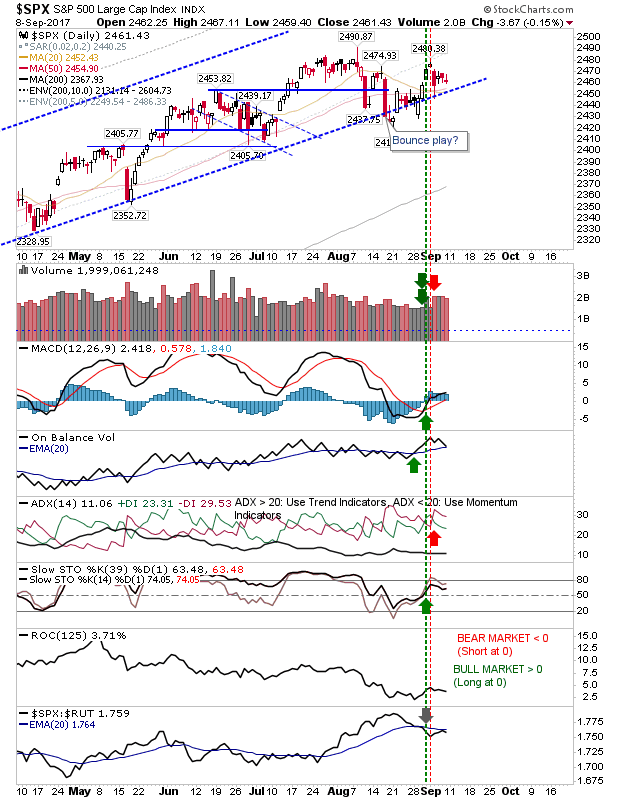

The coiling S&P 500 setup from last week unwound itself with a move lower; whether markets have blinked and are ready for further losses or if this is just some 'bear trap' remains to be seen. The key test will be whether support from long established rising price channels will hold if such losses continue.

The S&P only posted a small loss and some may consider Friday's action a shift in the coil position (use the 2-day high/low to define the trade and stop). However, the rising channel is very close and is in close proximity to the 20-day and 50-day MA.

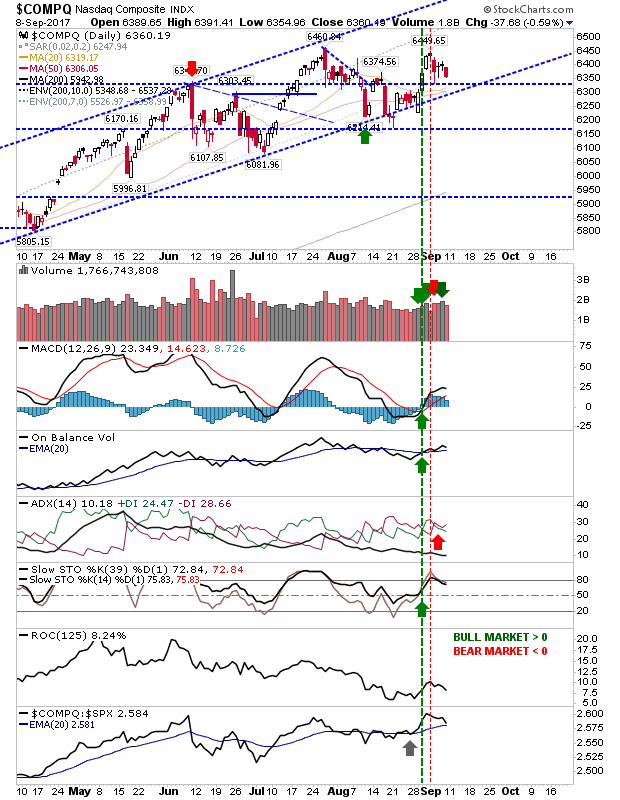

The NASDAQ experienced a bigger losses than the S&P but has a greater number of support levels to work with; horizontal and channel support along with converged 20-day and 50-day MAs. One key difference to the S&P is the relative outperformance of Tech stocks to Large Caps. If buyers are to enjoy a boost then the NASDAQ may benefit ahead of the S&P.

