Market Brief

Better-than-expected initial jobless claims stopped the greenback sell-off and allowed the dollar index to erase previous losses after reaching its lowest level since February 19. Report shows that only 265k Americans filled applications for unemployment benefit last week while markets expect 278k. EUR/USD is down 1.65% at 1.1206, unable to break the strong 1.1380 resistance. However, April’s payroll are due this afternoon, we expect it to come in slightly below the 228k consensus. A higher read would awake dollar bulls and drag EUR/USD lower. Unemployment is expected at 5.4%, 5.5% prior read. Investors will focus on wage growth as a higher read could indicate an increase in inflation and therefore would fuel speculation about a rate hike in June.

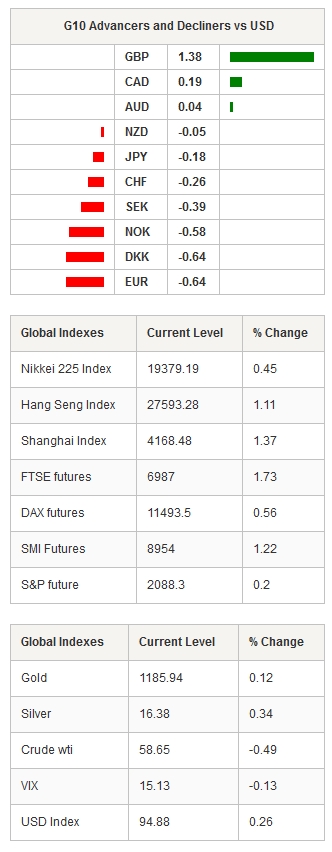

Asian markets are mixed this morning, with a slight positive bias, stabilising amid encouraging US jobs report and temporary results of the UK general election. Nikkei is up 0.45%, Shanghai Composite is up 1.37%, Hang Seng is up 1.11%. USD/JPY gained 0.78% from yesterday’s low to 119.97 this morning. We believe there is room for further dollar/yen appreciation, one can find hourly resistance at 120.18 (Fib 50% on March sell-off) and 122. On the downside, the pair will find strong support at 118.50.

In Australia, S&P/ASX is blinking red, down -0.20% to 5,634.6. AUD/USD erased almost entirely weekly gains. The Aussie was unable to break the 0.8030 resistance and is back in its decline channel.

In the UK, exit polls indicate that Conservative party is winning 316 seats versus 239 seats for Labour. Traders greeted the news, the cable traded as high as 1.5523, up 2.34% from yesterday’s low. European equity futures are all green with the FTSE 250 up more than 1.78%, followed by the STOXX 600 index up 1.32%, German futures edge up 0.61%.

WTI and Brent crude suffered losses in the European and US sessions. WTI retreated 4.1% from yesterday high to 58.76 while its counterpart from the North Sea declined almost 5% to 65.49.

In Switzerland, April’s unemployment rate was released at 3.3%, matching expectations. EUR/CHF is grinding lower toward 1.03. The cross almost cancels the upside move triggered by the tightening of exemption rules by the SNB two weeks ago. Yesterday, USD/CHF printed a new 3-month at 0.9072. However, the dollar gains momentum and is currently trading at 0.9233. On the down side, a support lies at 0.9073, then 0.90 (psychological level) and finally 0.8936 (low from late January).

Today traders will also watch Switzerland April CPI (exp. 0.1%m/m, 0.3% prior), UK Halifax house price (exp. 0.3%m/m, prior 0.4%) and obviously the final results of the UK general election. In Brazil, April IPCA inflation figures are due today (exp. 8.23%y/y, 8.13% prior).

