Two days of selling has finally put a stop to the accelerated gains from December but it should also provide an opportunity to shake the weak hands out of their positions and set up a more sustainable rally.

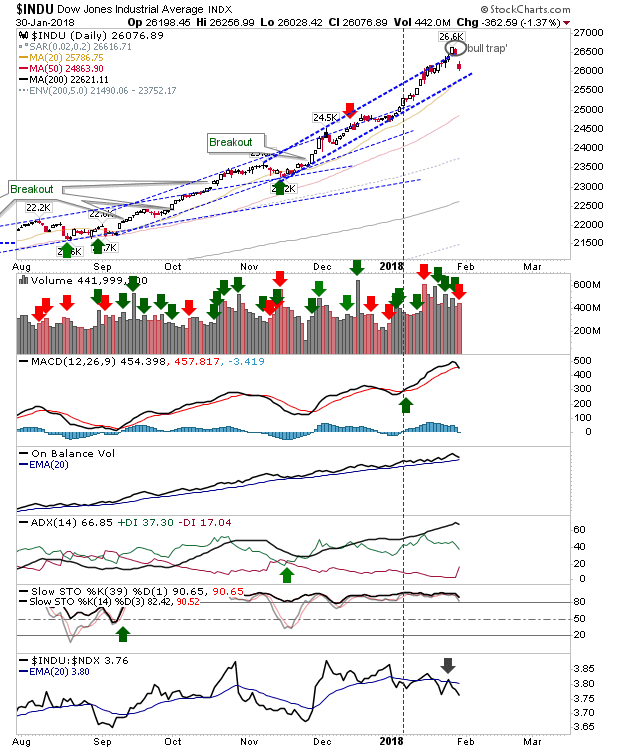

The nascent breakout in the Dow has been undone by the fall back inside the prior channel, leaving in its wake a 'bull trap'. Shorts will use the 'bull trap' highs as a place for stops. Typically, 'bull traps' from channel breakouts go all the way and drop out the other side—this would be a secondary shorting opportunity but we are not there yet.

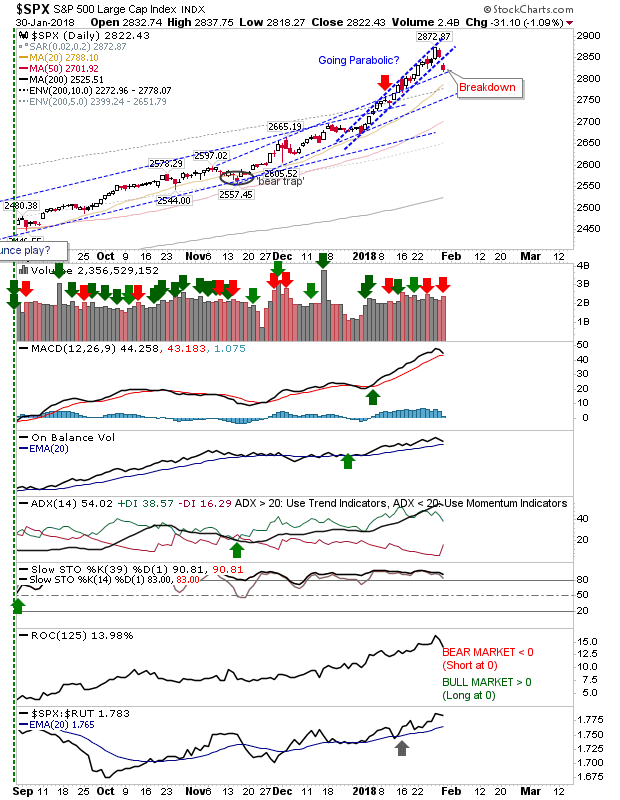

The S&P made a clean break of the narrow channel from December, returning to a slower channel support level (which was former channel resistance). Technicals remain bullish so the channel break doesn't suggest any larger deterioration other than a slow down of the existing advance

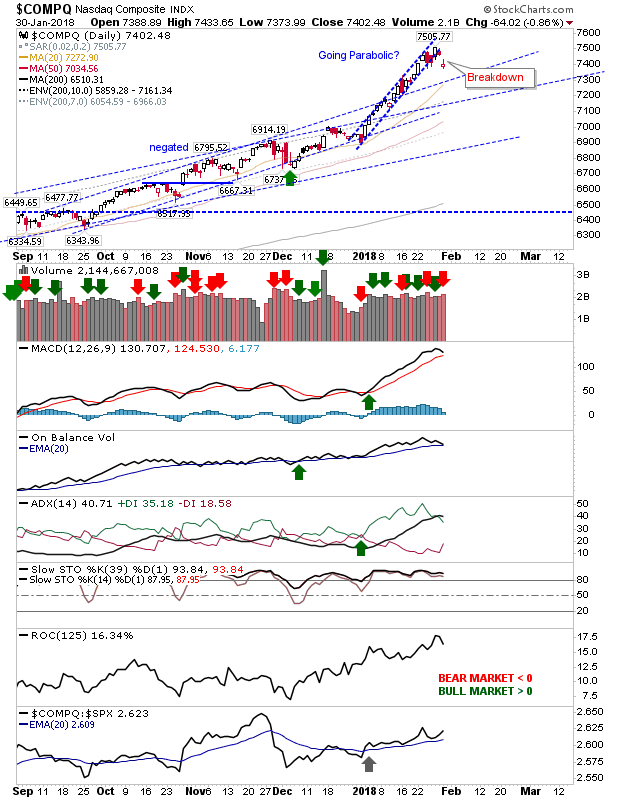

It was a similar story yesterday for the NASDAQ—a channel break—with the option of former channel resistance turned support to lean on if needed.

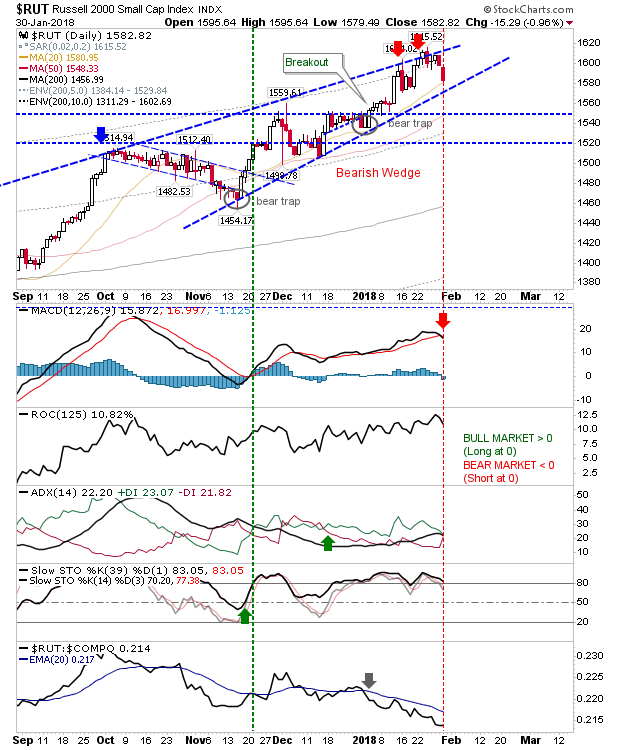

The Russell 2000 will have rewarded persistent shorts but the bearish wedge has yet to confirm - a break of wedge support will be needed for this.

The coming days will be about confirming the channel breakdowns, the 'bull trap', and potentially a break of the bearish wedge (in the Russell 2000). The last two days are a start but we're a long way from confirming a market top. Profit taking is always prudent after any period of sustained gains - helping to free up funds to buy (back) stocks at a discount.