The stock of Chevron Corporation (NYSE:CVX) – the 2nd largest United States oil company is still attractive despite reporting a significant loss in its most recent quarter.

Chevron is one of only 2 oil and gas Dividend Aristocrats, and is one of the 6 oil and gas super majors. Chevron stock is currently offering investors a high dividend yield.

While waiting for a significant recovery in the price of oil, investors can enjoy the generous dividend currently yielding 4.2% a year.

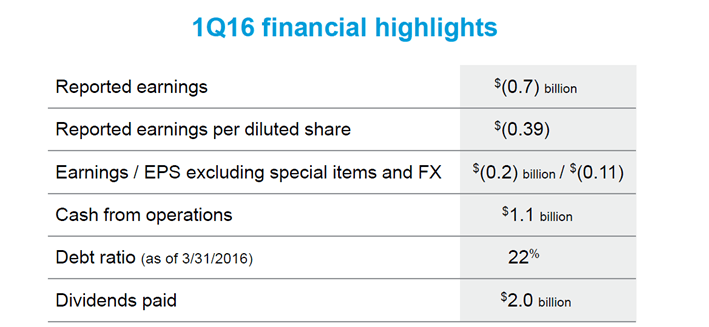

On April 29, Chevron reported its first-quarter 2016 financial results.

Source: 2016 1Q Earnings Conference Call Presentation

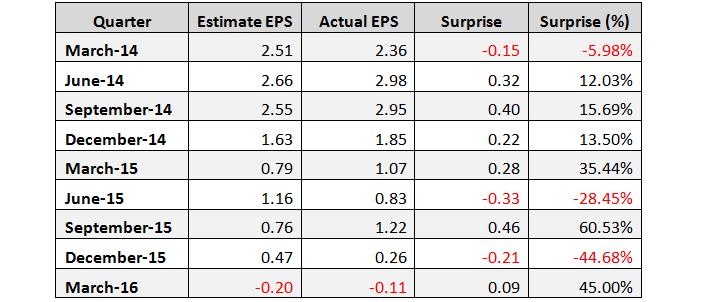

Although the company posted a significant loss in the quarter, it beat the adjusted earnings-per-share expectations by $0.09 (45%). Quarterly revenue fell 28% year over year to $23,553 million but was slightly higher than Street forecasts of $23,547 million. Chevron beat adjusted earnings-per-share estimates in six of its last nine quarters, as shown in the table below.

Data: Yahoo Finance

In the report, Chairman and CEO John Watson, said:

“First quarter results declined from a year ago. Our Upstream business was impacted by a more than 35 percent decline in crude oil prices. Our Downstream operations continued to perform well, although overall industry conditions and margins this quarter were weaker than a year ago.”

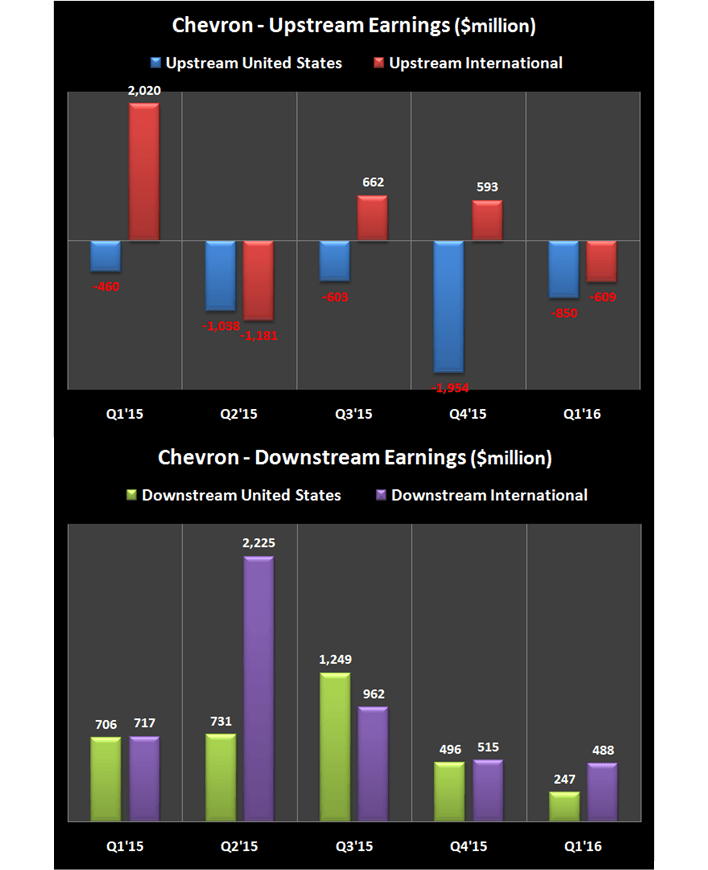

To emphasize the dramatic change in Chevron’s earnings due to the crash in oil prices, I put together, in the charts below, the upstream and the downstream earnings in the U.S. and international in the last five quarters.

