I received a fair amount of feedback to my post last week, A consideration of the bear case. While an intermediate term top is not my base case scenario, it is a possibility that we have to consider. Subsequent to that post, I am revising down the probability of a bearish outcome for stocks in 2015.

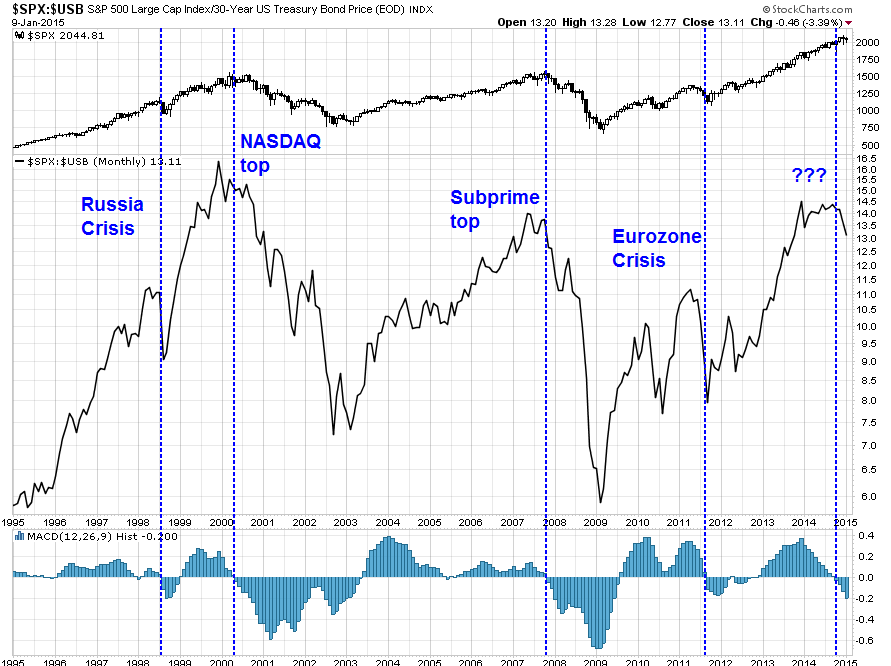

First, let me recap that post. I showed this chart indicating the loss of positive momentum in risky assets, which suggested that most past episodes of momentum rollover have seen bear phases in the stock market.

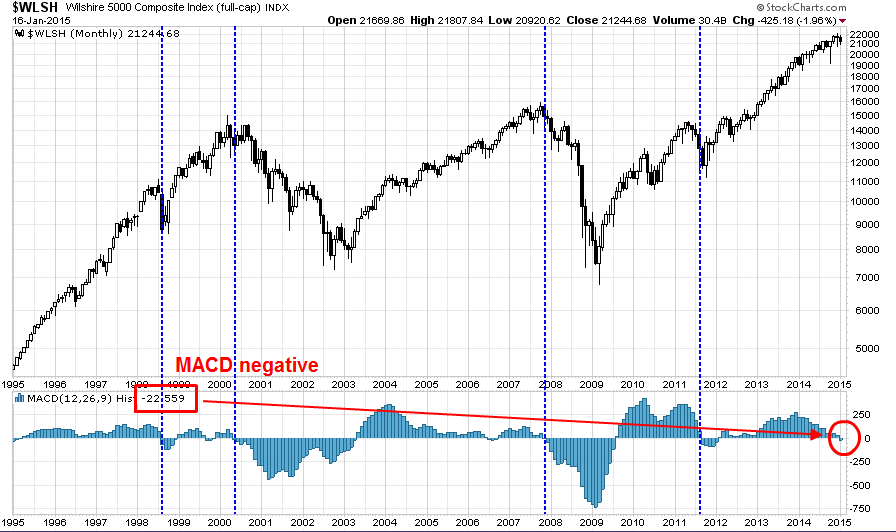

I further showed a similar chart of the Wilshire 5000, which has deteriorated since that post was written:

Recency bias in analysis?

