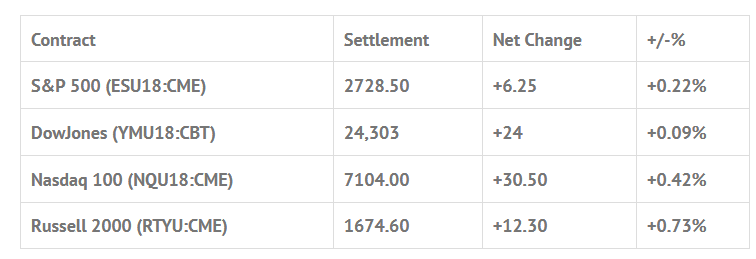

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -1.11%, Hang Seng -1.82%, Nikkei -0.31%

- In Europe 7 out of 13 markets are trading higher: CAC +0.13%, DAX +0.05%, FTSE +0.28%

- Fair Value: S&P +2.05, NASDAQ +20.28, Dow -9.11

- Total Volume: 1.38mil ESU & 464 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Durable Goods Orders 8:30 AM ET, International Trade in Goods 8:30 AM ET, Retail Inventories 8:30 AM ET, Wholesale Inventories 8:30 AM ET, Pending Home Sales Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, Randal Quarles Speaks 11:00 AM ET, and Eric Rosengren Speaks 12:15 PM ET

S&P 500 Futures: Small Up After Big Down

Yesterday started with the Shanghai Composite down -0.52%, the Stoxx 600 up +0.26% at midday, and the S&P 500 futures up +0.10% before the open. The overnight Globex trading range in the ES was 2714.75 to 2728.50, with 233,000 contracts traded.

On the 8:30 CT futures open the first print was 2725.50. The ES then rallied up to 2728.00, and in the first few minutes dropped down to 2718.25 and rallied back up to 2727.75. The futures then ‘double bottomed’ at 2721.25, traded back up to 2727.75, pulled back a few handles, then rallied up to a new high at 2730.50 before flunking down to a new low at 2717.25. After the low the ES rallied back up to the 2726.50 area, back and filled, and then traded up to 2735.25.

I put this out right after the ES made its high – Dboy:(12:52:34 PM) : es / nq act tired – and at 2:20 the ES traded back down to 2728.00 as the MiM went from $575 million to sell to $756 million to sell. When the MiM went to over $1.2 billion to sell the ES rallied back up to the 2733.00 area. On the 2:45 cash imbalance reveal the futures traded 2727.50, with the MiM showing $2 billion to sell MOC. The ES then sold off down to 2723.25, traded 2726.00 on the 3:00 cash close, and went on to settle at 2728.50 on the 3:15 futures close, up +6 handles, or up +0.22% on the day.

In the end the ES did rally, but got weak late in the day as the MiM started to show ‘size’ for sale. Despite the slower trade, volume in the S&P 500 futures (ESU18:CME) was 1.38 million, which was not bad for the type of trade we had. In terms of the ES’s overall tone, it didn’t act all that great.

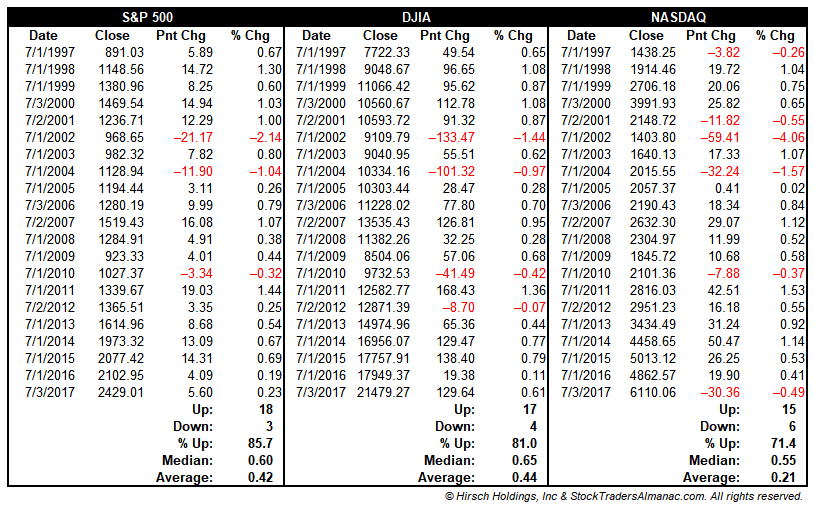

S&P 500 has advanced 85.7% of the time on July’s First Trading Day

From Stock Traders Almanac:

As a past subscriber or someone that has expressed interest in the Stock Trader’s Almanac and my digital service, Almanac Investor, I thought you would like to know that over the past 21 years, S&P 500 has advanced 85.7% of the time (average gain 0.42%) on the first trading day of July. DJIA’s has produced gains 81.0% of the time with an average advance of 0.44%. NASDAQ has been slightly weaker at 71.4% (0.21% average gain). No other day of the year exhibits this amount of across-the-board strength which makes a solid case for declaring the first trading day of July the most bullish day of the year over the past 21 years.

Receive the 2019 Stock Trader’s Almanac for FREE when you subscribe, renew, or extend your subscription to my digital subscription service, Stock Trader’s Almanac Investor, at a savings of up to 57% off regular pricing. New subscribers will also receive a free 2018 Stock Trader’s Almanac while supplies last.

- Almanac Investor Stock Portfolio up 458.3% versus 127.9% for S&P 500 since 2001

- Opportune ETF & Stock Trading Ideas with specific buy & sell price limits

- Timely Data-Rich & Data-Driven Market Analysis

- Market-Tested and Time-Proven Short- & Long-term Trading strategies

- “Best Six Months” Switching Strategy MACD Buy & Sell Signals

- Free 2018 Stock Trader’s Almanac Now & a Free 2019 Stock Trader’s Almanac Later this Year

- Access to my proprietary Almanac-based Tools (Market data beginning in 1901):

– Market Probability Calendar: Discover the best and worst days of any month

– MACD Calculator: Track the market momentum & test your own parameters

– Year-at-a-Glance: DJIA, S&P 500, NASDAQ, Russell 1000 & 2000 daily prices in an easy to read calendar format

– Monthly Data Bank: monthly closes, price change and percentage change

– Best & Worst: Days, Weeks, Months & Years

– Daily Performance: Weekly performance broken down into days of the week

– Market Volatility: Identify past periods of volatility and streaks of positive or negative performance

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.