—which will affect RUSL in the same way.

9. Direxion Daily Semiconductor Bull 3X Shares (NYSE:SOXL) – Bullish

SOXL has been in a large triangle formation and it barely broke it last week. I’m bullish as long as it can hold, so this is an early signal which makes for a safe stop loss distance. Price is above all the major moving averages and a long term downward trend line. The real key will be if we get a fast dip lower and then a move higher which is a common trick to take out early stops and get the cheapest position possible.

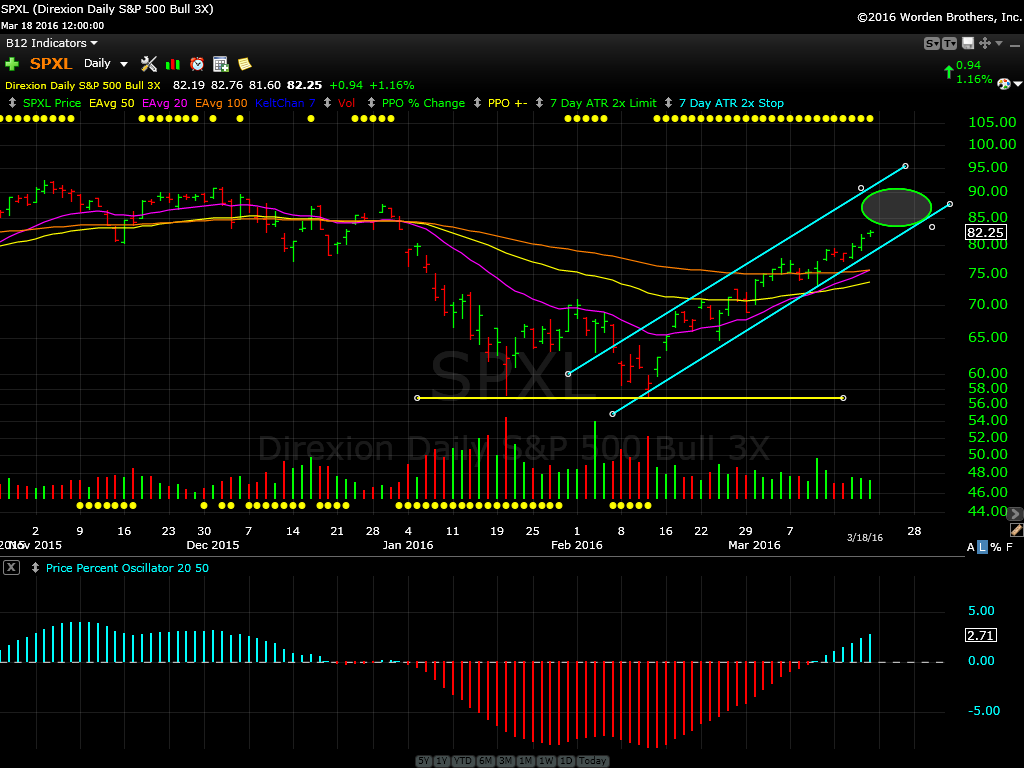

10. Direxion Daily S&P 500 Bull 3X Shares (NYSE:SPXL) – Bullish

More positive continuation from last week and it’s not slowing down. The SPX (S&P 500) is now making headlines and getting highlighted, so now to wait and see if we can push to the previous $2130 highs that failed many times before. I’m expecting with lower volume this week we will see more sideways movement but choppier intraday. Still, higher highs by the close of this week.

