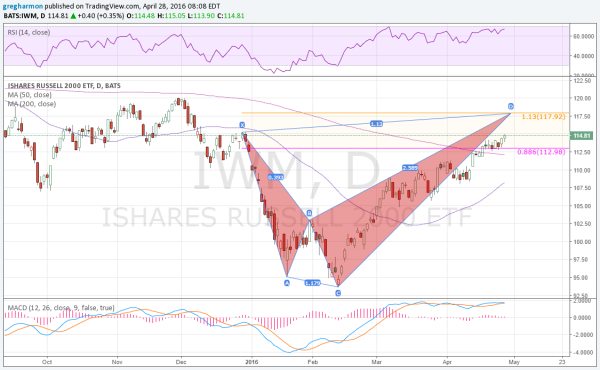

Tax day started it. That's when I noted that there were Sharks Circling the Russell 2000 chart. The pattern developing at that time looked to give the Russell a lift. Last week the story got even better and I pointed out 5 Positive things in the Russell 2000 chart.

The small-cap index continued higher. By the end of last week it had reached the Potential Reversal Zone (PRZ) of that Shark pattern at 113. With the pause there it looked like maybe that was it. Another lower high after a strong rally. And that still might be the case. The markets were disappointed by the Bank of Japan decision to take no action. The Japanese market lost over 3%. In the US the the S&P 500 has dropped all the way back to Monday levels. Not so bad. And the small caps? They opened near the Tuesday consolidation area at 114 on the Russell 2000 ETF (NYSE:IWM).

The small caps are continuing to show strength. And with that comes separation from that PRZ on the Shark pattern. This would mark a failed reversal for other harmonic patterns, but the Shark comes with 2 PRZs. The second one stands above at about 118. And with the continued strength in the RSI and MACD, it looks like a run to that second PRZ is in order. If that occurs, it would make for a higher high -- above the December range -- and place the Russell firmly back in the consolidation levels of last fall.