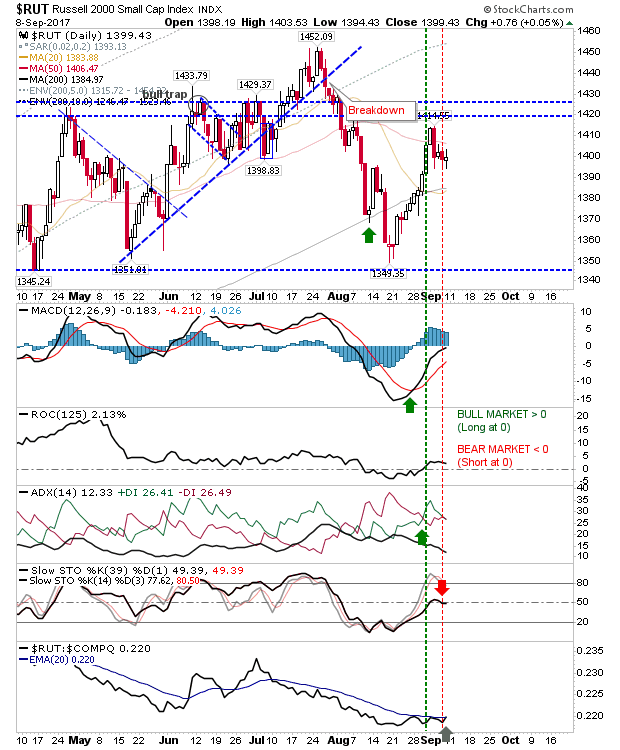

The Russell 2000 is trading inside the prior range. After failing to follow through on the break below the 200-day MA it's now building demand around its 50-day MA. I like the relative performance of this index; it's caught inside a range and below moving averages which will keep it away from technical scans and the interest of most momentum/short term traders. There may be one surprise in the bag - a duck-down-and-bounce off the 200-day MA would be ideal. This is one to watch.

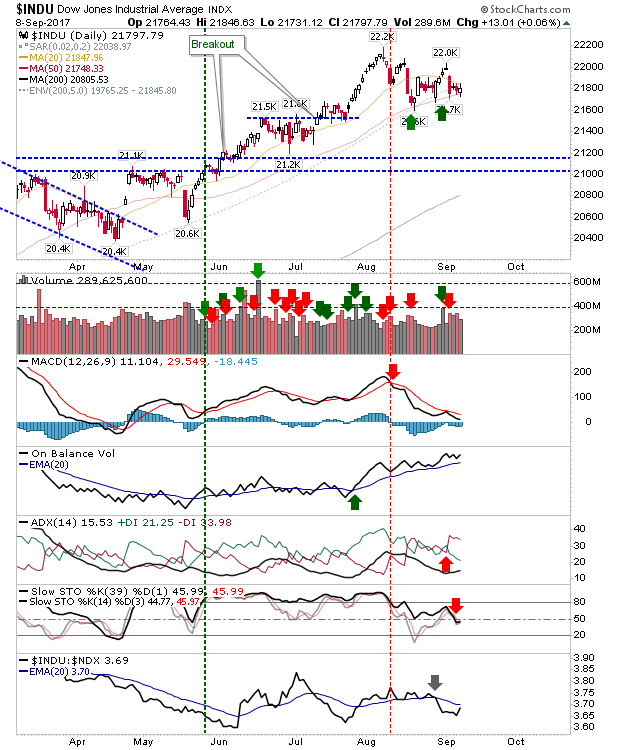

Another index looking ready to crack is the Dow. Two prior tests of the 200-day MA failed to ignite a bounce and Friday's third such test may be the one to break the camel's back. Supporting technicals are weak and the index is exhibiting the weakest relative performance. Downside target is the 200-day MA.

For today, shorts should probably focus on the Dow, longs could perhaps fish GTC buy orders around the 200-day MA in the Russell 2000 in addition to playing a break above the 50-day MA.