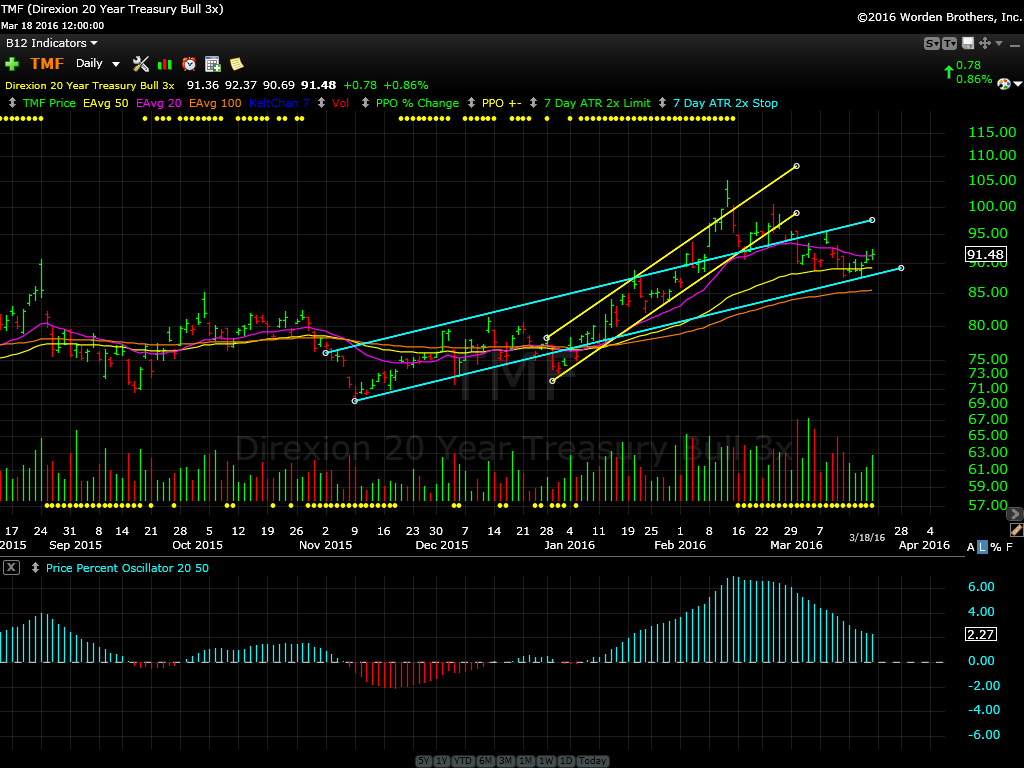

11. Direxion Daily 20+ Year Treasury Bull 3X Shares (NYSE:TMF) – Bullish

Nice bounce off the lower channel trend line in blue and the 50-day EMA in yellow. I was waiting for a healthy correction to the large move higher back in February and it appears we’ve settled in at a nice retracement. I’m bullish on TMF as long as it doesn’t fall below $87.00.

