Friday's late afternoon buying got some upside follow through on Monday without challenging resistance. There is a chance of further upside until it gets to such resistance.

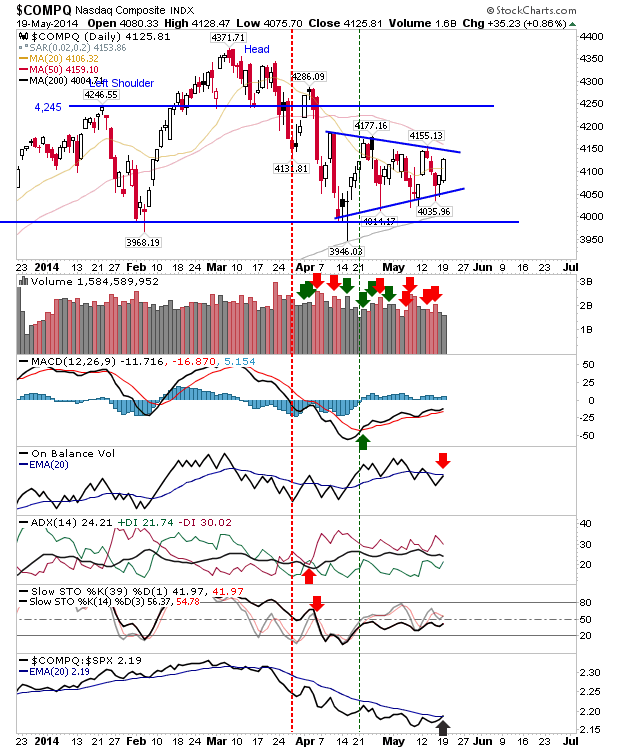

The Nasdaq will soon be meeting the converged 50-day MA and consolidation resistance, but it's a relative gain to the S&P that will help attract new buyers. It remains to be seen if it can get through this barrier, but recent action is working in its favour (more so than the S&P).

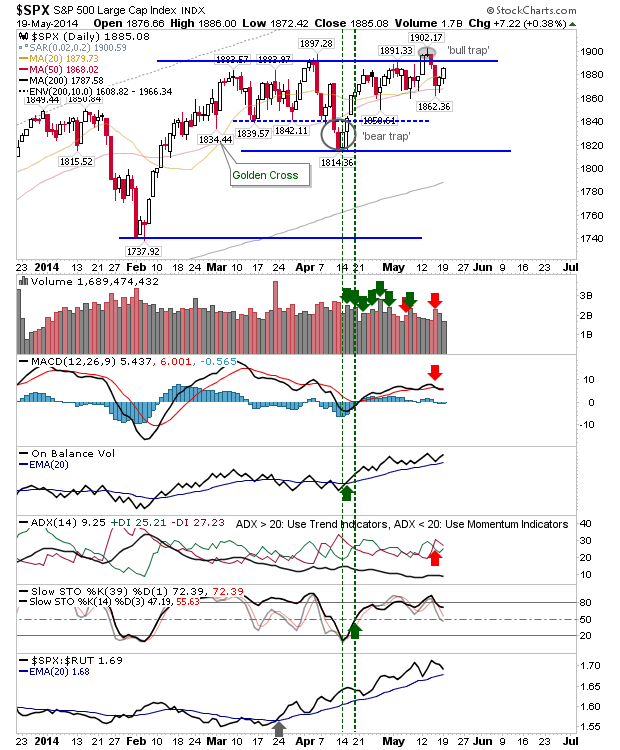

While the S&P has lost some ground against the Nasdaq, it still remains the index most likely to make new highs. It's streets ahead of both the Nasdaq and Russell 2000, and defensive issues will likely be the order of summer trading.

The Russell 2000 is reaching a critical juncture. It will soon find itself against the 20-day MA which has marked shorting opportunities in the past. Technicals are mostly flat, which favours bears a little more.

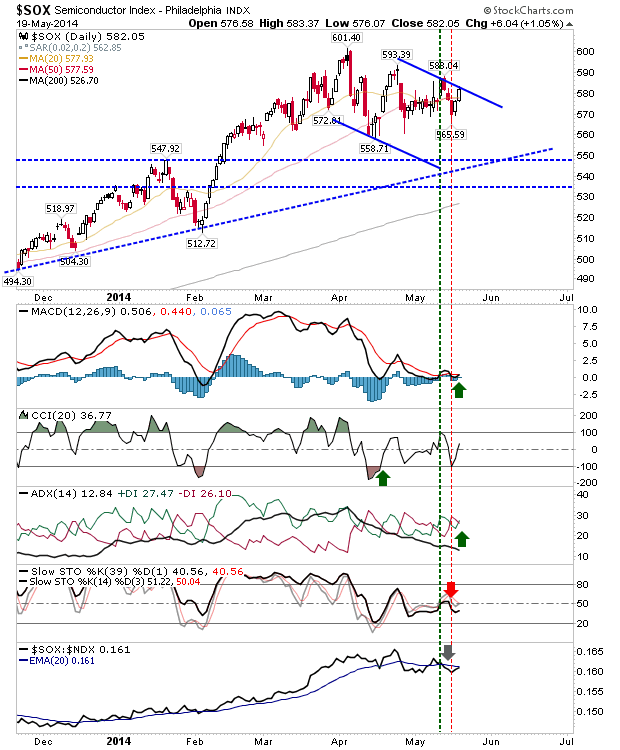

The semiconductor index is broadening its consolidation, the earlier 'bull trap' having now been consumed. Technicals are improving, and it's better placed to break higher than the Nasdaq. Should it manage to do so, then look for it to help the Nasdaq.

Today, look for bulls to continue the work they started yesterday, although the best of the gains may be booked by the morning.