Riots, Looting and Protest In U.S. Over George Flyod’s Video

There are on-going riots and looting in the U.S. In places like Minneapolis, Chicago, Sandiego, California, Washington have been in the news because of the video that showed the killing of George Floyd. Business owners are trying their best to protect their business while they are unsure if riots covered by insurance. One thing is for certain that riots are illegal and Trump is pushing for National Guards to restore the situation, but it seems like things are getting out of control.

National Guards, Curfew And Threat For US Equity Markets

There is also a notion that Americans are angry because of higher unemployment that is triggered due to coronavirus. Some believe that Geroge’s Floyd's video is a catalyst but the actual reason is the lack of jobs and unfair system. Speaking of Covid-19, the on-going riots in many of the US states also brings this question if Coronvirus cases will rise due to the riots. Social distance measures aren’t respected in these places, and if these rules aren’t appreciated, the likelihood of virus cases shooting up in the US is much stronger.

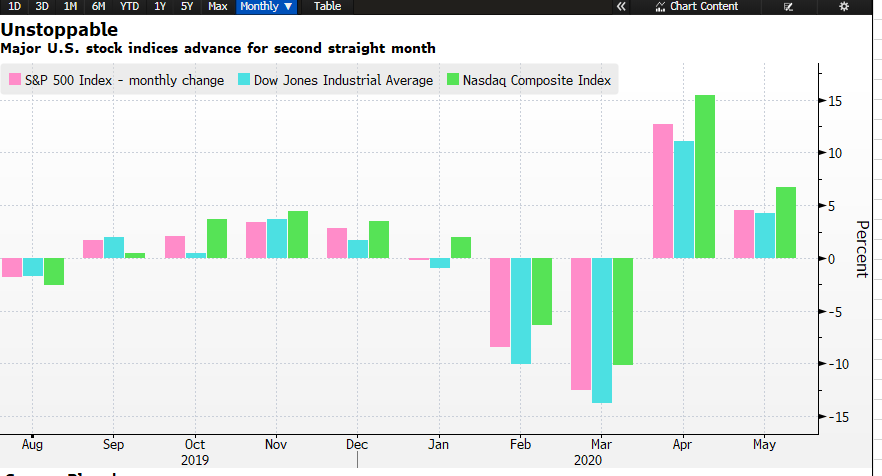

The fact is that if the social unrest situation isn’t addressed it can prolong the recovery process in the U.S. The Federal Reserve has worked hard to restore confidence in the US equity markets and if investors continue to see National guards and threats of curfew, it would hurt their confidence level. So far the three major indices, the S&P 500, the Dow Jones, and the NASDAQ have performed exceptionally well since the Covid-19 low. The chart below shows that the U.S. equity markets have posted two consecutive months of gains.

OPEC+ To Discuss Oil Supply Cut Extension

Opec+ is set to discuss the possibility of an oil supply cut’s extension. The cartel is considering to meet earlier than expected and bring forward it's meeting a few days to Jun 4. It was the current oil production cuts that helped the oil prices to recover from their 2020’s oil price crash. The current proposal is to extend the production by at least one month and a maximum of three months. If agreed, the move can further strengthen the WTI crude oil price and Brent oil prices. The WTI crude oil price has already jumped above $35 but down today by a small percentage. The Brent price has surged to $37 but again, it is down by 0.21%

Trump Avoided Tough Sanctions On China

Hong Kong’s stock market rallied today as investors felt relief that President Trump refrained from announcing tough sanctions on China over a new national security law for Hong Kong imposed by Bejing. He did promise some direct and indirect sanctions against Chinese and Hong Kong officials in eroding Hong Kong’s autonomy but went short of identifying individuals. The key takeaway is that Trump’s news conference on Hong Kong’s security law didn’t escalate affairs further between the two superpowers and this is positive for the risk-on sentiment. Had he escalated the tensions between the U.S. and China it would have put the US-China trade deal in jeopardy. This would have also threatened the recovery in both countries—the single biggest threat for the stock markets.

As discussed last week, Trump’s response on Friday was nothing but a slap on the wrist. Trump wants to show himself tough ahead of U.S. elections by showing that he is not afraid of China but he also knows the importance of the U.S. China trade deal that took nearly a year.

Hong Kong’s Unrest And Hang Seng’s Biggest Jump

The Asian index, the Hang Seng gained jumped 3.4% today, the biggest one-day percentage jump since late March, as investors rushed to bag some bargains because the index was beaten badly last week due to the fear that the U.S. may be imposing some tough sanctions on China. The Shanghai stock index and the South Koren Kospin index also surged on the back of this optimism.

Coronavirus And Chinese Economic Data

China continues to beat the woes of Coronavirus. While speculators continue to ask this question: are China coronavirus numbers real? The economic data confirm that the Chinese economy has started to recover from Coronavirus. The

Chinese Caixin manufacturing PMI data released today confirmed that this economic reading is back in the expansion territory. The reading came in at 50.7 against the forecast of 49.7. A number below 50 confirms contraction and above expansion. Yesterday’s manufacturing PMI was also above 50, it printed the reading of 50.6 but it was a little short against the forecast of 51.1.