Dow Jones futures are up despite the demonstrations in cities across the U.S. Dow futures are trading higher by over 100 points today while the gold price is off a few dollars, currently trading around $1,721. Speculators believe gold could skyrocket if the protests escalate to the point that Trump calls upon the full force of the military to crush any riots.

Will Stocks Crash?

The Dow Jones index closed 1.05% up yesterday, while the S&P 500 jumped by 0.82% and the NASDAQ gained 0.61%. Investors are largely focused on the reopening of the US economy and continue to bet for a pick-up in growth.

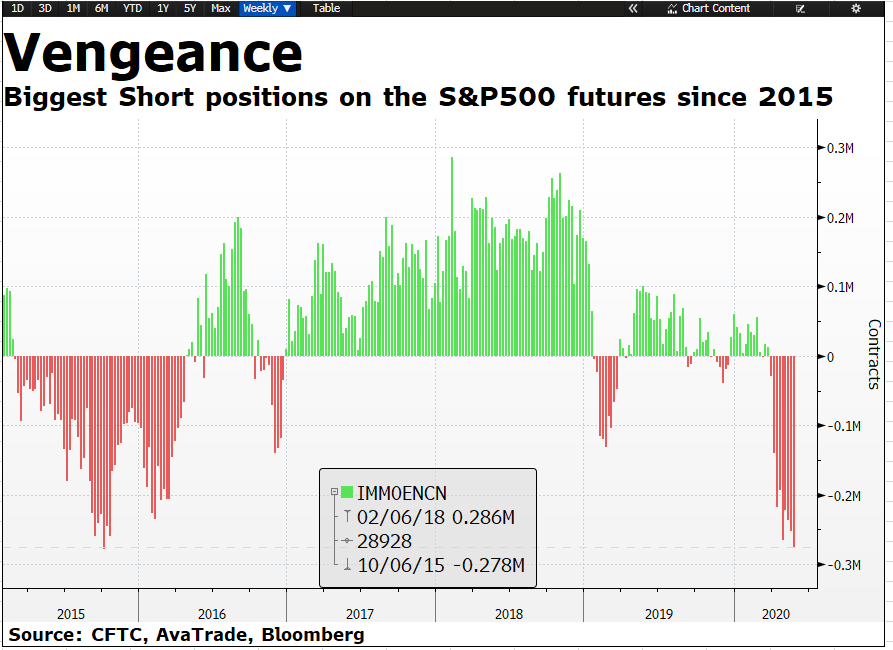

This comes at a time when S&P 500 Futures-positioning data show that bears are holding the biggest short on US stocks since 2015. This could certainly make the price action a lot uglier in the coming days.

Trump, Protests And Chaos

In political news, President Donald Trump is facing a significant challenge to restore order after he threatened to deploy the military to crackdown on protests, drawing condemnation from Democrats and Republicans alike. Not even a single Republican governor publicly accepted Trump’s offer to send in the military to deal with the situation. Trump saw his public support wane even further, after police used tear-gas and flash-bang devices to disperse peaceful protesters, in order for him to walk from the White House to pose in front of a church holding a bible for a photo opportunity.

OPEC And Russia: Brent Oil Tops $40

Brent and WTI crude oil futures have surprised investors with the strength of the rally that ensued after the US benchmark contract turned negative back in April for the first time in history. At the time, not many imagined that WTI or Brent would recover this quickly. But they were wrong. Brent crude has rallied to three-month highs above $40 a barrel and is up another 1.84% today, while WTI is up by 2.74% to trade just below $38 a barrel.

Speculators are betting that the recent agreement between OPEC+ to curtail production will be extended possibly to August. Russia has previously shown reluctance to prolong any supply cuts, but has recently shown more willingness to agree to an extension.

Traders will also be closely watching the upcoming weekly government crude inventory due later today. The American Petroleum Institute reported a decline of 2.2 million in crude stockpiles at the Cushing storage hub. Today's data from the Energy Information Administration is forecast to show a rise of 3.0 million barrels, after last week's 7.9-million barrel increase.