March has been another volatile month for the broader exchanges and, naturally, the exchange-traded funds (ETFs) that track them.

Despite ongoing geopolitical tensions, the Fed’s tightening to curb red-hot inflation, a flattening yield curve which inverted last week, and resurging COVID-19 cases worldwide, broader markets have bounced back quite impressively, especially in the second half of the month.

Yet, the S&P 500, NASDAQ, and Dow Jones indices all posted heavy losses over the first quarter of the year.

Below, we list those ETFs that were either clear winners or obvious losers in March based on data by Finscreener. Our list offers just a glimpse of some of the many exchange-traded funds’ monthly performances—listed in the US—excluding leveraged and inverse ETFs.

Several of these funds could inspire readers to put together long-term diversified portfolios within their risk/return parameters. We've covered a large number of these funds previously, and we plan to discuss others in the future.

3 ETFs Following The 3 Major US Indices

Before we move on to the best- and worst-performing ETFs for March, let’s look at funds that provide exposure to three bellwether Wall Street indices—the Dow Jones, S&P 500, and the NASDAQ.

SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA) tracks the Dow Jones. It was up 4.1% for the month of March.

The SPDR® S&P 500 (NYSE:SPY) tracks the S&P 500 index. The fund was up 5.2% in March.

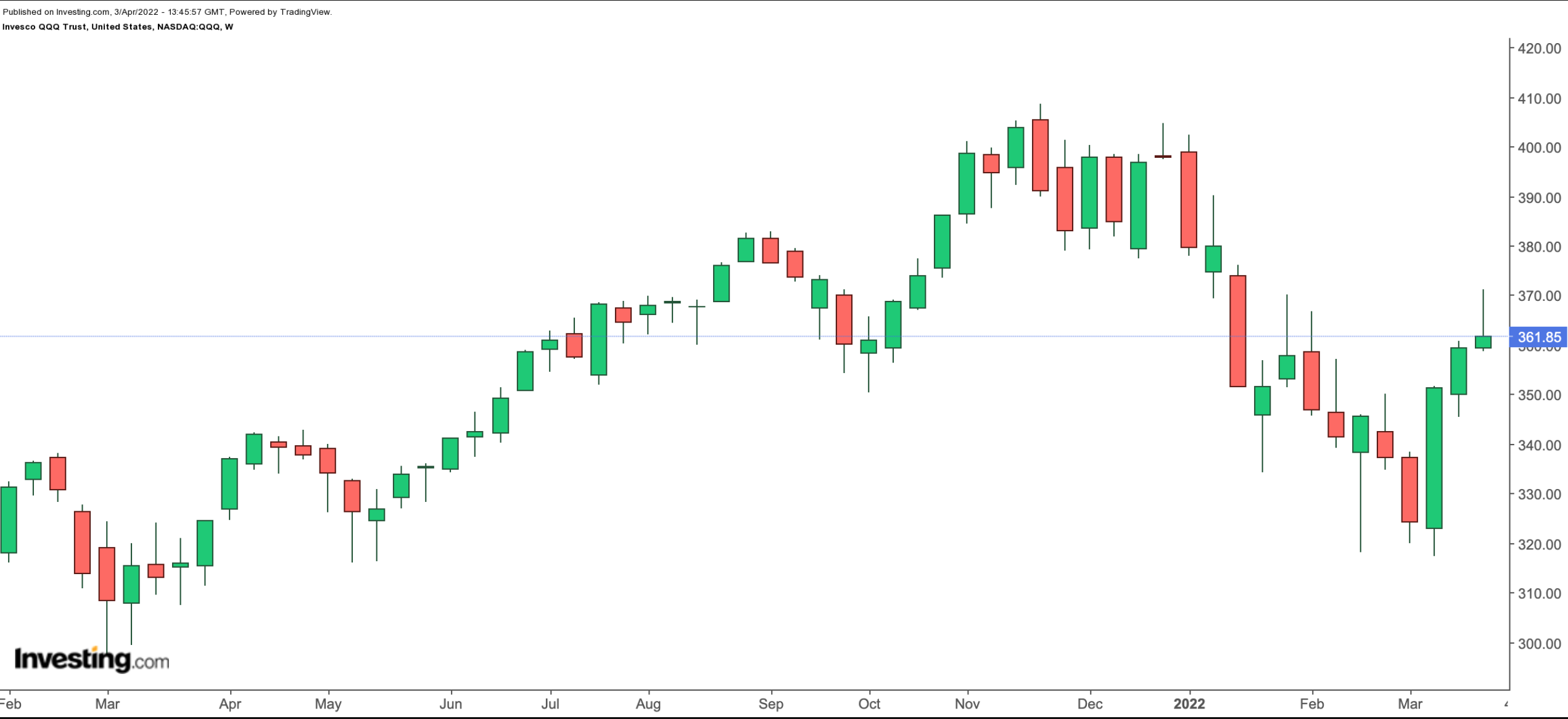

The Invesco QQQ Trust ETF (NASDAQ:QQQ), which tracks the NASDAQ 100 index, saw 6.2% gains in March.