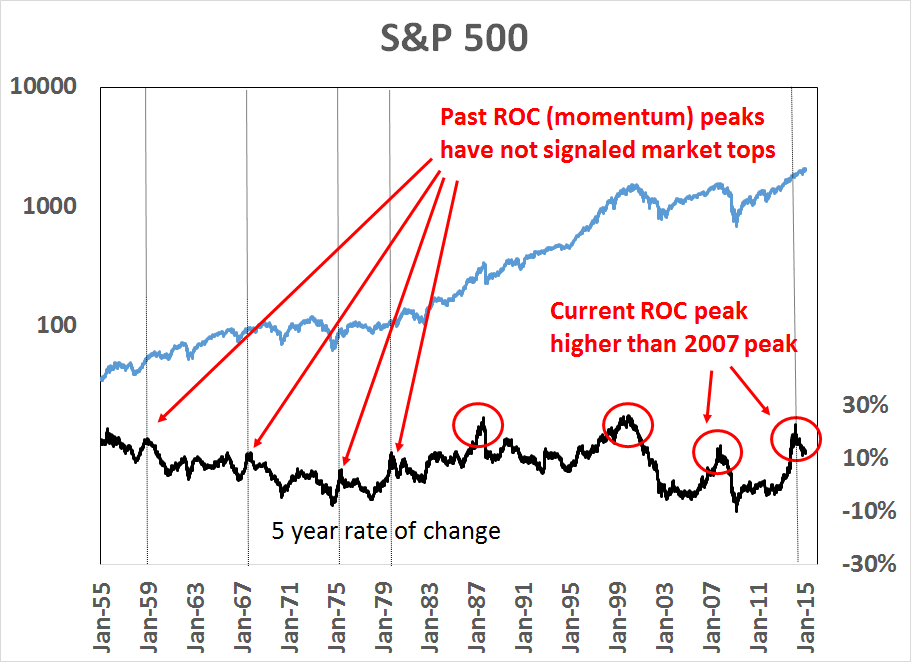

One criticism that I received was that I wasn't looking back far enough in my history. While the last 20 years are interesting, past instances of momentum rollover have not necessarily resulted in bear markets. The chart below depicts the SPXand its rolling 5-year rate of change. While the current ROC peak is higher than the 2007 peak and similar in magnitude to the NASDAQ peak, momentum peaks during the 1955-1980 period have not necessarily resulted in bear markets.

No valuation support

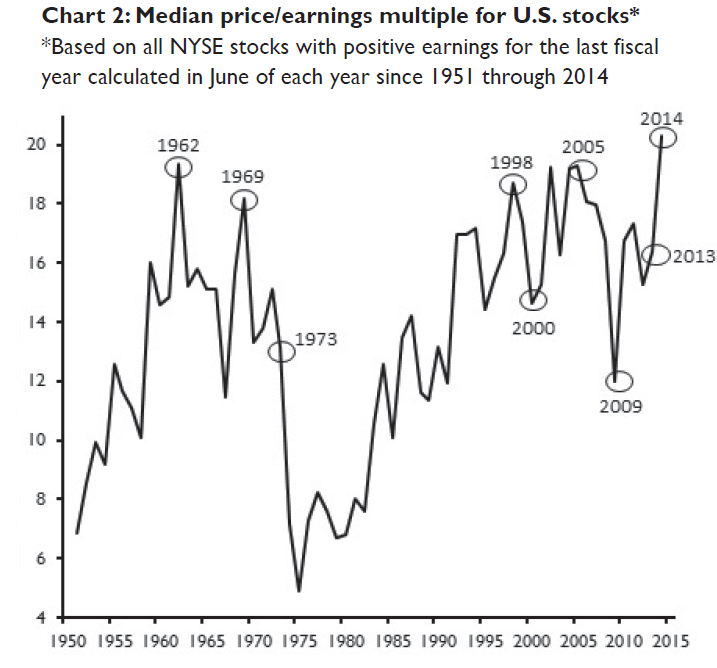

I further argued that valuations are highly stretched. Paulsen at Wells Fargo Capital Management showed that median PEs are very high by historical standards.

