Equities and risk-linked currencies rebounded yesterday, while safe havens came under selling interest after the Fed announced tweaks to its bond purchases, widening the range of eligible assets to include all US corporate bonds. Today, market participants may stay on the lookout for fresh comments by Fed Chair Powell, who delivers his semi-annual testimony on monetary policy before the Senate Banking Committee.

RISK APPETITE IMPROVES AS FED WIDENS THE RANGE OF BONDS TO PURCHASE

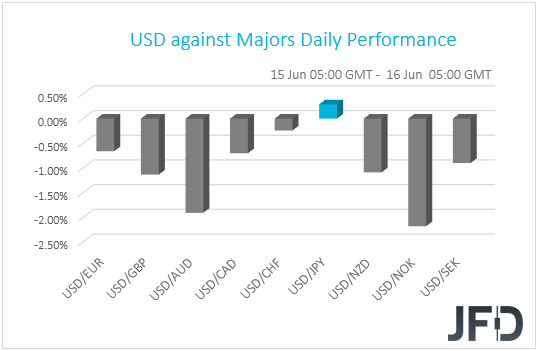

The dollar traded lower against all but one of the other G10 currencies on Monday and during the Asian morning Tuesday. It lost the most ground against NOK, AUD, GBP, and NZD in that order, while the currency against which it underperformed the least was CHF. The greenback gained slightly only versus JPY.

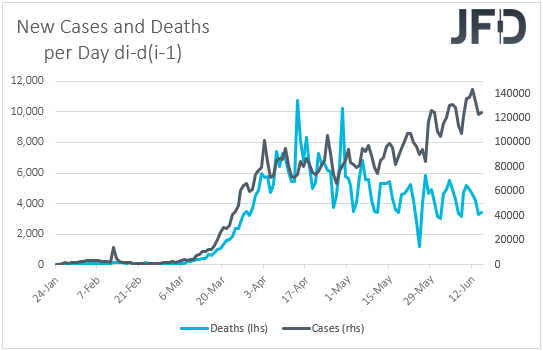

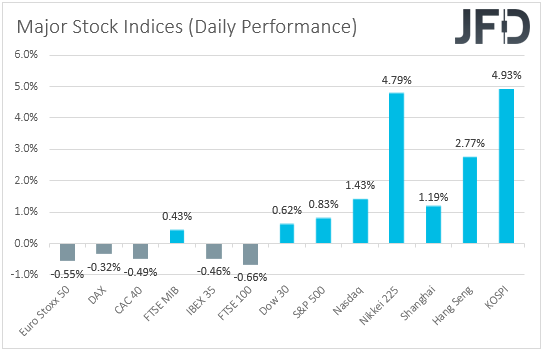

The strengthening of the risk-linked currencies Aussie and Kiwi and the weakening of the safe-havens dollar, yen and franc suggest that investors have switched to risk-on trading at some point during the day. Looking at the performance of the equity markets, we see that most of the major EU indices closed in negative waters, perhaps due to increasing fears over a second wave in coronavirus cases. Indeed, on Friday, global infected cases hit a new daily record, with China seeing the most serious flare-up since February. Several US states have also seen record numbers in cases and hospitalizations.

Having said all that though, investors’ morale improved during the US session after the Fed announced tweaks to its bond purchases, widening the range of eligible assets to include all US corporate bonds. The upbeat appetite rolled over into the Asian session today, with Japan’s Nikkei 225, China’s Shanghai Composite, and Hong Kong’s Hang Seng gaining 4.79%, 1.19% and 2.77% respectively.

As for our view, it has not changed. Although China re-introduced restrictions in some areas, as long as governments around the rest of the world continue to ease their lockdown measures, and as long as data continues to suggest that the deep economic wounds due to the fast-spreading of the coronavirus are behind us, we would see decent chances for risk assets to stay supported. In order to start re-examining that view, we would like to see more governments re-imposing “stay at home” restrictive measures. For now, it seems that fiscal and monetary efforts to restart the engines of the global economy are working well enough.

