Yesterday, major indices were rather on the mixed side, as different indices closed in different directions. European airline stocks took a beating yesterday, as low bookings force the companies to find new cost-cutting ways. Over the Atlantic Ocean, in the US, markets were mainly in the green, driven by a surge in tech stocks. This morning, the Reserve Bank of Australia released its previous meeting minutes, where they have stated that there is no need to adjust their policy, for now.

Markets End Yesterday’s Trading Mixed

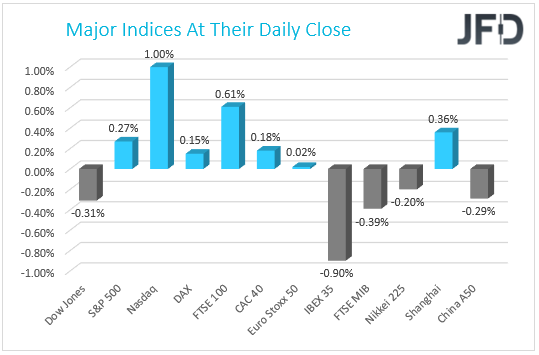

Yesterday, major indices were rather on the mixed side, as different indices closed in different directions. It looked like every index was for itself, where South European country bourses closed mainly in the red, but the Western European ones were able to squeeze some gains. For example, Spanish, Portuguese and Italian indices took small dives, whereas German, UK, French, Swiss and Dutch indices were seen closing their sessions in the green.

European airline stocks took a beating yesterday, as low bookings force the companies to find new cost-cutting ways. UK’s EasyJet announced that they will be closing down three of its bases in the United Kingdom, this way losing around 670 jobs. That would be part of easyJet’s measure to reduce its workforce by a total of 4500 jobs, in order for the company to survive. Ryanair also announced that they will be reducing their flight capacity by another 20% in September and October. The reduction will mainly come in the frequency of the flights, rather than in the closure of the routes. European airline company stocks moved lower on Friday last week, after UK announced that passengers coming from France and the Netherlands will have to quarantine themselves for 14 days. As it has come to market attention yesterday, France is preparing a countermeasure, where anyone arriving from the United Kingdom will also have to self-isolate for 14 days. We are also seeing that other EU member states are imposing similar quarantine rules for passengers arriving from other member states. As we already know, the biggest losers in all this are the airline companies, which are seeing a large reduction in air travelers, who just don’t want to go through the hassle of being locked down for two weeks. Instead, they chose to stay inside their home country, or if there is a possibility, to drive to a neighboring one. All this means that the aviation stocks could remain under pressure and keep their current status of less attractive stocks. 2020 is already considered to be a “dead year” for them, as investors might seek opportunities elsewhere. That is, of course, if the situation with the coronavirus will remain as difficult as it is right now.

Over the Atlantic Ocean, in the US, markets were mainly in the green, driven by a surge in tech stocks. The S&P 500 closed with a modest gain, coming very close to hitting its all-time high, reached in mid-February of this year. Nasdaq 100 was not on the shy side in that sense, as it got pushed to a new all-time high, hitting the 11306 level and gaining around 1% on the day. Unfortunately, the Dow Jones Industrial Average index took a hit yesterday, closing in the red. That was mainly due to the losses in the financial and industrial stocks. As we know, the earning season is ending, with most of the companies delivering not-their-best results. The indices could rally for a bit more, however, there is a slight risk of seeing investors locking in their profits once all the companies have reported their earnings. Also, investors may start paying a bit more attention to the China – US trade talks, which so far, are not a symbol of calm and peaceful negotiations. In January, the two sides have agreed to purchase certain amounts of each other’s goods, however, till today, both sides have not fulfilled all of their obligations.

