Market Brief

EUR/USD got hammered in the late London and early US session yesterday and reached its lowest level since August 5th. The single currency fell below the $1.0848 support level to print a new multi-month low at $1.0844. Janet Yellen’s upbeat comments about the state of the US economy - during her testimony before the House Financial Services Committee - finished off the job started by Mario Draghi a couple of weeks ago. The Federal Reserve Chairwoman declared that “Domestic spending has been growing at a solid pace”. Therefore, we believe that if upward pricing pressure gains momentum, it would be supportive of a December rate hike. However, the latest inflation reports provided major disappointment as the core PCE deflator has proven unable to take-off, stuck at 1.3%y/y. Yellen just shifted the market’s attention from the job report to the inflation report, the only part of the Fed’s mandate that is lagging behind. The party will start next week with the PPI figures, when we’ll get CPI on November 17th and finally PCE deflator in three weeks.

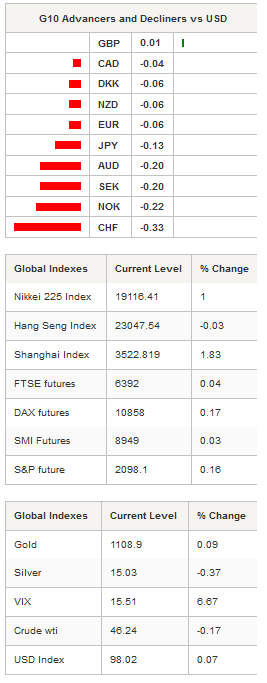

On the equity front, Wall Street ended the session in negative territory yesterday as investors took their profits home and started to adjust their portfolio ahead of tomorrow's NFPs. The S&P 500 fell 0.35%, the Dow Jones 30 slid 0.28% and the Nasdaq edged down 0.05%. In Asia, Japanese and Chinese stocks were rallying for a second straight day with the Shanghai and Shenzhen composites rising 1.83% and 0.20% respectively. In Tokyo, the Nikkei 225 soared 1%, while the broader TOPIX gained 0.95%.

Further south, the Aussie also got slammed yesterday against the US dollar to the greatest satisfaction of Governor Stevens. AUD/USD fell as low as 0.7127 in the early Asian session before returning quickly to around 0.7140. The S&P/ASX 200 was down 0.94%.

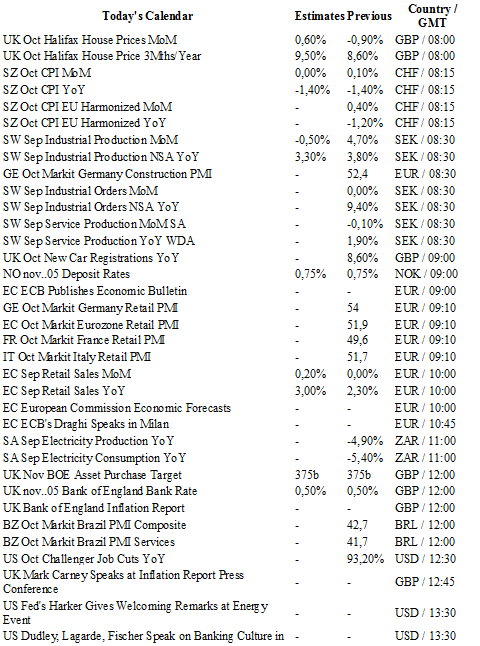

The big event is the Bank of England rate decision and inflation report. Even if some expect Martin Whale to join the pro tightening faction of Ian McCaffety - which we believe is unlikely - we think that despite decent growth figures, the BoE has to deal with weak inflationary pressure. We therefore expect an 8 - 1 score. GBP/USD sits on the 1.5383 resistance level (Fib. 50% on September-October debasement) ahead of the BoE “Super Thursday”. In cable, the risk remains on the downside as the expectation for a hawkish press conference and improvement in inflation levels are pretty high.

Today traders will be watching Swiss CPI; industrial production from Sweden; Norges Bank rate decision; retails sales and retail PMI from the euro zone; composite and service PMI from Brazil; initial jobless claims, nonfarm productivity and Bloomberg consumer comfort index from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1079

CURRENT: 1.0880

S 1: 1.0809

S 2: 1.0458

GBP/USD

R 2: 1.5659

R 1: 1.5508

CURRENT: 1.5400

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 121.63

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 0.9952

S 1: 0.9739

S 2: 0.9476