Market Brief

Volatility continued to ease in the FX market as investors digest Donald Trump's win. EUR/USD moved in a very narrow range in Tokyo - between 1.0876 and 1.0923. Given the fact that a December Fed interest rate hike is again fully priced in, the risk is on the upside in EUR/USD with the 1.13 level as the closest resistance.

On the downside, the 1.0822-51 support area (previous low) will act as strong support. If broken, the road will be wide open towards 1.0458 (low from March 2015). However, given the ECB’s reluctance to increase stimulus, we see no reason for further EUR weakness in the short-term.

This is, however, a different story in the medium to long-term as political risk will be the key factor as we move towards 2017. Upcoming risks events include the Italian constitutional referendum, the Spanish general election and Dutch national election in December this year, while next year the French presidential and parliamentary elections and German federal election will attract the market’s attention.

Emerging market currencies suffered a massive sell-off yesterday with investors expecting a tougher trade relationship between the US and emerging economies. The Brazilian real was in free-fall yesterday as it dropped almost 5% against the greenback with USD/BRL hitting 3.40 in session yesterday.

The Colombian peso was off 3.75% to 3117.48, while the Chilean peso slid 1.08% to 656.80. In Asia, the South Korean won was off 1.24% as the BoK left its 7-day repo rate unchanged at 1.25%. Finally, the Indonesian rupiah was off 2.46% with stabilising 13,467 after hitting 13,872.

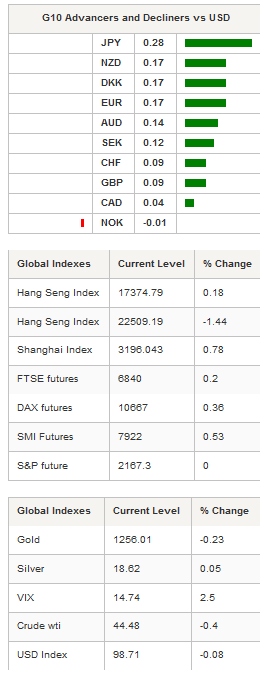

Asian equity returns were mixed on Friday with the Japanese Nikkei and Topix edging up 0.18% and 0.14% respectively. In mainland China, the Shanghai Composite and Shenzhen Composite were up 0.78% and 0.53% respectively. Offshore, the Hang Seng slid 1.44%, while the TAIEX (HK:3089) was off 2.12%.

In Europe, equity futures were extending gains with the DAX up 0.36% and the Footsie rising 0.12%. In Switzerland the SMI was up 0.82%, while EUR/CHF was treading water at around 1.0750 as the SNB remained reluctant to step in to weaken the Swiss franc.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1210

CURRENT: 1.0899

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2771

CURRENT: 1.2566

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 111.45

R 1: 107.49

CURRENT: 106.71

S 1: 102.55

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9858

S 1: 0.9632

S 2: 0.9537