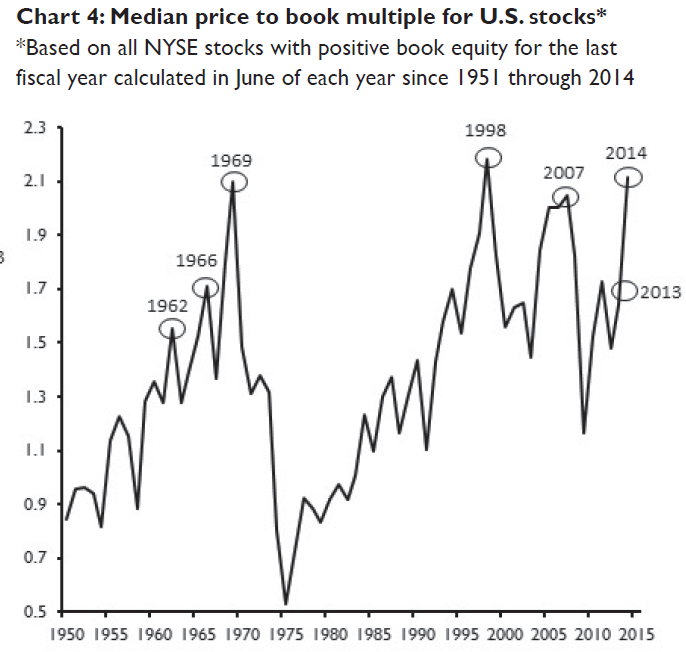

...and so are median PB ratios:

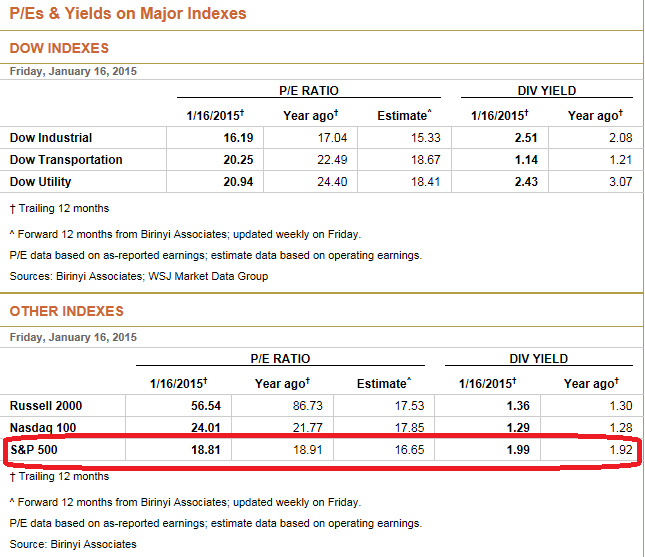

I would agree. The WSJ shows that the SPX is trading at 18.8x trailing and 16.7x forward earnings. The market is not cheap.

Earnings growth is the key to the market

If past momentum peaks do not necessarily indicate market tops, but valuations are rich, what should investors think?

The current environment suggests that EPS growth is the key to the market. As the Fed prepares to raise interest rates this year, don't expect gains from multiple expansion in 2015. Instead, we may see some multiple contraction.

In the past, the Fed has only started to raise rates when it believed that the economy was growing fast enough to withstand the withdrawal of monetary stimulus. Such episodes have been associated with economic growth, which has pushed EPS to greater levels. In short, we need to see earnings growth for this stock market to go up.

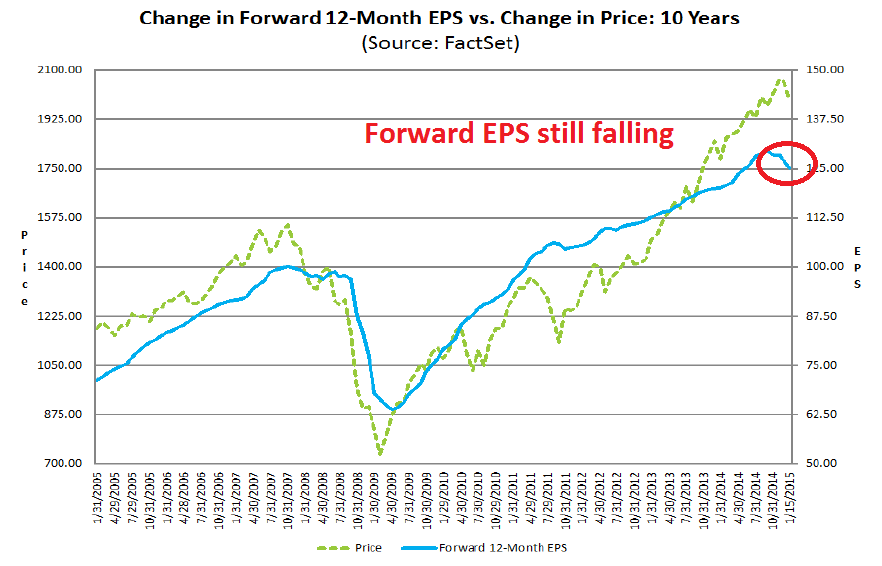

In my last post (see The global deflationary storm is abating), I voiced my concerns about this chart from John Butters of Factset. Forward EPS are still falling and past episodes of falling forward EPS have also seen either corrections or bear markets.

