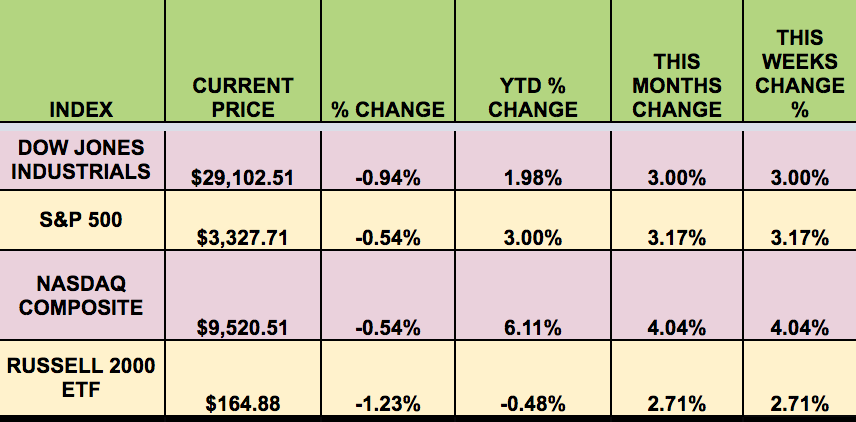

Market Indexes: It was an up week for the market, with the NASDAQ hitting a new record, although Friday saw losses in all 4 indexes.

“The Nasdaq hit a record high on Tuesday and the S&P 500 headed for its biggest one-day gain in about six months as fears of a heavy economic impact from the coronavirus outbreak waned after China’s central bank intervened. The People’s Bank of China (PBOC) injected a total of 1.7 trillion yuan ($242.74 billion) through reverse repos on Monday and Tuesday, as the central bank said it sought to stabilize financial market expectations and restore market confidence.” (Reuters)

This Week’s Options Trades: Looking for high yield covered call and high yield put-selling trades?

