Equities slid, while the safe havens USD and JPY gained yesterday and during the Asian morning today, after Johnson & Johnson (NYSE:JNJ) said that it had stopped its vaccine trials due to an unexplained illness in a study participant.

In the currency world, the Kiwi was the main gainer among the G10s, on positive remarks by an RBNZ official, while the British pound tumbled on the lack of any progress in trade talks between the EU and the UK.

Equities Slide, Safe Havens Gain As J&J Halts Vaccine Trials

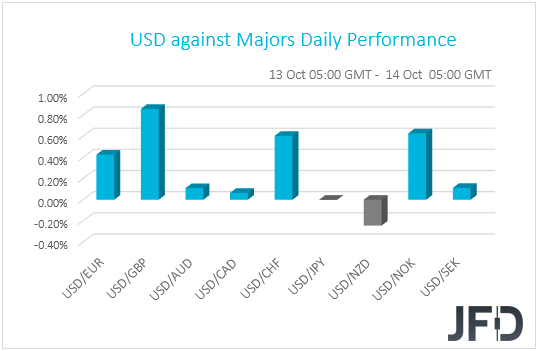

The US dollar traded higher against the majority of the other G10 currencies on Tuesday and during the Asian morning Wednesday. It lost some ground only against NZD, while it was found virtually unchanged versus JPY. The greenback gained the most against GBP, NOK, CHF, and EUR in that order.

The strengthening of the US dollar and the Japanese yen suggests that markets traded in a risk-off fashion. However, the strengthening of the Kiwi and the weakness in the Swiss franc point otherwise. Thus, in order to get a clearer picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world.

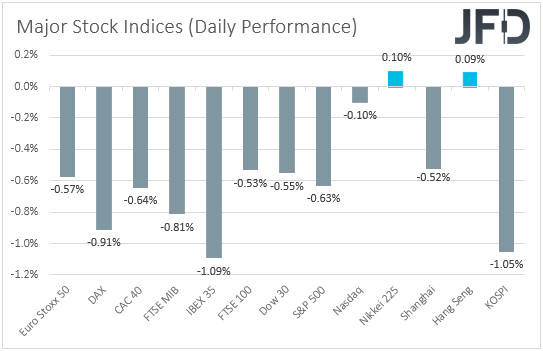

There, major EU and US indices were a sea of red, with the negative morale rolling into the Asian session today as well. Although Japan’s Nikkei 225 and Hong Kong’s Hang Seng are currently up around 0.10% each, China’s Shanghai Composite and South Korea’s KOSPI are down 0.52% and 1.05% respectively.

Market participants decided to abandon riskier assets and seek shelter in safe havens after Johnson & Johnson said that it had temporarily stopped trials of a potential coronavirus vaccine, due to an unexplained illness in a study participant, raising concerns that a final vaccine may take longer to be delivered than previously thought.

What may have added to investors’ nervousness may have been negative headlines with regards to further fiscal stimulus in the US. Yesterday, House Speaker Nancy Pelosi rejected a USD 1.8bn offer from President Trump, diminishing further the chances of any deal being reached ahead of the November election.

As for our view, looking at the charts, we see that the technical picture of most stock indices, especially the US ones, remains relatively positive, which means that yesterday’s retreat may be an opportunity for some buyers to jump back into the action.

That said, even if we see a rebound in the next days, we remain reluctant to trust a long-lasting recovery. We repeat that we prefer to take things day by day as there are several risks to be considered, including how fast the virus continues to spread, the US elections, and the stalemate in Brexit talks.

