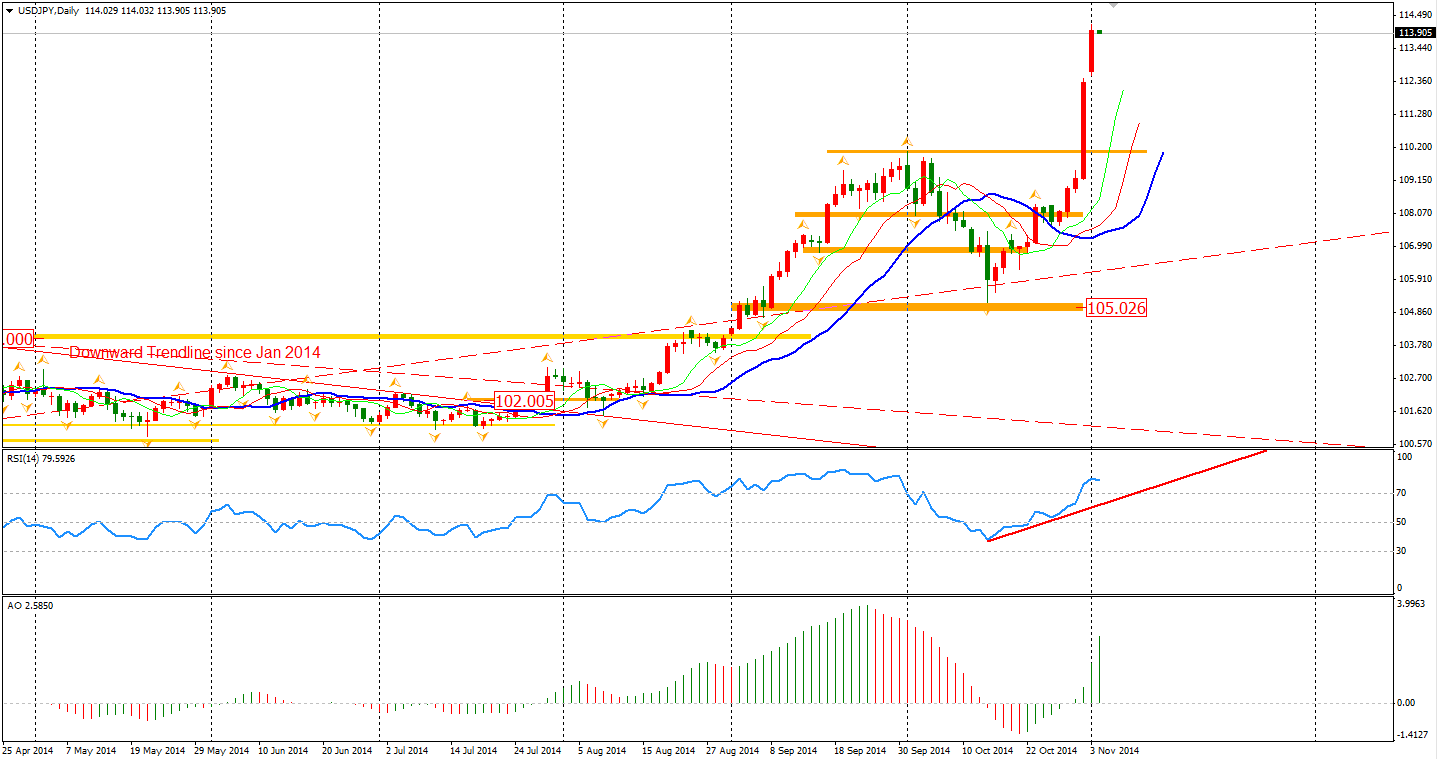

Unsurprisingly, USD/JPY keeps on rising now having reached the 104 level. The trading strategy of selling Yen seems to be quite simple and obvious as the BOJ had determined would provide further easing. Personally, I think the BOJ board may even add more bets in the future if the result of this round of QQE is dissatisfactory. The mid-to-long term target may be the 124-125 area which was the peak of 2007. Actually now, I can’t tell when this rally will stop in the short run.