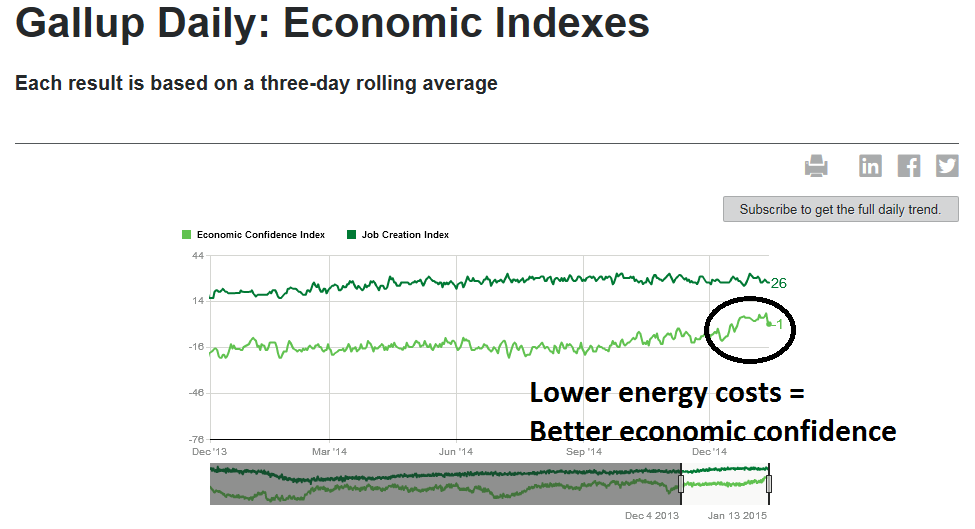

Nevertheless, I remain optimistic. The American consumer is poised to come back strongly. The Gallup survey of economic confidence saw a surge in December, just as oil prices fell.

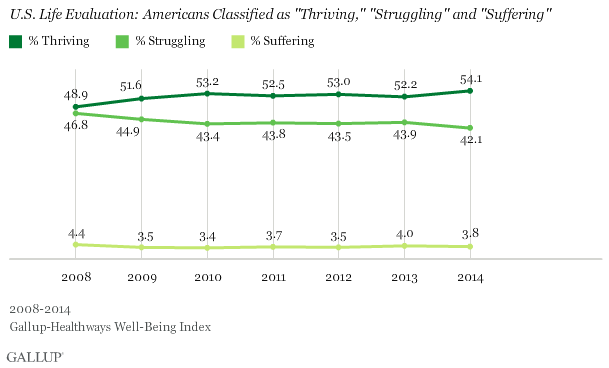

In addition, a Gallup survey of life confidence showed that the personal life outlook of Americans is improving.

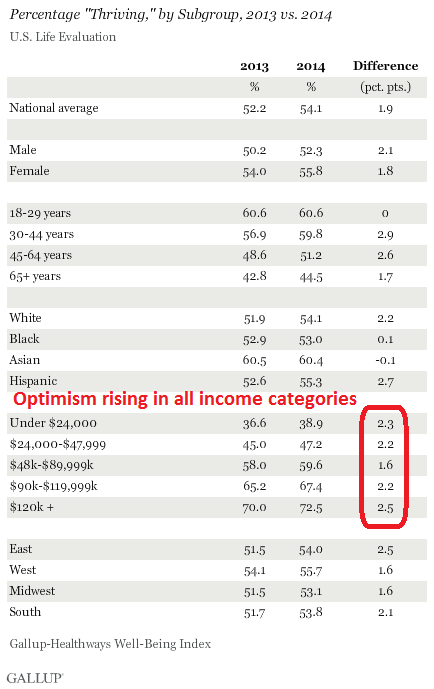

More importantly, the uptick is occurring across the board in all income categories.

