Investing.com’s stocks of the week

So far, the selloff has been relatively orderly with a mix of accumulation and distribution. Barring initial breakdowns from acute channels, there hasn't been any acceleration in the downward moves.

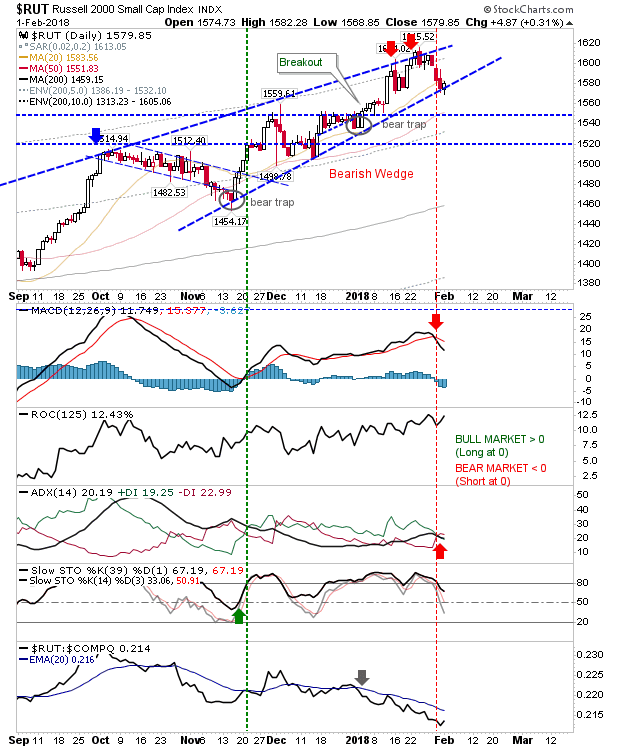

The first index to offer itself as a bounce opportunity is the Russell 2000. Thursday's slightly higher close left the index bang on wedge support anchored by the November and January 'bear traps'. Technicals are weak but aside from the relative performance there hasn't yet been a net bearish shift so there is still a chance buyers could step in and attract fresh buying.

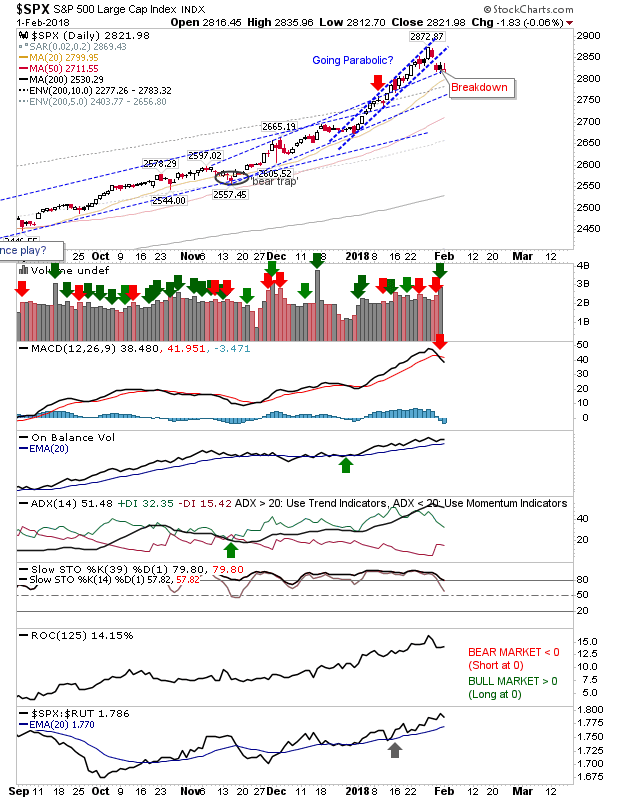

The S&P is also trading at support but it's a more tentative level so the chance for a bounce may not be as strong as for the Russell 2000. There is a 'sell' trigger for the MACD but other technicals are in good shape which will help.

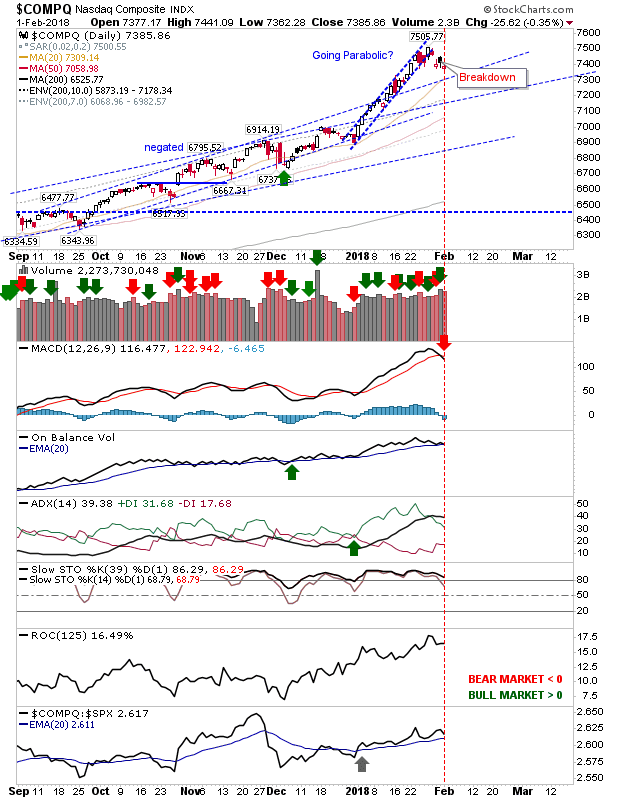

The NASDAQ still hasn't reached a support level and has a MACD trigger 'sell' to contend with. Relative performance has been respectable so if one was to look for a momentum play then this would be it.

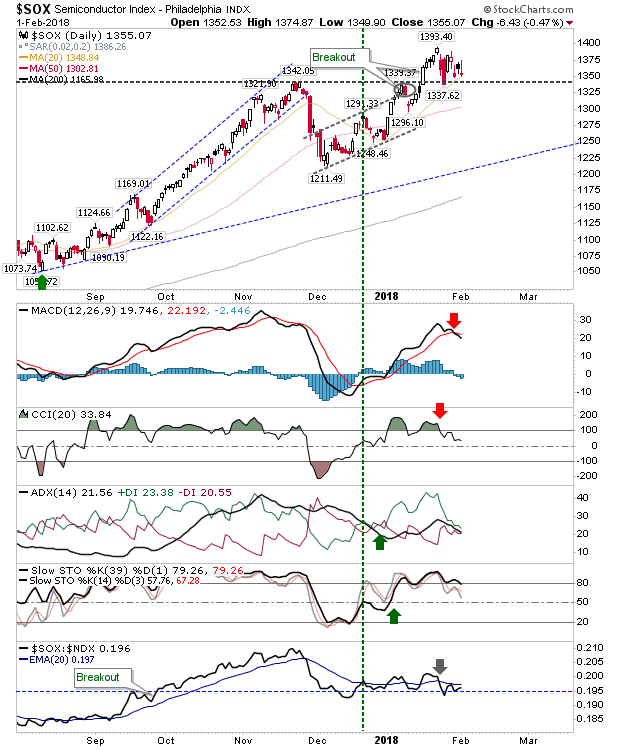

The other index which is shaping up nicely is the Semiconductor Index. The breakout is holding and while there is a 'sell' trigger in the MACD and CCI there is a lack of conviction to push the index below 1,340.

For Friday, watch the Russell 2000 for a bounce off support and perhaps the Semiconductor Index for a longer term play. Short term momentum holders can focus on the NASDAQ which has been doing most of the leg work.