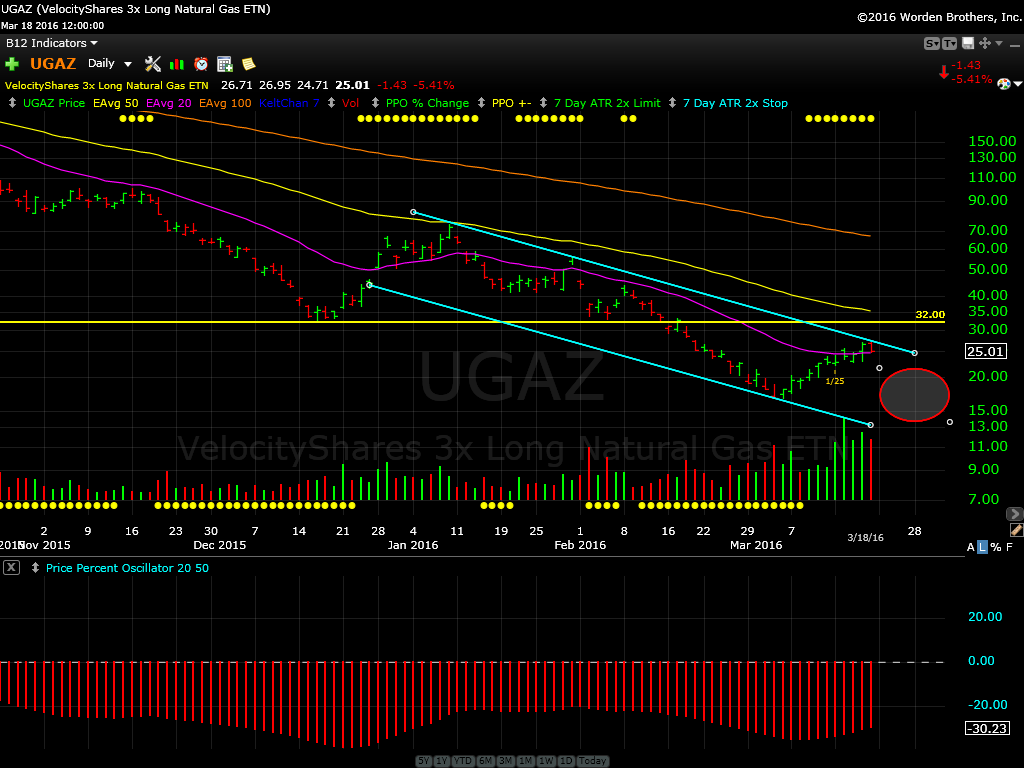

12. VelocityShares 3x Long Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:UGAZ) – Bearish

I’m going out on a limb on this one, but I’m guessing that the 20-day EMA in purple and the upper downward trend channel is going to hold. Crude Oil took a dip on Friday and this seems like a perfect formation for a Natural Gas move lower. I’ll wait until price falls back below the 20-day EMA for final confirmation, but we’ve had an amazing 10-days up in a row and I imagine there is a line of profit-takers waiting to unload next week.

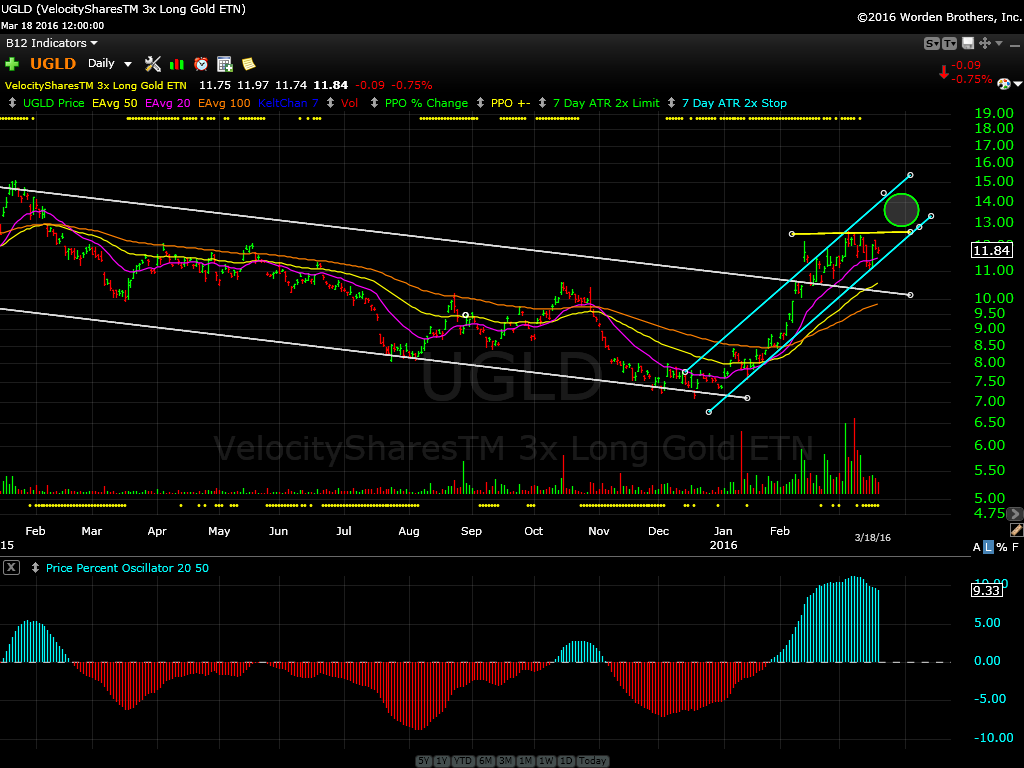

13. VelocityShares 3x Long Gold linked to SP GSCI Gold ER Exp 14 Oct 2031 (NASDAQ:UGLD) – Bullish

Gold is pausing somewhat, just like JNUG (Junior Gold Miners), but all the technicals are still holding. Price is way above its long term downward trend channel and price remains above all 3 major moving averages which hasn’t been done in years. We are seeing short term resistance around $12.00 so price needs to break that to further confirm this uptrend.