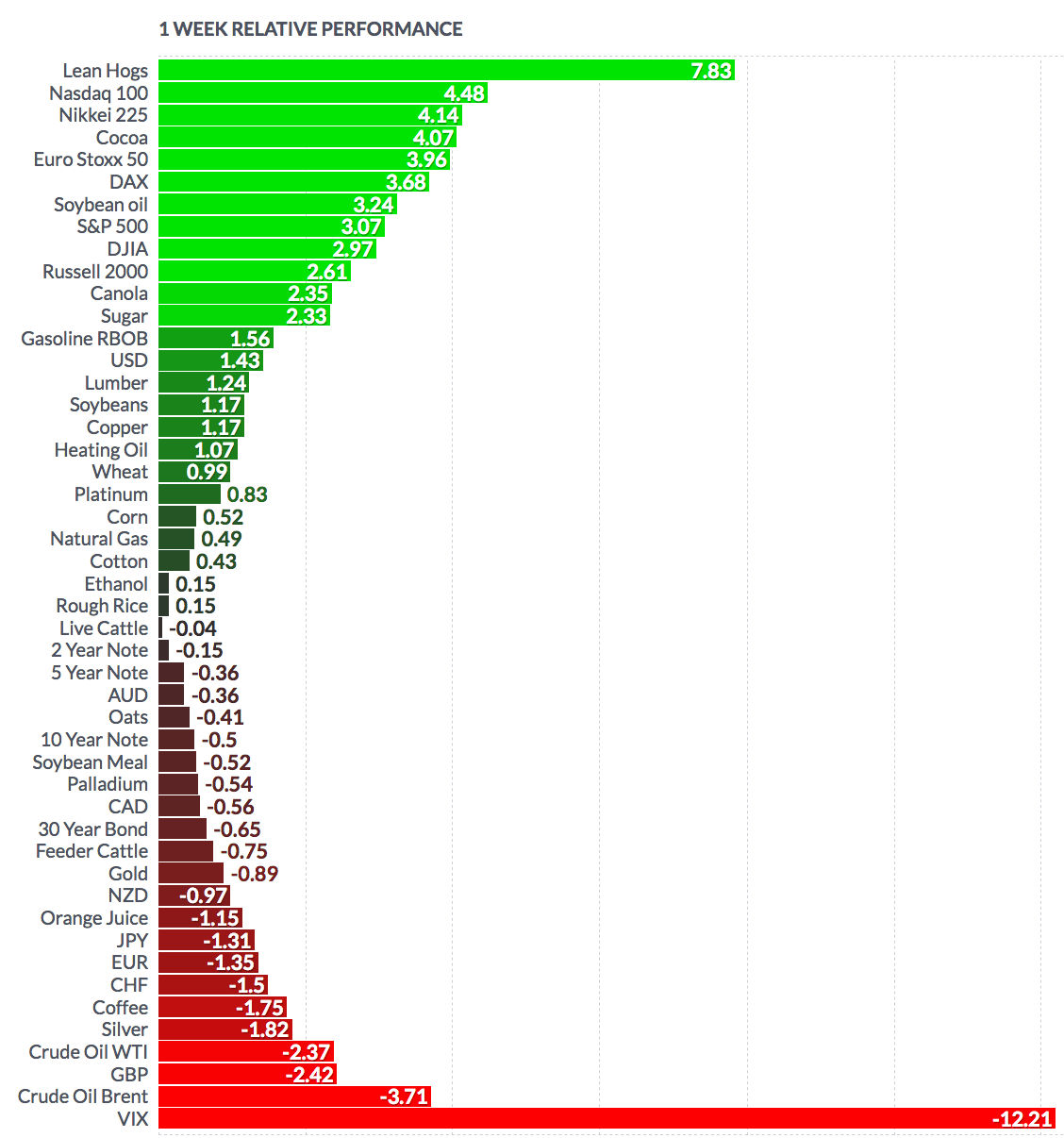

Volatility: The VIX fell -17.89%% this week, ending the week at $15.47.

High Dividend Stocks: These high yield stocks go ex-dividend next week: NMM, XOM, SLB, AHC, CORR, ENB, SAF.

Market Breadth: 3 out of 30 DOW stocks rose this week, vs. 10 last week. 84% of the S&P 500 rose, vs. 20% last week.

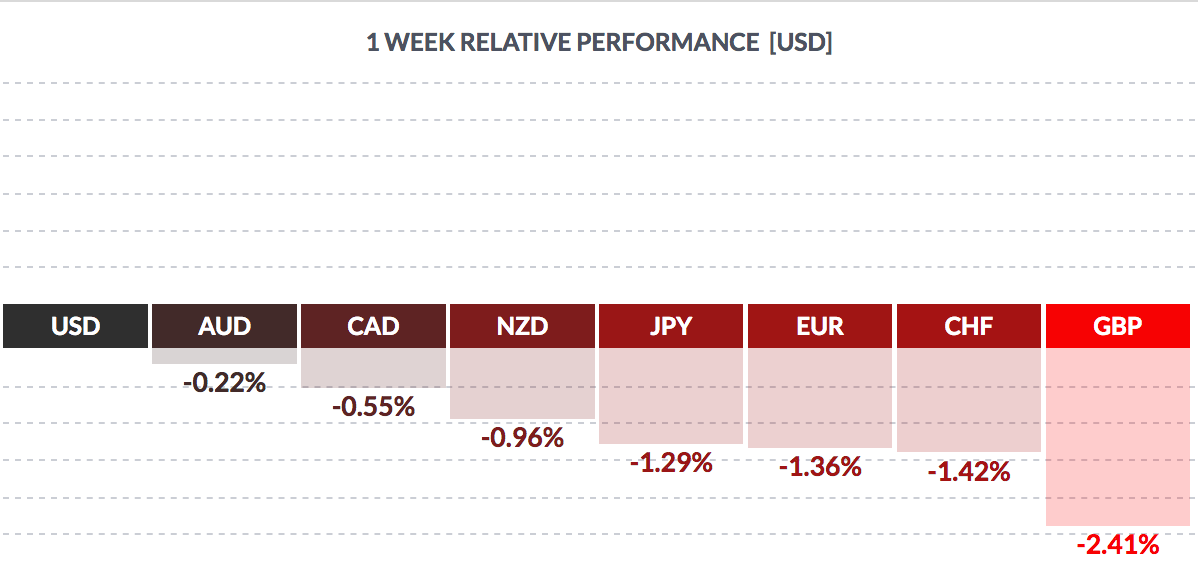

FOREX: The USD rose vs. most major currencies, except the yen.