FED CHIEF POWELL TESTIFIES BEFORE CONGRESS, BOJ PASSES UNNOTICED

Today though, market participants may stay on the lookout for fresh comments by Fed Chair Powell, who delivers his semi-annual testimony on monetary policy before the Senate Banking Committee. He will deliver the same testimony tomorrow, before the House Financial Services Committee. Yesterday, we noted that this event may not result in any fireworks as we heard from Powell just last week, after the Fed’s monetary policy decision. However, following yesterday’s announcement over corporate bonds, investors may be eager to find out whether the Fed remains willing to do more in order to support economic activity hit by the pandemic. If so, equities and risk-linked currencies are likely to continue their journey north, as investors keep diverting their capital out of safe havens, the likes of the US dollar, the yen and the franc.

Apart from headlines surrounding the Fed and the flare-up in coronavirus infections, overnight, we also had a BoJ monetary policy decision. Japanese officials maintained short-term interest rates at -0.1% and the target of the 10-year government bond yields at around 0% as was widely expected, noting that the economy will likely improve as the fallout from the pandemic subsides. That said, they noted that they are likely to increase the size of money pumped out via market operations and lending facilities to combat the virus from the current JPY 75trln to JPY 110trln. The yen did not react at the time of the release, perhaps as JPY-traders kept their gaze mostly locked on developments surrounding the broader market sentiment.

