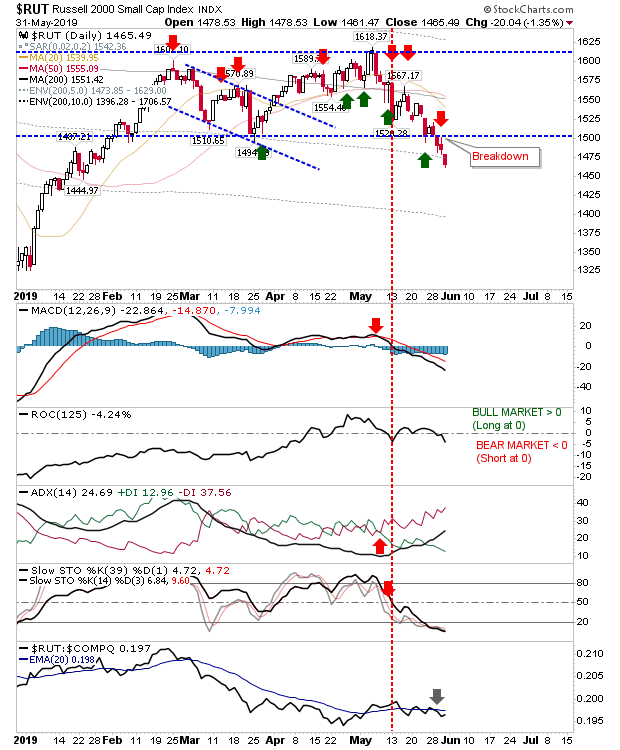

Friday was yet another day bears maintained control of markets with the Russell 2000 again leading markets lower.

The Russell 2000 is looking at swing low support of January 2019 after breaking below horizontal support. Converged moving averages (20-day, 50-day and 200-day MA) are now major resistance but markets would be a a month or two away from this test even if there was a rally now.

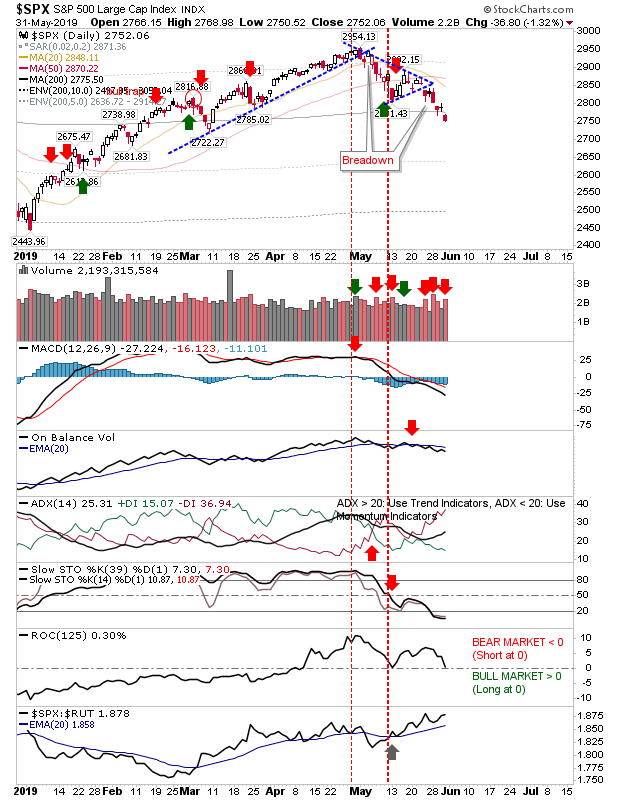

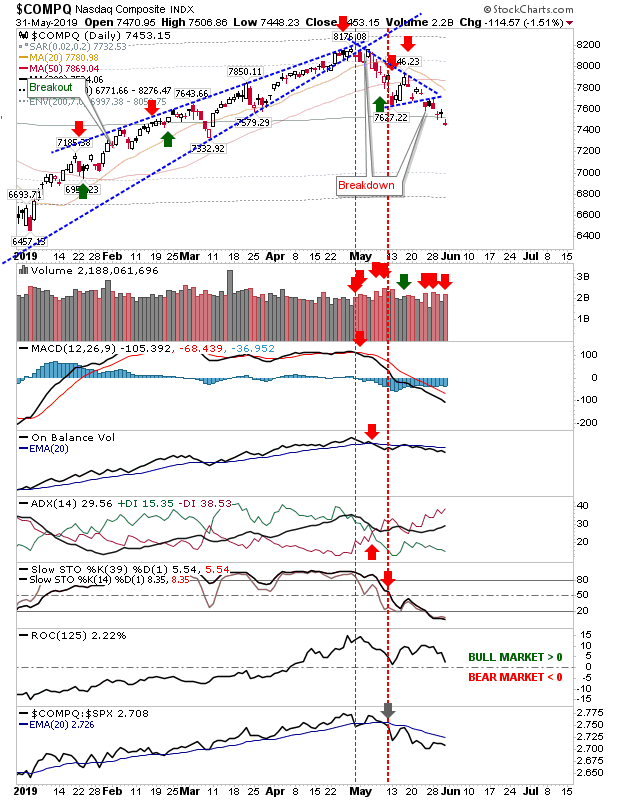

The S&P and NASDAQ each undercut their 200-day MAs on higher volume distribution. March swing lows are the next stop down but these are only minor swing lows. The January swing low is of greater significance.

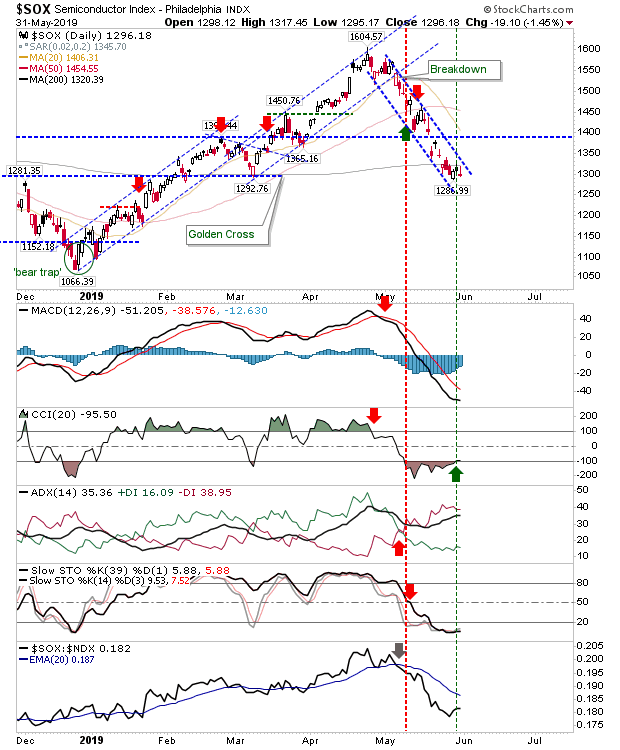

The Semiconductor Index, while it suffered a loss, hasn't broken away far enough from its 200-day MA to suggest bulls can't yet mount a 'bull trap' defense. Technicals are not surprisingly bearish but are oversold. While price action has maintained an orderly decline inside a narrow price channel it does still remain vulnerable to a crash-style collapse

For today, the question for some will be whether Trump will continue with his tariff war or if reason will prevail. Markets don't like uncertainty but I suspect the Trump factor has long since been priced in, leaving the current decline likely one more thing tied to negative-feedback generated profit-taking instead of one driven by Trumps' actions.