April 30: Five things the markets are talking about

The week offers a plethora of new data along with monetary policy announcements from the Reserve Bank of Australia (RBA) later this evening and the Federal Open Market Committee (FOMC) on May 2. No policy changes are anticipated.

US trade policy will be markets focus this week with US Treasury Secretary Mnuchin visiting China for high-level trade talks.

In Europe, it’s a holiday shortened trading week, however, both the April manufacturing and composite PMI’s will be released along with quarterly growth data (May 2) from the eurozone and Italy.

Stateside, despite the Fed expected to keep rates unchanged, the market will be watching for any clues on Treasury yields and GDP. Apple Inc (NASDAQ:AAPL) dominates the week in earnings when it reports on Tuesday.

US personal spending is expected to have accelerated last month, while manufacturing may have expanded at a slower pace in April.

On Friday, the US will be posting the granddaddy of all economic indicators, its nonfarm payroll (NFP) report at 08:30 pm EDT.

1. Stocks in favor

Global equities have kicked off the week broadly higher as solid corporate earnings is boosting investor sentiment and as geopolitical worries ease.

Note: Liquidity has been low overnight due to its Golden Week in Japan, with public holidays Monday, Thursday and Friday. China is shut Monday and Tuesday.

Down-under, Aussie shares advanced to a seven-week high on Monday, led by broad based gains, with banks being the dominant contributor. The S&P/ASX 200 index rose +0.5% at the close of trade. The benchmark added +0.7% on Friday. In South Korea, the KOSPI jumped +0.9% and is set to end April more than +2.5% higher following record profits from tech giant Samsung (KS:005930) and after a spectacularly successful inter-Korean summit.

In Europe, regional indices are trading slightly higher across the board buoyed by a flurry of M&A deals. UK supermarkets are in focus after J Sainsbury PLC (LON:SBRY)’s and Asda agreeing to merge. Elsewhere, Germany’s Deutsche Telekom (DE:DTEGn) trades higher after T-Mobile) and Sprint Corp (NYSE:S) agreed to merge with Deutsche Telekom.

US stocks are set to open in the ‘black’ (+0.3%).

Indices: STOXX 600 +0.1% at 384.9, FTSE +0.4 at 7528, DAX +0.2% at 12605, CAC 40 +0.2% at 5491, IBEX 35 +0.4% at 9965, FTSE MIB +0.2% at 23982, SMI +0.4% at 8881, S&P 500 Futures +0.3%

2. Oil slips on rising US rig count, gold higher

Oil prices have eased a tad overnight after a rising rig count in the US pointed to higher production there. Nevertheless, markets trade within striking distance of recent highs on supply concerns amid prospects that the US could re-impose sanctions on Iran, while OPEC-led producers continue to withhold output.

Brent crude futures have dipped -50c, or -0.7% to +$74.14 a barrel. Prices climbed as high as +$75.47 last week, levels not seen since November 2014. US West Texas Intermediate (WTI) crude futures are at +$67.82 a barrel, down -28c, or about -0.4%, from Friday’s close.

According to Baker Hughes, US drillers added five oil rigs in the week to April 27, bringing the total count to +825, the highest level since March 2015.

Note: US President Trump has until May 12 to decide whether to restore the sanctions on Iran that were lifted after an agreement over its disputed nuclear program.

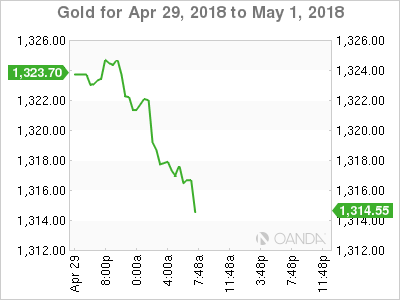

Gold prices have inched up ahead of the US open, as the mighty US dollar trades steady after it’s recent run of gains, weighed down by a decline in the benchmark US 10-year Treasury yield. Spot gold rose +0.1% to +$1,323.20 per ounce, while US gold futures for June delivery were up +0.1% at +$1,324.40 per ounce.