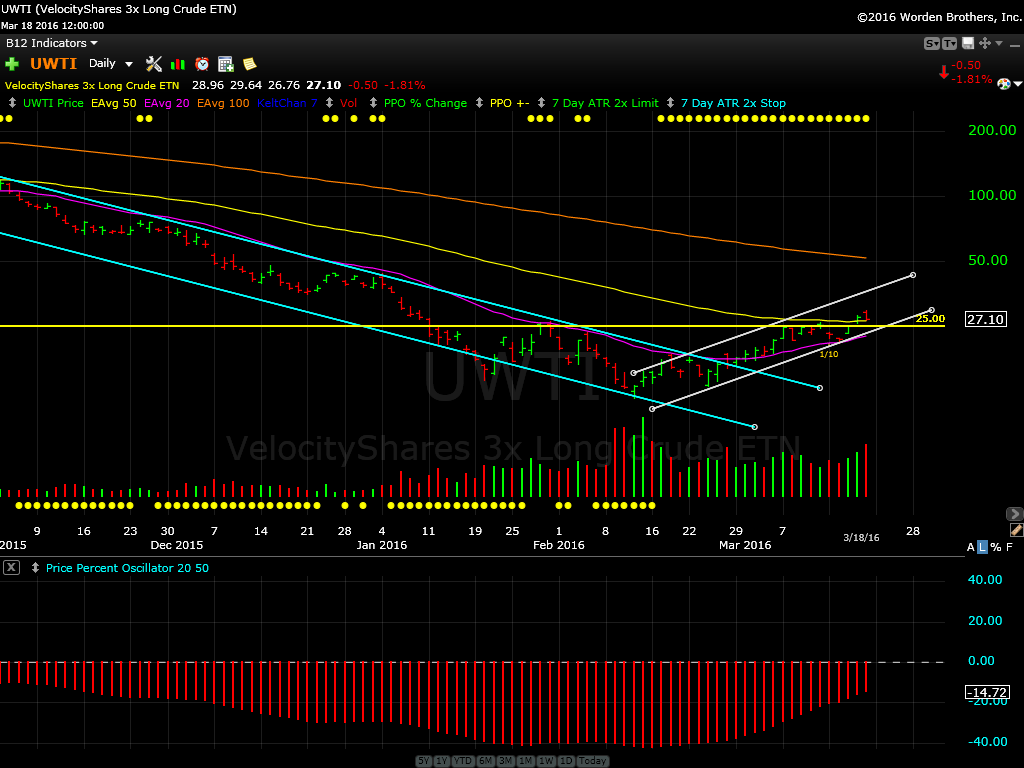

14. VelocityShares 3x Long Crude linked to S&P GSCI Crude Oil Excess Return (NYSE:UWTI) – Slightly Bullish

Perhaps I’m putting too much emphasis on Friday’s move lower, but after the rig count turned out to be worse than expected, we’re just not seeing the huge speculative moves in Crude. Crude Inventories come out weekly so there may be another push higher if this holds. However from the technicals, price is above the key $25.00 resistance level and now above the 50-day EMA, so it could be winding up for more movement higher. I’m always skeptical of calling new major bullish reversals after long downtrends. Finally, UWTI had a 10:1 reverse split to get it back above the $1.00 share price which if held for more than 30-days would have forced the ETF to be delisted, so despite the new $27.00 price level, the downtrend is still extremely strong in this market.

