Investing.com’s stocks of the week

Risk appetite improved during the US session yesterday after the Republicans said they would support an extension of the federal debt ceiling into December.

A pullback in oil and gas prices after Russian leaders indicated that supply to Europe could increase helped equities rebound.

However, we are still reluctant to call for a change in the broader fundamental background of the financial world.

Signs of Common Ground In US Senate Lift Sentiments

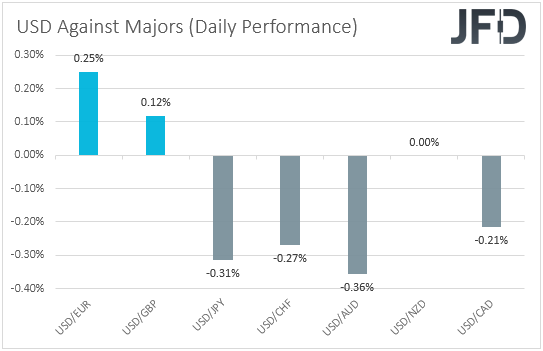

The US dollar traded lower against major currencies on Wednesday and during the Asian session Thursday. It lost ground against AUD, JPY, CHF, and CAD. In contrast, it gained versus EUR and GBP, remaining unchanged against NZD.

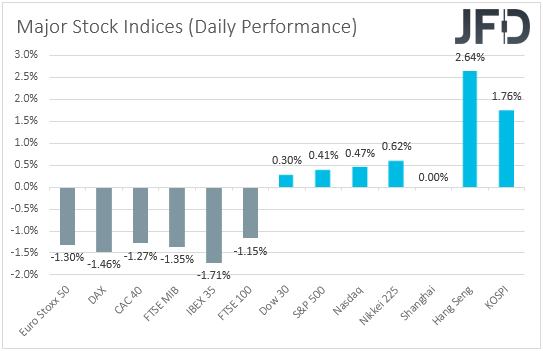

Major EU indices traded in the red, but the S&P 500, Dow Jones Industrial Average, and Nasdaq 100 closed green. The recovery in investors' morale rolled over into the Asian session today as well.

Asian indices slid after the Reserve Bank of New Zealand (RBNZ) hiked interest rates and signaled that more hikes could follow. This raised concerns that other major central banks may follow suit.

Risk appetite improved during the US session after Mitch McConnell said his party would support an extension of the federal debt ceiling into December. This is the first sign of compromise in the latest standoff between Democratic and Republican lawmakers.

The treasury department has forecast that it will run out of ways to meet all its obligations by Oct. 18, resulting in delayed salaries for millions of federal employees and delayed unemployment insurance and medical payments if the debt ceiling isn't raised.

Still, the matter may need to be addressed again in December, and therefore, even if equities trade higher for a while more, we are reluctant to call for a positive switch in the broader outlook.

Fears over the impact of Evergrande's (OTC:EGRNY) potential default on the global economy and high inflation forcing central banks to take a hawkish stance on monetary policy are factors weighing on equities.

What may have also helped equities to rebound yesterday may be the pullback in oil and gas prices after Russian leaders indicated that supply to Europe could increase.

However, with only talks and no concrete action yet, and with energy prices staying in steep uptrends, we believe that market participants may stay concerned over high energy prices translating into a higher in inflation.

The path of least resistance for stock indices may still be to the downside and the recovery late yesterday and overnight is a corrective bounce, in our view.

At the same time, we see the US dollar strengthening significantly if tomorrow's NFPs add extra credence to the case of a November tapering by the Federal Open Market Committee (FOMC).