AUD/USD – TECHNICAL OUTLOOK

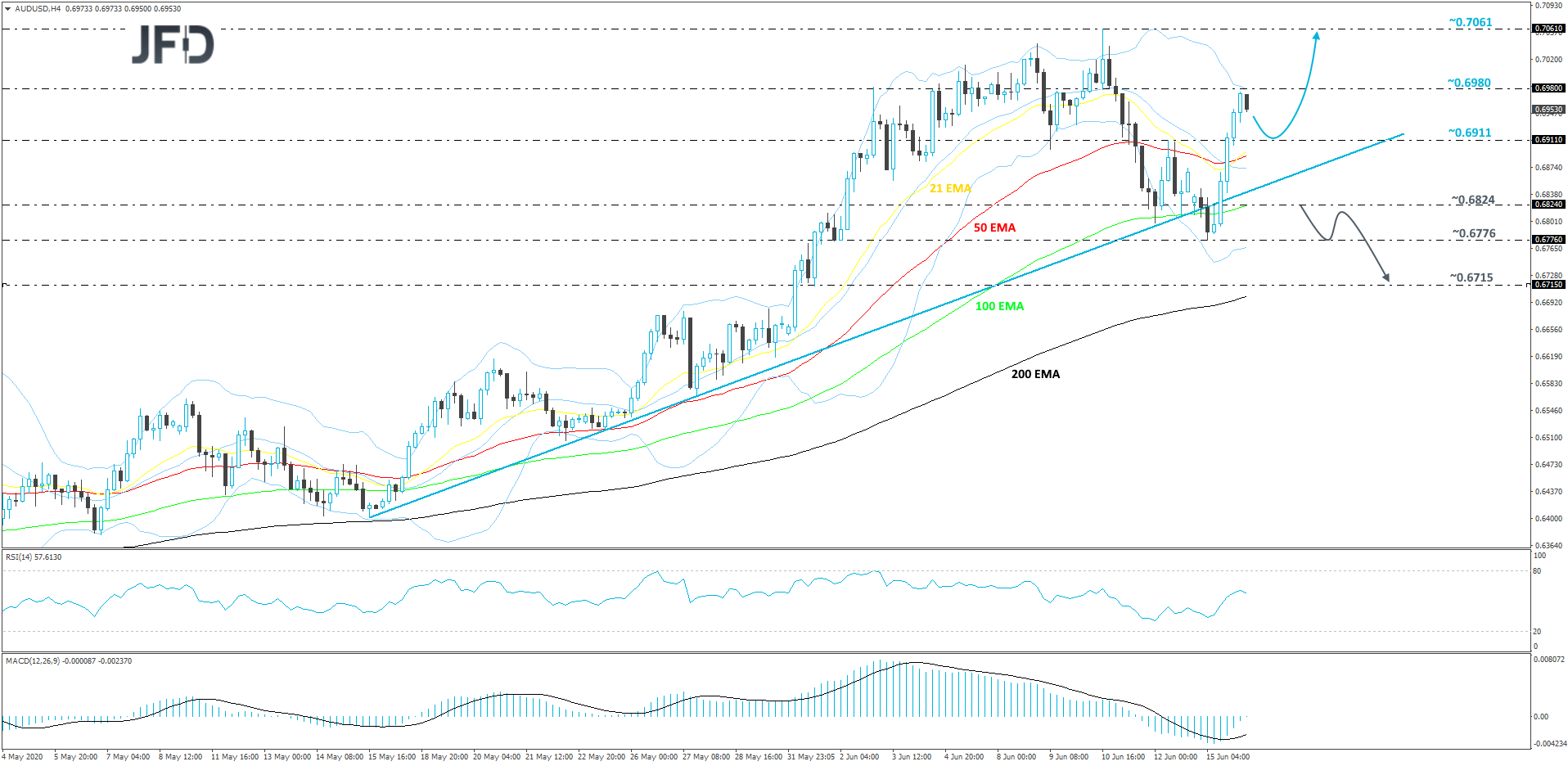

AUD/USD reversed sharply to the upside yesterday, traveling back above its short-term upside support line taken from the low of May 15th. The pair may continue with its journey up if the market sentiment continues to improve. That said, given the sharp upmove seen yesterday, there could be a possibility for a small correction before another leg of buying. For now, we will take a positive approach.

A small decline to the 0.6911 hurdle, marked by the high of June 12th, might be seen as a temporary correction, especially if that hurdle provides decent support. If so, AUD/USD could get picked up by the bulls and may be lifted closer to the 0.6980 zone again, which is the intraday swing low of June 10th. If the buying continues, the next possible resistance area might be near the high of June 10th, at 0.7061.

Alternatively, if the rate falls back down and breaks the aforementioned upside line, that may be the first sign for the bulls to start worrying. The short-term downside scenario could become even a bigger reality if

AUD/USD slides below the 0.6824 hurdle, marked by yesterday’s intraday swing high. The pair may then drift to the 0.6776 obstacle, a break of which could set the stage for a drop to the 0.6715 level, marked by an intraday swing low of June 1st.