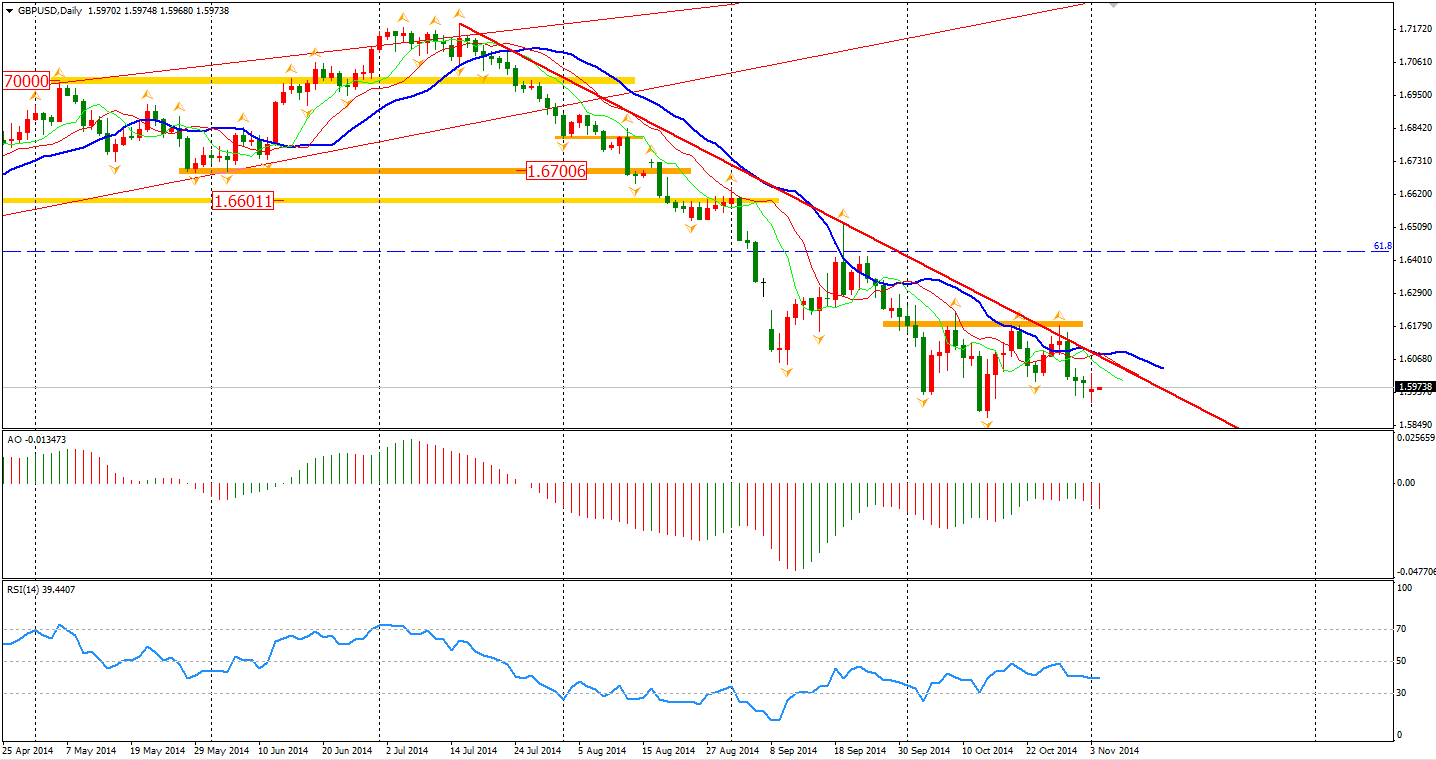

European currencies are relatively stronger and rebounding against the Dollar. The Sterling rose to 1.60 in response to the news that UK manufacturing growth unexpectedly accelerated to the fastest pace in three months in October. The reading increased to 53.2 as UK domestic demand was strong enough to offset the slowing exports to the Euro region.

