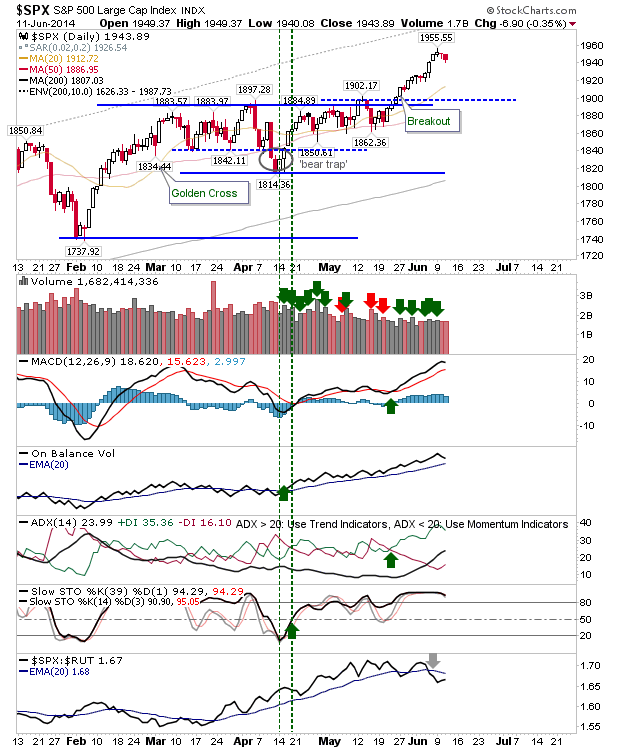

Stockcharts data may be back, but there wasn't much to miss. Indices finally got a down day, but it was nothing to suggest it was anything more than the start of a consolidation. Today's action was welcome, probably by both sides. Overall low volume losses in the S&P 500 (SPX) could also be viewed as distribution at a pinch, but best to stick with the low volume thesis.

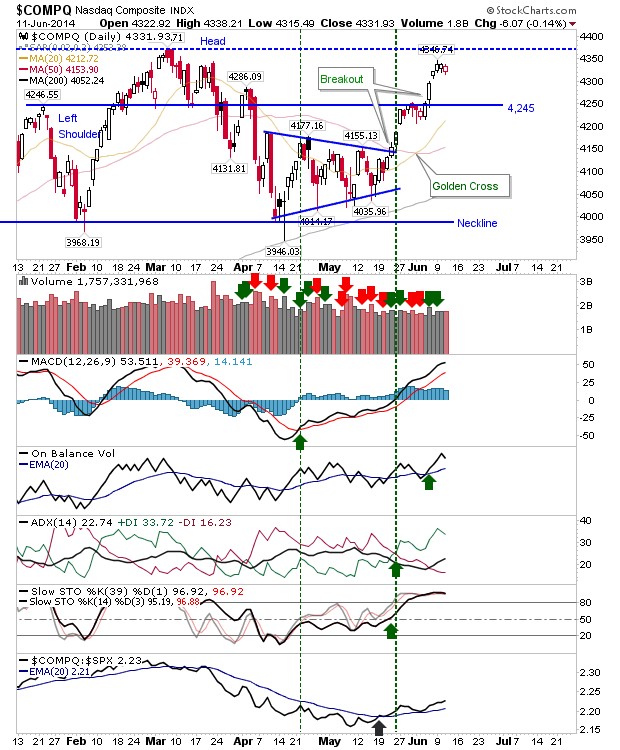

The NASDAQ managed to make gains against its open price, closing higher, although below yesterday's close. It's looking like a nice bullish flag just below 'head' resistance.

The Russell 2000 (RUT) took losses, but was able to recover some of those losses by the close. Action like this often breaks lower fast, but can recover just as quick. Look for a breakout retest, but if today's highs are quickly knocked out tomorrow then today's low becomes the stop for long positions.

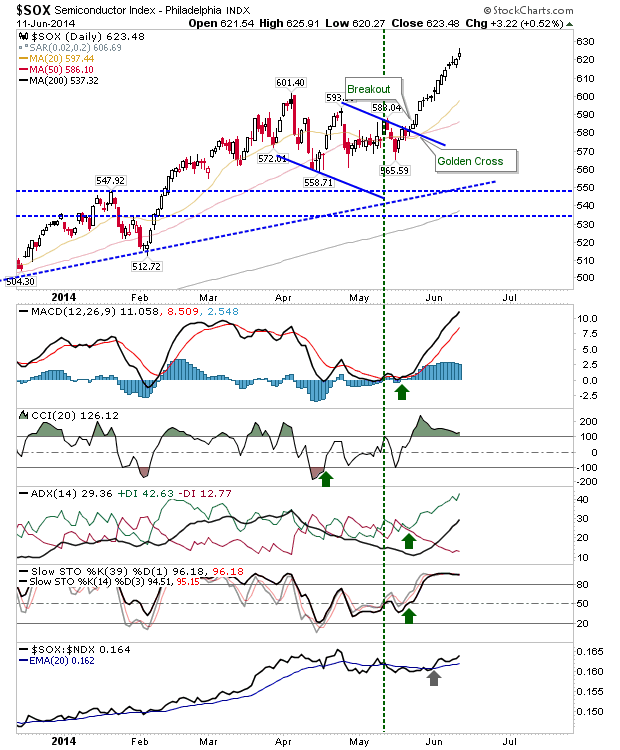

As for the Tri-Star reversal in the Semiconductor Index (SOX) - that's over.

Play for continuance of the rally, embrace weakness, at least until September when the real decision makers return to markets.