Market Brief

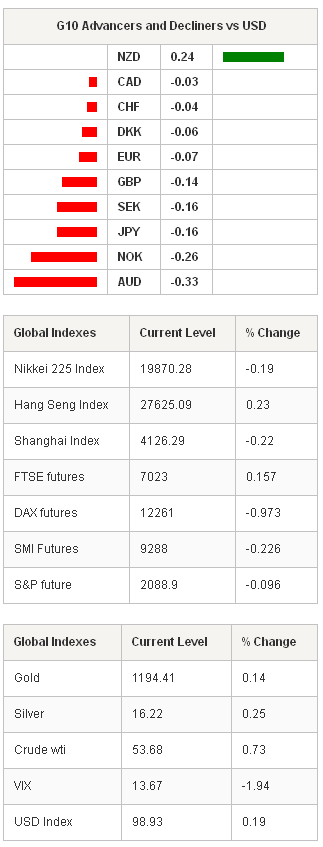

The first quarter was definitely disappointing as retail sales came in lower than expected for the third month in a row, even though it was the biggest raise in a year. The change in sales at the retail level for March was released at 0.9% verse 1.1% expected while the reading for February was revised upward from -0.6% to -0.5%. As a result traders pushed back expectation for when the Fed may increase its fund rate. The USD was broadly sold-off yesterday during the US session; the dollar index lost 1.17% down to 98.37. EUR/USD jumped from 1.0558 to 1.0707, GBP/USD gained 1.36% while USD/JPY retreated 85pips. However, retail sales for March showed the highest change since April 2014 and suggest that the US economy is recovering slowly after two disappointing months. The US economy may be out of the wood now.

In Asia tonight, the dollar erased most of its previous losses. But the big news this morning was the released of China’s GDP growth for Q1 2015. The China economy expanded by a disappointing 7% (matching median estimates), the lowest read since Q2 2009 (6.1%). Consequently Asian equities paired losses overnight: the Hang Seng lost more than 1.5% on the news, erasing early session gains, while the Shanghai Composite drop 2.15% to 4070 before bouncing back to 4120. In Tokyo the Nikkei retreated by -0.2% to 19,870.

EUR/USD was unable to continue its walk to the parity yesterday as the euro failed to convert the 1.0685 resistance (Fib 38.2% on Feb-March sell-off) into a support. The greenback is currently heading back to 1.06 and should find some fresh boost to break the 1.05/1.0458 area which is a strong resistance (low from March 15). On the upside, the single currency should find little resistance around 1.0677. One can find the next resistance at 1.0870 (multiple highs from March 19 and 22, April 8). US futures are mixed, S&P 500 and NASDAQ are slightly lower by -0.1% and -0.13% respectively while the Dow Jones is up 0.30%.

In Europe, futures are in red this morning with CAC, DAX and SMI lower by -0.65%, -0.97% and -0.23% respectively; only UK equities managed to remain in positive ground, slightly up by +0.16%.

In the FX market, EUR/GBP is treading water since Monday and stayed around the psychological level of 0.72, however the pair is stuck in its declining channel since the beginning of the month. We may see some movements this afternoon following the publication of French and German inflation for March while the ECB meeting will likely be a non-event as no forecast is due until June.

USD/CHF refuses to depreciate and is stuck above 0.9714 (Fib 38.2% on March sell-off). On the downside, a support stands at 0.9634 (Fib 23.6%) while on the upside the pair would find some buying interests above 0.9805/60. EUR/CHF remains in a declining channel and reached 1.0297 yesterday before bouncing back to 1.0370. The pair is getting closer and closer to the parity; we expect the single currency to reach that level, pulled down by EUR/USD.

Today Traders will watch MBA Mortgage Application, Empire Manufacturing and Capacity Utilization in the US, ECB Meeting, Manufacturing Sales and BoC rate decision meeting in Canada.

Today's CalendarEstimatesPreviousCountry / GMT NO Mar Trade Balance NOK - 21.0B NOK / 08:00 EC Feb Trade Balance SA 22.0B 21.6B EUR / 09:00 EC Feb Trade Balance NSA 21.0B 7.9B EUR / 09:00 US avr..10 MBA Mortgage Applications - 0.40% USD / 11:00 EC avr..15 ECB Main Refinancing Rate 0.05% 0.05% EUR / 11:45 EC avr..15 ECB Deposit Facility Rate -0.20% -0.20% EUR / 11:45 EC avr..15 ECB Marginal Lending Facility 0.30% 0.30% EUR / 11:45 CA Feb Manufacturing Sales MoM 0.10% -1.70% CAD / 12:30 US Apr Empire Manufacturing 7.17 6.9 USD / 12:30 CA Mar Existing Home Sales MoM - 1.00% CAD / 13:00 US Mar Industrial Production MoM -0.30% 0.10% USD / 13:15 US Mar Capacity Utilization 78.60% 78.90% USD / 13:15 US Mar Manufacturing (SIC) Production 0.10% -0.20% USD / 13:15 CA avr..15 Bank of Canada Rate Decision 0.75% 0.75% CAD / 14:00 US Apr NAHB Housing Market Index 55 53 USD / 14:00 CA Bank of Canada Releases Monetary Policy Report - - CAD / 14:00 US U.S. Federal Reserve Releases Beige Book - - USD / 18:00 US Feb Net Long-term TIC Flows - -$27.2B USD / 20:00 US Feb Total Net TIC Flows - $88.3B USD / 20:00

Currency Tech

EUR/USD

R 2: 1.1052

R 1: 1.0755

CURRENT: 1.0604

S 1: 1.0504

S 2: 1.0200

GBP/USD

R 2: 1.5137

R 1: 1.4990

CURRENT: 1.4761

S 1: 1.4500

S 2: 1.4231

USD/JPY

R 2: 121.52

R 1: 120.77

CURRENT: 119.62

S 1: 119.08

S 2: 118.33

USD/CHF

R 2: 0.9948

R 1: 0.9858

CURRENT: 0.9732

S 1: 0.9625

S 2: 0.9481