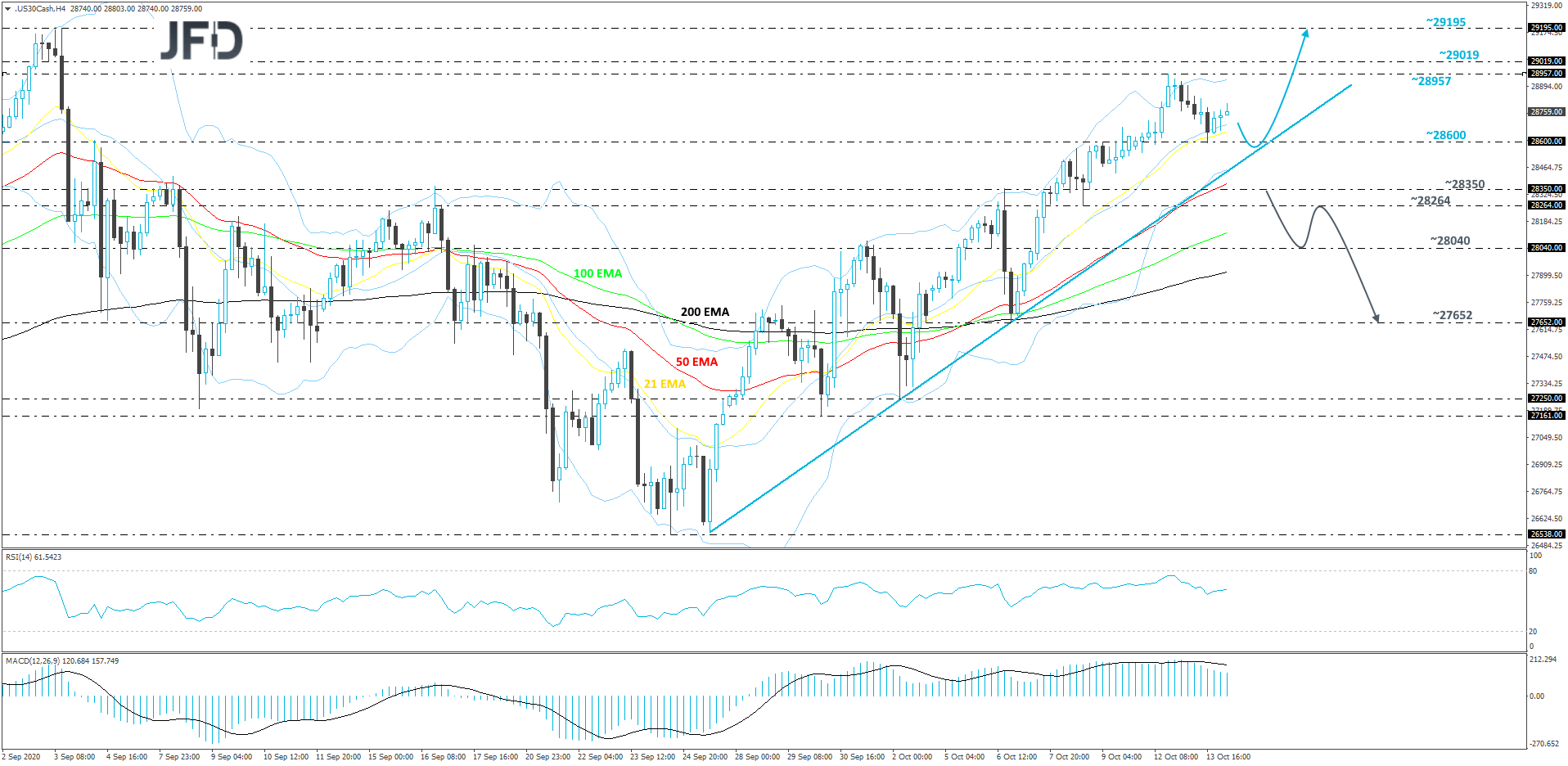

DJIA Technical Outlook

Since the reversal to the upside at the end of September, the DJIA index continues to grind higher, while balancing above a short-term tentative upside support line taken from the low of Sept. 25.

On Monday, the price found good resistance near the 28957 hurdle, from where it started drifting lower. If the index continues to slide, but eventually gets held near the above-discussed upside line, this move lower could be classed as a temporary correction before another leg of buying. We will take a somewhat bullish approach for now.

As mentioned above, a small drop lower could bring the price to the 28600 zone, marked near yesterday’s low, or the index might end up testing the aforementioned upside line. If that line does provide good support, DJIA may rebound again, as the bulls could take advantage of the lower price.

