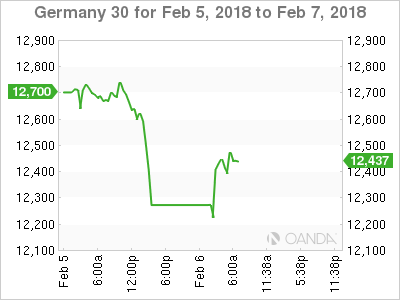

The DAX index continues to lose ground this week. In the Tuesday session, the index is trading at 12,454.51, down 1.88% on the day. On the release front, German Factory Orders impressed with a gain of 3.8%, crushing the estimate of 0.6%. On Wednesday, Germany releases Industrial Production.

The DAX ended last week with losses, as a sharp decline in Deutsche Bank (DE:DBKGn) shares sent European stock markets lower on Friday. The DAX declined 4.2% last week, and the slide continues, as the index has shed another 2.4% this week. The Dow Jones posted its biggest loss in one day on Monday, losing 1,500 points at one stage. The index ended the day down 4.6%, and the downward trend has continued in the Asian and European markets on Tuesday. What happened? Some analysts are pointing to the changing of the guard at the Federal Reserve, with Jerome Powell replacing outgoing chair Janet Yellen on Saturday. However, Powell is not expected to change current monetary policy, so it’s unclear how Powell would have rubbed the markets the wrong way before uttering a word as head of the Fed.

More likely, the stock markets woes can be attributed to strong US nonfarm payrolls and wage growth reports, which were released on Friday. Investors fear that the sharp data could lead to higher inflation, which in turn would result in more rate hikes this year. Higher interest rates make the dollar more attractive for investors, at the expense of the stock markets. Adding to investors’ concerns, there are expectations that the ECB and possibly the Bank of Japan could raise rates late in 2018, which would push up the euro and yen and weigh on the stock markets.

Algo Trading Blamed for Monday’s Market Crash

Dow Suffers Biggest Ever One Day Points Loss

The German economy continues to shine, despite the ongoing coalition negotiations, which have dragged on since September. A spokesman for the SPD party, which is negotiating with Angela Merkel’s conservative bloc, said on Tuesday that a deal is “90-95%” done. For her part, Merkel has said that she is willing to make painful concessions in order to form a government. Both parties have stated that they want to reach an agreement on Tuesday. If there is an announcement later in the day, the euro could move higher.

Economic Calendar

Tuesday (February 6)

- 2:00 German Factory Orders. Estimate 0.6%. Actual 3.8%

- 4:00 German Buba President Weidmann Speaks

- 4:10 Eurozone Retail PMI

Wednesday (February 7)

- 2:00 German Industrial Production. Estimate -0.4%

*All release times are GMT

*Key events are in bold

DAX, Tuesday, February 6 at 6:05 EDT

Open: 12,203.50 High: 12,483.29 Low: 12,190.19 Close: 12,451.50