40 Winner ETFs in March

- United States Natural Gas Fund (NYSE:UNG): up 22.4%

- SPDR® S&P Oil & Gas Equipment & Services ETF (NYSE:XES): up 18.9%

- Franklin FTSE Latin America ETF (NYSE:FLLA): up 13.7%

- SPDR® S&P Metals and Mining ETF (NYSE:XME): up 13.7%

- Invesco S&P SmallCap Energy ETF (NASDAQ:PSCE): up 12.9%

- John Hancock Multifactor Utilities ETF (NYSE:JHMU): up 11.4%

- Virtus Reaves Utilities ETF (NYSE:UTES): up 10.7%

- VanEck Rare Earth/Strategic Metals ETF (NYSE:REMX): up 10.6%

- ETFMG Alternative Harvest (NYSE:MJ): up 10.4%

- iPath® Series B Bloomberg Cotton Subindex Total Return ETN (NYSE:BAL): up 9.9%

- VanEck Environmental Services ETF (NYSE:EVX): up 9.4%

- North Shore Global Uranium Mining ETF (NYSE:URNM): up 9.1%

- Tortoise MLP Closed Fund (NYSE:NTG): up 8.6%

- iShares Evolved U.S. Innovative Healthcare ETF (NYSE:IEIH): up 7.3%

- U.S. Global Jets ETF (NYSE:JETS): up 6.7%

- ProShares S&P 500® ex-Financials ETF (NYSE:SPXN): up 6.7%

- First Trust International Multi-Asset Diversified Inc (NASDAQ:FID): up 6.7%

- Anfield Capital Diversified Alternatives ETF (NYSE:DALT): up 6.4%

- Invesco S&P 500 Minimum Variance ETF (NYSE:SPMV): up 6.4%

- Pacer US Export Leaders ETF (NYSE:PEXL): up 6%

- Teucrium Corn Fund (NYSE:CORN): up 6%

- SPDR® S&P Telecom ETF (NYSE:XTL): up 6%

- VanEck Low Carbon Energy ETF (NYSE:SMOG): up 5.8%

- Global X Data Center REITs & Digital Infrastructure ETF (NASDAQ:VPN): up 5.5%

- KFA Small Cap Quality Dividend Index ETF (NYSE:KSCD): up 5.3%

- Teucrium Wheat (NYSE:WEAT): up 4.8%

- ProShares Equities for Rising Rates ETF (NASDAQ:EQRR): up 4.7%

- Invesco S&P MidCap 400® Equal Weight ETF (NYSE:EWMC): up 4.7%

- Invesco Dynamic Food & Beverage ETF (NYSE:PBJ): up 4.5%

- AdvisorShares DoubleLine Value Equity ETF (NYSE:DBLV): up 4.4%

- AdvisorShares Focused Equity ETF (NYSE:CWS): up 4.3%

- Barclays iPath Bloomberg Softs Subindex Total Return (NYSE:JJS): up 4.2%

- Invesco Dynamic Food & Beverage ETF (NYSE:PBJ): up 4.1%

- Invesco Dynamic Networking ETF (NYSE:PXQ): up 3.8%

- ProShares Managed Futures Strategy ETF (NYSE:FUT): up 3.6%

- John Hancock Multifactor Consumer Staples ETF (NYSE:JHMS): up 3.6%

- Global X Alternative Income ETF (NASDAQ:ALTY): up 3.4%

- Simplify Volt Cloud and Cybersecurity Disruption ETF (NYSE:VCLO): up 1.9%

