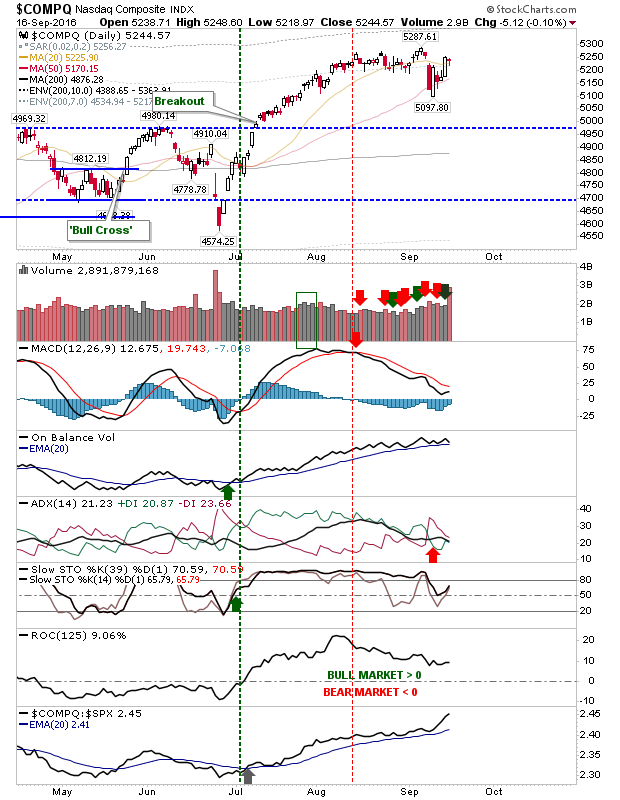

Friday saw some big volume, although there was relatively tight price action to close near the highs of Thursday.

Best of the action looked to belong to the NASDAQ as it knocks on the door of 5,287. A gap higher on Monday opens up for a push to new all-time highs. Watch if it coincides with a MACD trigger 'buy'. This will strengthen the validity for the move higher and encourage technical buying.

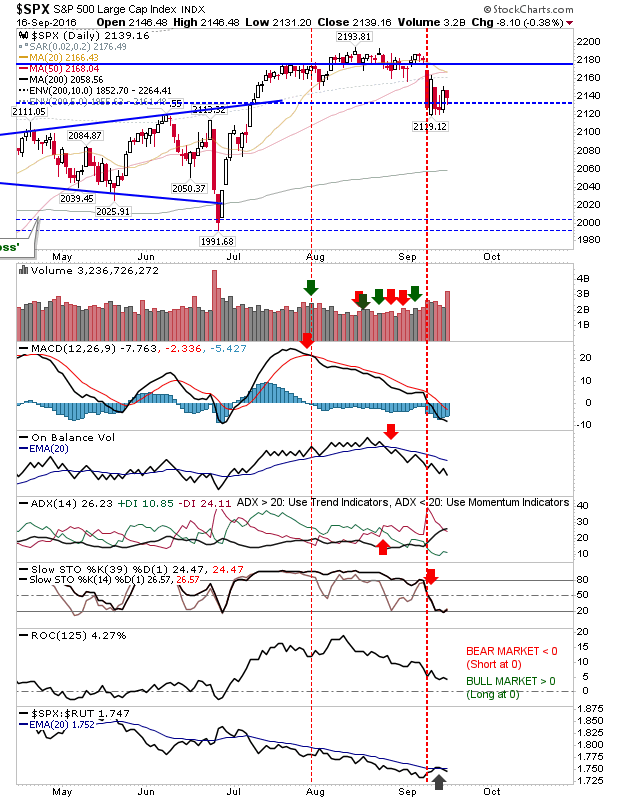

Large Caps have more work to do as jobs data losses remain dominant. A bearish cross of the 20-day MA against the 50-day MA sets up another overhead supply point for shorts to attack. Other than oversold conditions, there is little of positive technical note for the S&P.