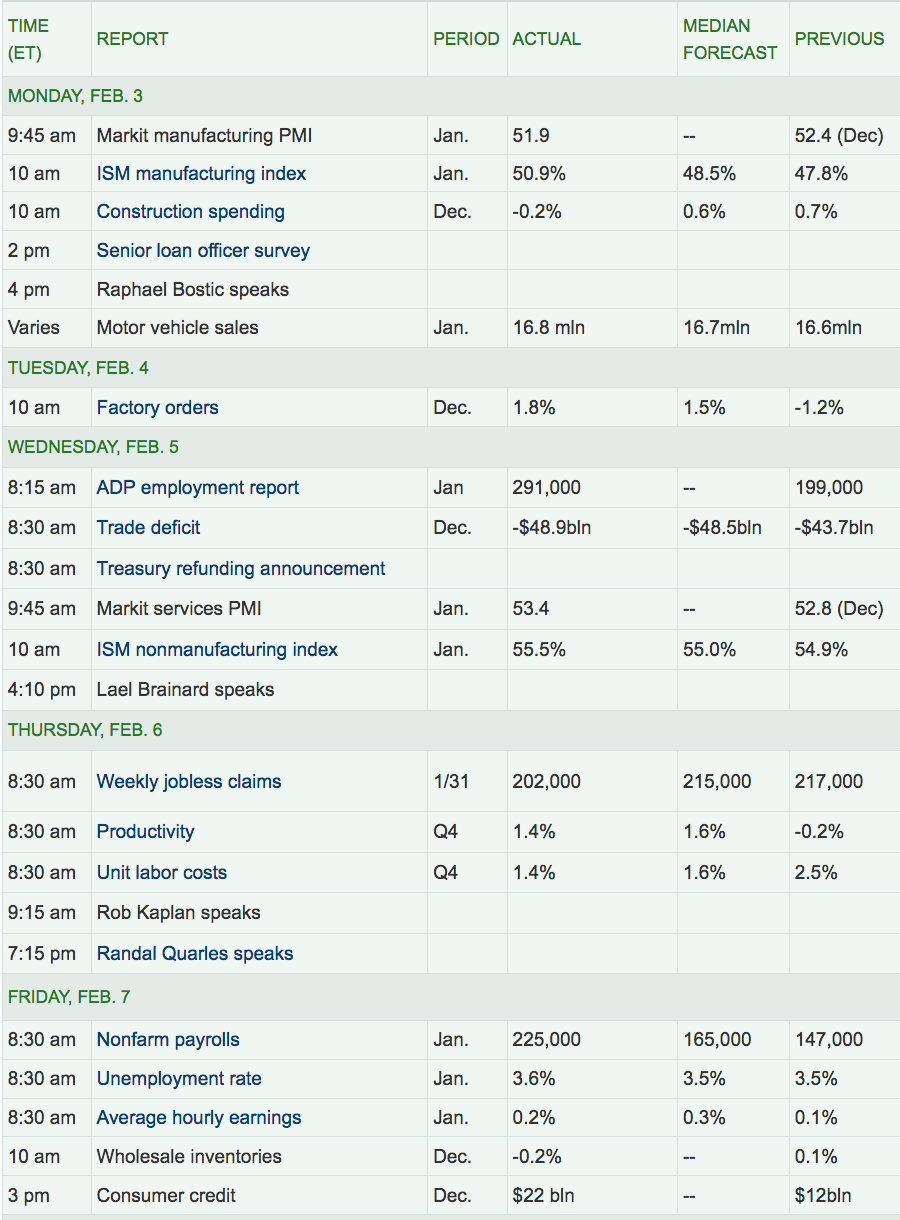

Economic News: The economy added 225K jobs in January, higher than estimates, while the Unemployment Rate rose to 3.6%.

“The Labor Department’s closely watched monthly employment report on Friday, showed the economy created 514,000 fewer jobs between April 2018 and March 2019 than originally estimated. This was the biggest downgrade to payrolls over a 12-month period since 2009. U.S. job growth accelerated in January, with unseasonably mild temperatures boosting hiring in weather-sensitive sectors, indicating the economy could continue to grow moderately despite a deepening slump in business investment.” (Reuters)

“U.S. factory activity unexpectedly rebounded in January after contracting for five straight months amid a surge in new orders, offering hope that a prolonged slump in business investment has probably bottomed out. The Institute for Supply Management (ISM) said on Monday its index of national factory activity increased to a reading of 50.9 last month, the highest level since July, from an upwardly revised 47.8 in December.

The improvement in the ISM data likely reflects ebbing trade tensions between the United States and China. Washington and Beijing signed a Phase 1 trade deal last month. The deal, however, left in place U.S. tariffs on $360 billion of Chinese imports, about two-thirds of the total, which economists say will remain a constraint on manufacturing.” (Reuters)