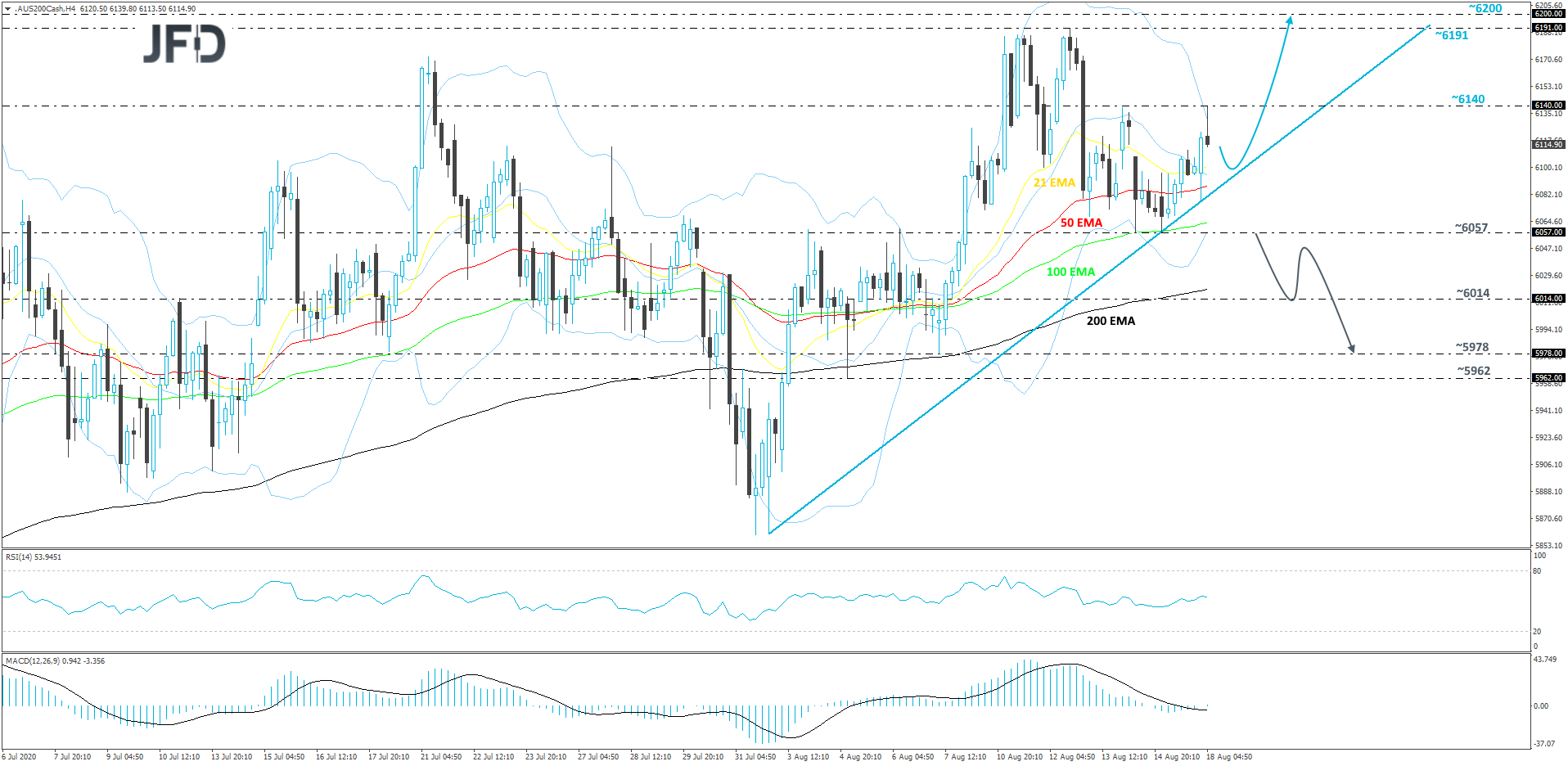

ASX 200 – Technical Outlook

The Australian ASX 200 index continues to slowly grind higher, while balancing above a short-term tentative upside support line taken from the low of August 3rd. This morning, the index tried to push above the 6140 hurdle, which is marked near the high of August 14th, but failed to do so and corrected slightly lower. ASX 200 was still able to end the day in the positive territory. Even if the price corrects a bit further down, as long as it stays above that upside line, we will continue targeting higher areas.