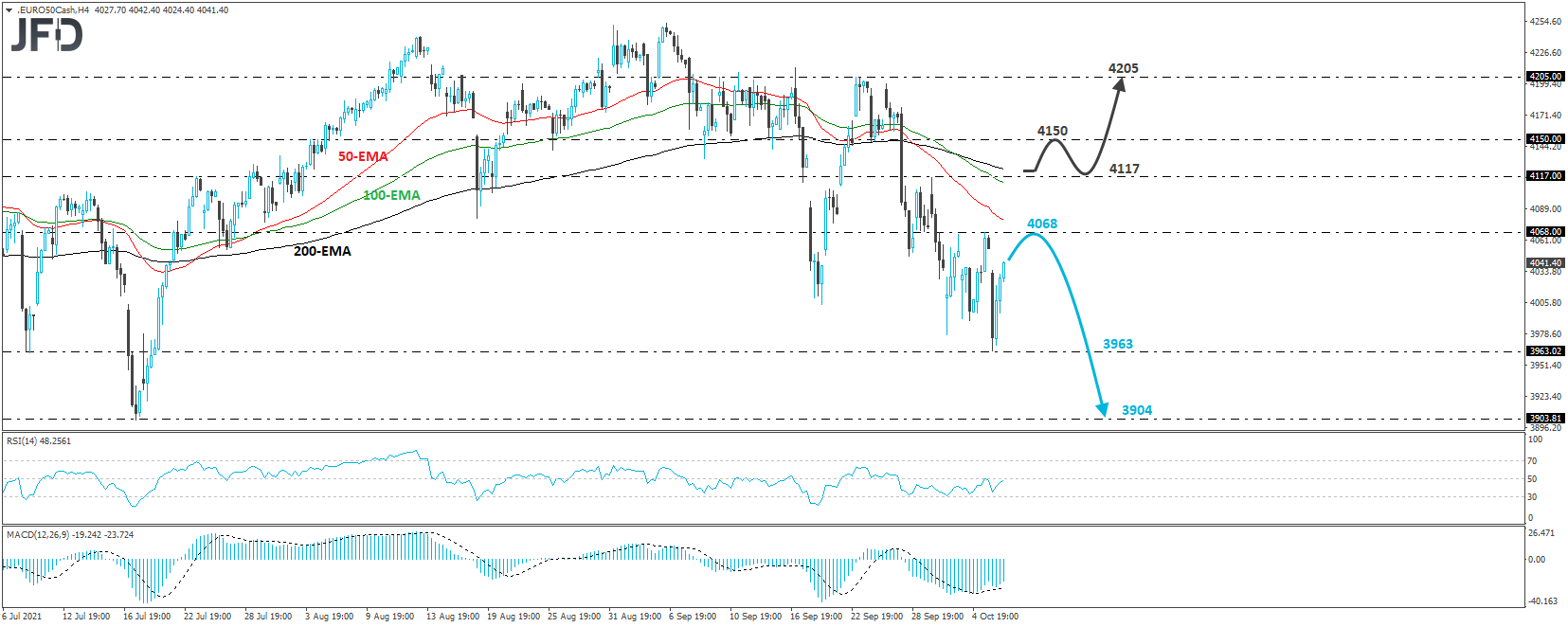

EURO STOXX 50 – Technical Outlook

The EURO STOXX 50 ETF (NYSE:FEZ) cash index traded lower during the early European morning yesterday but hit support at 3964 and rebounded later in the day.

Overall, the price structure continues to suggest a choppy short-term downtrend, and thus, we would consider the latest rebound a corrective move.

The bears may retake charge near 4068, marked as resistance by the high of Oct. 5, with the forthcoming slide resulting in another test at 3964.

If that barrier surrenders this time, we may experience extensions towards the 3904 zone, near the low of July 19.

To abandon the bearish case, we would like to see a recovery above the peak of Sept. 30, at 4117. This could target the inside swing low of Sept. 24, at around 4150, the break of which could carry extensions towards 4205.