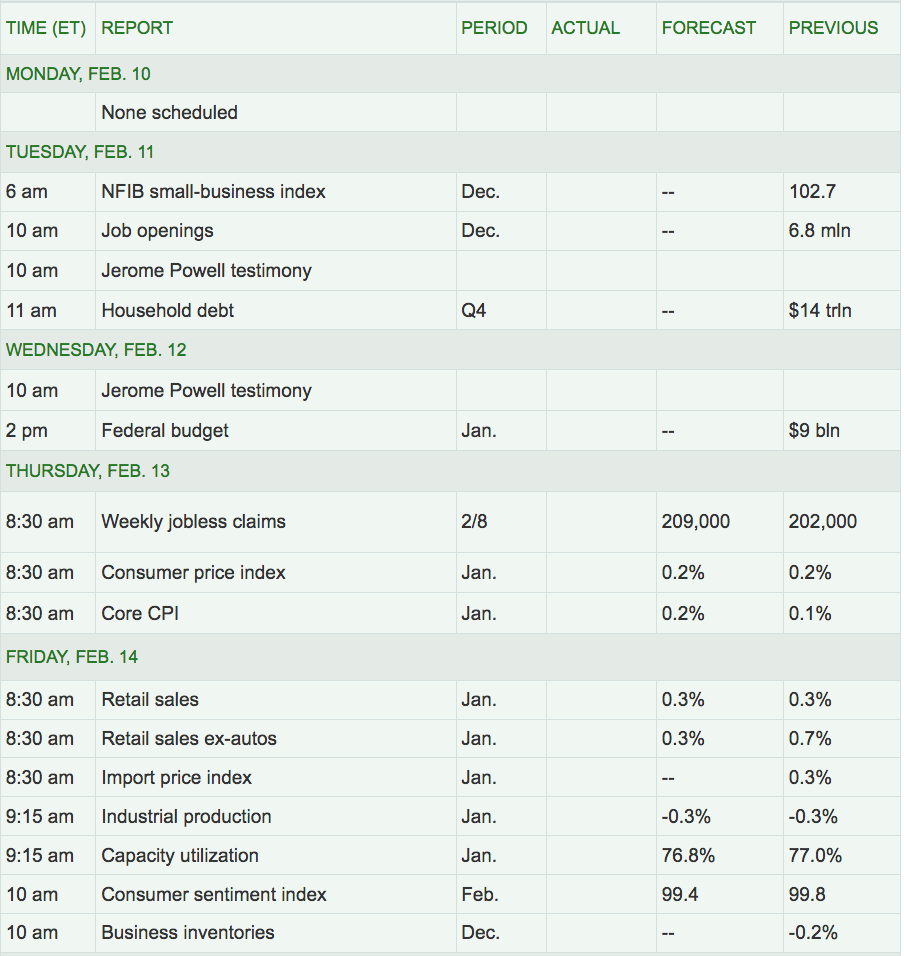

Week Ahead Highlights: Q4 ’19 Earnings season starts to wind down, with only 1 DOW stock reporting, Cisco (NASDAQ:CSCO), and 14% of the S&P 500 reporting. Fed Chief Powell will testify in DC.

Next Week’s US Economic Reports:

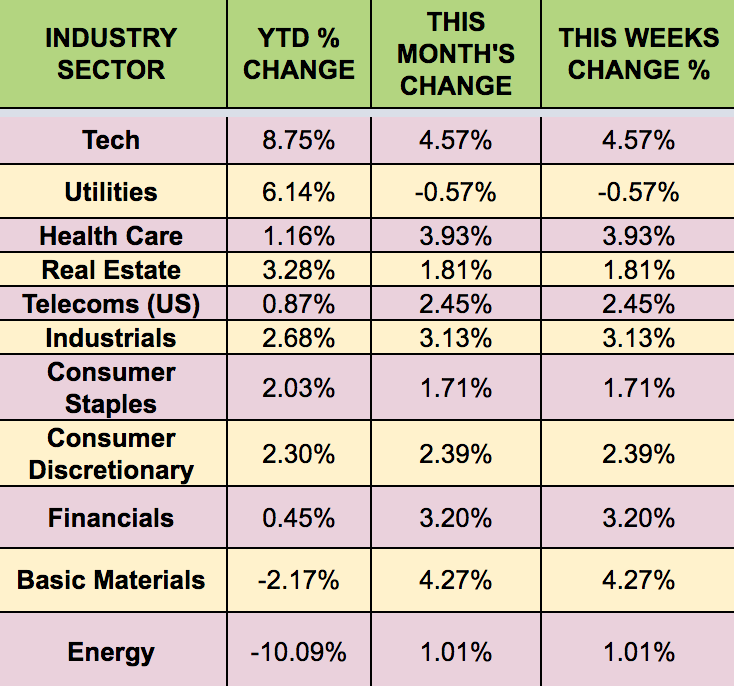

Sectors: Tech and Healthcare led this week; Utilities lagged.

Futures: WTI Crude fell -2.37% this week, finishing at $50.34,