If so, the buyers might push the index back towards the current high of this week, at 28957, and if that area surrenders and breaks, this could clear the path further north. That’s when we will aim for the 29019 obstacle, a break of which might set the stage for a push to the 29195 level, marked by the highest point of September.

If the previously-mentioned upside line breaks and the price falls below the 28264 and 28350 levels, marked by the low of Oct. 8 and the high of Oct. 6, that may spook the remaining bulls from entering the field for a while. DJIA might then fall to the 28040 obstacle, a break of which could set the stage for a push to the 27652 area, marked by the low of October 6th.

NZD The Main G10 Gainer, GBP Slides As Brexit Talks Lead Nowhere

Now, back to the currency world, the Kiwi was the main gainer among the G10s, perhaps due to remarks by RBNZ Assistant Governor Christian Hawkesby, who said that some economic data have surprised to the upside, reducing the chances for the adoption of negative interest rates by this Bank.

That said, the prospect is not totally off the table. Hawkesby himself sad that the discussion of negative rates is “not a game of bluff”.

The main loser was the British pound, coming under selling interest due to the little progress made in trade talks between the EU and the UK. Recent reports have shown that the EU wants more concessions from Britain before entering a last phase of negotiations.

And all this comes just a day before the self-imposed deadline to find an accord. In our view, a deal is unlikely to be sealed tonight, and thus, in the EU summit beginning tomorrow, officials are likely to discuss the progress being (or not being) made until now.

The pound may stay under selling interest due to the uncertainty surrounding the talks, but we don’t expect GBP-traders to panic, as we see decent chances for the talks to continue even after the self-imposed deadline. After all, EU chief Brexit negotiator Michel Barnier recently suggested that talks could continue up until the end of the month, while another report noted that the EU is preparing for negotiations to last until mid-November.

