Daily Markets Broadcast April 24, 2019

The technology sector led the way higher for US stocks, with the NAS100 index hitting a record high while the US500 and US30 also climbed. Japanese shares are struggling to match gains on Wall Street ahead of the Bank of Japan policy meeting tomorrow.

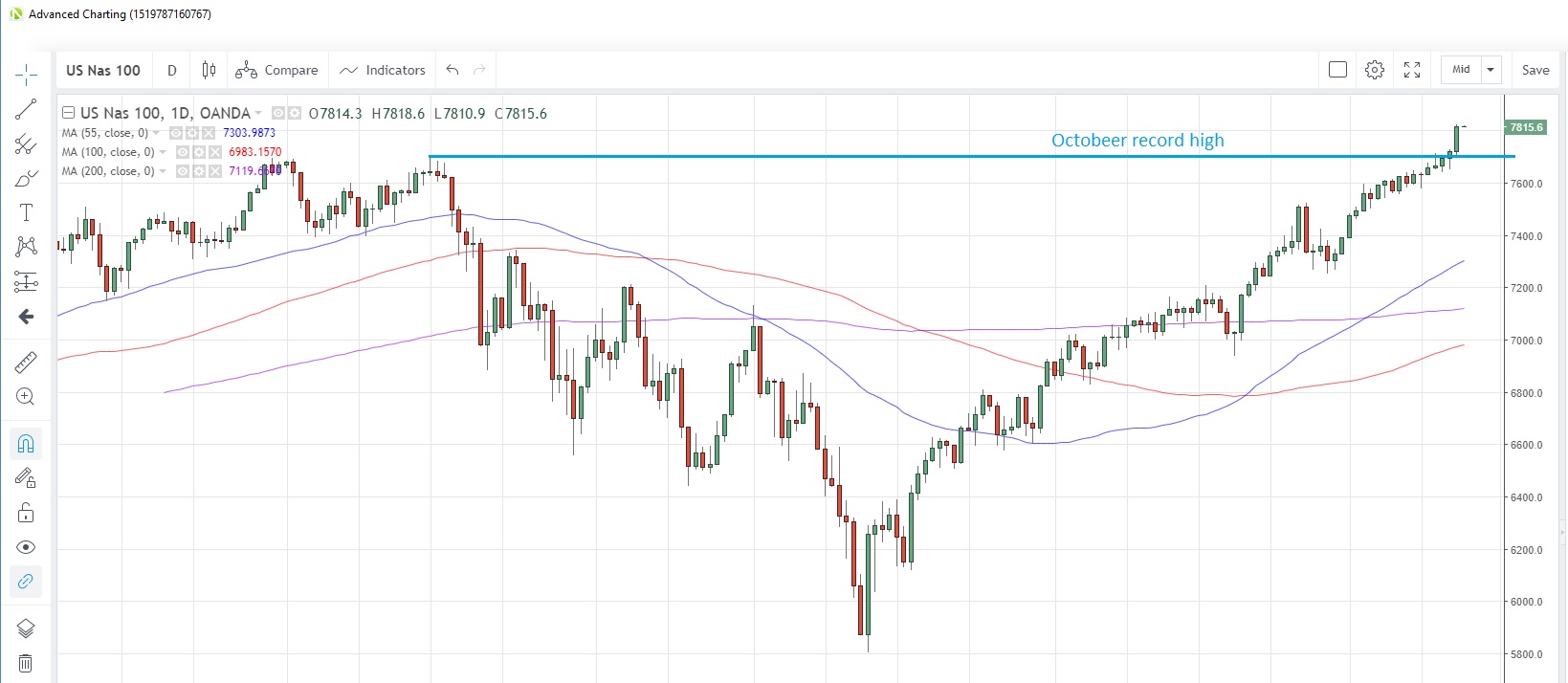

NAS100USD Daily Chart

Source: OANDA fxTrade

- The NAS100 index posted the biggest one-day gain in more than a month yesterday amid solid Q1 earnings reports from Twitter Inc (NYSE:TWTR).

- The index easily overcame the October high of 7,702. The rising 55-day moving average support is at 7,304 today.

- US new home sales were higher than expected in March, rising 4.5% m/m, more than the -2.5% expected but not as strong as February’s +5.9%. There are no key economic data releases scheduled for today.

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index closed marginally lower yesterday, the first day of trading after the long Easter break, as higher oil prices impacted sentiment. That was the first down-day in eight days.

- The index touched the highest since October 4 on Thursday. The 78.6% Fibonacci retracement of the May-December drop is at 12,581.

- Germany’s IFO surveys for April are seen mixed with the current assessment slipping to 103.6 from 103.8 but the business climate is expected to improve to 99.9 from 99.6 and the expectations index to 96.1 from 95.6.

JP225USD Daily Chart

Source: OANDA fxTrade

- The JP225 index looks poised to snap a nine-day rising streak today, despite firm cues from Wall Street. The index started positively but is now in the red, led by weakness in Toyota shares.

- Prices touched 22,474 earlier this morning, the highest since December 4. The 61.8% Fibonacci retracement of the drop from October to December is at 22,469.

- The Japan all industry activity index is seen falling 0.1% m/m in February after posting a 0.2% decline in January. The Bank of Japan holds a policy meeting tomorrow but is not expected to change rates nor the bond-buying programme.