So far, the view on the ground from Earnings Season paints an upbeat view of the American consumer. Here is an excerpt from Scott Krisiloff's summary of the corporate earnings calls:

The big question on everyone’s mind is: how does the oil price drop affect business?

The consensus is that it’s a net positive for the consumer

“America as a whole is a net consumer of energy and American households will benefit from the decline in energy prices, which is positive for the U.S. economy.” ($WFC)

“From any indication that we see it’s a positive experience for the American tax payer, for the American economy.” ($CSX)

“Overall, oil is a reasonable positive for the economy and consumer” ($JPM)

Bank of America is already seeing a benefit from lower oil prices in its credit card data

“in the consumer spending in January on debit and credit cards basically…even the first week or so January we’re seeing the benefit of the consumer very historically when the year-over-year compares” ($BAC)

So far growth is only 3% though, a step down from where it was

“So far January of 2013 versus January of 2014, spending on credit debit cards of about 3% year-over-year and that’s overcoming a drag effect of about percentage and a half from lower fuel prices.” ($BAC)

Wells Fargo is still optimistic on the economy

“when I look at the businesses that we’re in and as I am talking with customers…and frankly looking at the numbers..I am optimistic…I don’t think this is a breakout, but I think we’re on the front foot and consumer’s confidence is at a all time high since the downturn. So the way I read the tea leaves, I’m optimistic.” ($WFC)

CSX maintains a positive view of the economy too

“Looking forward, we expect a positive demand environment in the first quarter with stable to favorable conditions for 96% of our markets and unfavorable conditions for the remaining 4%.’ ($CSX)

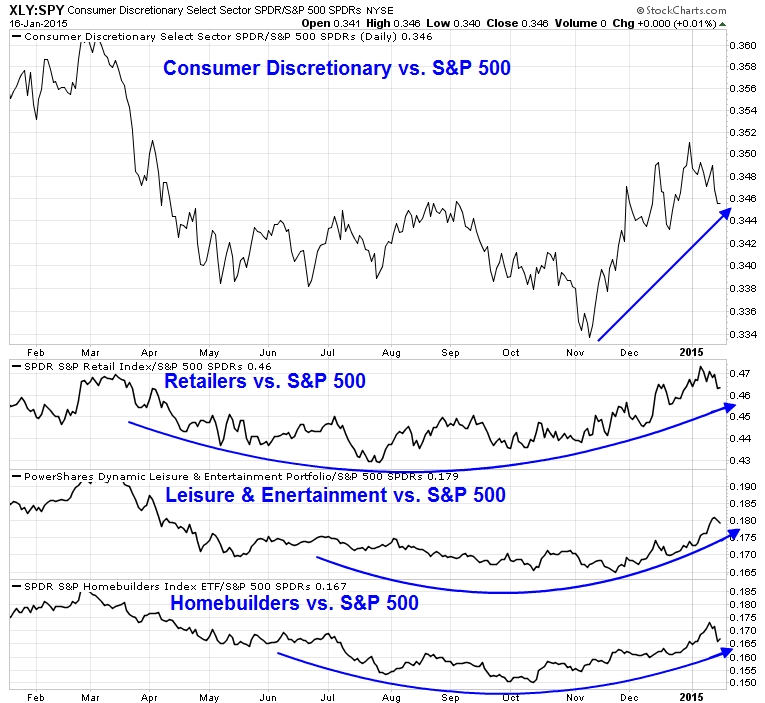

Unless oil prices turn around and head back to over $100, these circumstances should lead to better consumer spending and a pickup in employment. I also showed this chart of the relative performance of consumer spending sensitive sectors in yesterday`s post, which indicated that the market is expecting a consumer-led turnaround. Recessions do not start when the American consumer is resurgent.

In the meantime, investors will have to deal with the volatility that occurs during Earnings Season. Energy companies will see some EPS downgrades and so may large cap multi-nationals as they disclose the degree of headwind they face with a strong USD. Patient investors should be able to benefit from the benefits of higher consumer spending from a growing economy and lower oil prices. A better way to get exposure to this theme of a resurgent American consumer would be to tilt towards mid and small cap stocks, where the companies tend to do more business in the US rather than abroad (also see Focus on small caps in 2015).

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.