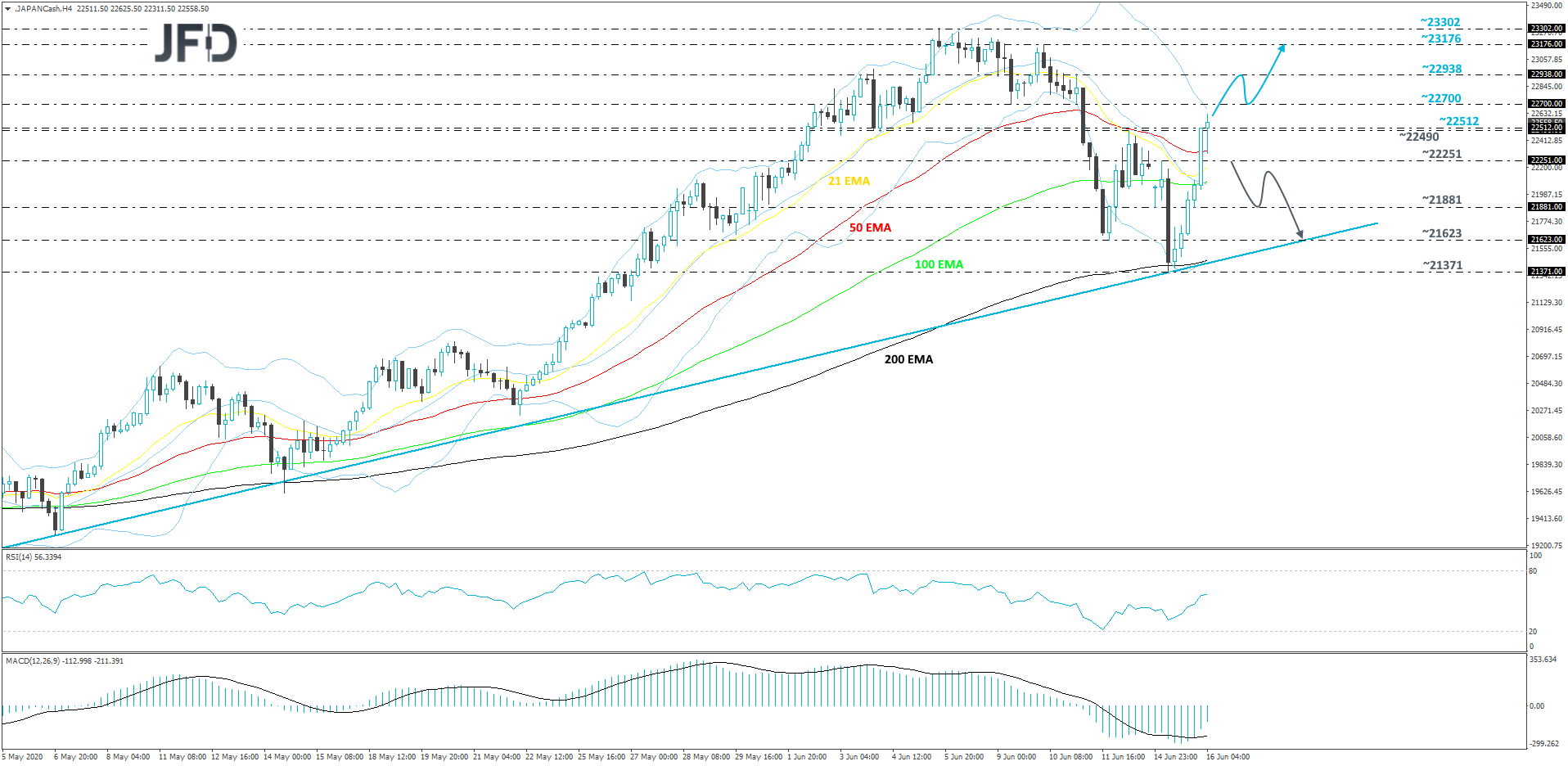

NIKKEI 225 – TECHNICAL OUTLOOK

After yesterday’s rebound from its short-term upside support line taken from the low of April 3rd, Nikkei 225 seems to be willing to recover all the losses made last week.

The index already has retraced more than half of last week’s slide and it looks like the buyers are not ready to let go of the index that easily. For now, we will stay positive with the near-term outlook and aim for slightly higher areas.

A further push north could bring Nikkei 225 to the 22700 obstacle, or even to the 22938 hurdle, marked by the high of June 11th, where the price might get a temporary hold-up. The index may correct back down a bit, however, if it remains above the 22700 area, the bulls may run back into the field and push Nikkei 225 higher. If this time the price gets lifted above the 22938 obstacle, the next resistance level might be at 23176, marked by the high of June 10th. Slightly above it lies the current highest point of June, at 23302, which could get tested as well.

On the other hand, if the price suddenly drops below the 22251 hurdle, marked by yesterday’s high, that may lead Nikkei 225 to a larger correction lower. The index might then drift to the 21881 obstacle, a break of which could set the stage for a re-test of last week’s low, at 21623. Around there, the slide might get halted near the previously-discussed upside line, which could support the price from declining further. This whole move lower could still be seen as a temporary correction, if the above-mentioned upside line stays intact.

AS FOR THE REST OF TODAY’S EVENTS

Ahead of the EU open, we already got the UK employment data for April. The unemployment rate stayed unchanged at 3.9%, instead of rising to 4.7% as the forecast suggested, while the net change in employment showed that the economy added 6k jobs in the three months to April, instead of losing 83k. Average earnings though slowed by more than anticipated. The including-bonuses rate dropped to +1.0% YoY from +2.4%, while the excluding-bonuses one fell to +1.7% YoY from +2.7%.

Germany’s ZEW survey for June is also coming out. Both the current conditions and economic sentiment indices are expected to have increased to -84.0 and 60.0 from -93.5 and 51.0 respectively. Eurozone’s wages and the Labor cost index for Q1 are also on the agenda.

As for the US data, we have retail sales, industrial and manufacturing production, all for May. They are all expected to have rebounded after tumbling in April.

Tonight, during the Asian trading Wednesday, New Zealand’s current account balance for Q1 and Japan’s trade balance for May are coming out. New Zealand’s current account deficit of NZD 2.66bn is forecast to have turned into a surplus of NZD 1.48bn, while Japan’s trade deficit is expected to have narrowed to JPY 560bn from 931.9bn.

With regards to the speakers, apart from Fed Chair Jerome Powell, we have another one on today’s agenda and this is Fed Vice Chair, Richard Clarida.