Emerging-market stocks retreated from a four-month high after their best rally in March since 2009, and currencies fell following a record gain.

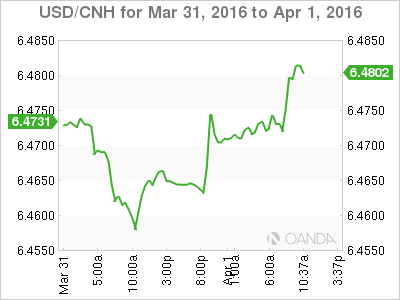

The MSCI Emerging Markets index dropped 1.3 percent to 825.63 as of 8:51 a.m. in London, after climbing 13 percent last month. Reports on Friday showed China’s factory production gauges beat forecasts in March before U.S. jobs data later that may give greater insight as to the timing of the Federal Reserve’s next rate increase. A gauge tracking 20 developing-nation currencies fell 0.1 percent after surging more than 6 percent last month.

“Basically, it’s profit-taking after a fairly good recovery,” said Geoffrey Ng, director at Fortress Capital Asset Management Sdn. in Kuala Lumpur, overseeing about $238 million. “The one-off PMI reading is of course a feel-good factor, but I think investors would want to see more of a trend from now on.” Ng said the fund is taking short-term positions as markets are still prone to swings.

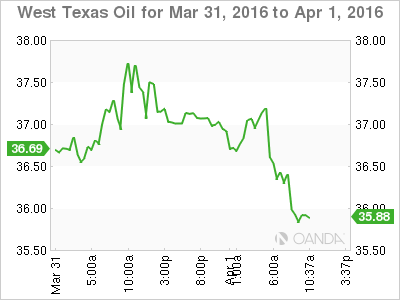

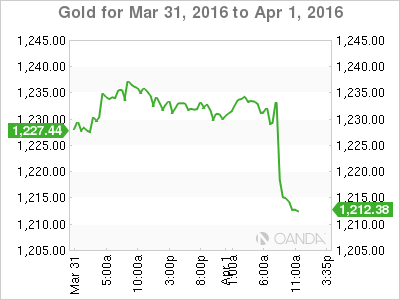

Fed Chair Janet Yellen stressed the importance this week of being cautious in tightening monetary policy, brightening the outlook for inflows to emerging-market assets. Oil, one of the key drivers behind last month’s rallies, fell for a second week as a supply glut that pushed Brent crude prices to a 12-year low in January lingers. The Bloomberg Commodity Index headed for a second week of losses.

Behind the emerging-market gains, there are some ominous signs that the rally is about to hit a wall.

Stocks

When the MSCI index of developing-nation equities last increased more than 13 percent in May 2009, it declined the following month before resuming a rally in July. More than four stocks fell for each one that rose on Friday as all the 10 constituent industry groups retreated, led by consumer discretionary and information technology companies. Taiwan Semiconductor Manufacturing Co. dropped 2.2 percent, the most in more than two months. Samsung Electronics (KS:005930) fell 2.5 percent in the steepest decline since March 8 after climbing last month by the most since October.

Benchmark stock gauges dropped across Asia. The Hang Seng China Enterprises Index of mainland companies trading in Hong Kong slid 1.8 percent after rising on Thursday to the highest level since early January. The Shanghai Composite Index reversed an earlier decline of as much as 1.6 percent.

Russia’s MICEX Index declined 1 percent, halting a two-day rally. South Africa’s FTSE/JSE Top40 fell 1.3 percent, the biggest drop in more than a week.

“Investors are taking a cautious stance — the Chinese PMI data seem favorable but the question now is has this reached stability and is the expansion sustainable moving forward,” said Jonathan Ravelas, chief market strategist at Manila-based BDO Unibank Inc., the Philippines biggest bank by assets. Investors are locking in gains as disappointing U.S. data “may unravel the rally,” he said.

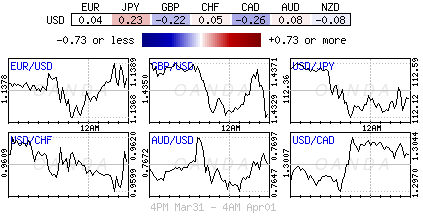

Currencies

South Korea’s won led a decline among emerging-market currencies on Friday after reaching the strongest in four months on Thursday, when it completed its biggest monthly gain since 2009. Malaysia’s ringgit fared better as the currency dipped only 0.2 percent, after surging 10 percent last quarter, the best performance since 1973. Indonesia’s rupiah bucked the trend and rose 0.6 percent.

Russia’s ruble declined 0.3 percent after rallying 12 percent in March, the best among 24 emerging-market currencies tracked by Bloomberg ahead of the Brazilian real. Turkey’s lira fell 0.3 percent.

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, slid 1.6 percent this week, the steepest drop since early February as Fed rate-hike expectations are pushed back. It slumped 3.9 percent in March following February’s 1.8 percent loss.

“Markets have gone from extremely bullish U.S. dollar in January to extremely bearish in February-March,” said Philip Wee, senior currency economist at DBS Group Holdings Ltd. in Singapore. “And markets risk reading too much into Yellen’s recent remarks. Nothing much has changed in emerging markets — exports are still in recession for most countries and China is still in the middle of a difficult economic transition.”

Bonds

The Bloomberg Emerging Market Local Sovereign Index gained after last month’s 4.8 percent increase, the biggest since at least 2010. A similar gauge tracking dollar debt also rose after climbing 3.3 percent last month. The yield on Thailand’s 10-year government note fell 10 basis points to 1.61 percent. That’s the steepest drop since March 2.