Today's CalendarEstimatesPreviousCountry / GMT UK Apr Halifax House Prices MoM 0.30% 0.40% GBP / 07:00 UK Apr Halifax House Price 3Mths/Year 7.80% 8.10% GBP / 07:00 SP Mar Industrial Output NSA YoY - 1.10% EUR / 07:00 SP Mar Industrial Output SA YoY 1.30% 0.60% EUR / 07:00 SP Mar House transactions YoY - 15.50% EUR / 07:00 SZ Apr CPI MoM 0.10% 0.30% CHF / 07:15 SZ Apr CPI YoY -0.90% -0.90% CHF / 07:15 SZ Apr CPI EU Harmonized MoM 0.10% 0.50% CHF / 07:15 SZ Apr CPI EU Harmonized YoY -0.60% -0.50% CHF / 07:15 SW Apr Budget Balance - -1.7B SEK / 07:30 SW Mar Household Consumption (MoM) 0.40% 0.70% SEK / 07:30 SW Mar Household Consumption (YoY) - 3.40% SEK / 07:30 NO Mar Industrial Production MoM - 2.60% NOK / 08:00 NO Mar Industrial Production WDA YoY - 1.90% NOK / 08:00 NO Mar Ind Prod Manufacturing MoM 0.20% 1.20% NOK / 08:00 NO Mar Ind Prod Manufacturing WDA YoY - 0.80% NOK / 08:00 IT Mar Industrial Production MoM 0.20% 0.60% EUR / 08:00 IT Mar Industrial Production WDA YoY -0.20% -0.20% EUR / 08:00 IT Mar Industrial Production NSA YoY - -0.20% EUR / 08:00 UK Mar Visible Trade Balance GBP/Mn -£9800 -£10340 GBP / 08:30 UK Mar Trade Balance Non EU GBP/Mn -£2850 -£3238 GBP / 08:30 UK Mar Trade Balance -£2400 -£2859 GBP / 08:30 BZ May 7 FGV CPI IPC-S 0.64% 0.61% BRL / 11:00 BZ Apr IBGE Inflation IPCA MoM 0.75% 1.32% BRL / 12:00 BZ Apr IBGE Inflation IPCA YoY 8.23% 8.13% BRL / 12:00 CA Apr Housing Starts 182.0K 189.7K CAD / 12:15 US Apr Change in Nonfarm Payrolls 228K 126K USD / 12:30 CA Apr Unemployment Rate 6.90% 6.80% CAD / 12:30 CA Apr Net Change in Employment -5.0K 28.7K CAD / 12:30 US Apr Change in Private Payrolls 225K 129K USD / 12:30 CA Apr Full Time Employment Change - -28.2 CAD / 12:30 US Apr Change in Manufact. Payrolls 5K -1K USD / 12:30 CA Apr Part Time Employment Change - 56.8 CAD / 12:30 US Apr Unemployment Rate 5.40% 5.50% USD / 12:30 CA Apr Participation Rate 65.9 65.9 CAD / 12:30 US Apr Average Hourly Earnings MoM 0.20% 0.30% USD / 12:30 US Apr Average Hourly Earnings YoY 2.30% 2.10% USD / 12:30 US Apr Average Weekly Hours All Employees 34.5 34.5 USD / 12:30 US Apr Underemployment Rate - 10.90% USD / 12:30 US Apr Change in Household Employment - 34 USD / 12:30 US Apr Labor Force Participation Rate - 62.70% USD / 12:30 US Mar Wholesale Inventories MoM 0.30% 0.30% USD / 14:00 US Mar Wholesale Trade Sales MoM 0.50% -0.20% USD / 14:00 IN Apr Local Car Sales - 176011 INR / 22:00 AU 4Q CBA/HIA House Affordability - 96.2 AUD / 22:00

Currency Tech

EUR/USD

R 2: 1.1529

R 1: 1.1450

CURRENT: 1.1194

S 1: 1.1111

S 2: 1.1000

GBP/USD

R 2: 1.5826

R 1: 1.5552

CURRENT: 1.5464

S 1: 1.5156

S 2: 1.5051

USD/JPY

R 2: 122.03

R 1: 120.10

CURRENT: 119.99

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9240

S 1: 0.8936

S 2: 0.8823