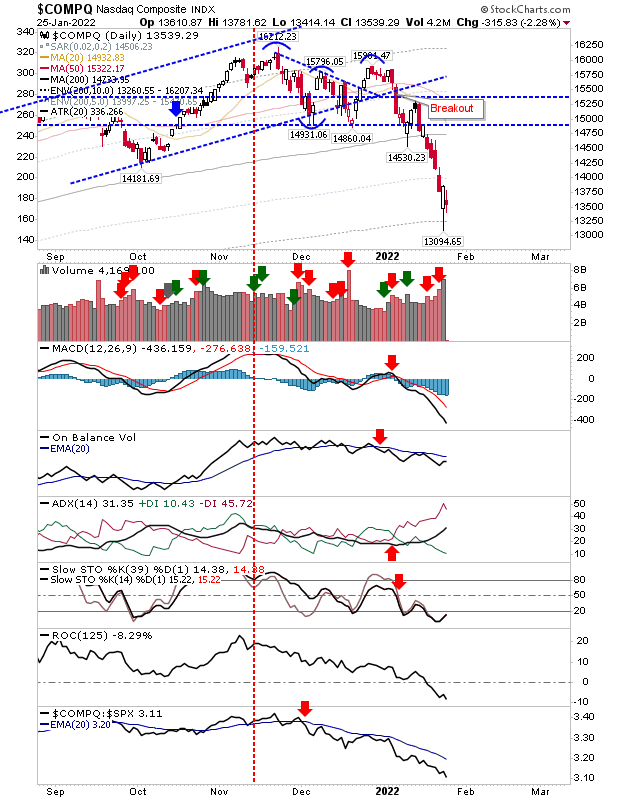

For those with a long hold time frame, buying here is not to bad a thing to be doing. Those Tik Tok traders looking to steal a profitable trade are unlikely to fare too well as whipsaw becomes a real issue based on the sharp uptick in volatility.

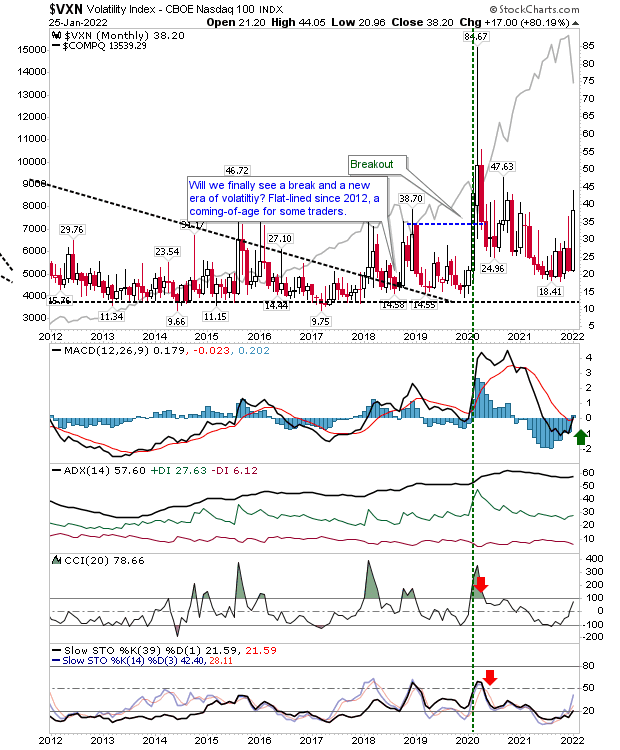

The NASDAQ 100 enjoyed a sustained period of low volatility for most of the 2010s, but since breaking from this period of (volatility) consolidation in 2018 it has been steadily rising. Luckily, markets had enjoyed a sustained period of gain despite COVID, but as the virus enters the latter stage of its infectious cycle the 'sell the news' has made an early start, and this creates the volatility we are seeing now.

On Tuesday, the NASDAQ tagged its 10% band from its 200-day MA, but it would need to get 14% below its 200-day MA to start suggesting it's near a long term buy. However, if you are an investor with a buy-and-hold philosophy, now is the time to be buying—even if Monday's low proves to be a false dawn, it will be a swing low. The buying on Monday ranked as accumulation even though all other technicals are bearish.

