Investing.com’s stocks of the week

Market Brief

The data released on Friday painted a gloomy picture of the US economy and dampened the mood after a week dominated by fears of recession. Retail sales ex-auto contracted -0.1%m/m in December versus +0.2% median forecast, while the previous month increase was downwardly revised to 0.3% from 0.4%. The manufacturing sector continues to struggle in a strong dollar environment and faltering global demand. The Empire Manufacturing index slid to a seven-year low in January, reaching -19.37 from a downward revision of -6.21. Industrial production contracted another -0.4%m/m in December, below market expectations of -0.2% but above the previous revised contraction of -0.9%. Finally, Michigan sentiment index improved to 93.3 from 92.6, beating consensus of 92.9. After opening down more than 2%, US equities remained relatively stable on Friday in spite of the bad news. US stock and bond markets will be closed Monday for Martin Luther King Day, while FX volume are expected to be thin in New York.

The single currency paid the price of a worsening risk-off sentiment as it lost ground against the US dollar in overnight trading. EUR/USD fell as much as 1% from Friday’s high to 1.0875 in Tokyo earlier this morning. The nearest support can be found at 1.0711 (low from January 5th) while a resistance stands at 1.1060 (high from December 15th).

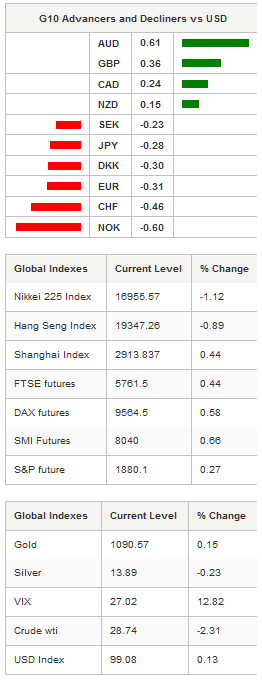

In Asia, equity returns are mixed today but selling pressures remain strong. In mainland China, all equity indices managed to stay in positive territory with the Shanghai Composite and Shenzhen Composite up 0.44% and 1.90% respectively. In Japan, the Nikkei 225 fell 1.12%, while the broader TOPIX dropped 1.04%. BoJ’s governor Kuroda declared, during a branch manager meeting, that the central bank will continue easing until the 2% inflation target is reached. On the data front, industrial production’s final reading printed higher to -0.9%m/m from -1.0% first estimate. USD/JPY’s response was muted and moved sideways between 117.00 and 117.36. Over the short-term, the Japanese yen will likely continue to take advantage of the global risk-off sentiment. USD/JPY already broke the 118 support and is now heading towards the next key area at around 116.18-115.57 (lows from August 24th and December 2014).

In Europe, futures are pointing to a higher open with the FTSE 100 up 0.44%, the DAX 0.58%, the SMI 0.66% and the CAC 40 0.18%. After falling 3.5% since the beginning of the year, GBP/USD failed to validate a break in the strong 1.43 support and is currently trading nearby. We believe that the pound sterling has been widely oversold, meaning that a reversal is becoming increasingly likely. The cable is approaching a key support lying at 1.4231 (low from May 21st 2010); a strong boost will be needed to break this level to the downside.

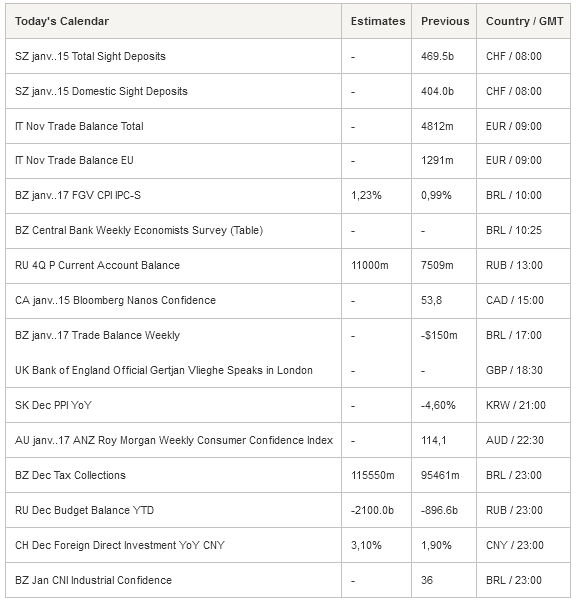

Today’s economic calendar will be light: Trade balance from Italy; weekly inflation report and trade balance from Brazil; current account balance from Russia.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0882

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4315

S 1: 1.4231

S 2: 1.3657

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 117.43

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0065

S 1: 0.9786

S 2: 0.9476