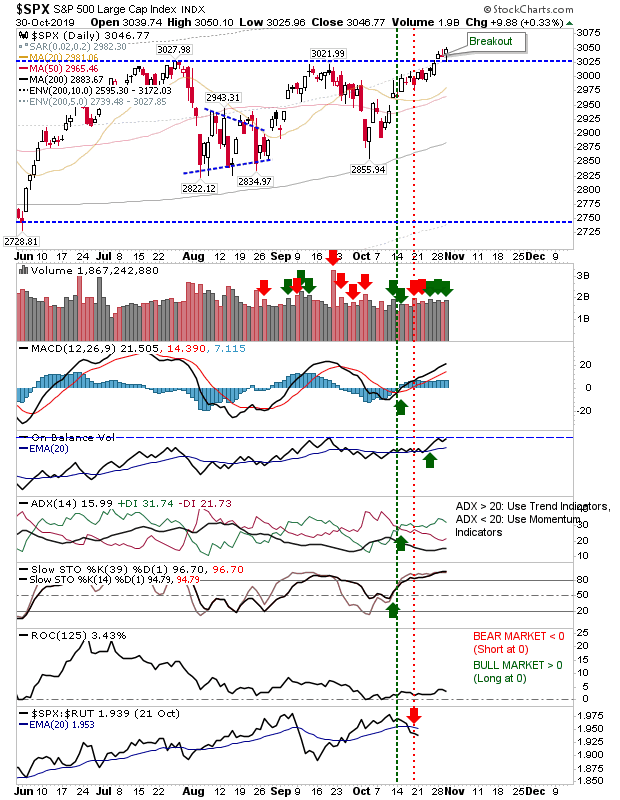

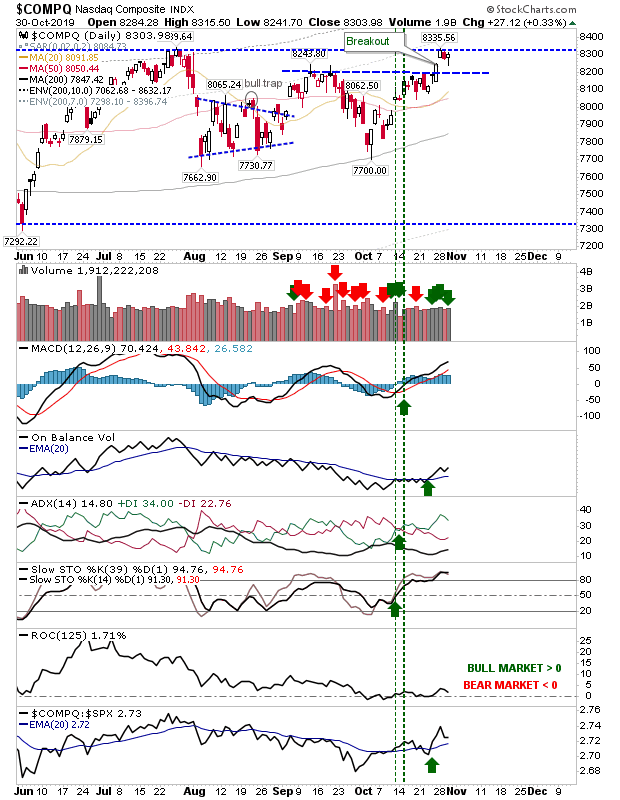

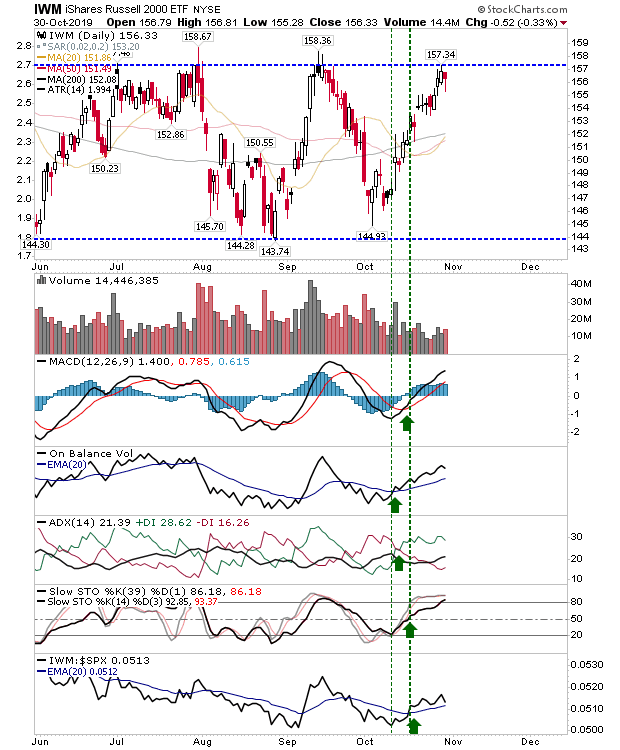

Sellers tried to reverse the breakouts in the indices yesterday, but were instead undone by higher volume buying. Indices which had broken out remained above resistance, while those still waiting remain well placed to do so.

The S&P tagged breakout support on higher volume accumulation. There has yet to be a supporting breakout in On-Balance-Volume to match the breakout in price but volume rose in accumulation.

The NASDAQ also closed with a bullish hammer just below resistance—registering as an accumulation day too. A breakout is likely by end of week.

The Russell 2000 (via iShares Russell 2000 (NYSE:IWM)) is also waiting to break, although its advance to resistance is even sharper and will likely need a few days going sideways before it can push beyond overhead resistance.

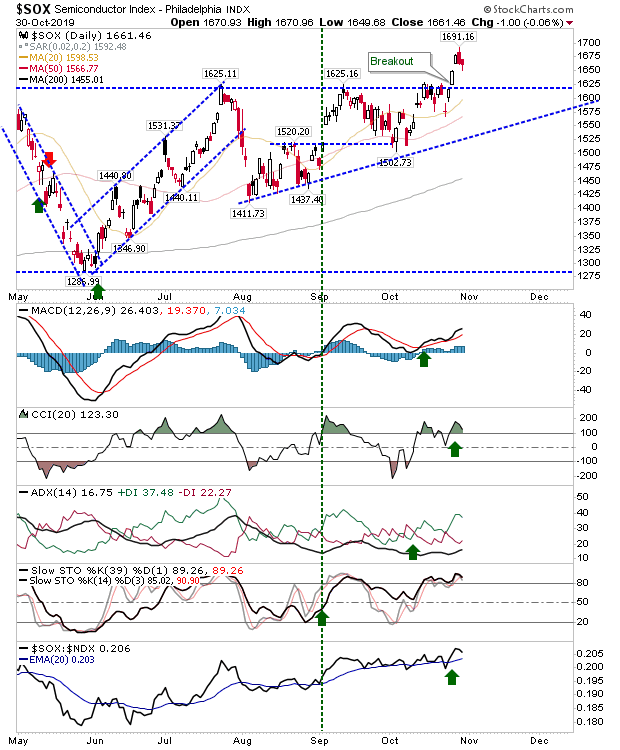

The Semiconductor Index took a small loss, but is well above breakout support for this not to matter.

For today, Thursday, traders will be looking to the NASDAQ to benefit from the breakout in the Semiconductor Index by mastering one of its own. The Russell 2000 may follow suit, but I suspect it will need to consolidate the gains it has managed already before breaking to new all-time highs.