After Hurricane Irma exited following a lesser-than-estimated impact and North Korea stayed away from any further nuclear missile test, the Wall Street got back its shine.

Furthermore, Apple’s (NASDAQ:AAPL) annual consumer-products event held on Sep 12 is expected to revive investor appetite in the technology space. In fact, the record-high closings of the Dow, S&P 500 and Nasdaq indices on Sep 11 are indicative of the fact that the U.S. equity markets have been performing really well for quite some time now.

Republican Brunt on MedTech Space

While the overall investment world has been gaining prominence, investors in the MedTech industry are unfortunately seeing a reverse trend. This is largely because of the healthcare policy related debacle that had started since the change of President.

After a series of regulatory debacles, the Republicans’ agenda to exterminate the Obamacare failed miserably. Stocks tumbled and things got riskier when the “skinny" repeal bill to partially retract Obamacare fell flat as well.

In this regard, let’s not forget the tax-reform pledges that President Trump had taken to abolish the infamous 2.3% medical device sales tax. Although investor confidence trends up with the hope of ‘enactment of new tax reforms’, we believe the market has not got a whiff of it due to the lack of favorable developments in the regulatory front.

Dental Grapples With Political Issues

Amid such a political conundrum in the MedTech space, the condition of the U.S. dental industry has been getting worse as well. However, this sector has had a stellar performance on the bourse over the last five years, gaining 94.7%, outperforming the S&P 500’s return of just 73%.

Apart from the major political issues that have affected consumer spending in the dental space, there are issues like ease of entrance of dental suppliers, abundance of substitutes, monopoly of suppliers, strict consumer sovereignty and intra-industry rivalry which have been impeding the industry’s growth for quite some time now.

Also, aggressive reimbursement policy adopted by the government and insurers has made it difficult for medical companies to market their products due to increased scrutiny. A notable exception to this trend has been stocks concerning dentistry, since consumers pay a higher percentage of costs in this particular industry. Undoubtedly, dental stocks have been facing the regulatory brunt.

Accordingly, the scenario of the industry is gradually deteriorating and over the last three years, it has just gained 20.6%, much lower than the S&P 500’s return of almost 25%. Furthermore, a discouraging broader industry rank (among Bottom 31% of more than 250 industries) indicates looming concerns for the dental space. We also note that this industry’s projected earnings per share growth rate is 8.7%, lower than the S&P 500’s 9.8%.

5 Dental Stocks to Bet On

Owing to the adversities, market watchers have adopted a bearish stance toward the dental space. However, these are the only five dental stocks that are expected to beat the ongoing MedTech gloom. Apart from a strong Zacks Rank #1 (Strong Buy) or 2 (Buy), these stocks have a favorable estimate revision trend.

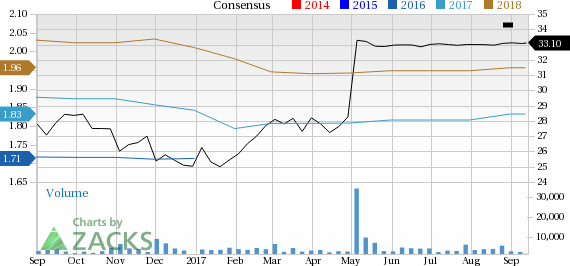

VWR Corporation (NASDAQ:VWR) : This Zacks Rank #2 company is an independent worldwide provider of products, services and solutions to laboratory and production facilities. VWR is currently looking forward to long-term synergy benefits from the proposed merger with Avantor. Based on a series of initiatives taken of late, VWR has showed balanced growth in the Americas and EMEA-APAC organically.

Avantor's buyout of VWR is expected to create a major consumables-focused solutions and services provider for the high-growth life sciences and advanced technologies industries. The acquisition will build on the company's strengths, including Avantor's cGMP manufacturing processes, significant exposure to emerging markets and VWR's strong position in the Americas and Europe.

Meanwhile, the company’s recent earnings estimates have been promising. The current year has seen two estimates go higher in the past 60 days, while one next-year estimate moved up in the same time period. This had a nominal impact on the consensus estimate though as both the current and next year consensus estimates have risen 0.5% in the past two months.

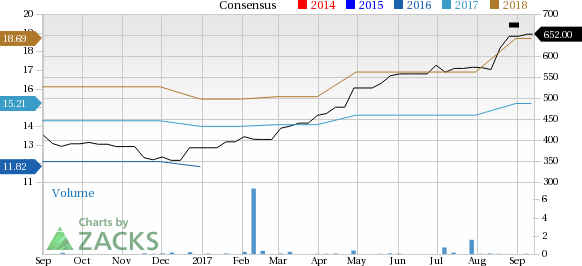

VWR Corporation Price and Consensus

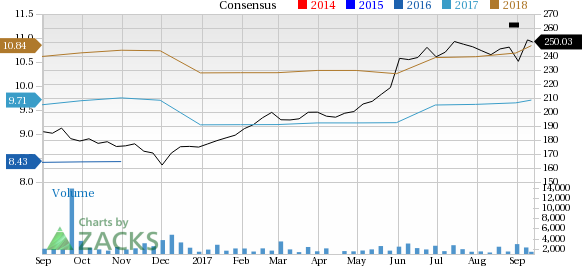

The Cooper Companies Inc. (NYSE:COO) ): This Zacks Rank #2 company is a specialty medical device manufacturer operating on a global basis. Cooper Companies is poised to gain from an expanding product portfolio and increasing penetration in international markets. Accretive acquisitions are also key catalysts for the long haul. You can see the complete list of today’s Zacks #1 Rank stocks here

