This past Wednesday, March 9th, marked the seven-year anniversary of the current U.S. bull market. The recent correction notwithstanding, this is quite an accomplishment considering that historically, the average bull run is about 59 months. Since March of 2009, the major indices have registered some hefty gains through this period, the NASDAQ up 266%, the Dow Jones Industrials up 159% and the S&P 500 up 193%. Not bad at all, especially for those investors who were courageous enough to shop during the fire sale of the Great Recession.

With stock valuations not particularly cheap (forward twelve-months price/earnings are approximately 16.1x according to FactSet data) and the economy trying to find a stronger footing, the question continues to be, are we on the cusp of a bear market or is this just a tired bull? In A Tale of Two Cities, Charles Dickens wrote, “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness…” This seems particularly apt today considering it is an election year although wisdom does seem in short supply amidst a general glut of foolishness.

So what is out there, aside from the contentious election debates?

- Oil prices may have found a bottom and although no one is expecting a return to $100 per barrel, OPEC and non-OPEC nations will meet on March 20th to discuss an output freeze. Odds of agreement probably fall somewhere between not likely and you must be kidding but anticipation of the meeting may continue to move prices in the short term.

- Credit spreads have narrowed between Treasuries and high yield corporate issues. Some is likely attributable to bottom fishing from aggressive investors amid hope that oil prices have seen their lows.

- Inflation pressures are possibly rising. Wages are increasing in some industries, partially due to political pressures (minimum wage laws). The positive aspect of this is that consumers will have additional disposable income.

- China is? Hard landing/soft landing – still up in the air, but seemingly more worrisome as time goes on. February export numbers released this week reflected a significant drop of over 25% in exports from China versus last year. That is a very large number and the biggest drop in six years.

- What is Mario Draghi up to now? Thursday morning, the European Central Bank chief announced sizeable easing measures, including raising monthly asset buys, adding investment grade corporate bonds to the permissible purchases and lowering rates. Draghi announced a cut of the main ECB rate to zero from 0.05%, a ten basis cut in the deposit rate to -0.4% (yes that is a negative number) and a cut of five basis points to 0.25% on the bank overnight lending rate. The ECB, is pulling out the stops again, attempting to stimulate the banks to lend; however lending is also dependent on demand so we will have to wait and see…

- Employment numbers continue to show strength. The latest initial unemployment claims figure for the week ended March 5th showed a decline of 18,000 to a seasonally adjusted 259,000. The four-week moving average is at 267,500. Claims have been below 300,000 which is considered to be a positive indicator for labor markets for a year. This is the longest run since the 1970s.

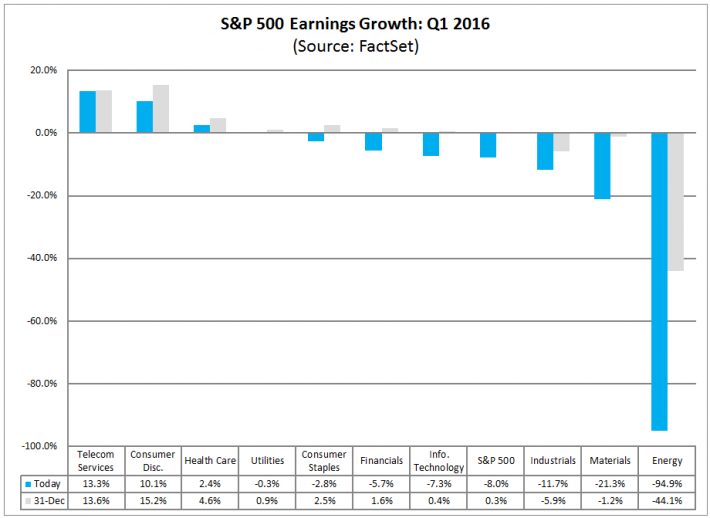

- Following a disappointing year for most companies, negative corporate earnings revisions continue into 2016 – and in a very big way. According to FactSet, during January and February, the bottom-up consensus analysts’ estimates for the first quarter of 2016 dropped 8% – the largest since the first quarter of 2009. Again the worst of the worse is the Energy Sector (perhaps we will see some upward revisions if oil prices hold?); however, all ten sectors have had earnings estimates cut. Refer to the chart below.

This is not coming as much of a surprise to us. As mentioned in previous writings, this is a substantial concern that we have had for the past couple of quarters, as we continuously review stock holdings and conduct due diligence on purchase candidates. In fact, earnings and revenue growth for the S&P 500 are not expected to turn positive until the second half of the year, something about which we aren’t very confident. This theme of a second half improvement was also the consensus last year – we will see as 2016 progresses whether this scenario plays out this time around.

As individual investors, we have little to no control over whom the next President will be. In the global sphere of influence we are less than tiny motes floating in the atmosphere. What is under our control, however, is our analysis and response to the economic and market data. What are the current risks and the potential returns? That objective balancing act is our starting point.

Going beyond that, your individual circumstances also shape your portfolio. A retiree, will not, (and should not) approach their investments in the same manner as someone who is in the prime of their career or someone just starting out. In uncertain times – and today certainly qualifies – capital preservation is a much greater factor for retirees since they have few options to renew their capital. Asset allocation decisions are about more than just one’s appetite for risk; it is also about one’s ability to take risk. Our age, employment status, health and other personal characteristics may play a larger role than any personal perception of risk. Just a reminder that after a nice rally off the early year lows, it might be an opportune time to do a check up on your risk tolerance and asset allocation.