by Pinchas Cohen

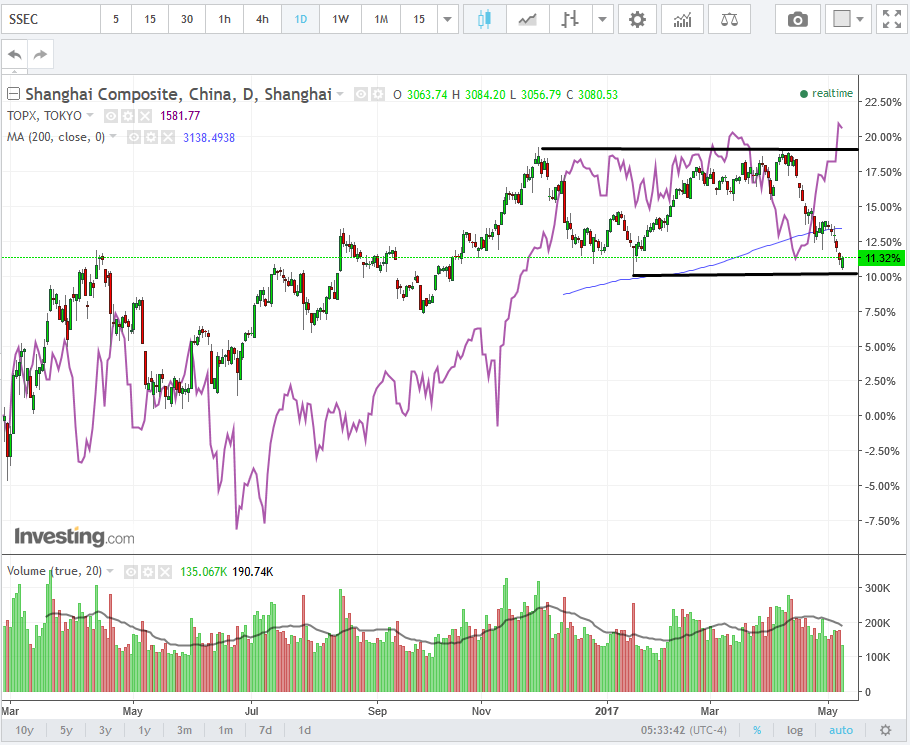

Japan's TOPIX and China's Shanghai Composite are Asia's two leading stock indexes. They've had a positive correlation for quite some time, going back more than a full year. But from December through February the situation shifted.

At that time, even as the Japanese market retained its animal spirit and held on to the Trump trade, the Shanghai had to contend with a $45 billion decline in China’s FX reserves, when reserves fell for the sixth straight month, to the lowest they'd been since February 2011, a result of massive outflows.

The 5% Shanghai tumble, while the TOPIX held on to its gains, was the beginning of what may prove to be a double bottom. While the Japanese index found support at the 200dma (blue) and proceeded to cross over both the 50 and 100dma, the Shanghai Index did the opposite; it fell through all three major moving averages.

Even as the Topix climbed to its highest level since December 2015 and closed above its March peak—a sign the rising trend should resume, the Shanghai Index reached its lowest point since January 16.

Last week we noted that the Shanghai Index crossed below the 200dma for the first time since September 2016. We pointed out that a bullish hammer formed on April 27 and suggested that a decisive close below 3,100 would indicate whether the Index could see additional losses. Yesterday, the index closed at 3078.613, 0.60% below the low of the hammer.

Today’s trading reached an even deeper low, at 3056.558, which brings the intra-day fall 1.32% below the hammer. Since then, the Shanghai Composite has gained 0.78% to 3080.527.

If you believe there's an additional down-move ahead for the Shanghai, this rise may provide a good entry point. Be aware though, there's one remaining obstacle. And it's a big one.

On January 16, trading created a super-sized hammer. Remember, a hammer requires that the lower shadow be at least twice, but preferably three times, as long as the actual body. That lower shadow is 50 times the size of the body.

A double top can officially be declared only when the neckline is crossed. It’s the bottom of that mega hammer, which may provide it with cast-iron support. A decisive violation of that support carries the implication of a price target of 2800, an 8% drop, which can happen as quickly as in a couple of months.