As mentioned above, if the index slides a bit lower, but rebounds from the aforementioned upside line, that may help bring the price back to the 6140 hurdle. ASX 200 might stall there temporarily, but if the bulls are still feeling a bit more comfortable, that may lead to a break of that hurdle, potentially opening the way towards the 6191 and 6200 levels. Those levels mark the current highest point of August and the highest point of June respectively.

Alternatively, if the aforementioned upside line breaks and the price falls below the 6057 zone, marked near the lows of August 14th and 17th, that may change the short-term trend and clear the path to some lower areas. Such a move would also confirm a forthcoming lower low and could send the index to the 6014 obstacle, a break of which might set the stage for a push to the 5978 level, marked by the low of August 7th.

RBA Meeting Minutes

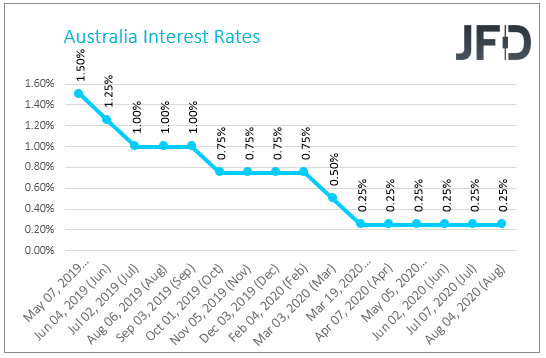

This morning, the Reserve Bank of Australia released its previous meeting minutes, where they have stated that there is no need to adjust their policy, for now. During their last meeting, the Bank kept its cash rate at the same level of +0.25%. However, RBA acknowledges that there are a lot of economic indicators that need to be monitored, in order to be ready to adjust policy, if required. As stated in today’s minutes: “Members commenced their discussion by noting that the economic downturn in Australia over the first half of 2020 was the most severe in many decades: staff estimates suggested a decline in GDP of around 7 percent and a contraction in hours worked of around 10 percent”. Also, the Bank is watching the global situation in relation to the COVID-19 and how it affects major and emerging economies. As stated in the minutes: “Members commenced their discussion of the global economy by noting that new COVID-19 cases had increased significantly over the preceding month. Case numbers were high in the United States and in several large emerging market economies. Some countries that had brought case numbers down to low levels, such as Japan and Australia, had experienced fresh outbreaks in July”.