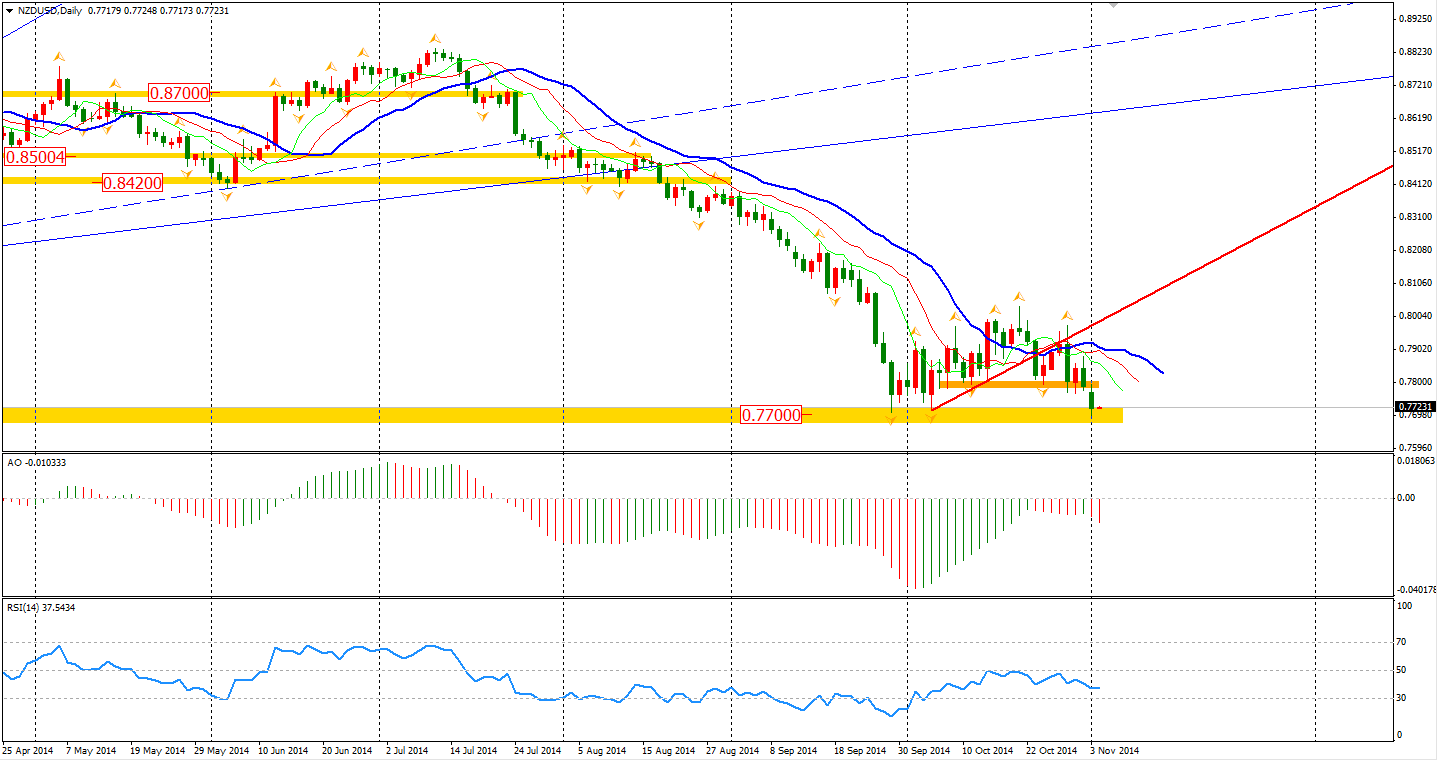

The commodity currencies fell on the concerns of China’s slowdown. The China official non-manufacturing PMI dropped to a 9-month low of 53.8. Along with the lower manufacturing PMI released last weekend, it shows the Chinese are still moving in a downward path, most likely affected by the depressed real estate market.

Watch out as it looks like the Kiwi Dollar seems ready to break the 0.77 support level.

The Asian stock markets showed little change. The Shanghai Composite rose 0.41% to 2430. ASX 200 lost 0.36% to 5507. In the European stock markets, the UK FTSE was down 0.89%, the German DAX edged down 0.81% and the French CAC 40 Index fell 0.92%. The US market fell after refreshing an all-time high. The S&P 500 closed flat at 2018. The Dow rose 0.14% to 17366, while the NASDAQ Index gained 0.18% to 4639.

It is a big day ahead for Australian traders before they can enjoy the Melbourne Cup. Retail Sales and Trade Balance will be released at 11:30 AEST and the RBA Rate Statement will be out at 14:30 AEST which is expected as no change on the rate. The US and Canada Trade Balance will be out at midnight.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Maintains Strength Prior To Data, Rate Decisions

Published 11/03/2014, 07:03 PM

Dollar Maintains Strength Prior To Data, Rate Decisions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.