3. Sovereign yields back up

A softening in eurozone economic data and signs that inflationary pressures remain subdued, has been encouraging the European Central Bank (ECB) to hold off from raising interest rates until well into next year, and therefor supported the bond markets in recent weeks.

Despite this, EU Government bond yields have nudged a tad higher this morning as the markets focus turns to preliminary inflation data from Germany and Italy, two of the bloc’s biggest economies.

Note: Consumer prices in the German state of Saxony rose by +1.6% y/y in April, up from +1.5% in March.

Germany’s 10-year Bund yield is up almost +2 bps at +0.58%, above a one-week low of +0.56% print on Friday. In addition to inflation data, bond investors also waiting for this week’s US Fed meeting, although no major changes to monetary policy are expected.

Elsewhere, the yield on US 10-year Treasuries gained less than +1 bps to +2.96%, while the UK’s 10-year Gilt yield decreased -3 bps to +1.445%, hitting the lowest in more than a week with its fifth straight decline.

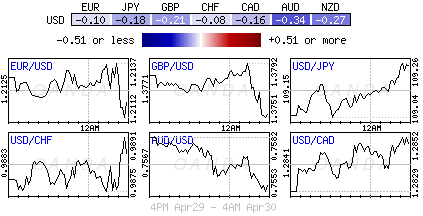

4. Dollar little changes amidst lack of geopolitical risks

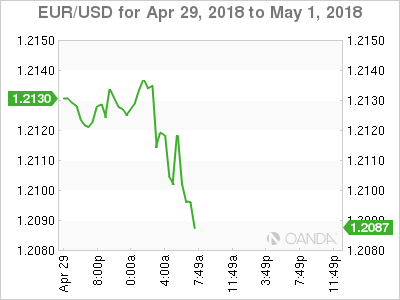

The dollar rose in the past couple of weeks because of the squeeze in short positioning and because of the US yield curve steepening, but the curve is flattening again, and so this should moderate the supportive momentum in the dollar. Smart money is expecting the currency to return on offer and remain under pressure on a multi-quarter basis.

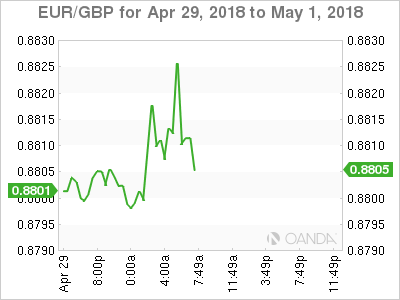

However, the USD is holding onto its recent gains as German inflation data (see below) highlighted the headwinds in reaching the ECB’s +2% target while political woes accompany recent soft UK data.

EUR/USD (€1.2107) continues to probe the lower end of the €1.21 level as the recent ECB cautious tone was reiterated in this morning’s German April CPI data.

GBP/USD (£1.3730) is a tad softer and trading atop of some key support levels after UK Home Secretary Rudd resigned over an immigration scandal. Recent sterling pressure has come from politics and soft economic data that suggest that the Bank of England (BoE) should not be in any hurry to hike rates any time soon.

5. Fall in German core inflation supports ECB’s cautious stance

Regional CPI data from German states for April published this morning suggest that German HICP inflation was unchanged at +1.5% as increases in energy and food prices were offset by a fall in the core-rate.

Analysts note that the decline in core inflation is not as worrying as it sounds – it reflects the fact that Easter fell earlier this year than last, meaning that average package holiday prices in particular were lower than last April. This effect is expected to be temporary.

Digging deeper, inflation in other core components (clothing and transportation) was broadly stable. However, with German wage growth finally edging higher, core inflation is expected to rise further in time.

Today’s data goes someway to justify the ECB’s latest decision not to make any major changes in its forward guidance for now.