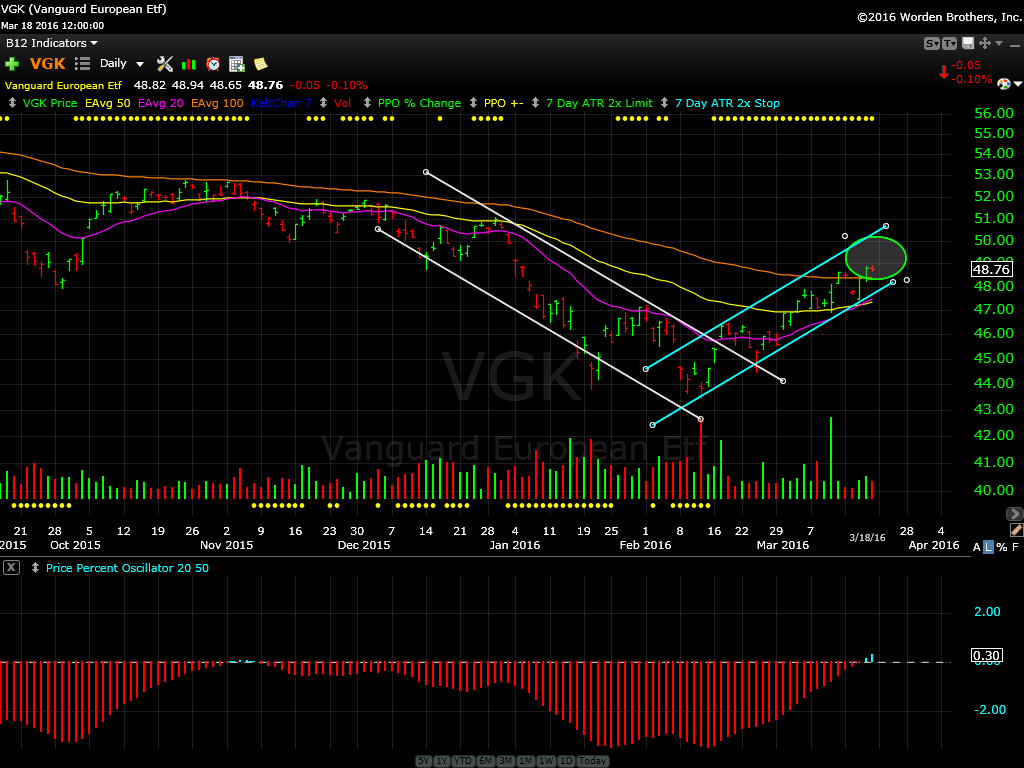

15. Vanguard FTSE Europe (NYSE:VGK) – Bullish

The upward trend channel continues to hold and now price is above it’s final milestone of the 100-day EMA in Orange. I’d expect this trend to be over once it falls below the $74.00 price level.

