DAX is providing a bullish pattern (Inverted Head and Shoulders) that is not yet confirmed and bearish divergence signals at current levels. As can be seen in the daily chart below we could draw a bullish inverted Head and Shoulders pattern with a neckline at 10700. In the daily chart price is trying to break out of the Ichimoku cloud and is now forming the right shoulder and as early as today we could see an upward breakout.

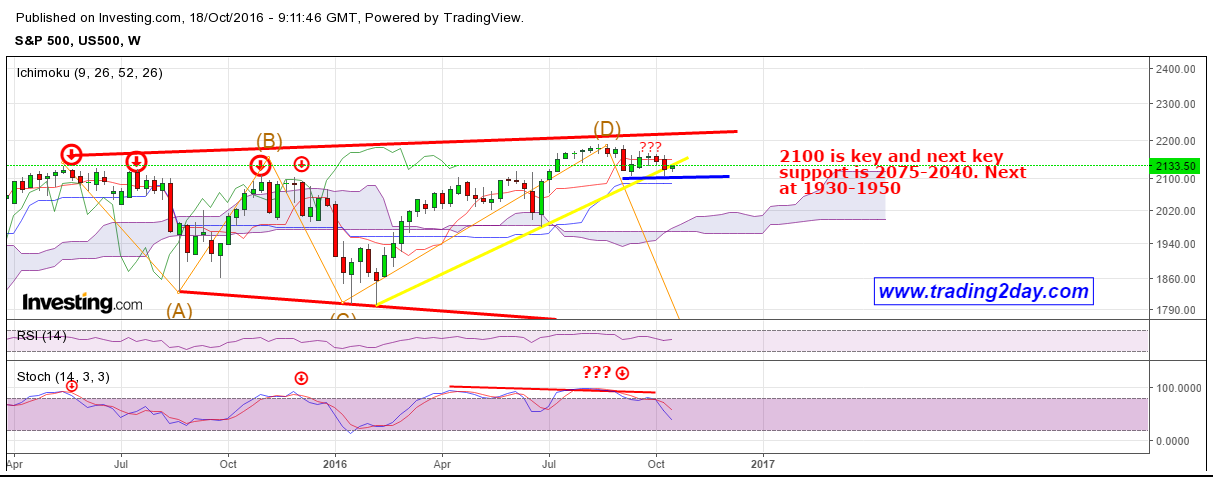

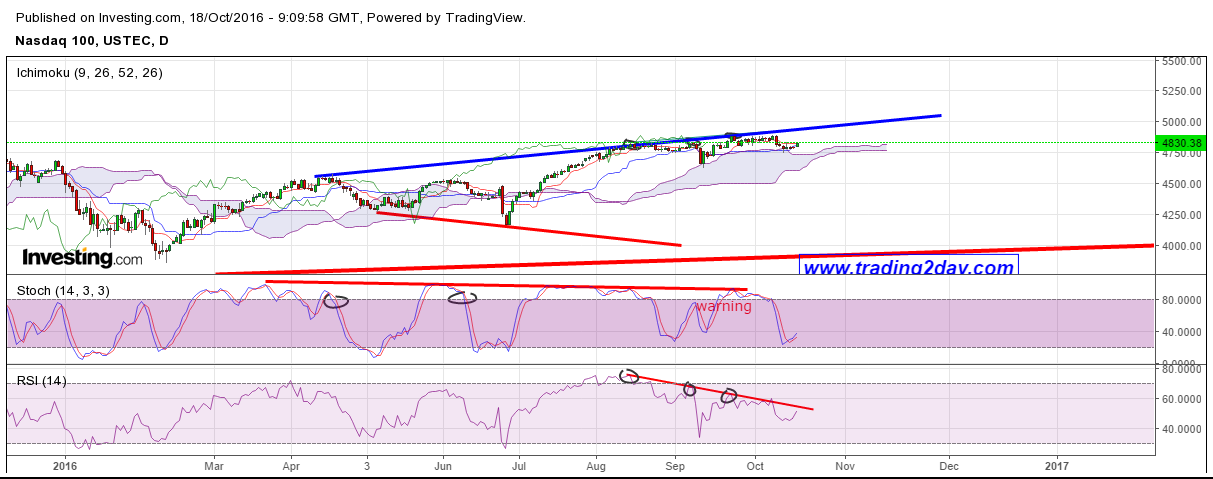

However oscillators on a weekly basis justify a pull back at least towards the broken downward sloping red trend line (that was once resistance). I tend to agree with the bearish scenario more as technicals in other major indices are as well as bearish for the short-term at least.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.