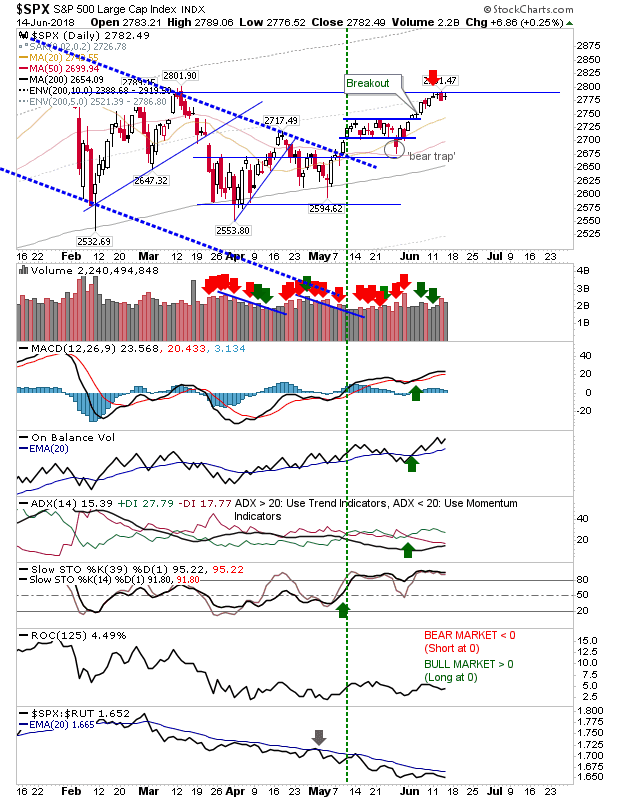

Bulls have done a good job of clawing back the losses generated by the individual days of selling which have peppered the market since April's lows.

The S&P 500 had reversed from the point of the March high in what looked to be a good shorting opportunity but the lack of follow-through leaves this play vulnerable to a swift exit. A short-stop at 2,792 is the best protective play but further highs are looking more likely.

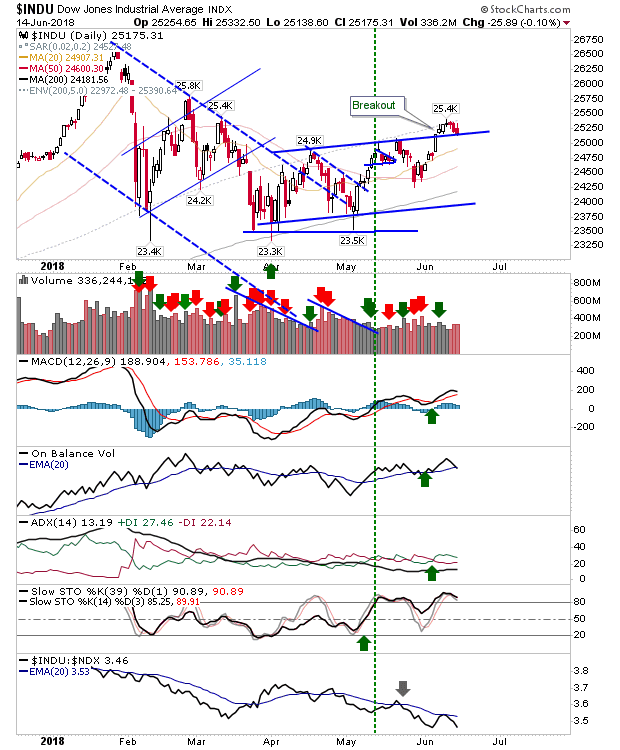

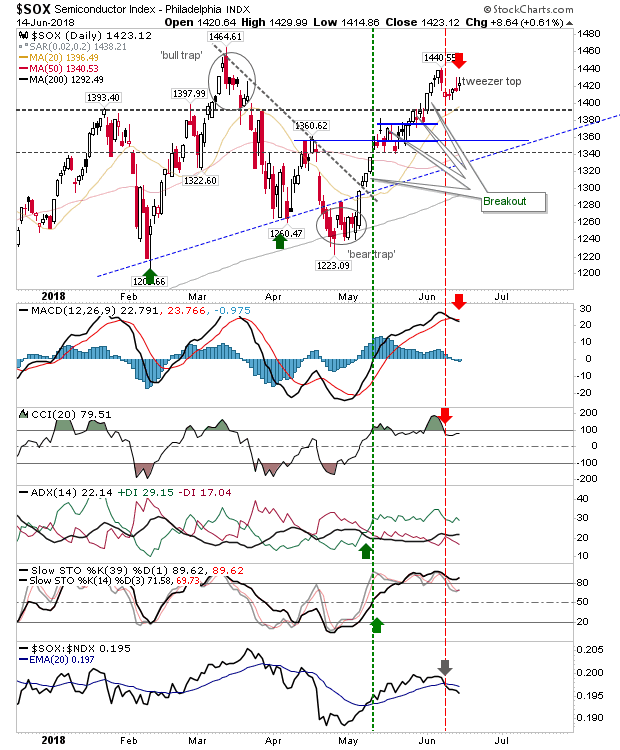

The two indices which have the most to offer are the Dow and the Semiconductor Index.

The Dow Jones is a play for Longs. It has tagged breakout support and now offers a chance for pullback buyers to take a long position. Further losses will open up a shorting opportunity and a potential 'bull trap' but another day of losses is needed for this.

The Semiconductor Index has the potential to head in the other direction. There is a mini-tweezer top just below the recent swing high in what could be a potential double top. Adding to the potential bearish tone are sell 'triggers' for the MACD and CCI. The main argument against the short play is the overall bullishness of the market as a whole. This is an against the tide play.

There wasn't a whole lot to report for other indices. Holding on to existing long plays is perhaps the best course of action if not looking at either of the aforementioned opportunities.