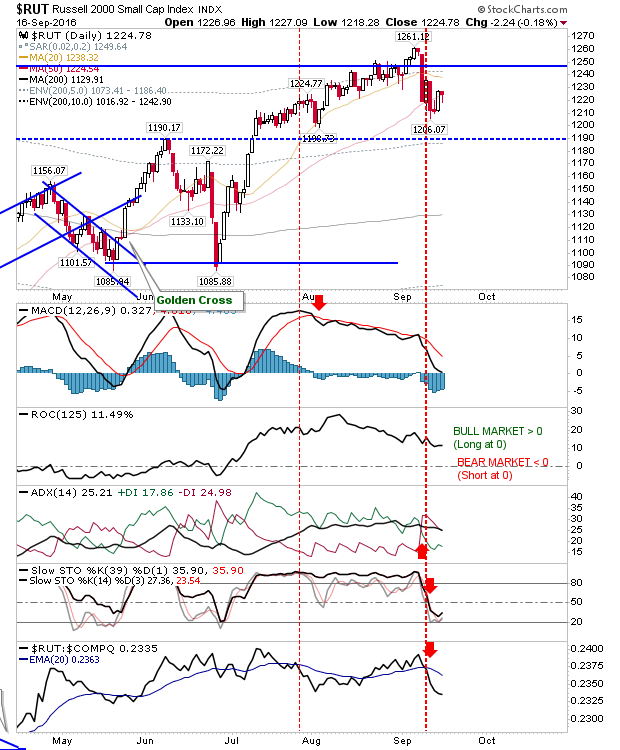

It's a similar picture for the Russell 2000 as for the S&P. This index is underperforming relative to the S&P and NASDAQ which puts it at the bottom of the pile for attractive buyers. However, a positive start from the NASDAQ should help power gains for the Russell 2000, but the index will have to get past 20-day and 50-day MA resistance.

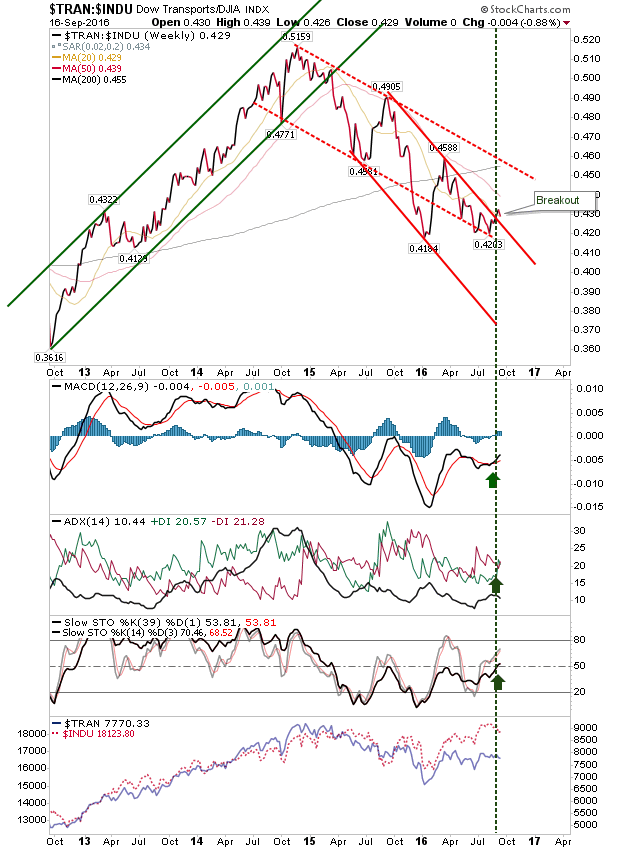

While longer term charts are still in bears' favour, there is an indication shorter term strength is contributing to a reversal in the long term. First of these to come around is the DowTheory—Dow:Transports relationship. There is a positive channel break with a technical 'buy' signal; can this end a 2-year+ decline?

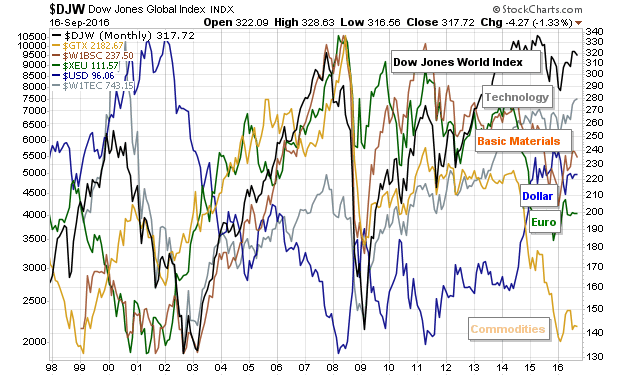

While I remain disappointed with my Copper stop-out, commodities remain the value sector:

For the coming week, keep an eye on Tech indices. Value players can look to play the commodity opportunity, but need to be more flexible than I have been with the stop (i.e. smaller position with a wider stop).