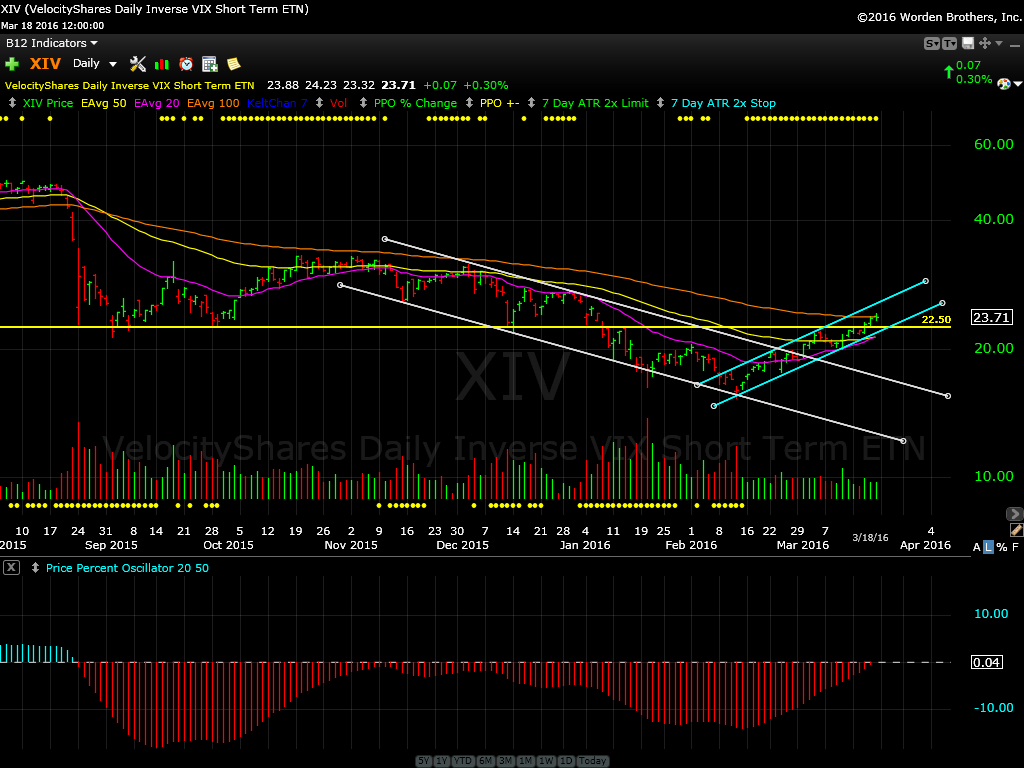

16. VelocityShares Daily Inverse VIX Short Term linked To SP 500 VIX Short Fut Exp 4 Dec 2030 (NASDAQ:XIV) – Bullish

XIV has been on my radar since it broken out of it’s multi-month downward trend channel starting back in November. Price is now above all the major levels I look for, the 20-day EMA in purple, the 50-day EMA in yellow and the $22.50 resistance level. Looking for price to break the 100-day EMA in Orange and see how far this can climb.

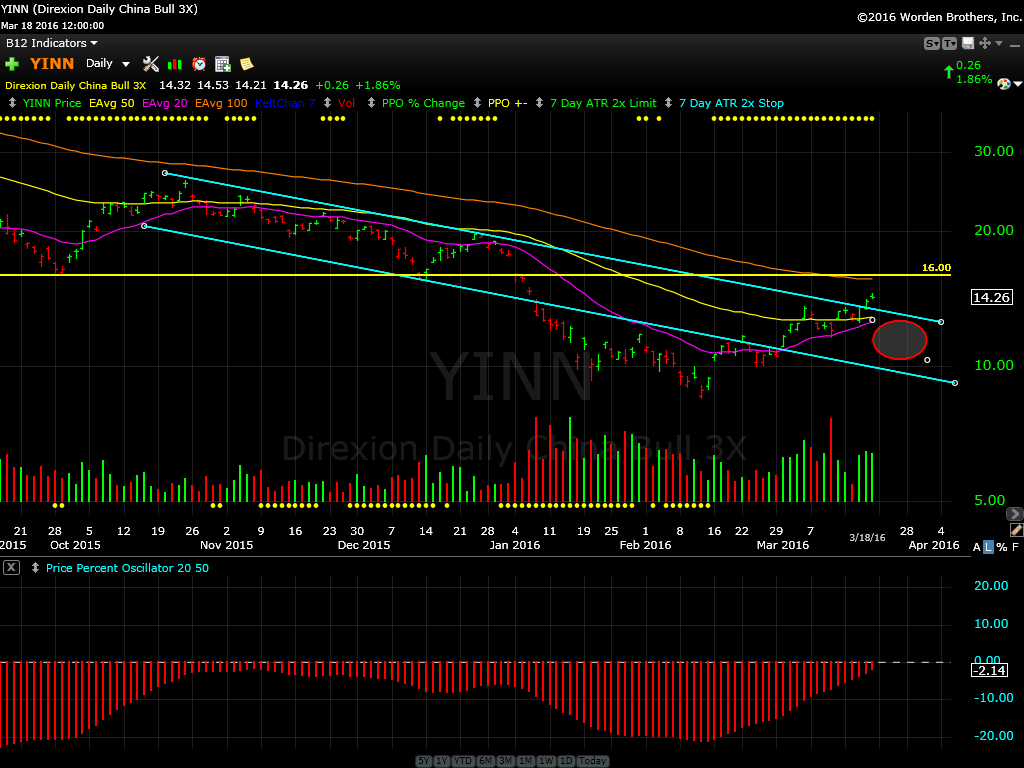

17. Direxion Daily FTSE China Bull 3x Shares (NYSE:YINN) – Short term bullish

I can’t deny the price action we’re seeing here. Price has now moved above the 20-day EMA in purple and the 50-day EMA in yellow. It’s also broken out of its longer term down trend channel. YINN has been a very untrustworthy market to play, but I have to call this one bullish up until $16.00 is tested. If it can break $16.00 then we could have a confirmed bottom in YINN and a new longer uptrend to contend with.