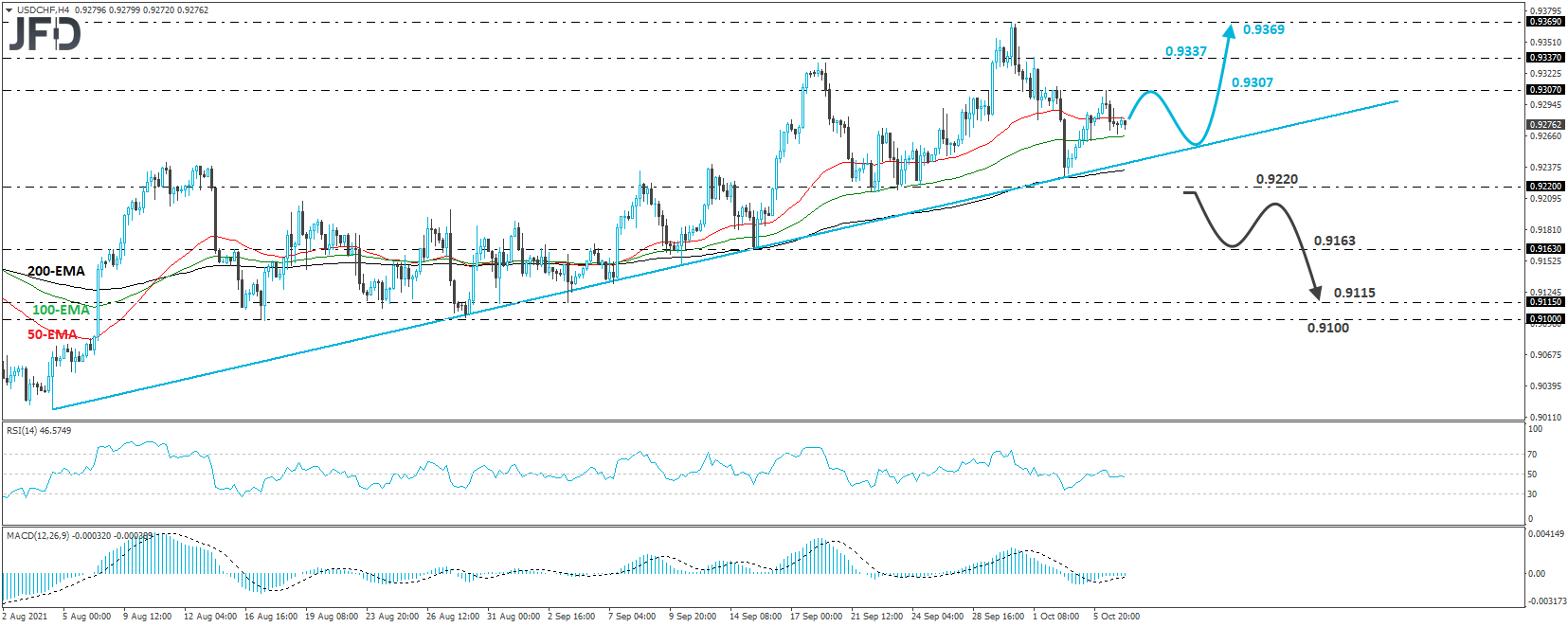

USD/CHF – Technical Outlook

USD/CHF traded lower after it hit resistance at 0.9307. However, the rate remains above the upside support line taken from the low of Aug. 4, and the near-term outlook remains cautiously optimistic.

The current retreat may continue for a while, but the bulls may jump back into the action near the upside support line. This could result in another test at 0.9307, the break of which could target the peak of Oct. 1, at 0.9337.

Another break above 0.9337 could pave the way towards the peak of Sept. 30, at 0.9369.

We will start examining a bearish reversal upon a dip below 0.9220, a zone that acted as a temporary floor between Sept. 22 and Oct. 4.

This will confirm a forthcoming lower low as well a break below the support line. The bears may push the action towards the low of Sept. 15, at 0.9163, where another break may pave the way towards the 0.9115 territories, marked by the lows of Aug. 31 and Sept. 3.

Today's Events

We get the minutes from the latest European Central Bank (ECB) monetary policy meeting during the EU session. The bank announced a "moderately lower pace" of PEPP purchases for the next quarter, but President Lagarde made it clear that this was not a tapering move and that when PEPP is over, they have all other tools available.

In our view, this may be a hint that when PEPP is over, conditional upon the economic outlook, they could compensate by buying more through other schemes, like the Asset Purchase Program (APP).

So, we will scan the minutes to see whether this is the case. Clearer hints that the bank stands ready to offset the end of the PEPP by buying more through other programs could encourage more euro selling.

Later in the day, the US initial jobless claims for last week are due to be released, and expectations are slightly declining to 348,000 from 362,000. Canada's Ivey PMI for September is also coming out, but no forecast is available.

As for the speakers, we will hear from ECB Executive Board members Frank Elderson, Philip Lane, Isabel Schnabel, and Bank of Canada (BoC) Governor Tiff Macklem.