US Markets

- S&P 500 Futures – Flat

- 10-Year Treasury 2.68%

- Oil +$0.59 – $56.89

- VIX 16.51

- US Dollar Index +0.18 +97.06

International Markets

- Japan Nikkei -0.65%

- China Shanghai +0.14%

- Hong Kong HSI -0.89%

- Singapore STI +0.21%

- South Korea KOSPI -0.45%

- Australia ASX +0.29%

- UK FTSE -0.25%

- German DAX -0.15%

Key Events:

- ECB Meeting – Leaves Rates Unchanged, unveils new stimulus

- Eurozone GDP +1.1% vs. Est 1.2%

- US Non-Farm Productivity+1.6%

ECB

The ECB today left rates unchanged and now expects those rates to stay at the current level through year-end. Additionally, they will launch a new round of quarterly refinancing operations. Today’s news is bullish for equities and multiple expansion, while bearish for the euro. In fact, equity markets are stronger since the announcement

The euro is once again on the cusp of a significant breakdown versus the dollar. Again, this move by Draghi puts Powell in a box and essentially puts the Fed on hold for the balance of the year.

The risk of allowing the dollar to strengthen materially would kill off any inflationary force in the economy. The Fed can’t afford for that to happen.

International Trading

South Korea

Stocks were mixed overnight. The market we have been most concerned about has been South Korea and that market continues to sink. Still, the index is at crucial support, and as long as it holds, there is hope the markets won’t slip further. But this continues to be one region of particular interest at this point.

Hong Kong

Hong Kong also continues to pause at resistance.

US Markets

Russell

The move yesterday in the Russell was the most concerning and when you look at the chart from this standpoint you can get a sense of just how much damage was done. I can’t emphasize enough just how important support at this 1,534 level is. A drop below here sends the index back to 1,492. While it is not the end of the world, it will make those bearish calls louder. But as long as support holds there is a reason to be optimistic, and might have Mario to thank!

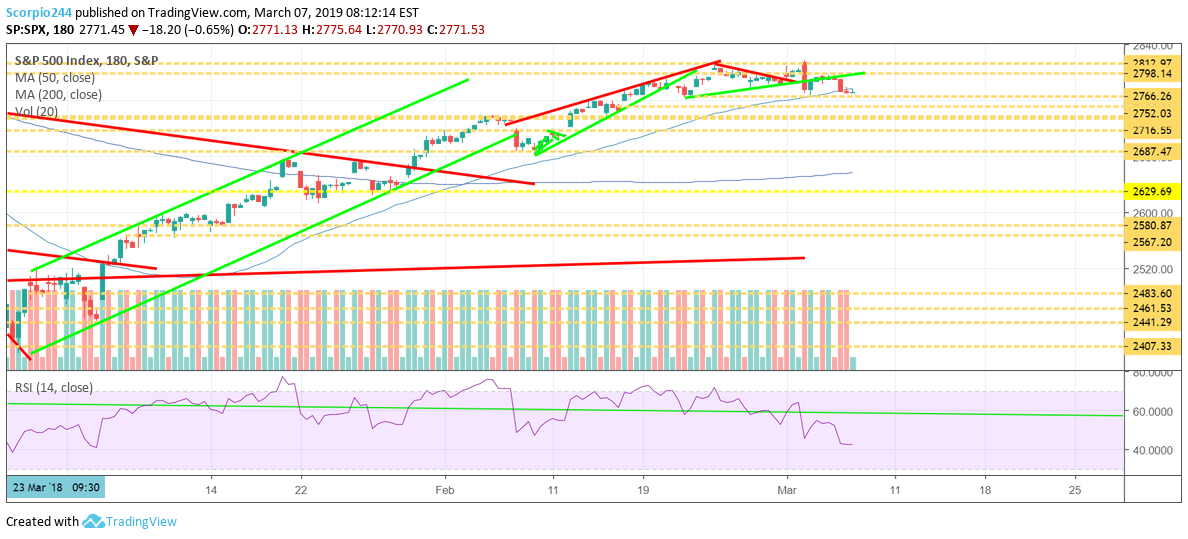

S&P 500 (SPY (NYSE:SPY))

While the S&P 500 continues to hold support around 2,770, and that is reason enough to stay optimistic. I still think that the outlook for the balance of the year looks strong and that valuations support a move towards 3,200 by year-end. With the ECB in its position and the Fed in a box, the case for low rates and multiple expansion strengthen.

I also continue to believe that the recent services ISM continues to suggest the economy is doing better than most fear. The GDPNow estimate for the first quarter growth is 0.5% which up from 0.3%. The next reading comes on the 8th, and I expect that number to continue to rise.

Job growth based on ADP (NASDAQ:ADP) seems sturdy and the most recent trends suggest the BLS remain firm on Friday.

NXP (NXPI)

NXP is one stock on the rise after reports surfaced that Samsung (KS:005930) is looking to make a bid for the company. Clearly, this would be interesting given Qualcomm’s failed attempt for NXP. Yes, an acquisition by Samsung would make sense from a few standpoints. Samsung would have the resources to pull a deal off, and it likely would not go through same issues for approval from China, since neither company is US-based. For now we have to wait and see as Samsung has denied the rumor.

Support for NXP continues to be around $91, while a break above $97 could push shares back around $106.

Nvidia (NVDA)

Nvidia continues to drift lower and a drop below $150 could result in a drop back to $140.

Facebook (NASDAQ:FB)

It was reported that advertisers are leaving Facebook. The stock finds itself in a critical spot. Resistance is right $173, and for now, the stock is failing. A pullback could drag the stock all the way back to $148, which is the level I have looked for a few weeks.

Qualcomm (NASDAQ:QCOM)

Qualcomm continues to trend higher and it suggests shares may continue to head towards $58.