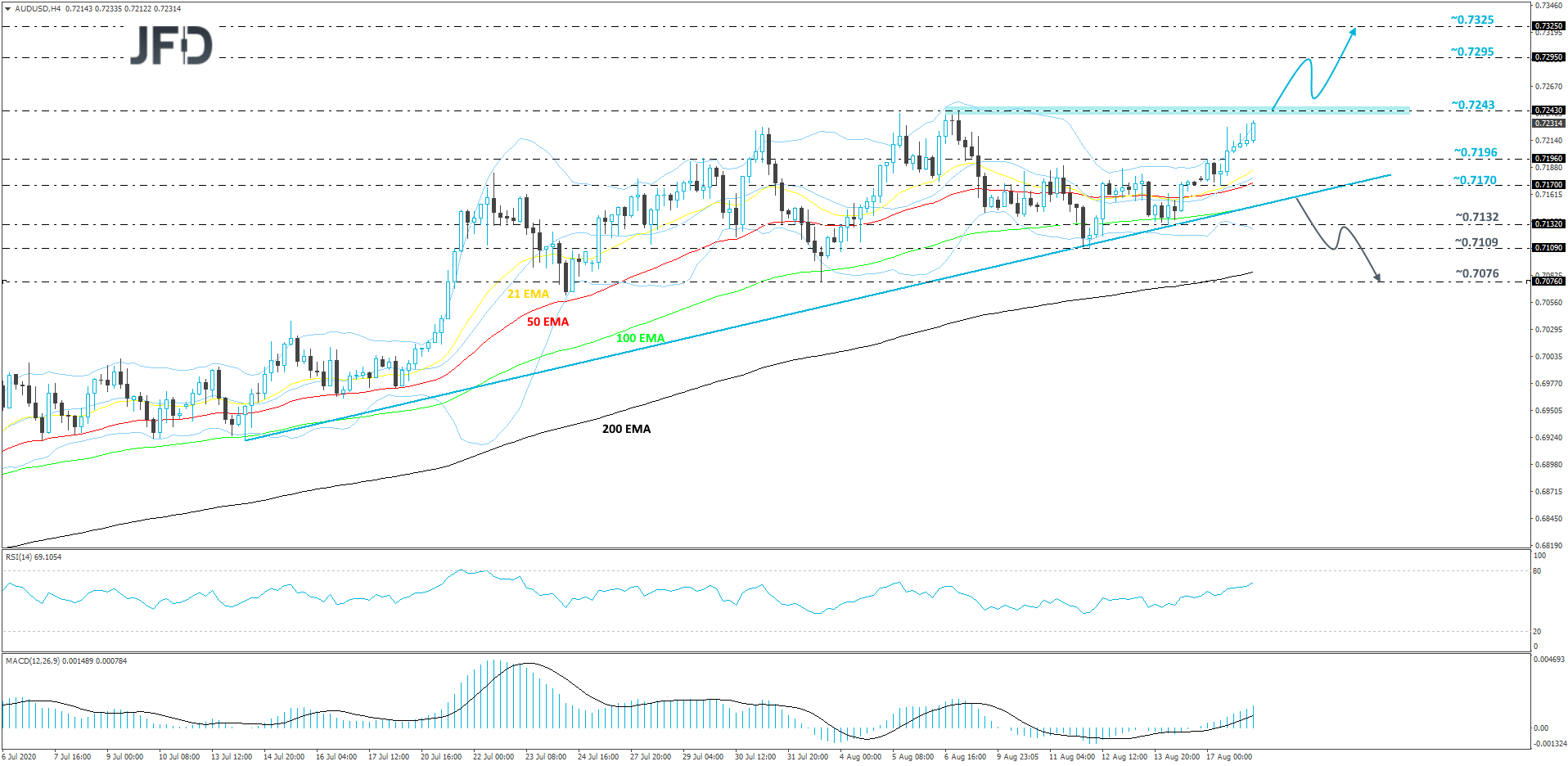

AUD/USD – Technical Outlook

AUD/USD is seen climbing higher, while trading above a short-term upside support line drawn from the low of July 14th. The pair is close to the current highest point of August, at 0.7243. Although the near-term outlook looks quite positive, in order to get a bit more comfortable with higher areas, a break of the 0.7243 barrier would be needed.

If AUD/USD gets a push above the 0.7243 barrier, that would confirm a forthcoming higher high, potentially inviting more buyers into the game. The pair might then drift to the 0.7295 zone, marked by the highest point of January 2019. The rate may stall there for a bit, or even correct back down. That said, if it remains above the 0.7243 hurdle, the bulls could try and take advantage of the lower rate and push it back to the 0.7295 area. If this time that area surrenders and breaks, the next possible resistance level might be at 0.7325, which is marked near the highs of November 18th and 19th of 2018, and also marks the inside swing low of December 4th.

On the other hand, to consider the downside scenario, a break of the aforementioned upside line would be required. If the rate continues to slide below the 0.7132 hurdle, that may strengthen the idea of seeing further declines. That’s when we will target the 0.7109 obstacle, a break of which could set the stage for a drop to the current lowest point of August, at 0.7076.

As For The Rest Of Today’s News

Today, we will receive the US building permits for the month of July, together with the housing starts for the same period. Both numbers are believed to have improved. The building permits are forecasted to have gone from 1.258m to 1295m and the housing starts are expected to have risen from 1186m to 1230m. We believe that the figures will not affect the market significantly.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Equity Markets Show Mixed Signs, RBA Meeting Minutes

Published 08/18/2020, 03:40 AM

Updated 07/09/2023, 06:31 AM

Equity Markets Show Mixed Signs, RBA Meeting Minutes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.