Total upstream earnings in the first quarter of 2016 were negative at -$850 million in the U.S. and -$609 million international. In contrast to upstream operations profitability that is directly correlated to oil prices, downstream operations are benefiting from the high refining margins, even though lower in the last quarter and strong demand for refined products. Total downstream earnings in the first quarter of 2016 were at $247 million in the U.S. and $488 million international.

Source: Company’s reports

Crude Oil Market

Oil prices have shown a significant rebound in the last three and half months, which makes me think that the worst for oil prices is over.

As such, we can expect much better results for Chevron’s upstream operations in the forward quarters. Brent crude oil last price of $45.37 per barrel is already up 47.1% from its 12-year low on January 20, of $30.84, while WTI crude oil last price of $44.66 per barrel is up 40.6% from its January 20 low of $31.77.

Last week the oil markets experienced major unexpected supply disruptions. The largest disruption came from Canada, where forest fires have torched large swathes of boreal forest near major oil sands operations.

Also last week, Nigerian militants attacked a platform operated by Chevron in the Niger Delta. The facility is currently shut-in and according to Chevron, they are assessing the situation and have deployed resources to respond to a resulting spill.

According to OilPrice.com, the collapse of the rig count and depressed drilling activity has already knocked about 700,000 barrels per day of oil production offline. However, the rig count could bottom out this year and begin climbing again. Nevertheless, the U.S. Department of Energy [EIA] does not expect oil production to rise in the short run even if the rig count rebounds.

Oil production is expected to continue to fall through 2017 as too few new wells come online to replace rapidly falling shale output. Total U.S. oil production is expected to decline from 9.43 million barrel per day in 2015 to 8.04 million barrel per day in 2017, a figure that includes rising output from the Gulf of Mexico.

According to EIA, the sharp decline in oil prices since the fourth quarter of 2014 has had a significant effect on drilling in the United States. The number of active onshore drilling rigs in the Lower 48 states fell 78% (from 1,876 to 412) between the weeks ending on October 31, 2014, and April 15, 2016, according to data from Baker Hughes (BHI). The decline in active rigs and well completions is projected to result in month-over-month onshore oil production declines of 120,000 barrel per day through September 2016.

All in all, market fundamentals continue to suggest that the combination of robust demand and weak supply growth will move global oil markets closer into balance by the end of the year.

Dividend

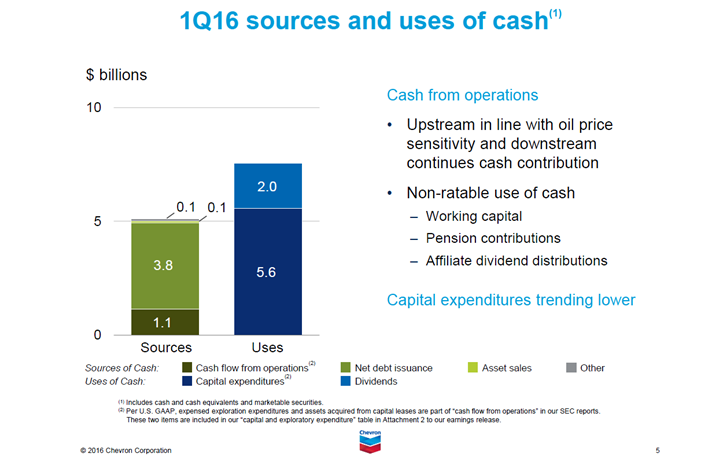

In its last quarter presentation, Chevron reiterated its priority to maintain and grow its dividend.

Source: 2016 1Q Earnings Conference Call Presentation

While waiting for a significant rebound in the price of oil, investors can enjoy the generous dividend currently yielding 4.20% a year.

The company has been paying dividends since 1970, and it has a long record of 27 years of continued raising its dividend.The annual rate of dividend growth over the past three years was at 6.8%, over the past five years was at 8.5%, and over the last ten years was at 9.4%. Even during the global economic crisis of the years 2008-2009, the company continued to raise its dividend. As such, it is hard to believe that Chevron would break that many years tradition.