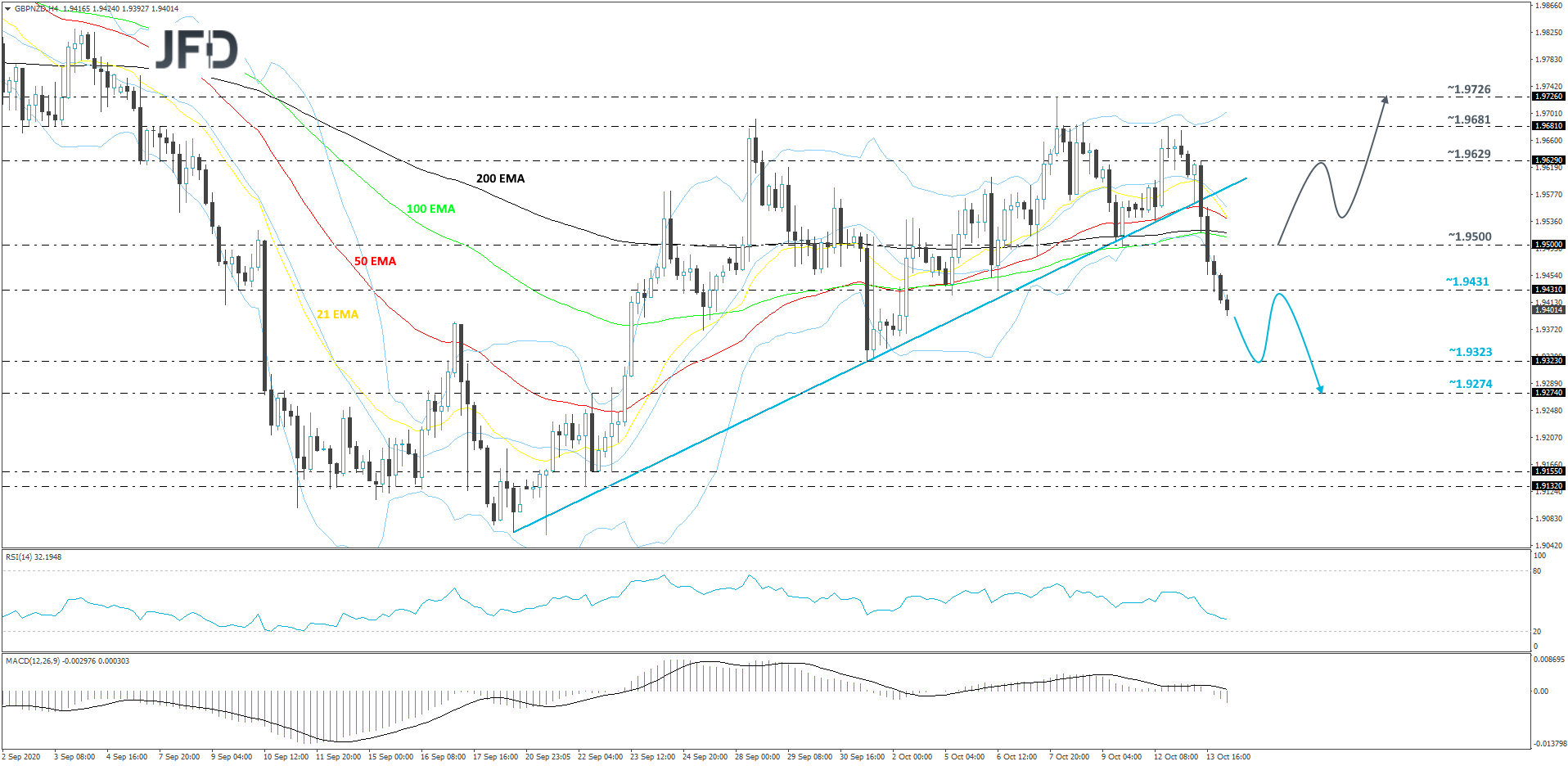

GBP/NZD Technical Outlook

After yesterday’s break of the short-term upside support line, drawn from the low of Sept. 18, GBP/NZD continues to drift south this morning. The pair already broke below some of its key support levels and the oscillators on our 4-hour chart still show negative price momentum. All this suggests there could be more downside, at least in the near term, hence why we will take a bearish approach, for the time being.

A further drift lower may bring the pair to the 1.9323 hurdle, marked by the current lowest point of October. GBP/NZD might get a hold-up around there, or even rebound back up again. That said, if the rate struggles to get back above the 1.9431 barrier, which marks the low of Oct. 6, this could lead to another slide. If this time the 1.9323 zone is not able to withstand the bear pressure, a break of it would confirm a forthcoming lower low and may clear the way to the 1.9274 area, marked by the high of Sept. 22.

In order to consider the upside scenario, we would at least like to see a rise back above the 1.9500 barrier, marked by the inside swing low of Sept. 9. That might attract a few more buyers into the game, potentially opening the door for a move to the 1.9629 hurdle, which is yesterday’s intraday swing high. If the buying doesn’t stop there, the next potential resistance levels to consider could be at 1.9681 and 1.9726, marked by the highs of Oct. 12 and 8 respectively.

As For Today's Events

Wednesday is a relatively light day in terms of economic indicators with the only one worth mentioning being Eurozone’s industrial production for August. Expectations are for a slowdown to +0.7% mom from +4.1%, but this would drive the yoy rate higher, to -7.1% from -7.7%.

That said, we will get to hear from five speakers. Those are Fed Vice Chair Richard Clarida, ECB Chief Economist Philip Lane, BoE Chief Economist Andy Haldane, Fed Board Governor Randal Quarles, and BoC Deputy Governor Timothy Lane.

As for tonight, during the Asian session Thursday, Australia’s employment report for September is coming out. The unemployment rate is expected to have increased to 7.1% from 6.8%, while the net change in employment is forecast to show that the economy has lost 35k jobs after gaining 111k in August.

At its latest gathering, the RBA kept its monetary policy settings unchanged, disappointing those looking for further easing after Deputy Governor Guy Debelle flagged the prospect, with options including currency market intervention and negative interest rates. That said, a weak employment report may revive speculation for more stimulus, perhaps at one of the Bank’s upcoming meetings.