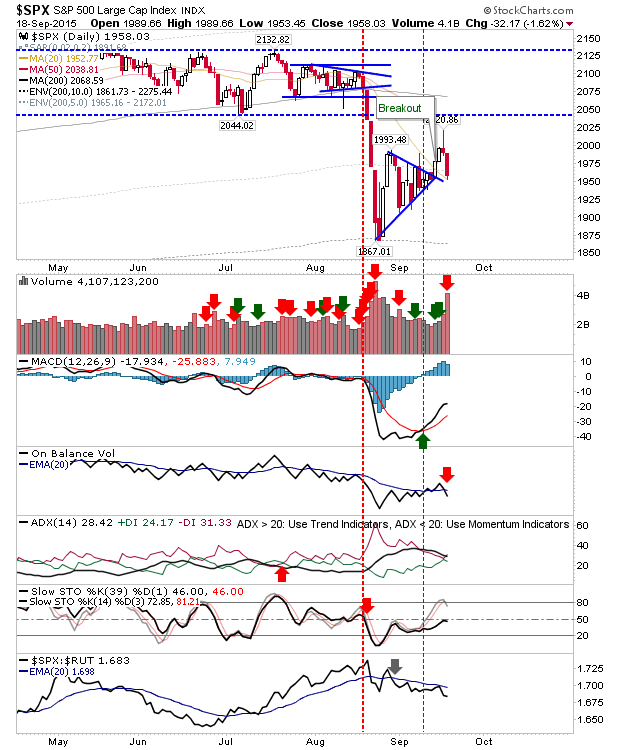

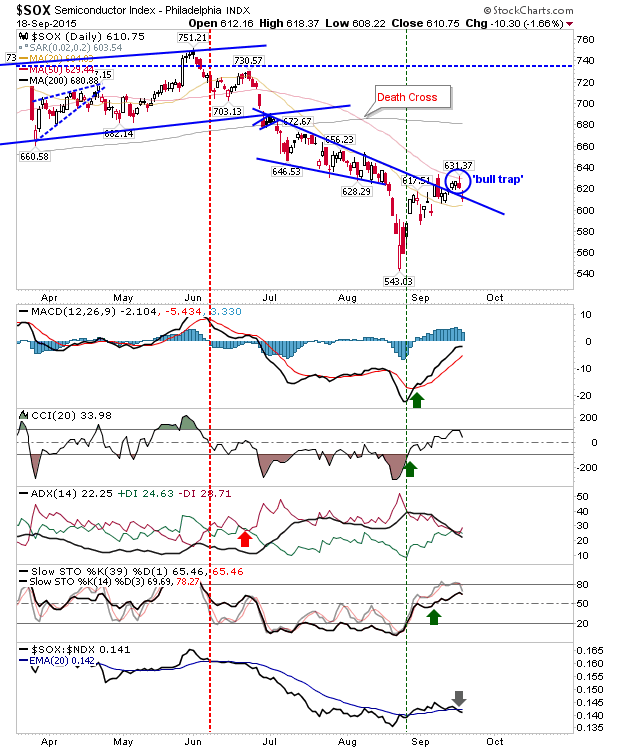

The Fed decision delivered the 'sell the news' action, while Friday followed through on this reversal. With earlier consolidation breakouts now fading to 'bull traps' the scene is set for further selling in the early part of next week. On the flip side, a retest of August lows could offer a nice long set up which could merge with a 'Santa Rally' later in the year. If bulls are to recover last week's breakout, they will need a good show of strength today.

Friday's distribution in the S&P was comparable to that delivered in August. The move came with a 'sell' trigger for On-Balance-Volume. But all of this is building on the relative underperformance of the S&P to the Russell 2000 dating back to the end of August.

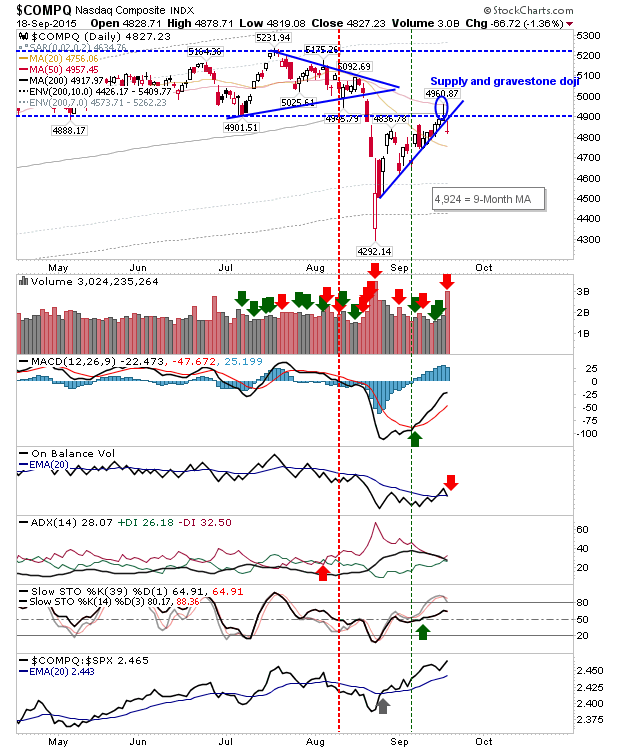

The NASDAQ delivered a picture perfect 'gravestone doji' on Thursday, tagging the 50-day MA, and closing below former support turned resistance of the early summer base. Momentum is hanging on to the bullish side of the fence, but if this dips below the mid-line there will be plenty of room to fall before it becomes oversold again.