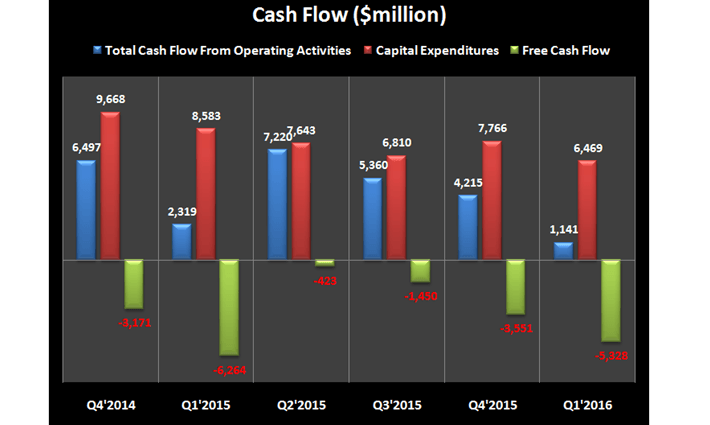

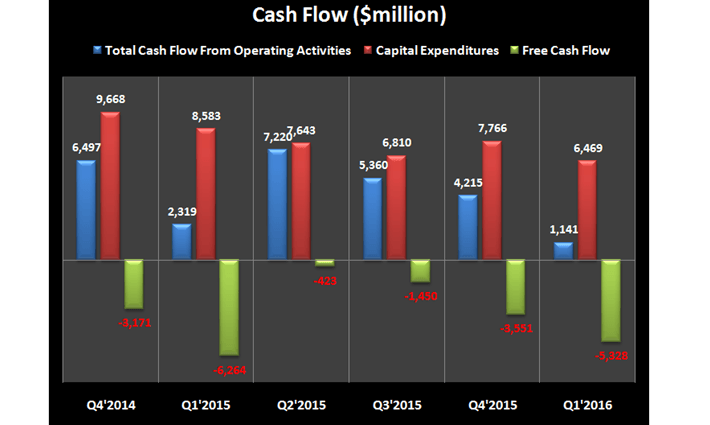

The inability of the company to generate positive free cash flow in the last few quarters could be a matter of concern to investors.In the chart below, I have put together the total cash flow from operating activities, the capital expenditures, and the free cash flow for the last six quarters.

However, since maintaining and growing the dividend is the company’s number one financial priority, it can fund the dividend by taking on additional debt, divesting assets, and drawing down its cash balance.

Chevron had cash and cash equivalents of $8.56 billion at the end of the first quarter, and total debt of$42.34 billion. Furthermore, the company has also suspended its $1.25 billion quarterly share buyback to conserve cash.

Also, the company expects to reduce capital expenditures in 2017 by about $4 billion due to completion projects under construction. According to the company, its efforts are focused on improving free cash flow, and it is controlling its spend and getting key projects under construction online, which will boost revenues.

Source: 2016 1Q Earnings Conference Call Presentation

Valuation

Since the beginning of the year, CVX’s stock is up 13.2% while the S&P 500 Index has increased 0.6%, and the Nasdaq Composite Index has lost 5.4%. However, since the beginning of 2012, CVX’s stock has lost 4.3%, in this period, the S&P 500 Index has increased 63.6%, and the Nasdaq Composite Index has risen 81.8%.

CVX’s stock is trading at a price to book value ratio of 1.25. The forward price-to-earnings ratio is at 22.19. The price-to-sales ratio is at 1.48, the Enterprise Value/EBITDA ratio is low at 12.35, and the PEG ratio is also low at 1.13.

In addition, CVX’s Return on Capital parameters have been much better than its industry median, and its sector median, as shown in the table below.

Source: Portfolio123

Summary

Chevron reported an adjusted earnings-per-share loss in the in the first quarter of 2016. Nevertheless, I believe that the company is poised to achieve higher price appreciation when oil prices recover than that of other super-major oil & gas companies due to its bigger historical upstream contribution.

Oil prices will eventually recover sooner or later. Commodities prices are moving in cycles, and lower capital expenditures on exploration and production will eventually cause oil prices to rebound.

While waiting for a significant rebound in the price of oil, investors can enjoy the generous high dividend currently yielding 4.20% a year. According to the company, its number one financial priority is to maintain and grow the dividend and it has a strong balance sheet for precisely transition times like this.