A weaker CNY midpoint fixing and a renewed selloff in Mainland Chinese markets have heightened fears that Friday’s selloff could merely be the beginning of a more significant correction for Chinese equities. Although the Chinese “National Team” looked keen to quell potential fears over a currency devaluation today, it did not seem to encourage the Chinese equity markets.

After a tentative open in Japan and Australia, a wave of selling hit markets after 11.00am AEDT just ahead of the opening of the Chinese futures market at 12.15pm AEDT. The CNY midpoint fix weakened the currency even further today seeing an initial spike in the offshore CNH rate and heightening tensions in equity markets that we could see another CNY devaluation. However, a wave of strong buying of the CNH directly in the FX market (allegedly by a large Chinese bank) came in at 12.40pm AEDT to stem the weakening of the currency. The CSI 300 and Shanghai Composite also opened in positive territory. However, as Mainland markets headed into the red and H-shares also started to see a pickup in selling, fears of a “Black Monday Redux” did begin to grip Asian markets.

One theory behind the strengthening of the CNH may be the CNY’s imminent announcement of its inclusion in the IMF’s Standard Drawing Rights (SDR) basket. Given this, the Chinese government may be hoping to see a wave of buying of the CNY and if the currency is weakening there would seemingly be very few FX portfolio managers who would be keen to see immediate losses on their CNY purchases.

Japan

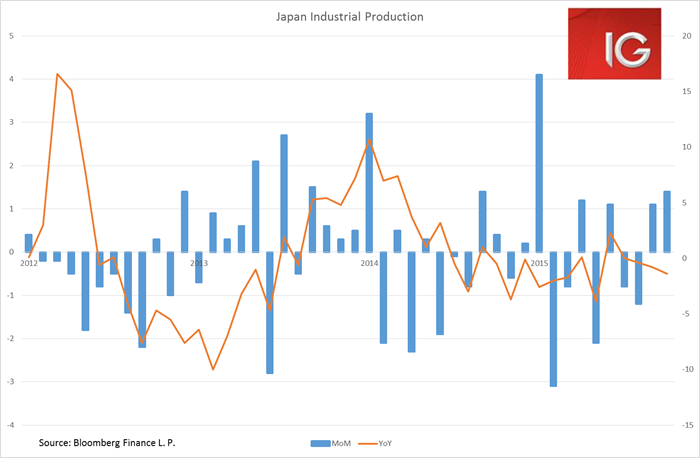

Japanese October industrial production came in slightly weaker than expectations, but nonetheless gave a strong indication that Japan would be exiting its “technical recession” in Q4 after seeing two consecutive month-on-month increases. Retail sales managed to beat market expectations on the monthly and yearly line, pointing to a pickup in consumption. Nonetheless, China concerns appeared to weigh more heavily on the Nikkei than the relatively upbeat data releases as it lost 0.5%.

Australia

The positives from the Australian data releases today were certainly to the private sector’s credit, TD-MI monthly inflation gauge, and the quarterly company operating profits numbers. The key figure will be the current account data released tomorrow, which will provide some insight into the net exports component of Q3 GDP.

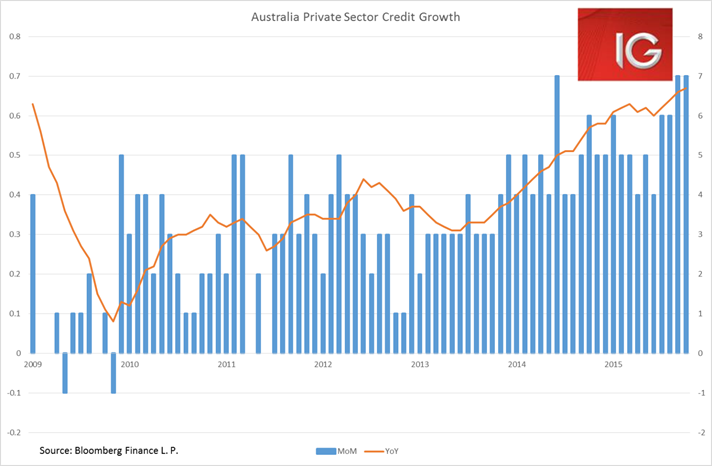

Private sector credit continued to see strong growth in October, expanding at 6.7% year-on-year (YoY). It is clear the momentum in private sector credit growth has begun to pick up since slowing down in June with 3-month and 6-month annualised measures both continuing to increase alongside the YoY rate. This is further evidence of the growing resurgence of the Aussie consumer. Strong credit growth, strong employment growth, elevated consumer confidence and high auto sales clearly are indicating some positive developments in the economy despite the ongoing decline in mining-related sectors.

The TD-MI inflation gauge had inflation increasing at 1.8% YoY in November, far higher than the official 1.5% growth seen in Q3, which does look to be pointing to a bounce in Q4 inflation closer to where the Reserve Bank of Australia (RBA) would like to see it.

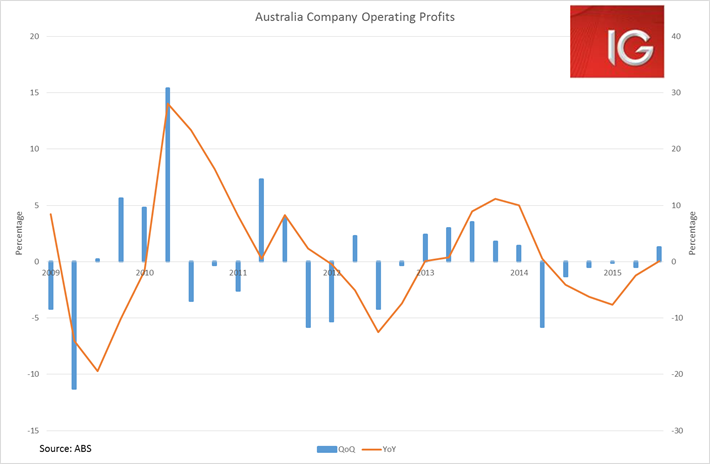

Quarterly company operating profits also came in better-than-expected at 1.3% quarter-on-quarter (QoQ), the first positive quarterly increase since Q1 2014. Non-mining sector profits continued to see strong gains, growing 4.4% in year-ended terms. Inventories also increased 0.1% QoQ in Q3, which if we see a solid net exports number in the current account tomorrow should see a GDP number coming in around expectations for 0.7% QoQ.

ASX

After opening in positive territory, China worries prompted a selloff in the ASX. A weaker CNY midpoint fixing and a renewed selloff in Mainland Chinese markets have heightened fears that Friday’s selloff could merely be the beginning of a more significant correction.

Despite talks of Chinese production cuts for non-ferrous metals, metal prices in the Shanghai Futures Exchange continued to see further selling today impacting the materials sector. The announcement that the Brazilian government was looking to sue BHP (N:BHP) and Vale for US$5.2 billion over the Samarco tailings dam spill saw the big miner stay deep in the A$18 handle. The sector as a whole lost over 2%.

The Aussie banks also tipped into the negative territory as general global market sentiment turned. The sector as a whole lost 0.3%.

Nonetheless, the healthcare and IT sectors continued to show their resilience, managing to stay in positive territory despite the general selloff. The Aussie healthcare behemoth CSL (OTC:CSLLY) pushed up over A$100 and looked to hold it, providing a strong sentiment for the sector as a whole. This helped lift smaller names Resmed (N:RMD), Ansell (AX:ANN) and Mesoblast (O:MESO) as well.