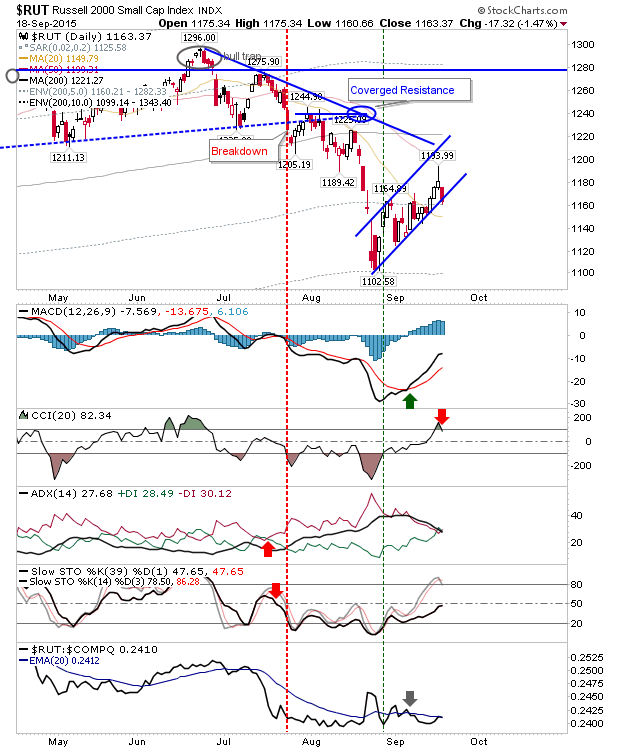

The Russell 2000 is hanging on to its 'bear flag' support. Because of this, it holds a relative strength advantage over both Tech and Large Caps indices, but if there is selling on Monday, which breaks this 'flag,' it could get ugly across all indices.

There is very little room to maneuver for bulls. If buyers are going to recover this they are going to have to do this off the open.

The Semiconductor Index is playing with a 'bull trap' which levered off the 50-day MA and is setting up for a retest of 543. This will further fuel pressure on the Tech indices. Bulls will look to the 20-day MA to act as support.

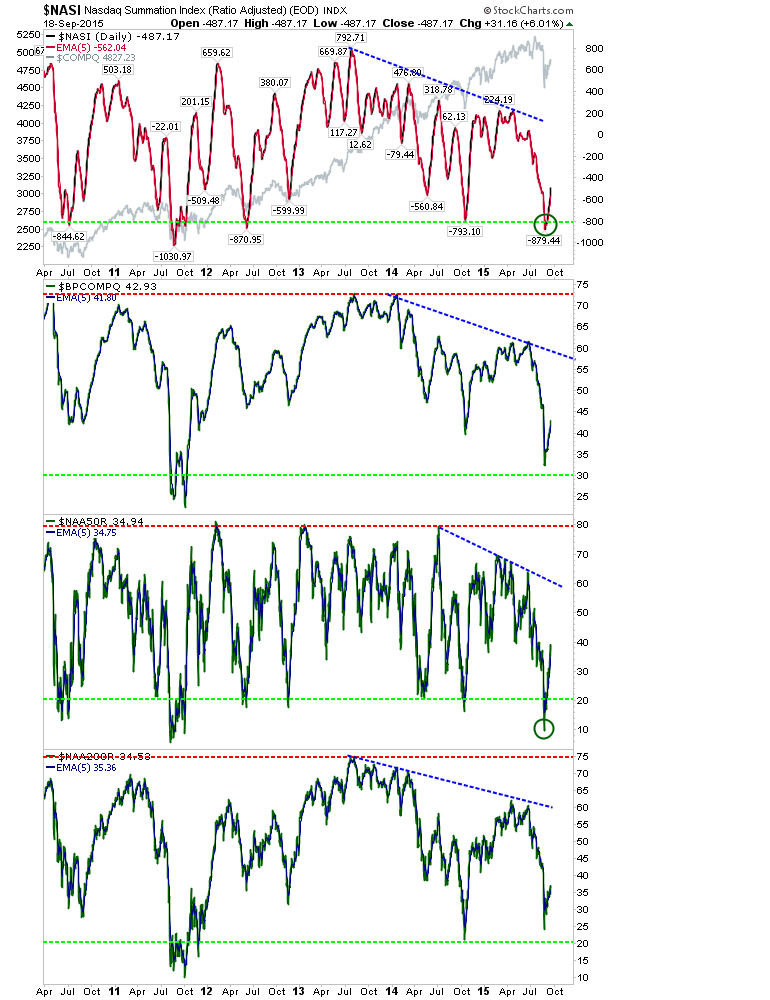

If there is a silver lining for bulls it comes from breadth metrics. In the case of the NASDAQ, there is enough of a case to suggest the bottom is in place and any weakness is a good long term buying opportunity. Buy-and-Holders take note.

For today, Monday, bulls will have to come out strong from the traps. If there is any doubt it will only erode confidence and keep bulls on the sidelines until markets get close to August lows.

Bears have the easier path, but watch for short, sharp covering rallies. Bullish rallies will offer measured gains inter-spaced with sideways phases, but covering rallies will offer lots of consecutive green candles with little pause in the move.