The Russell 2000 is used by many traders and investors as an indicator of strength of the market and a harbinger of which way it may head. So it should come as no surprise that traders are studying the recent action and are ready to attack.

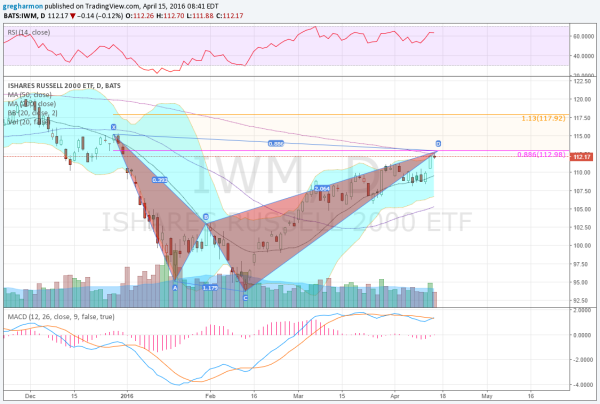

The Russell 2000 (NYSE:IWM) has built a Shark harmonic pattern over the last 3-and-a-half months. The chart below shows the detail. This is a bearish reversal pattern and if price action triggers, expect a move to 113 and then a fall back lower. At that point the pattern would look for a a 38.2% or 61.8% retracement of the full range, which would draw it lower to 107 or even 101.90.

But the Shark is mysterious and so is the pattern. It actually has 2 Potential Reversal Zones (PRZ), and the second is still well above 118. The momentum indicators suggest that the run higher is not done yet. The RSI is in the bullish zone and the MACD is crossing up and positive. The Bollinger Bands® are also pointing higher. The 200-day SMA just overhead will have many bearish-leaning traders looking to take some profits.

Will it stop and reverse here near 113, or continue to 118? Or something completely different? We will have to watch and see.