- iShares Preferred and Income Securities ETF (NASDAQ:PFF): up 1.1%

- Invesco DB US Dollar Index Bullish Fund (NYSE:UUP): up 0.8%

35 Losing ETFs

- Global X MSCI China Consumer Staples ETF (NYSE:CHIS): down 16.4% in March

- Invesco Golden Dragon China ETF (NASDAQ:PGJ): down 12.8%

- Aberdeen Standard Physical Palladium Shares ETF (NYSE:PALL): down 12.7%

- KraneShares SSE STAR Market 50 Index ETF (NYSE:KSTR): down 12.6%

- iShares U.S. Home Construction ETF (NYSE:ITB): down 10.8%

- SPDR® S&P Homebuilders ETF (NYSE:XHB): down 8.6%

- EMQQ The Emerging Markets Internet & Ecommerce ETF (NYSE:EMQQ): down 8.5%

- First Trust Dow Jones International Internet ETF (NASDAQ:FDNI): down 7.6%

- GraniteShares Platinum Trust (NYSE:PLTM): down 6.7%

- Renaissance International IPO ETF (NYSE:IPOS): down 5.5%

- Quadratic Interest Rate Volatility and Inflation Hedge ETF New (NYSE:IVOL): down 5.4%

- iShares MSCI BRIC ETF (NYSE:BKF): down 4.8%

- Invesco S&P SmallCap Consumer Discretionary ETF (NASDAQ:PSCD): down 4.5%

- iShares Asia 50 ETF (NASDAQ:AIA): down 4.3%

- SPDR® Bloomberg International Treasury Bond ETF (NYSE:BWX): down 4.3%

- Alpha Architect Merlyn.AI Tactical Growth and Income ETF (NASDAQ:SNUG): down 3.8%

- Global X Social Media ETF (NASDAQ:SOCL): down 3.7%

- Amplify BlackSwan ISWN ETF (NYSE:ISWN): down 3.6%

- SPDR Barclays Long Term Corporate Bond (NYSE:SPLB): down 2.5%

- Invesco International Corporate Bond ETF (NYSE:PICB): down 3.5%

- ARK Genomic Revolution ETF (NYSE:ARKG): down 3.4%

- First Trust Nasdaq Bank ETF (NASDAQ:FTXO): down 3.3%

- iShares MSCI Frontier and Select EM ETF (NYSE:FM): down 3.1%

- ARK Innovation ETF (NYSE:ARKK): down 3%

- Teucrium Soybean (NYSE:SOYB): down 2.9%

- VanEck Vectors Green Bond (NYSE:GRNB): down 2.9%

- Roundhill BITKRAFT Esports & Digital Entertainment ETF (NYSE:NERD): down 2.9%

- Columbia Diversified Fixed Income Allocation (NYSE:DIAL): down 2.4%

- Global X Health & Wellness ETF (NASDAQ:BFIT): down 2.4%

- Cambria Value and Momentum ETF (NYSE:VAMO): down 2.1%

- RPAR Risk Parity ETF (NYSE:RPAR): down 2%

- Loncar Cancer Immunotherapy ETF (NASDAQ:CNCR): down 2%

- Aberdeen Standard Physical Silver Shares ETF (NYSE:SIVR): down 1.9%

- WisdomTree Cloud Computing Fund (NASDAQ:WCLD): down 1.9%

- Invesco DWA Consumer Cyclicals Momentum ETF (NASDAQ:PEZ): down 1.6%