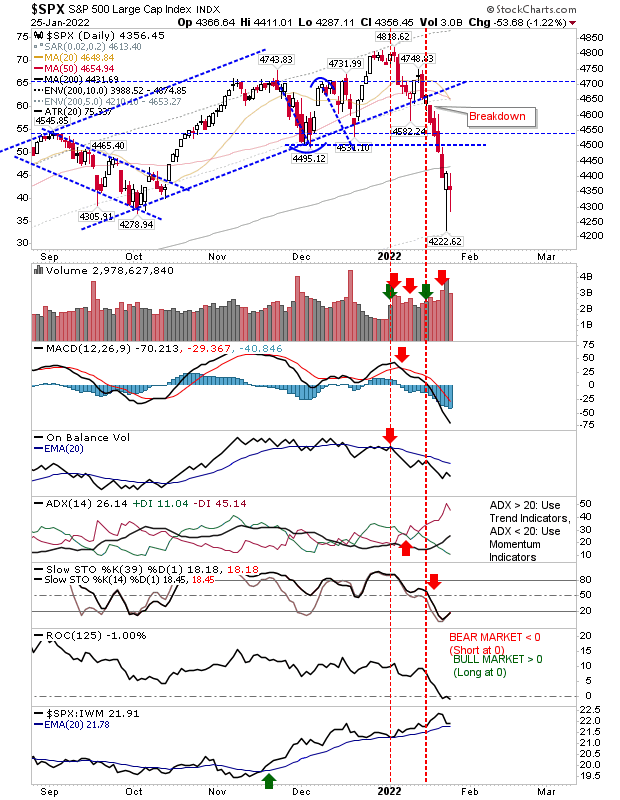

Yesterday the S&P closed the day with a potential bullish Harami Cross. There is decent demand on pushes below 4,350, although technicals remain net bearish.

The one technical working in its favor is relative performance over Small Caps. If the bullish Harami Cross plays true we should see a gap open and a higher close later today. Any close into the spike low will open for a move to 4,222.

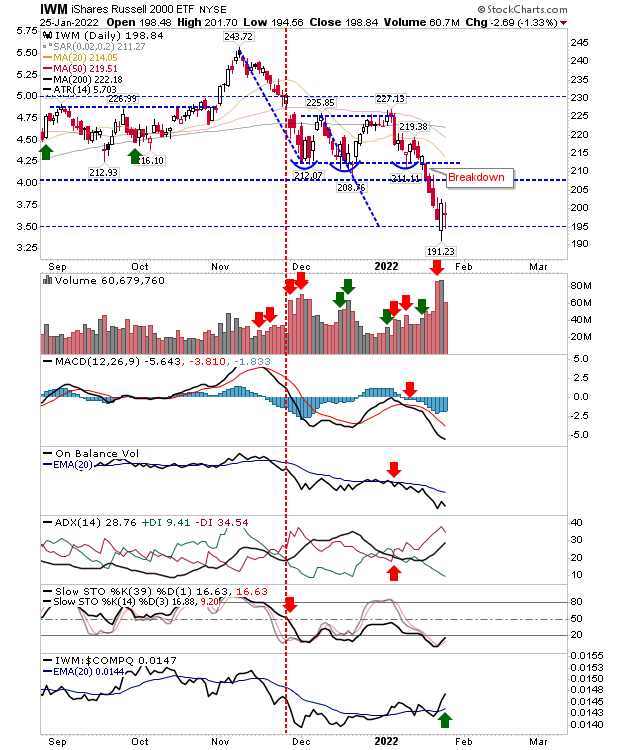

The Russell 2000 (via IWM) is trading around its measured move target. Like the S&P, it also finished with a bullish Harami Cross and is well placed to advance on Wednesday. A lower close, however, would negate the pattern.

On the face of it, Tuesday's weak start probably put many traders on edge, but the paired pattern with Monday is a bullish set up. Having said that, it needs to deliver, and a gap open higher would be a typical start.

Bullish Harami Crosses don't close lower, so if there is any weakness in the opening half hour later today, then a degree of caution is advised.