The company recently signed an asset-purchase agreement to acquire the flagship contraception platform of Israel-based Teva Pharmaceutical Industries (NYSE:TEVA) — PARAGARD Intrauterine Device. This $1.1-billion cash transaction will bolster the company’s CooperSurgical business segment in the contraceptive device market. Furthermore, the outlook for the contact lens industry is favorable, which is likely to boost the stock over the long haul.

Meanwhile, the company’s recent earnings estimate revision has been favorable. Both the current year and next year have seen two estimates go higher in the past 60 days, compared to no movement in the opposite direction. Current-year estimates increased 0.9%, while next-year consensus estimate has risen 1.4% in the past two months.

Cooper Companies, Inc. (The) Price and Consensus

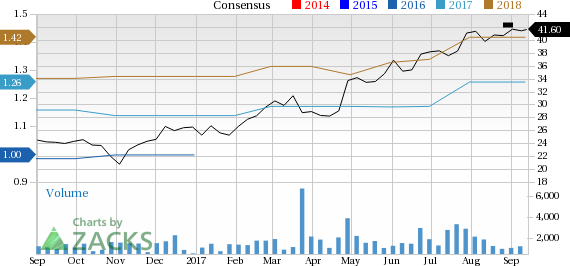

Merit Medical Systems, Inc. (NASDAQ:MMSI) ): This Zacks Rank #1 stock produces single-use medical products of high quality and superior. Merit Medical Systems forecasts top-line growth of approximately 8% for fiscal 2018 and 2019.

The company expects to gain from recent introduction of products for research and development functions and the integration of merger and acquisition activities that have been completed so far this year. Per management, the acquisition of Argon, changes in sales force structure and compensation are likely to bolster footprint.

Meanwhile, the company’s recent earnings estimate revision has been encouraging. Both the current year and next year have seen four estimates go higher in the past 60 days, compared to no movement in the opposite direction. This has had a promising impact on the consensus estimate as the current year estimates increased 7.7%, while the next year consensus estimate have risen by 6% in the past two months.

Merit Medical Systems, Inc. Price and Consensus

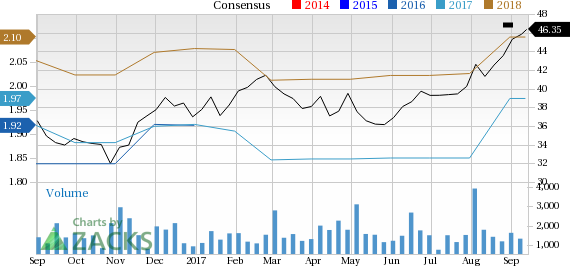

Halyard Health, Inc. (NYSE:HYH) ): This Zacks Rank #2 company is focused on advancing health and healthcare by preventing infection, eliminating pain and speeding recovery. The company’s broad product spectrum is the key catalyst at the moment.

The company continues to focus on growth through strategic M&A, new product development, expansion into new markets, and better leveraging our businesses to generate more synergies, and increase productivity. In fact, the company has recently launched COOLIEF direct-to-patient marketing campaign for the treatment of patients with osteoarthritic knee pain. Per management, response at the platform has been strong till now and it represents an exciting market development opportunity ahead.

Meanwhile, the company’s recent earnings estimates have been favorable. Both the current and next year have seen five estimates go higher in the past 60 days, compared to no movement in the opposite direction. This has had a promising impact on the consensus estimate as current-year estimates increased 6.5%, while next-year consensus estimate inched up 0.1% in the past two months.

Halyard Health, Inc. Price and Consensus

Straumann Holding AG SAUHF): This Zacks Rank #1 stock is a global leader in implant and restorative dentistry and oral tissue regeneration.

In collaboration with leading clinics, research institutes and universities, Straumann researches, develops and manufactures dental implants, instruments, prosthetics and tissue regeneration products for use in tooth replacement and restoration solutions or to prevent tooth loss.

The stock has a long-term expected earnings growth rate of 15%.

Straumann Holding AG Price and Consensus

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Apple Inc. (AAPL): Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI): Free Stock Analysis Report

Cooper Companies, Inc. (The) (COO): Free Stock Analysis Report

Straumann Holding AG (SAUHF): Free Stock Analysis Report

Halyard Health, Inc. (HYH): Free Stock Analysis Report

VWR Corporation (VWR): Free Stock Analysis Report

Original post